In the present era, ‘Financial Inclusion’ and ‘Inclusive Growth’ have become part of the common man’s glossary as well as an important item in the development agenda. Financial inclusion is one of biggest challenges in the world economics. Financial inclusion is defined by various researchers and government’s committees in heterogeneous views. Rangarajan Committee (2008) defined Financial inclusion as a process of ensuring access to financial services and timely and adequate credit where needed by vulnerable groups such as weaker sections and low income group at affordable cost.

In order to fulfill objectives, the field survey has been conducted to collected primary data from rural households in Haryana. Four districts of Haryana have been selected for field survey such as one district from north, one from south, one from east and one district from west region of Haryana. Total number of respondent rural households is 525.

Data have been obtained from respondents on various dimensions of financial inclusion such as usage of bank account, availing credit from banks, frequency of use ATMs, Internet banking, mobile banking etc. This paper examines the status of financial inclusion among rural households in Haryana.

The expansion of financial services in the whole economy is very important because it leads to the promotion of the economic development and growth. It will include poor sections in rural and urban areas like farmers, small vendors, agricultural and industrial laborers, people engaged in unorganized sectors, unemployed, women, children, old people, physically challenged people, who can be benefited through the banking inclusion. The poor people belonging to all sections of the society will get opportunity to come into banking fold.

ADVERTISEMENTS:

They will be able to open accounts and can save money, whereas they will also be able to use the credit facilities. The deposits of the poor people will result in increased the resources of banks. Banking habit will help people to avoid risks associated with holding of cash and cash transaction.

Banking inclusion will create opportunities for banks to increase the number of their savings bank accounts which will also lead to increase their size of business. Lending programs of banks and micro credit will empower people at lowest strata of the society enabling them to get rid of their poverty themselves.

The Government of India, RBI and other institutions have taken a number of initiatives to ensure inclusion in the development process through many ambitious schemes. Recently Prime Minister of India, Sh. Narendra Modi launched a new financial inclusion scheme namely Pradhan Mantri Jan Dhan Yojana on 15th August 2014 to help the poor people in opening bank account which will provide the Rupay card facility and insurance cover of one lakh rupees.

The focus of the financial inclusion in India is to promote the sustainable development and generating the employment to for rural and urban poor. In rural area, maximum numbers of people are financial excluded being a non-salaried person. Salaried persons have relatively easier access to credit from financial institutions because they can fulfill required paperwork and conditions needed by commercial banks for granting a loan. Thus, there are few challenges in financial inclusion, but the cost of inclusion is not more than its fruits which will ultimately provide platform for inclusive and sustainable growth.

Rationale of the Study:

ADVERTISEMENTS:

Financial inclusion is an invincible approach to achieve the inclusive growth as well as faster inclusive growth of the country. Haryana is a progressive and agriculture based state of the country. Here, 68.84 percent of total population is living in rural areas. About 34 percent of them do not have bank account. The service sector is very important aspect that may be called as a backbone of the economy. Meanwhile, rural population of country does not have financial literacy does not have access to banking services.

So, there is need to financially include the vulnerable group of population such as low income group of people or weaker section of the society. Financial inclusion is approach where vulnerable sections of society can also take benefits of affordable financial services provided by banks under the planed objective and guideline of Reserve Bank of India (RBI). Though, it is felt to do a research work on financial inclusion among rural household in Haryana.

Objectives of the Study:

The proposed objectives of the study are as follow:

1. To assess the awareness of financial services and technology among rural households in Haryana.

ADVERTISEMENTS:

2. To assess the usage of financial services and role to technology in financial inclusion.

3. To find out the reasons behind not availing financial services.

Research Methodology:

This research study deals with the interpretation of primary data on various dimensions of financial inclusion, which are collected by conducting the primary sample survey through filling structured interview schedules. The field survey is conducted in four districts of Haryana such as one from north, one from south, one from east and one from west region of Haryana. One village has been selected from each block of the districts; therefore, 21 villages have been selected for conducting field survey.

The sample size of 25 respondent households has been taken from each village, whereas one village has been chosen from each block of districts. Therefore, total size of sample is 525 respondent households from rural areas of Haryana. The data have been collected on several indicators of financial inclusion such bank account, credit, deposit, insurance policy, technological factors like ATM, Internet banking, mobile banking, etc.

ADVERTISEMENTS:

The district wise tabulation of data has been done in this research work. In this research, the level of awareness of financial services and technology and usage of financial services are shown through tabulation of primary data. This research work is divided into five sections and various sub sections.

Data Analysis and Discussion:

i. Mahendergarh District:

Status of Credit Availed by Rural Households:

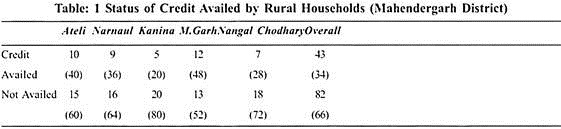

The status of credit availed by rural households in rural area of Mahendergarh district is depicted in table 1. The results of primary sample survey reveal that 66 percent households have not availed the credit from formal financial institutions due to long period of processing application loan, strict KYC norms, difficult to arrange guarantor, high rate of interest, corruption in bank official etc.

Reasons for Not Availing Credit from Formal Financial System:

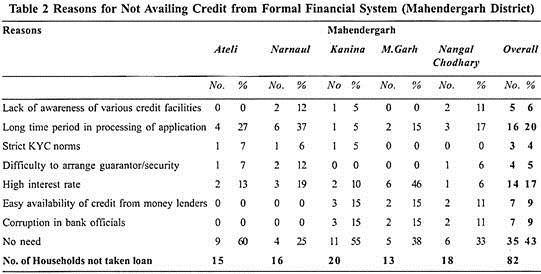

The reasons for not availing the credit from formal financial institutions are shown in table 2. The rural households in Mahendergarh district expressed several reasons for not availing the credit from formal financial institutions such as Lack of awareness of various credit facilities, long time period in processing of application, strict KYC norms, difficult to arrange guarantor/ security, high interest rate, easy availability of credit from money lenders, corruption in bank officials, no need etc.

The village wise answer of respondents for not availing credit is shown in this table. There are around 20 percent of households, who did not avail the credit due to long processing in application of loan, while about 17 percent of respondents did not take loan from formal financial institution due to high rate of interest on credit amount. Around 8 percent of respondents feel about not availing the credit due to easy availability of credit from village money lenders.

ADVERTISEMENTS:

Other 9 percent respondent did not take loan from formal financial institution due corruption involved in bank officials. They face the problem of demanding money for providing credit from financial institutions. Although, about 43 percent households do not take credit from formal financial institutions, they feel no need of credit.

Awareness of Financial Services and Technology:

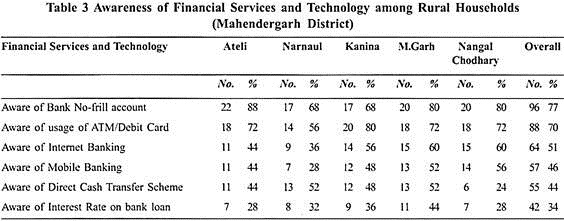

Table 3 depicts the level of awareness of financial services and technology among rural households in Mahendergarh district. The several variables have selected to know the awareness level like aware of bank No-frill account, aware of usage of ATM/Debit Card, aware of internet banking, aware of mobile banking, aware of direct cash transfer scheme, and aware of interest rate on bank loan.

In rural area of Mahendergarh district, 30 percent of respondent households do not know even that how to use the debit/ATM card, but about 77 percent households are aware of no-frill account. On the other hand, only 51 percent households heard about internet banking and 46 percent heard about mobile banking.

ADVERTISEMENTS:

Usage of Financial Services by Rural Households:

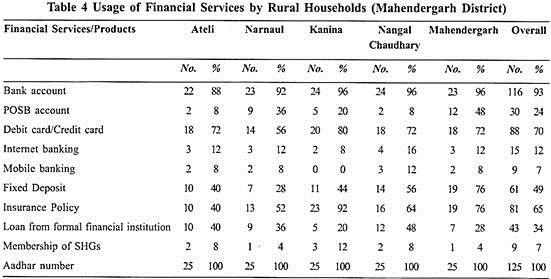

The usage of financial services by rural households are shown in table 4, a households can use the financial services in term of use of bank account, POSB account, debit card/credit card, internet banking, mobile banking, fixed deposit, insurance policy, credit from formal financial, credit through SHGs etc. The study found that there is very low level of usage of financial service.

Only 7 percent of respondent households have mobile banking, while this usage is usually done by young person in family. About 12 percent have internet banking services. Another finding of the study is that use of post office in rural area is declining. The SHG is another important tool of microfinance, but the membership of SHGs is only 7 percent.

ii. Fatehabad District:

ADVERTISEMENTS:

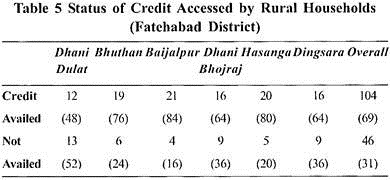

Status of Credit Availed by Rural Households:

Table 5 depicts the status of credit availed by rural households in rural area of Fatehabad district. The results of primary sample survey reveal that the credit from formal financial institution is availed by about 69 percent households.

They feel difficulties in availing credit from formal financial institutions such as long period of processing application loan, strict KYC norms, difficult to arrange guarantor, high rate of interest, corruption in bank official etc. The rural households of Fatehabad district have more access of credit in comparison to Mahendergarh and Karnal districts.

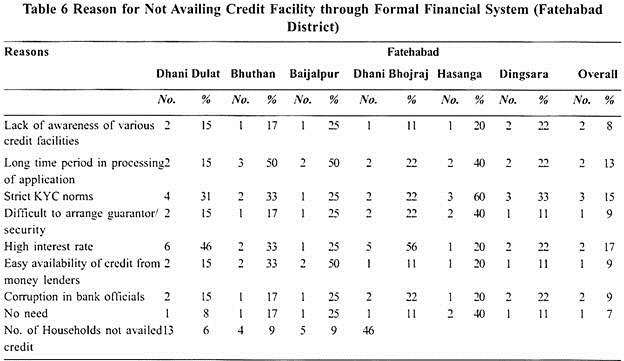

Reasons for Not Availing Credit from Formal Financial System:

Table 6 depicts the momentous reasons for not availing the credit from formal financial institutions. The various recordable reasons for not availing the credit from formal financial institutions are presented in this table. There are around 13 percent of households, who did not avail the credit due to long processing in application of loan, while about 17 percent of respondents did not take loan from formal financial institution due to high rate of interest on credit amount.

Around 9 percent of respondents feel about not availing the credit due to easy availability of credit from village money lenders. Other 9 percent respondent did not take loan from formal financial institution due corruption involved in bank officials.

They face the problem of demanding money for providing credit from financial institutions. There are only 38 percent households; they feel no need of credit from formal financial institution. In rural of Dhani Dulat block, about 13 percent of respondent family did not availed loan from formal financial institutions in past period.

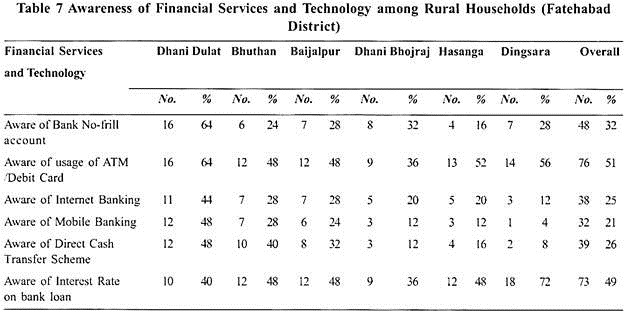

Awareness of Financial Services and Technology:

Table 7 depicts the level of awareness of financial services and technology among rural households in Fatehabad district. The several variables have selected to know the awareness level like aware of bank No-frill account, aware of usage of ATM/Debit Card, aware of internet banking, aware of mobile banking, aware of direct cash transfer scheme, and aware of interest rate on bank loan.

In rural area of Fatehabad district, only 51 percent of respondent households are aware that how to use the debit/ATM card, while about 68 percent households are not aware of no-frill account. On the other hand, only 25 percent households are aware of internet banking and 21 percent of them know about mobile banking. It is found by conducting primary sample survey that the rural area persons, those did not availed credit from formal financial institutions, do not know about interest rate on credit. Only they know who have ever taken loan.

ADVERTISEMENTS:

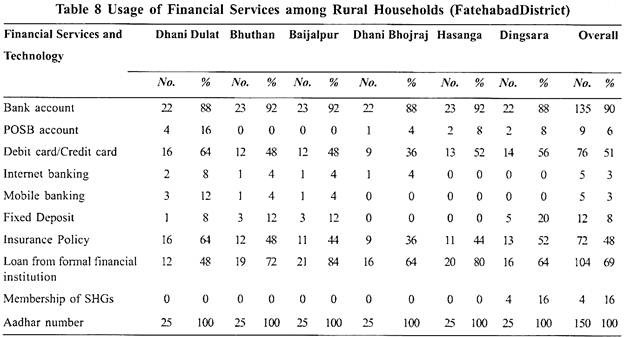

Usage of Financial Services by Rural Households:

The usage of financial services by rural households is shown in table 8. The present work includes financial services like bank account, POSB account, debit card/credit card, internet banking, mobile banking, fixed deposit, insurance policy, credit from formal financial, credit through SHGs etc. The study found that there is very low level of usage of financial service.

Only 3 percent of respondent households have mobile banking as well as internet banking financial services, about 69 percent of them have accessed credit from formal financial institutions that is somehow better than Mahendergarh and Karnal district. Another finding of the study is that use of post office in rural area is declining, only 6 percent of households usually save money in post office. About 16 percent households have membership with Self-Help Group (SHG) and availed, while SHG is important model of microfinance.

Only 8 percent families have fixed deposit with formal financial institutions. This sample survey shows that 90 percent households have bank account, but about 47 percent out of account holders use in more than 3 months or not using account. All the families of rural area of fatehabad district have Aadhar number, but do not have connectivity with banks.

iii. Karnal District:

ADVERTISEMENTS:

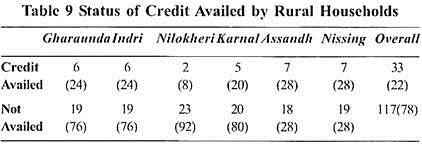

Status of Credit Availed by Rural Households:

The status of credit availed by rural households in rural area of Karnal district is depicted in table 9 The results of primary sample survey reveal that 78 percent households have not availed the credit from formal financial institutions due to long period of processing application loan, strict KYC norms, difficult to arrange guarantor, high rate of interest, corruption in bank official etc.

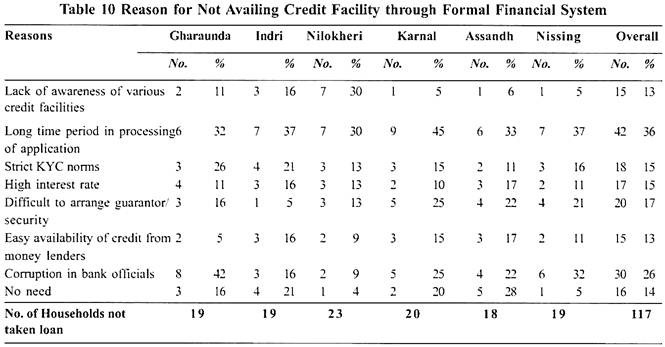

Reasons for Not Availing Credit from Formal Financial System:

The reasons for not availing the credit from formal financial institutions are shown in table 10. The rural households in Karnal district expressed several reasons for not availing the credit from formal financial institutions such as Lack of awareness of various credit facilities, long time period in processing of application, strict KYC norms, difficult to arrange guarantor/security, high interest rate, easy availability of credit from money lenders, corruption in bank officials, no need etc.

The village wise answer of respondents for not availing credit is shown in this table. There are around 36 percent of households, who did not avail the credit due to long processing in application of loan, while about 15 percent of respondents did not take loan from formal financial institution due to high rate of interest on credit amount. Around 13 percent of respondents feel about not availing the credit due to easy availability of credit from village money lenders.

ADVERTISEMENTS:

Other 26 percent respondent did not take loan from formal financial institution due corruption involved in bank officials. They face the problem of demanding money for providing credit from financial institutions. Although, about 14 percent households don’t take credit from formal financial institutions, they feel no need of credit.

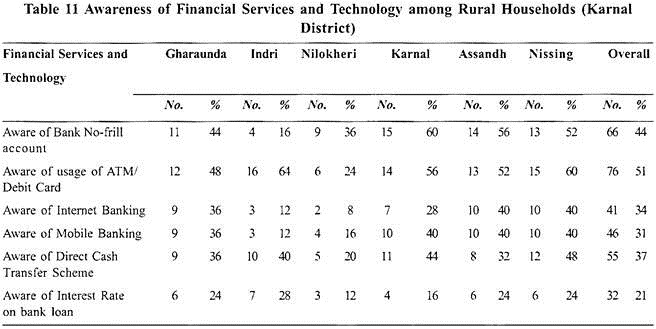

Awareness of Financial Services and Technology among Rural Households:

Table 11 depicts the level of awareness of financial services and technology among rural households in Karnal district. The several variables have selected to know the awareness level like aware of bank No-frill account, aware of usage of ATM/Debit Card, aware of internet banking, aware of mobile banking, aware of direct cash transfer scheme, and aware of interest rate on bank loan.

In rural area of Karnal district, 51 percent of respondent households know that how to use the debit/ATM card, while about 44 percent households are aware of no-frill account. On the other hand, only 34 percent households heard about internet banking and 31 percent household are aware of about mobile banking.

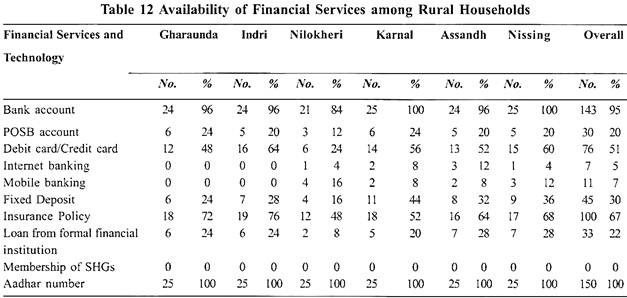

Usage of Financial Services by Rural Households:

Table 12 depicts usage of financial services by rural households such as bank account, POSB account, debit card/credit card, internet banking, mobile banking, fixed deposit, insurance policy, credit from formal financial, credit through SHGs etc. The study found that there is very low level of usage of financial service.

The results of primary sample survey shows that about 95 percent of total households have bank account, but more than 32 percent of total bank account holders do not usually make transaction in their bank account. This data is shown in table 13. Only 7 percent of respondent households have mobile banking, while this usage is usually done by young person in family. About 5 percent have internet banking services. Another finding of the study is that use of post office in rural area is declining.

The SHG is another important tool of microfinance, but the membership of SHGs is 0 only. About 20 percent of total households have accounts in post office saving banks and save their in post office. The primary study shows that only 5 percent of total households have internet banking and only 7 percent of total households have mobile banking, while around 57 of total internet banking holders do not make transaction through internet banking (Table 12).

The table also shows that about 67 percent of total households have insurance policy in life insurance company (LIC) and other private insurance companies and around 78 percent of rural households of Karnal district did not avail credit from formal financial system. It is therefore, the study suggested that the government should make required provision for rural household to include them in manifold of formal financial system.

iv. Gurgaon District:

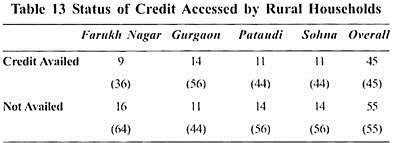

Status of Credit Availed by Rural Households:

Table 13 depicts the status of credit availed by rural households in rural area of Gurgaon district. The results of primary sample survey reveal that the credit from formal financial institution is not availed by about 55 percent households. They feel difficulties in availing credit from formal financial institutions such as long period of processing application loan, strict KYC norms, difficult to arrange guarantor, high rate of interest, corruption in bank official etc.

The rural households of Gurgaon district have more access of credit in comparison to Mahendergarh and Karnal districts but less than Fatehabad district (69 percent of total households). The index of financial inclusion (IFI) that shows the 4 rank of Gurgaon district in overall dimensions of IFI of Haryana rural, it means Gurgaon district has better position of inclusive financial system in comparison of other selected districts like Fatehabad, Karnal and Mahendergarh.

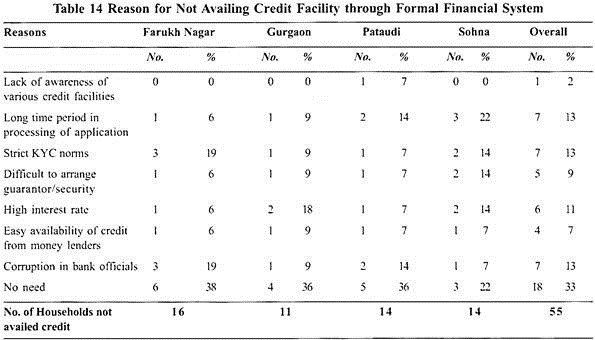

Reasons for Not Availing Credit from Formal Financial System:

Table 14 depicts the momentous reasons for not availing the credit from formal financial institutions. There are around 13 percent of households, who did not avail the credit due to long processing in application of loan, while about 11 percent of respondents did not take loan from formal financial institution due to high rate of interest on credit amount.

Around 7 percent of respondents feel about not availing the credit due to easy availability of credit from village money lenders. Other 13 percent respondent did not take loan from formal financial institution due corruption involved in bank officials, they face the problem of demanding money for providing credit from financial institutions. There are 33 percent households; they feel no need of credit from formal financial institution.

Awareness of Financial Services and Technology:

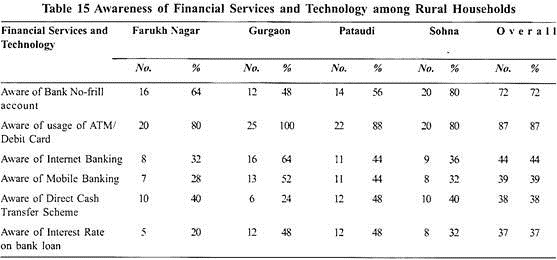

Table 15 depicts the level of awareness of financial services and technology among rural households in Gurgaon district. The several variables have selected to know the awareness level like aware of bank No-frill account, aware of usage of ATM/Debit Card, aware of internet banking, aware of mobile banking, aware of direct cash transfer scheme, and aware of interest rate on bank loan.

In rural area of Gurgaon district, only 87 percent of respondent bank account holder households are aware that how to use the debit/ATM card, while about 72 percent households are aware of no-frill account.

On the other hand, only 44 percent households are aware of internet banking and 39 percent of them know about mobile banking. It is found by conducting primary sample survey that the rural area persons, those did not availed credit from formal financial institutions, do not know about interest rate on credit. Only they know who have ever taken loan.

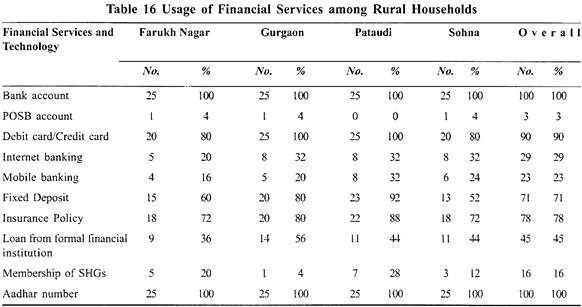

Usage of Financial Services by Rural Households:

The usage of financial services by rural households is shown in table 16. The study found that there is high level of usage of financial service in comparison to other selected districts. All household families have bank account in various sectoral banks like public sector banks, private sector banks, regional rural banks, cooperatives etc. About 23 percent of respondent households have mobile banking and 29 percent of total households have internet banking financial services.

This figure is far better than other selected districts. About 45 percent of them have availed credit from formal financial institutions that is somehow better than Mahendergarh and Karnal district, but less than Fatehabad district. Another finding of the study is that use of post office in rural area is declining, only 3 percent of total households usually save money in post office.

About 16 percent households have membership with Self-Help Group (SHG) and availed, while SHG is important model of microfinance. The rural area of Gurgaon district has better position in fixed deposits by rural households in comparison to other. About 71 percent of total households have fixed deposit with formal financial institutions. All the families of rural area of Gurgaon district have Aadhar number, but few of them have connectivity with banks.

Comparative Analysis:

The comparative analysis of selected districts of Haryana such as Mahendergarh, Fatehabad, Karnal and Gurgoan. The frequency of usage of bank account, debit card/ATMs, internet banking and mobile banking etc.

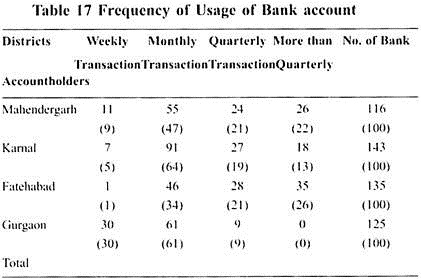

Frequency of Usage of Bank Account:

Table 17 reveals the Frequency of Usage of Bank Account in above said districts. The table shows that nearly 9, 47, 21 and 22 percent of bank account holders of Mahendergarh district make transactions weekly, monthly, quarterly and more than quarterly respectively.

The second row of the table depicts that 5, 64, 19 and 13 percent of bank account holders of Karnal district make transactions weekly, monthly, quarterly and more than quarterly respectively. The third row of the table shows that 1, 34, 21 and 26 percent of bank account holders of Fatehabad district transects weekly, monthly, quarterly and more than quarterly respectively.

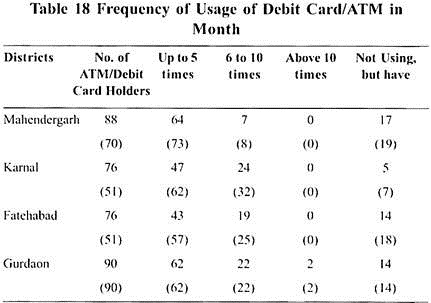

Frequency of Usage of Debit Card/ATM in Month:

Table 18 reveals the frequency of usage of Debit Card/ATM in a month. The results of the table depicts that approximately 70 percent of total households in Mahendergarh district holds ATM/ Debit Card in which 73 percent usages ATM/Debit Card up to five times, 8 percent usages six to ten times and rest of ATM/ Debit Card holders (19%) does not use their ATM/Debit Card. In Karnal district 51 percent of total households have ATM/Debit, about 62 percent out of them use up to five times, 32 percent use six to ten times and rest 7 percent does not usage ATM/Debit Card in a month.

In Fatehabad district approximately 51 percent of total households use ATM/Debit Card, where about 57 percent usages up to five times, 25 percent usages six to ten times. On the hand about 18 percent of total ATMs/Card holders usually do not use. The table shows that the usage of rural households of Gurgaon district is somehow better in comparison to other districts.

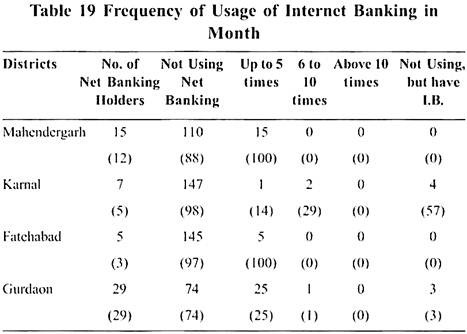

Frequency of Usage of Internet Banking in Month:

Table 19 reveals the frequency of usage of Internet banking in a month. The results of the table show that around 88 percent of total households in Mahendergarh district do not usage internet banking and vice-versa. All the internet banking holders use internet banking up to 5 times in a month. In Karnal district about 5 percent of total households do use of internet banking.

About 14 percent of internet banking holders use up to 5 times, 29 percent use six to ten times and 57 percent of total internet banking holders do not use internet banking. In Fatehabad district approximately 97 percent of total households do not use internet banking while only 3 percent of total households use internet banking, all internet banking holders use mobile banking up to 5 times in a month. About 29 percent of total households in rural area of Gurgaon have internet banking. All districts have low level of usage of technology; although number of rural households of Gurgaon district is more than other selected districts.

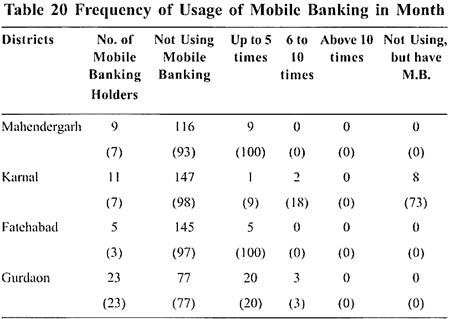

Frequency of Usage of Mobile Banking in Month:

The frequency of usage of mobile banking per month is revealed in table 20. The table depicts that around 93 percent of total households in Mahendergarh district do not use mobile banking. In Karnal district about 98 percent of total households do not usage mobile banking in a month, it includes households, those are not using mobile banking but have mobile banking.

Only rest 7 percent of total households use mobile banking in which 9 percent of Mobile Banking Holders use up to 5 times, 18 percent usages six to ten times in a month while rest 73 percent of mobile banking holders do not use mobile banking. In Fatehabad district around 97 percent of total households do not use mobile banking while only 3 percent of total households use mobile banking. On other hand, about 23 percent of total households in Gurgaon district have mobile banking.

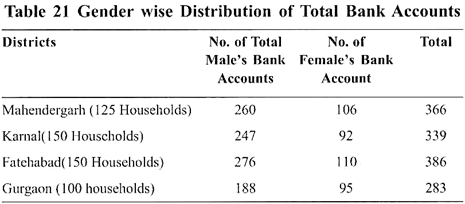

Gender Wise Distribution of Total Bank Accounts:

Table 21 depicts the gender wise distribution of total bank accounts in selected area of the research study. The 150 rural household respondents of Mahendergarh district have 366 accounts in various banks like private sector banks, public sector banks, regional rural banks, cooperative banks, post office saving banks etc. About 260 and 106 bank accounts are owned by males and females respectively. The primary sample survey reveals that female members of rural households in Gurgaon district have more bank accounts in comparison of female members other districts.

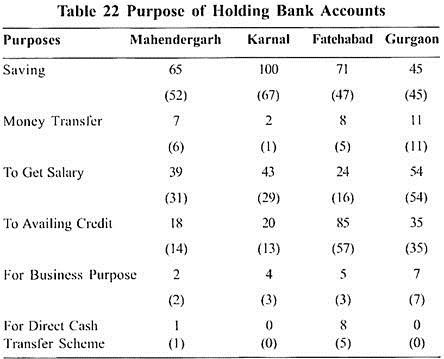

Purpose of Holding Bank Accounts:

The purpose of holding bank accounts by rural households is depicted in table 22. The households of rural area have various purposes such as most common used saving purpose, somehow stumpy practice of money transfer, getting salary whether she or he is doing job in government sector private sector, availing credit from formal financial institutions, business purpose and purpose of getting benefits of direct cash transfer scheme.

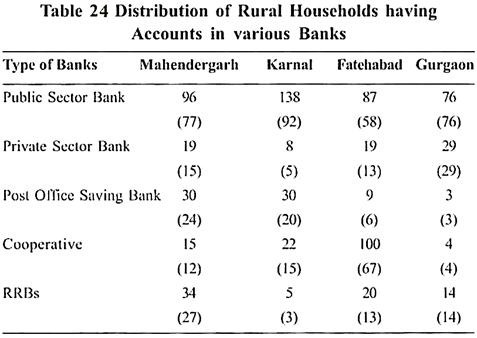

Distribution of Rural Households having Accounts in Various Banks:

Table 24 has been design in order to achieve an important objective viz. to analyze the effectiveness of various banks and other institutions in financial inclusion among rural households in Haryana. This table presents the number of rural households who have bank accounts in various types of banks like Public Sector Bank, Private Sector Banks, Post Office Saving Bank, Cooperatives societies, and regional rural banks (RRBs) etc.

Table depicts that there are many households those have bank account in more than one bank such as some of households own accounts in public sector bank as well private sector bank. In Mahendergarh district, about 77, 15, 24, 12, 27 percent of total households own accounts in public sector banks, private sector banks, post office saving banks, cooperative societies, and regional rural banks respectively.

About 92, 5, 20, 15, 3 percent of total selected rural households in Karnal district have accounts in public sector banks, private sector banks, post office saving banks, cooperative societies, and regional rural banks respectively. In Mahendergarh district, about 58, 13, 6, 67, 13 percent of total households own accounts in public sector banks, private sector banks, post office saving banks, cooperative societies, and regional rural banks respectively.

The primary sample survey depicts that rural household respondents of Fatehabad district own accounts in cooperative societies like primary agriculture cooperative society (PACS). The PACS are performing better in comparison of other selected districts of Haryana.

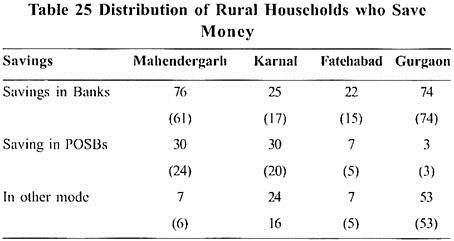

Distribution of Rural Households to Save Money:

Table 25 depicts the distribution of rural households those are doing saving money in various channel such as banks, post office saving banks etc. In Mahendergarh district about 61 and 24 percent of selected rural households do saving in banks and POSBs. About 6 percent of rural households in Mahendergarh save money in other mode of saving like insurance companies.

In Karnal district, about 17 and 20 percent of selected rural households do, saving in banks and POSBs. About 16 percent of rural households in Mahendergarh save money in other mode of saving like insurance companies. In Fatehabad district, only 15 percent of households save their money in banks and 5 percent of them save in other mode of saving.

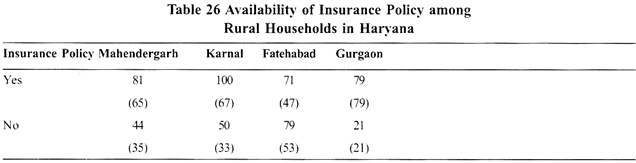

Availability of Insurance Policy among Rural Households:

Table 26 depicts the availability of insurance policy among rural households in rural area of Haryana. About 65 percent of households have insurance policy of their family members in rural area of Mahendergarh district. In rural area of Karnal district about 67 percent of household respondents have insurance policy of their family members in rural area of Mahendergarh district. In Fatehabad district, only 47 percent of households have insurance policy of their family members, it lower in comparison to rest of the districts.

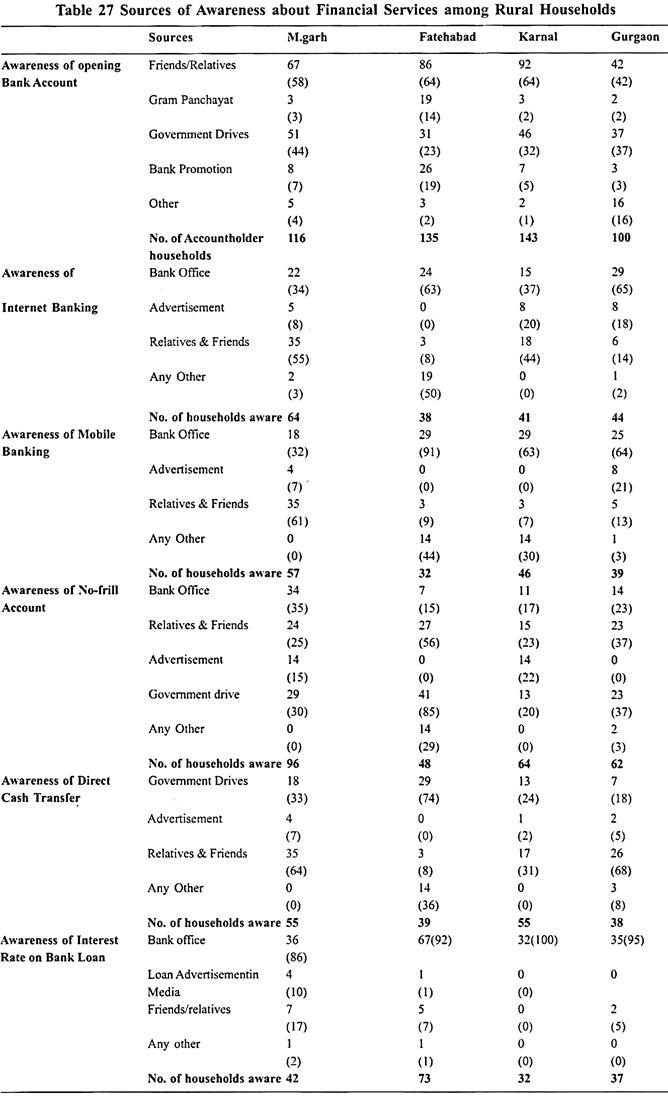

Sources of Awareness about Financial Services among Rural Households:

Table 27 depicts the various sources of awareness about financial services among rural households in Haryana such as awareness of opening bank accounts, awareness of internet banking, awareness of mobile banking, awareness of no-frill account, awareness of direct cash transfer, and awareness of interest rate on bank loan. The various source of awareness of above said variables are friends/relatives, gram panchayat, government drives, bank promotion, advertisement etc.

The study reveals that friends and relatives play an important role in disseminating the awareness of financial products and services in addition to government drives. About 58, 64, 64 and 42 percent of household respondents are come to know about opening bank account from their friends and relatives in rural area of Mahendergarh, Fatehabad, and Karnal and Gurgaon respectively.

Conclusion:

Many countries including developed countries such as USA, England, and Australia etc. have realized that structured efforts are required to enhance financial literacy for financial inclusion. Around 50 countries set targets of financial inclusion in their formal development plans.

Today it is increasingly realized that the idea of financial inclusion is key not only to a statutory compliance but it is also a profitable and sustainable business proposition based on the popular philosophy of fortune at the bottom of pyramid. India has invested considerable amount of resources to extend the banking network to offer financial services to unbanked people. Government of India (GoI) and RBI have taken numerous initiatives to foster the more inclusive financial system especially in rural areas.

Although, percentage of households having bank account have increased from thirty to around fifty five percent in rural India. But still, there is need to accelerate the number of households for opening bank account. The focus of the financial inclusion in India is to promote the sustainable development and generating the employment for rural as well as urban poor people. In rural area, maximum numbers of people are financial excluded being a non- salaried person.

The salaried persons have relatively easier access to credit from financial institutions because they can fulfill required paperwork and conditions needed by commercial banks for granting a loan. Thus, there are few challenges in financial inclusion, but the cost of inclusion is not more than its fruits which will ultimately provide platform for inclusive and sustainable growth.