After reading this article you will learn about the Small Scale Industries in India: 1. Meaning of Small Scale Industries 2. Growth of Small Scale Industries in India 3. Financial Needs.

Meaning of Small Scale Industries:

Small scale sector plays an important role in the development of every country. In a developing country like India this sector is indispensable. Since independence small scale units have made significant progress. After agriculture small scale sector provides highest employment to the labour force. Since small units are widely dispersed, they provide jobs to local residents.

In the sphere of production this sector provides a major share in the industrial production of the country. Large scale units are also dependent on small units for various needs. Ancillary units which are very important for big units are mostly in small sector. Government of India also encourages the development of small units through industrial and financial policies.

The basis of distinction between large-scale and small scale industries is generally the scale of operations, i.e. the size, capital investment and the number of persons employed in the industrial unit. The main Criteria used for this distinction is of capital investment.

All industrial units with a capital investment of not more than Rs. one crore (since February 17, 1999) in plant and machinery are treated as small-scale units. As per this classification all industries with capital investment higher than specified for small-scale units are large scale industries.

Growth of Small Scale Industries in India:

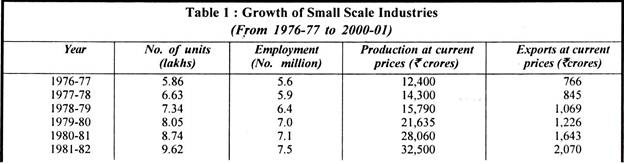

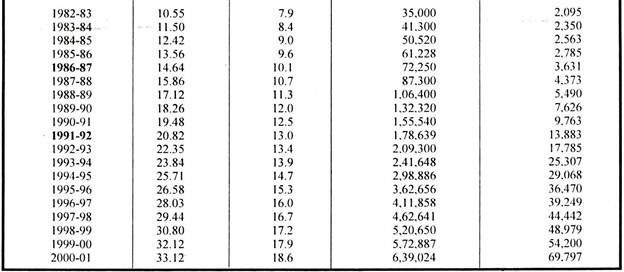

The small-scale industrial sector in India has been growing at a very rapid scale. Despite the global and domestic recession, small-scale industries registered a higher growth rate than the overall industrial sector in terms of number of units, production, employment and exports. Table 1 given below shows the growth of small scale industries from 1976-77 to 2000-01.

As per the third XII India Census of SSIs held for the year 2001-02, there were 105.21 lakh SSI units in the country, out of which 13.75 lakh were registered working units and 91.46 lakh unregistered units. Under the Micro, Small and Medium Enterprises Development (MSMED) Act, 2006, the definitions and coverage of the MSE sector have been broadened significantly.

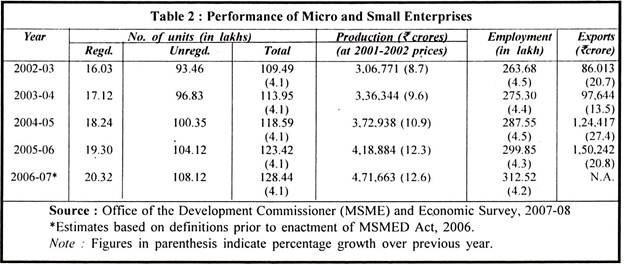

The micro and small enterprises (MSEs) provide employment to an estimated 31.2 million persons in the rural and urban areas of the country.

During 2003-07, the MSE sector registered continuous growth in the number of enterprises, production, employment and exports. Table 2 given below depicts the performance of micro and small enterprises. It is estimated that there are about 128.44 lakh MSEs in the country as on March 31, 2007, accounting for about 39 per cent of the gross value of output in the manufacturing sector.

Financial Needs of Small Scale Industries:

Financial requirements of small scale industries can be classified into two heads:

(i) Equity or risk capital and

(ii) Loan or borrowed capital.

Loaned capital can be sub-divided into:

(a) Long-term loans and

(b) Short-term loans.

(i) Equity Capital:

An investment by the owner of a small unit is the pre-requisite for setting up a unit.

The owner has first to set up the unit by his own capital and then he can ask for loaned funds. The owner’s funds should be used to purchase fixed assets like land and building, plant and machinery etc. If the entrepreneur is able to invest sufficient funds to acquire fixed assets then his chances of success are high.

If he depends on interest bearing funds for acquiring fixed assets then his earnings may not be sufficient to support such a liability.

In real practice the situation is quite different. In many cases the entrepreneurs do not have adequate funds for investing in the units – they depend upon the dealers for the supply of raw materials and purchase of finished products. It is the dealers who take most of the profits and entrepreneurs are left with small funds. Even after many years in work, they are unable to create sufficient funds to meet their day to day needs.

(ii) Loan Capital:

Besides equity capital small scale units require long-term and short-term loans. Long- term loans are needed either to purchase fixed assets or for expansion and diversification while short-term loans are needed for purchasing various inputs and other current needs. A sound financial position requires that fixed assets should be financed from long-term funds and short-term funds be used for working capital needs.

A good financial structure will be that where more investments are from owned capital but outside funds cannot altogether be ignored. A care should be taken to keep loaned funds only upto the level of owner’s funds and not beyond. A concern depending more on outside funds may be in a financial problem sooner or later.