In this article we will discuss about:- 1. Introduction to Retail Sector 2. The Indian Retail Scene 3. Retailing Format 4. Growth 5. Composition 6. Challenges and Opportunities 7. Conclusion.

Introduction to Retail Sector:

Retailing, which comes last in the distribution channel of goods and services, is not only an integral part of our economic structure, but also shapes our way of life. The retail industry is the largest private industry in the world. In the Indian context, the retail sector is the second largest employer after agriculture.

India is the ninth largest retail market in the world with estimated annual retail sales of about Rs.9,60,000 crores. Research done by the Tata Strategic Management Group indicates that over the next ten years, the Indian retail market is likely to grow at a compounded annual growth rate of 5.5%. The Indian retail industry is the largest among all the industry, accounting for over 10% of the country’s GDP and around 8% of the employment.

The face of retailing in India is undergoing rapid transformation. From traditional “Mom and Pop Kirana Shops”, we are moving to huge departmental stores, supermarkets, hyper markets, exclusive outlets, big bazars and most modern shopping malls. The total concept and idea of shopping has undergone an attention-drawing change in terms of format and consumer buying behaviour, ushering in a revolution in shopping in India.

Modern retailing has entered into the retail market in India as is observed in the form of bustling shopping centres, multi-storied malls and the huge comprises that offer shopping, entertainment and food all under one roof.

A large young working population with the median age of 24 years, nuclear families in urban areas, along with increasing working women population and emerging opportunities in the services sector are going to be the very factor in the growth of the organized retailing sector in India. The growth pattern in organized retailing and in the consumption mode by the Indian population will follow a rising graph helping the newer businessmen to enter the Indian retailing industry.

Indian organized retail is growing at the rate close to 20% reflecting the global trends in that as much as 50 retail organizations have positioned themselves in Fortune 500 companies. Organized retail has a major impact on the unorganized retail sector, traditional supply chain and employment issues. In India, the vast middle class and its almost untapped retail industry are the key attractive forces for global retail giants wanting to enter into newer markets, which in turn, will help the Indian retail industry to grow faster.

The entry of big players like Reliance and Bharti-Wall-Mart is going to impact Indian retailing in a revolutionary manner. After the announcement of FDI policy (Feb. 2006) to allow FDI of up to 51% in a single brand, many more international players are planning to enter the Indian retail market.

The Indian Retail Scene:

India is witnessing an unprecedented consumption boom. The economy is growing between 7 and 9% and the resulting improvements in income dynamics along with factors like favourable demographics and spending patterns are driving the consumption demand.

The Indian retail industry is ranked among the ten largest retail markets in the world. The attitudinal shift of the Indian consumer in terms of “choice preference”, “value for many” and the emergence of organized retail formats have transferred the face of retailing in India.

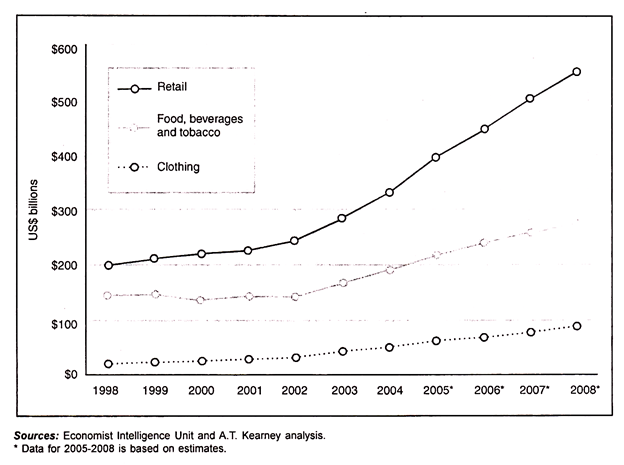

The Indian retail industry is currently estimated to be a US$200 billion industry and organized retailing comprises of 3% (or) US$6.4 billion of the retail industry. With a growth over 20% per annum over the last five years, organized retailing is projected to reach US$23 billion by 2010.

Initially, the growth in organized retail was very slow and confined mainly to metros due to rentals and space, which are proving to be largest constraints to development. These factors were key drivers for the retail wave in the country. South India is holding its ground as a pioneer in the organized retail growth due to low cost of real state and their purchasing behaviours.

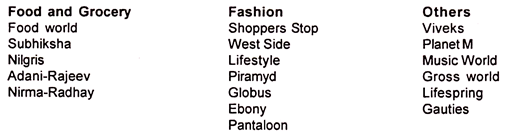

New entrants in organized retailing include Subhiksha, Nilgiris Vivek and Food World. Realizing the potential of business, big domestic industrial houses such as Tatas with Trent, the Piramal with Crossroads’, the Rajan Group with Globus, K. Raheja Group with Shopper’s Stop etc. has also been foraying into the retail segment.

The major players in Indian retail industry in the food and grocery, fashion and others.

Organized vs Unorganized Retailing:

The Indian retail sector is dominated by unorganized sectors. The retail industry in India is estimated to be US $ 200 billion, of which organized retailing, i.e. modern trade makes up 3% or US $ 6.4 billion according to TSMG. In contrast, players in the organized sector, have huge expenses to meet, and yet have to weep price low to compete with traditional sector.

High costs for the organized sector are due to high quality real estate, high labour costs, social security to employees, much bigger premises, comfort facility such as air conditioning, back-up power supply, taxes etc. These costs are met by high sales volume, and by cutting channel costs, control over supplying companies and naming private level to few products. The save margin cost is passed to the consumers who like to buy discounted product from organized retailer.

The face of retailing in India is undergoing rapid transformation. From traditional “Mom and Pop Kirana shops,” we are moving to huge departmental stores, supermarkets and many modern formats.

Retailing Format in India:

Malls – The largest form of organized retailing today. Located mainly in metro cities, in proximity to urban outskirts. Ranges from 60,000 sq. ft. to 7,00,000 sq. ft. and above. They lend an ideal shopping experience with an amalgamation of products, service and entertainment, all under a common roof. Examples include Shoppers Stop, Piramyd, and Pantaloon.

Specialty Stores – Chains such as the Bangalore-based Kids Kemp, the Mumbai books retailer Crossword, RPG’s Music World and the Times Group’s music chain Planet M, are focusing on specific market segments and have established themselves strongly in their sectors.

Discount Stores – As the name suggests, discount stores or factory outlets offer discounts on the MRP through selling in bulk, reaching economies of scale or excess stock left over at the season. The product category can range from a variety of perishable/non-perishable goods.

Departmental Stores – Large stores ranging from 20000-50000 sq. ft., catering to a variety of consumer needs. Further classified into localized departments such as clothing, toys, home, groceries, etc. Departmental stores are expected to take over the apparel business from exclusive brand showrooms. Among these, the biggest success is K Raheja’s Shoppers Stop, which started in Mumbai and now has more than seven large stores (over 30,000 sq. ft.) across India and even has its own store brand for clothes called Stop.

Hypermarkets/Supermarkets – Large self-service outlets, catering to varied shopper needs are termed as supermarkets. These are located in or near residential high streets. These stores today contribute to 30% of all food & grocery organized retail sales. Supermarkets can further be classified into mini-supermarkets typically 1,000 sq. ft. to 2,000 sq. ft. and large supermarkets ranging from of 3,500 sq. ft. to 5,000 sq. ft. having a strong focus on food & groceries and personal sales.

Convenience Stores – These are relatively small stores 400-2,000 sq. feet located near residential areas. They stock a limited range of high-turnover convenience products and are usually open for extended periods during the day, seven days a week. Prices are slightly higher due to the convenience premium.

MBO’s – Multi-brand outlets, also known as Category Killers, offer several brands across a single product category. These usually do well in busy market places and metros.

Growth of Retail Sector in India:

The Indian retailing sector is at an inflexion point where the growth of organized retailing and growth in the consumption by Indian population is going to take a higher growth trajectory. The Indian population is witnessing a significant change in its demographics.

A large young working population with medium age of 24 years, nuclear families in urban areas, along with increasing working of men population and emerging opportunities in the service sector are going to be the key growth drivers of the organized retail sector in India.

Retail and real estate are the two booming sectors of India in the present scenario. And if industry experts are to be believed, the prospects of both the sectors are mutually dependent on each other. Retail, one of India’s largest industries, has presently emerged as one of the most dynamic and fast paced industries of our times with several players entering the market. Accounting for over 10% of the country’s GDP and around 8% of the employment, retailing is gradually inching its way toward becoming the next boom industry.

As the contemporary retail sector in India is reflected in sprawling shopping centres, multiplex-malls and huge complex offer shopping, entertainment and food all under one roof, the concept of shopping has altered in terms of format and consumer buying behaviour ushering in a revolution in shopping in India. This has also contributed to large-scale investment in the real estate sector with major national and global players investing in developing the infrastructure and construction of the retailing business.

The trends that are driving the growth of the retail sector in India are:

a. Low share of organized retailing

b. Falling real estate prices

c. Increase in disposable income and customer aspiration.

d. Increase in expenditure for luxury items.

e. Increasing urbanization: larger urban population that value convenience, coupled with the higher propensity of the urban consumer to spend

f. Growing young population, with the attitude and willingness to spend.

Economic growth of 7-9% a year makes it one of the fastest emerging economies of the world. India retail industry with its size estimated to be $280 to $290 billion in 2003 (separate estimates of ICICI bank and EIU) and estimated of $350 billion in 2005 is expected to grow at the rate 12% to 14% a year for next five years — faster than growth in G.P.P. Organized or modern retailing is about $ 8 billion and is expected to grow at over 18% a year by conservative estimates to become a $22 billion (AT Kearny/KSA Technical) business by 2010 crossing $ 50 billion by 2015.

Composition of Retail Industry:

The retail sales of food, beverage and tobacco are estimated at above $200 billion in 2005 are expected to touch $300 billion by 2009-10 (EIU forecast). Their combined share in total retail sales has dropped from 70% in 1998 to 57% in 2004. Though the combined sale was stagnant in the period 1998-2002, after 2002 it has grown at 10-15% a year.

Market Structure by the Retailing Format:

The estimates of the total number of outlets in India vary greatly between one million to five million. By EIU estimate, 96% of the 5 million retail outlets in 2005 were smaller than 500 sq. ft. retailing firms like Pantaloon, RPG, Piramyd and K. Raheja Group are using multiple formats – hypermarkets, supermarkets, and malls to specialty and convenience stores – for expansion. The retail business exists in a milieu of varied geographic, demographics and sociocultural environment and varying spending power and pattern.

For the firms, the nature and the size of the market besides their own competencies and strategic objectives would determine the ways and means to capture the opportunities in organized retailing that exist across the country.

Rural and Urban Division of the Retail Industry:

The rural consumption of consumer goods is sizeable. For basic necessities – food, clothing and footwear – rural demand is more than 60% of the total while for other consumer goods, it is 57% of the total. It is 50-50 for rural and urban consumption in consumer durable whereas the share of rural spending on consumer services and entertainment is respectively 44% and 33% of the total.

Challenges and Opportunities of Retail Sector:

Retailing has seen such a transformation over the past decade that its very definition has undergone a sea change. No longer can a manufacturer rely on sales to take place by ensuring the mere availability of his product. Today, retailing is about so much more than mere merchandising. It’s about casting customers in a story, reflecting their desires and aspirations and forging long-lasting relationship.

As the Indian consumer evolves, he/she expect more and more at each and every time when he/she steps into a store. Retail today has changed from selling a product or a service to selling a hope, an aspiration and above all, an experience that a consumer would like to repeat.

Hence, there some challenges and opportunities before retail industry in India as outlined below:

Challenges:

1. Infrastructure and Distribution Challenges:

Poor roads and transportation infrastructure coupled with fragmented and sluggish traditional supply chain. Large geographical areas and a weak infrastructure along with lack of third party distribution services make distribution in India chaotic, very difficult, more costly and less reliable. The total logistics cost amounts to 10% to 12% of India’s GDP, according to CMIE (Centre for Monitoring Indian Economy).

On the other hand, fragmented, largely unorganized and traditional long supply chain results in high mark-up on prices of goods. Compared to the modern supply chain, the traditional trade uses multiple levels of the distributors and wholesalers and is more fragmented as a result. The economies of scale requires more transactions and holds more inventories within the chain but less at the retail point.

2. Retail Space Crunch:

Space for organized retailing is growing at 50-60% a year but the growth is not as impressive as it looks because of the small base. Demand and supply gap in space for organized retailing impose a major constraint on its growth. Modern retailing, which requires developing real estate, modern warehousing facilities and logistics infrastructure, is capital-intensive.

Developing infrastructure will require huge investments. The estimates of the demand for retail space vary greatly. According to an industry estimate, the retail space required for forecasted increase in retail sales of US $167 billion in next five year is between 600 million to 700 million sq. ft. of the retail space. With an addition of only 200 million sq ft. in sight, this would create a supply crunch of 400 to 500 million sq. ft. of retail space.

3. Training Workforce for Retail Industry:

Modern retailing growing at 15-18% a year would create additional 2.5 million direct jobs in the retailing sector by 2012. Lack of institutions for imparting vocational and professional training for the workforce and professionals required for the retailing industry is another weak area where India has to catch up.

The response from public and private institutions till now has been slow and it could become a case of too little too late. Some retailing firms like Kishore Binyani’s Pantaloon retail has sensed it and are building tie-ups with institutions for vocational training and professional courses in retailing.

Opportunity:

Retailing in India is currently estimated to be a US $200 billion industry, of which organized retailing makes up a paltry 3% or US $6.4 billion. By 2010, organized retail is projected to reach US $23 billion. For the retail industry in India, things have never looked better and brighter. Challenges to the manufacturers and service providers would abound when market power shifts to organized.

Another research carried out by the Tata Strategic Management Group (TSMG) indicates that over the next 10 years, the total retail market in India is likely to grow at a compounded annual growth rate (CAGR) of 5.5% (at constant prices) to US $374 billion (Rs.16,77,000 crore) in 2015.

The organized retail market is expected to grow much faster, at a CAGR of 21.8% to US $ 55 billion (Rs.246,000 crore) in the same timeframe, garnering around 15% of overall retail sales. Based on our projections, the top five organized retail categories by 2015 would be food, grocery and general merchandise, apparel, durables, food service and home improvement.

Conclusion:

The retail sector has played a phenomenal role throughout the world in increasing productivity of consumer goods and services. It is also the second largest industry in the US in terms of numbers of employees and establishments.

There is no denying of the fact that most of the developed economies are very much relying on their retail sector as a locomotive or growth. The India retail industry is the largest among all the industries, accounting for over 10% of the country’s GDP and around 8% of the employment. The retail industry in India has come forth as one of the most dynamic and fast-paced industry.

The government should bring in changes to allow foreign players, who have international exposure in organized retailing and can effectively meet the customer expectations. RPG, Piramal, Raheja, Tata and others have set-up retail business and the future will reveal the impact on Indian retail industry if international players are allowed to operate in India.

Will the impact any different from Marks and Spencer or Wal-Mart setting up operations in India? And as far as loss of employment due to threat from organized retailing is concerned, it will actually generate more employment at the front and backroom but the generation of employment would be directly proportional to the number of well-qualified employees, and high labour productivity. It will also generate indirect employment through support services such as security, maintenance, grading, packing, sorting, labelling etc.