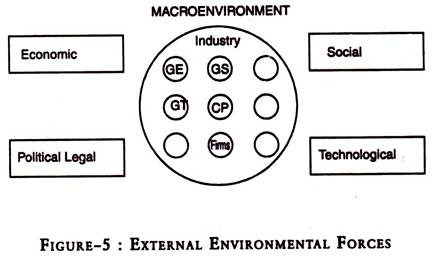

Read this article to learn about the influence of macro environmental forces on the strategy of industries.

1. Political-Legal Forces of a Firm:

1. Political-Legal Forces of a Firm:

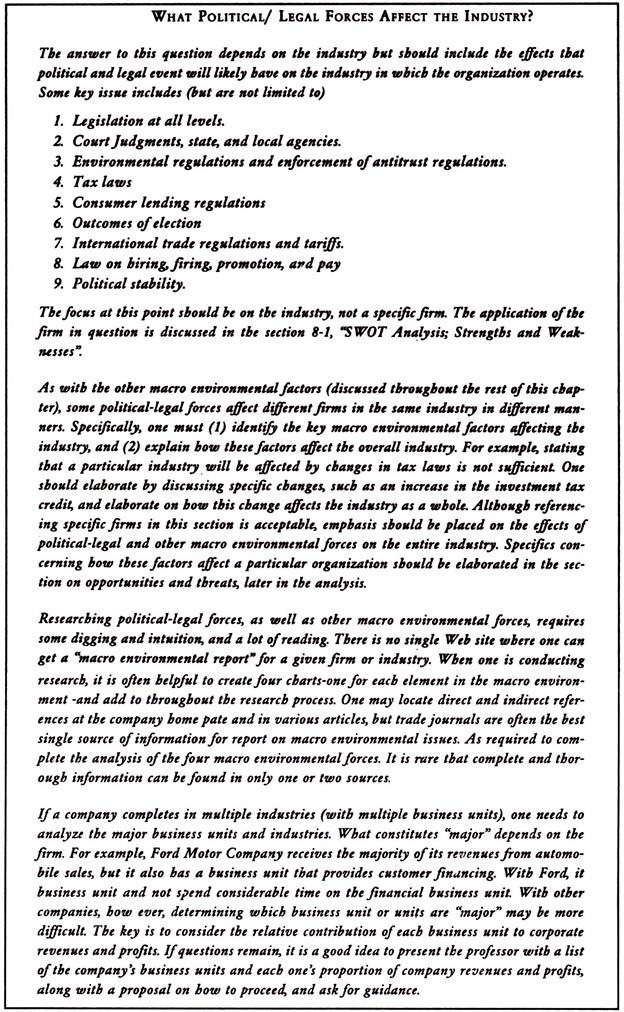

Political-legal forces include such factors as the outcomes of elections, legislation, and judicial court decisions, as well as the decisions rendered by various commissions and agencies at every level of government. Military conflicts can also influence how a number of industries operate, especially those with tight global ties. For example, during the 2003 war in Iraq, many firms modified their promotional strategies, fearing that their television advertisements might be considered insensitive if aired alongside breaking coverage of the war. At the same time, others began to plan for meeting the anticipated future needs in Iraq for such products as cell phones, refrigerators, and automobiles.

Industries are often affected by legislation and other political events specific to their line of business. For example, when mad-cow disease-a rare disease of the brain passed through tainted meat- began to show up in the United Kingdom in early 2001, most of Europe responded by banning the import of British beef. Financial losses for the industry were staggering.

All societies have laws and regulations that affect business operations. The major laws in the United States. Many socialist nations have rigid guidelines for hiring and firing employees or establishing operations, and some require that a portion of what is produced in that country be exported to earn foreign exchange. These regulations are specific to each nation and create opportunities: or pose threats to firms interested in operating across national boundaries.

At the global level, the period from World War II to the late 1980s was marked by increased trade protection. Many countries protected their industries by imposing tariffs, import duties, and other restrictions. Import duties in many Latin American countries ranged from less than 40 percent to more than 100 percent. However, this trend was not limited to developing nations.

Countries in Europe and Asia-and even the United States-have imposed import fees on a variety of products, including food, steel, and cars. In the 1980s, the United States also convinced Japanese manufacturers to voluntarily restrict exports of cars to the United States in lieu of a tariff. Interestingly, this particular tariff may be largely responsible for Japanese automobile manufacturers establishing a large number of production facilities in the United States, thereby blurring the concept of the “foreign car.”

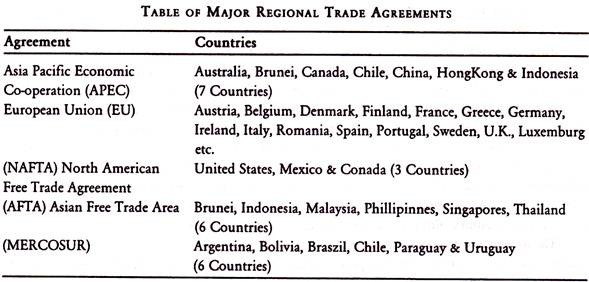

During this time, however, many nations desired to move toward the ideal scenario whereby all trade barriers are eliminated. In 1947, 23 countries entered into the cooperative General Agreement on Tariffs and Trade (GATT). GATT has assisted in relaxing quota and import license requirements, introducing fairer customs evaluation methods, and establishing a common mechanism to resolve trade disputes. GATT membership now includes more than 110 nations.

A major shift in U. policy occurred in the late 1970s and the 1980s in favor of “deregulation;” eliminating a number of legal constraints in such industries as airlines, trucking, and banking, but not all industries were deregulated. By 1990, a reversal of trade protectionism and strong governmental influence in business operations began to take place. In the United States, new economic policies reduced governmental influence in business operations by deregulating certain industries, lowering corporate taxes, and relaxing rules against mergers and acquisitions. This trend has continued into the twenty-first century, although not as forceful as- in the late 1990s.

The move toward free marketing was also seen in Europe, where a number of nations banded together to develop a trade-free European Community. Today, Europe is fast becoming, a single market of 350 million consumers. The European Economic Area, as it is called, is the largest trading bloc on earth, accounting for more than 40 percent of the world’s gross domestic product (GDP).

Meanwhile, the United States, Canada, and Mexico established the North American Free Trade Agreement (NAFTA) to create its own strategic trading bloc. A number of analysts believe that world business will be divided into several such blocs; each providing preferred trading status to other nations within the bloc.

This trend toward less regulation has even extended to the former communist countries. As the nations of the former Soviet bloc in Eastern Europe overturned their governments, they began to open markets and to invite foreign investment. In addition, China officially remains a communist nation, but its economic development policies have taken a distinctively free market approach since the late 1905.

It should be noted that trade restrictions will always exist to some extent, especially in politically sensitive areas. For example, the United States and other Western countries have banned the export of advanced technology in certain circumstances. The United States prohibits the export of certain electronic, nuclear, and defense-related products to many countries, particularly those believed to be involved in international terrorism. Many of these restrictions were revised and strengthened following the terrorist attacks of September 11, 2001.

2. Economic Forces of a Firm:

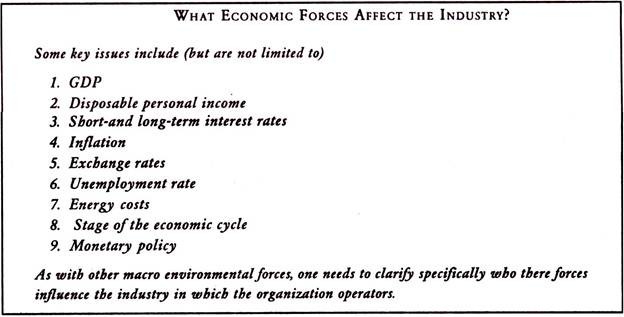

Economic forces significantly influence business operations, including growth or decline in gross domestic product and increases or decreases in inflation, interest rates, and exchange rates. These changes can present both opportunities and threats to strategic managers, depending on the industry.

i. Gross Domestic Product:

Gross domestic product (GDP) refers to the value of a nation’s annual total production of goods and service. Consistent GDP growth generally produces a healthy economy fueled by increases in consumer spending. A rapidly growing GDP is not necessarily beneficial. Likewise, a high degree of economic volatility and unpredictability can stymie strategic decision-making.

In contrast, a GDP decline signals lower consumer spending and decreased demand for goods and service. When GDP declines for two consecutive quarters, a nation’s economy is generally considered to be in a recession, during which time competitive pressures can lower profits and increase business failure rates. It is important to note that recession do not threaten all industries “equally. “Dollar” stores (i.e., those that price all products at one dollar) perform especially well during times of economic downturn. Likewise, college and university enrollments often increase as under graduate and graduate students seek to gain an advantage in a tight job market.

Recessions can also create opportunities for businesses on the supply side. The deluge of dotcom failure in 2000 and 2001 increased the supply of technical personnel at a time when demand for workers in this area was not being met. As a result, many traditional businesses were able to procure sorely needed technical expertise as software engineers and others became leery of dot-com startups. Unfortunately, it is difficult to forecast a recession in advance, and many recessions are identified only after they have “bottomed out”.

ii. Inflation Rates:

High inflation rates have a negative effect on most, but not all businesses. High rates raise many of the costs of doing business, and continued inflation constricts the expansion plans of businesses and triggers governmental action designed to slow economic growth. The U.S. Federal Reserve Board often raises its discount rate during inflationary periods to slow economic growth. Its counterparts in other developed nations typically follow suit, and in some cases precede Fed action.

An economic slowdown can have mixed effects on a particular industry through its effect on interest rates. During a recession, for example, new car retailers tend to have a difficult time attracting prospective customers to their showrooms. However, slowdowns are often accompanied by central bank interest rate cuts, which in turn reduce both interest rates for consumers and bank costs dealers must incur to finance their inventories. Hence, one needs to consider the composite impact that an economic factor may have on an industry, not only the single effect that may be most intuitive.

Like high interest rates, periods of inflation can present opportunities for some firms For instance, oil companies may benefit during inflationary times if the prices of oil and gas rise faster than the costs of exploration, refinement, and transportation. Sharp increases in the price of heating oil sparked resurgence in the market for coal stoves in the winter of 2000- . 2001. Companies that mine or sell precious metals may also benefit during periods of inflation because such metals serve as inflation hedges for consumers.

The cost of borrowing can be high in developing countries, with annual interest rates some- times-exceeding 100 percent. These high interest rates are often accompanied and influenced by excessive rates of inflation, as was the case in parts of Latin America in the 1990s. In small nations such as Bolivia, annual inflation has been as high as 26,000 percent. Even larger and more industrialized countries such as Brazil have recently experienced annual inflation rates of 2,700 percent. Routine decisions such a pricing and costing becomes almost impossible to make under such conditions. In addition, high inflation rates cause the prices of goods and services to rise and become less competitive in international trade.

iii. Interest Rates:

Short- and long-term interest rates affect the demand for many products and services, especially high ticket items whose costs are financed over an extended period of time, such as automobiles, appliances, and even major home renovations or repairs. At the consumer level, low short-term interest rates, for instance, are particularly beneficial for retailers such as Wal-Mart and JC Penney because they also tend to lower rates of credit cards, thereby encouraging consumer spending. At the corporate level, interest rates also influence strategic decisions related to financing. High rate for instance, tend to dampen business plans to raise funds to expand or to replace aging facilities. Lower rates, however, are more likely to spawn capital expenditures on expansion and development.

iv. Exchange Rates:

Currency exchange rates can be influenced by international agreements, the coordinated economic policies of governments, and international economic conditions. When such conditions rise the value of the dollar, for example, U.S. firms find themselves at a competitive disadvantage internationally, as the prices of American-made goods rise in foreign markets. At the same time, American consumers may be inclined to purchase products produced abroad, which are less expensive than goods produced domestically.

When the dollar is strong American manufacturers tend to locate more of their plants abroad and make purchases from foreign sources. However, when the dollar is relatively weak, the financial incentive for American companies to purchase from foreign sources is more limited, and they tend to focus their activities more on the domestic market.

Currency exchange rates present challenges because of their dramatic and often unpredictable changes over time. For instance, the Mexican peso has been historically devalued relative to the world’s major currencies once or twice every decade, reducing the profits of U.S. firms operating there. These rampant fluctuations began to subside in the late 1990s and early 2000s, but the future remains uncertain.

3. Social Forces of a Firm:

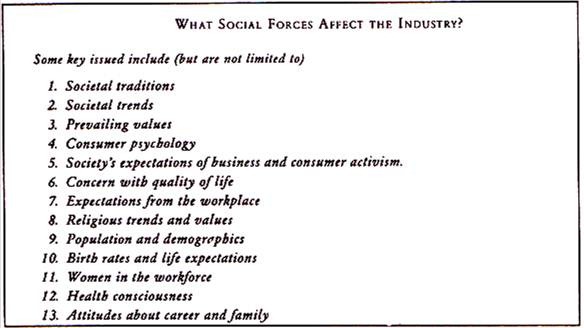

Social forces include such factors as societal values, tends, traditions, and religious practices and can substantially influence firm performance. Societal values refer to concepts and beliefs that members of a society tend to hold in high esteem. In the United States and Canada, major values include individual freedom, fairness, free markets, and equality of opportunity.

In a business sense, these values translate into an emphasis on entrepreneurship and the belief that one’s success is limited only by one’s ambition, energy, and ability. Interestingly, these values have attracted millions of immigrants to the United States and Canada during the past centuries in search of religious, economic, and political freedom, resulting in a business environment that is more vibrant than in countries that do not hold similar values.

Social trends can vary widely among nations, especially as they are related to other factors. For example, throughout the 1990s and early 2000s smaller cars have been the vehicle of choice in Europe, where road are more narrow, gasoline is heavily taxed, and fuel economy is a greater concern. In contrast, U.S. consumers continued to demand relatively huger vehicle in a country where roads are wider, gasoline is much less expensive, and fuel consumption does not play as strong a role in the purchase decision.

Societal trends present various opportunities and threats to businesses. For example, the health and fitness trend that emerged In the 1990s has spawned growth in a number of manufacturers of fitness equipment, as well as producers of healthy drinks, while hurting a number of businesses in less health-friendly industries such as tobacco and liquor. In 2002, Anheuser Busch launched Michelob Ultra, a low-carbohydrate beer, in an effort to tap the health-conscious market. Also in 2002, Pepsi Co. announced it would attempt to increase its sales of healthy snacks, including baked and low-fat offerings, to 50 percent of its total snack food sales.

In the late 1990s and early 2000s, fast-food consumers began eating less at traditional giants such as Burger King, Pizza Hut, and Taco Bell, in favor of more healthy alternatives such as Subway and Pan Era Bread. Although competitors such as McDonald’s have responded with more salads, expanded advertising campaigns, a rotation of temporary items, revamped dollar menus, and even credit card service, the company’s “fried” image remains intact and sales increases have been difficult to muster Even as U.S. fast-food icons continue to expand abroad, restaurant chains from other parts of the world, most notably Latin America, are expanding into the United States.

Today, the average American is older, better educated, less likely to be a member of the Caucasian race than in previous years, and more technologically astute and Internet savvy. This trend has had a profound effect on the demand for personal computers and educational services, and has led firms operating in the broad middle age market to notify their strategic approaches to include either younger or older adults. Cosmetics maker Avon, confronted with a shrinking clientele, launched a major effort in 2002 to expand its appeal to the trendier 16to 24-year-old market.

Societal trends also include demographic changes that can dramatically affect business opportunities. For example, the U.S. baby boom, which lasted from 1945 through the mid -1960s, initially provided opportunities for businesses such as clothing, baby apparel, and diaper manufacturers, private schools, and candy and snack makers. Later, as the baby boomers entered the job market, universities and businesses were blessed with tremendous pool of applicants.

As they have continued to age, the baby boomers have begun shopping at home more and are spending vast sums of money for health-care needs, leisure activities, and vacation alternatives. Further, this population segment may not be as brand loyal as previous generations of Americans and is becoming more and more open to purchasing goods and services or the Internet.

The tragic events of September 11, 2001, have spawned social changes that affect a variety of industries. For example; concerns over air travel safety have greatly influenced everything from routes to marketing strategies of major airlines. Broadly speaking, Americans are more willing to accept inconveniences associated with their transactions if they believe that safety and security are heightened as a result. Studies also suggest that investment and personal life strategies have become more conservative and reflective as a result of the tragedy. Even churches are taking notice, as the 25 percent increase in national attendance immediately following the events of September 11 had all but disappeared by early 2002.

In the early 2000s, a number of traditional retailers began to experience sales declines as more consumers shopped online. As a result, retailers began searching for new ways to attract prospective buyers to their stores. They discovered that many consumers were less likely to frequent a traditional retailer unless it also provided some form of entertainment value. Bass Pro Shops, for example, increased its store traffic substantially by including such amenities as a large fish tank, live bats, and even a rock-climbing wall. Mall developers began to include “activity zones” in their facilities for such attractions as skating and fitness centers. This trend of mixing retailing with entertainment is expected to continue in the coming years.

Other major trends include the emphasis on socially responsible manufacturing and waste management practices, as well as concerns for saving private wetlands from business development. Specifically, the last decade of the twentieth century witnessed a heightened interest in both consumer recycling and the production of recyclable products by manufacturers in the United States and other parts of the world.

To address this shift, Norwegian recycling giant Tomra expanded to about 200 recycling kiosks in California in 2001. The cleaner, more accessible kiosks are designed to appeal to socially sensitive consumers who prefer not to deal with the inconveniences associated with the traditional recycling centers. However, many analysts note that consumers are often unwilling to pay the higher prices typically associated with environmentally friendly products.

In many respects, social trends are the key driver of consumer markets. For example, the 1990s experienced the rise of the sport utility vehicles (SUVs) on the American automotive landscape. By the end of the decade SUVs were the vehicle of choice for many suburban families, and the minivan was passé. Auto manufacturers realized, however, that the new breed of-SUV patrons was willing to give up some of the rugged features associated with the SUV in exchange for the additional space and softer ride associated with the minivan.

As one GM executive put it, “The sport utility today is kind of becoming like the minivan, a family vehicle.” In early 2001, Ford responded to the shift in consumer preferences by introducing a redesigned Explorer with three rows of seats, additional safety- gadgets, and. a softer ride. By 2003, Ford, General Motors, and Nissan had begun to shift attention away from large SUVs to the hybrid vehicles they termed “crossovers” or “active lifestyle wagons.”

Interestingly, however, the popularity of the SUV in the United States has been attacked on the grounds of another social force-environmental responsibility. Opponents charge that SUVs are simply too large and fuel-inefficient, increasing the nation’s dependence on external sources of oil and potentially compromising the nation’s ability to broker a lasting peace in the oil-rich Middle East. Interestingly, some experts are predicting a decline in the SUV fervor during the mid-2000s. Nonetheless, SUV manufacturers still face a daunting task of balancing their desire to produce a vehicle still in demand and environmental concerns.

Social traditions define societal practices that have lasted for decades or even centuries. For example, the celebration of Christmas in the Western Hemisphere provides significant financial opportunities for card companies, toy retailers, turkey processors, tree growers, mail-order catalog firm, and other related businesses. In fact, many retailers hope to break even during the year and generate their profits during the Christmas shopping season.

Social forces have severely altered the way business I conducted in a number of retail industries. Traditional department stores such as Sears, JC Penney, and Dullards suffered revenue declines in the late 1990s and early 2000s as a result of changes in consumer buying habits that favor discounters such as Target and Wal-Mart, and e-tailers such as Amazon(dot)com. Department stores have responded by streamlining stores to facilitate faster service, modifying product lines to target specific consumer groups, and even increasing their reliance on private label brands.

The analysis of social force can be quite complex for firms operating in several countries. Each of the world’s nations has its own distinctive culture, its generally accepted values, traditions, and patterns of behavior. These cultural differences can interfere with the efforts of managers to understand and communicate with those in other societies. The unconscious reference to one’s own cultural values as a standard of judgment-the self-reference criterion-has been suggested as the cause of many international business problems.

Individuals, regardless of culture, become so accustomed to their own ways of looking at the world that they often cannot comprehend any significant deviation from their perspective. However, companies that can adjust to the culture of a host country can compete successfully. For instance, by adapting to local tastes rather than rigidly adhering to those of its U.S. customers, Domino’s has found profitable business overseas by selling tuna and sweet corn pizzas in Japan and prawn and pineapple pizzas to Australians.

Progressive companies recognize that cross-cultural differences in norms and values require modifications in managerial behavior. For example, business negotiations may take months or even years in countries such as Egypt, China, Mexico, and much of Latin America. Until personal friendships and trust develop between the parties, negotiators are unwilling to commit themselves to major business transactions.

In add, ion, Japanese business executives invite and even expect their clients or suppliers to interact socially with them after working hours, for up to three or four hours an evening, several times a week. Westerners who decline to attend such social gatherings regularly may be unsuccessful in their negotiations because these social settings create a foundation for serious business relationships.

Strategic managers of American corporations should remember that their firms have exceptionally high visibility because of their American origins. As such, citizens of other countries may disrupt the business operations of American corporations as a form of anti-American activity. Only two months after Euro Disneyland opened in France, many French citizens decried the venture. Hundreds of French farmers blocked entrances to the theme park with their tractors to express their displeasure with cuts in European Community farm subsidies that had been encouraged by the United States, even though 90 percent of the food sold at the park was produced in France.

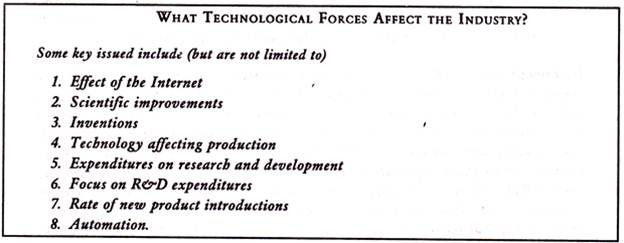

4. Technological Forces of a Firm:

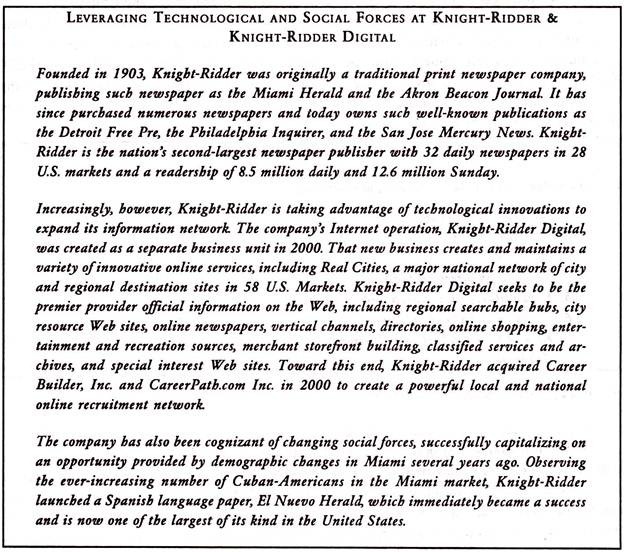

Technological forces include scientific improvements and innovations that create opportunities or threats for businesses. The rate of technological change varies considerably from one industry to another and can affect a firm’s operations’ as well as its products and services. A number of businesses have used advances in computer technology such as computers, satellites, a fiber optics to perform their traditional tasks at lower costs and higher levels of customer satisfaction. Many analysts believe satellite radio for cars will revolutionize the automobile audio entertainment industry.

Technological change can also decimate existing businesses and even entire industries because it shifts demand from one product to another. Historical examples of such change include the shifts from vacuum tubes to transistors, from steam locomotives to diesel and electric engines, from fountain pens to ballpoints, from propeller airplanes to jets, and from typewriters to computers. Internet icon Shawn Fanning spawned an “online mush swapping” industry with his launch of Napster, a service whereby patrons could exchange music Tiles via the Internet. However, copyright and legal complications forced a shutdown and sale of the business.

The widespread use of the Internet over the past decade is arguably the most pervasive technological force affecting business organizations since the dissemination of the personal computer. The effects are most profound in select industries, such as brokerage houses, where online companies have demonstrated huge gains in the market, or the travel industry, where the number of flights, hotels, and travel packages booked over the past decade has skyrocketed.

The Internet has also spawned the advent of online banking, a much less costly means of managing transactions. As such, by 2002, a number of major banks and creditors had begun encouraging customers to pay bills online by offering free software, elimination of fees, and even sweepstakes entries with each transaction. Indeed, the Internet has had a major effect on virtually every industry in the developed world.

Consider the airline industry. With the advent of the Internet, a number of consumers began to purchase their airline tickets online instead of utilizing the traditional intermediary, a travel agency. As airlines began investing in this much more efficient means of ticketing in the 1990s, they started to trim commissions paid to travel agencies for booking their flights.

In 2003, the major U.S. based large airlines followed Delta’s lead and eliminated commissions altogether for tickets sold in the United States, except where specially negotiated arranger Lents existed between the airline and the agency. Travel agencies have moved aggressively to the Internet and to expand volume. A number of agencies were dissolved during this period.

On the consumer side, estimates of global Internet access in 2003 range from 600 to 800 million individuals; the vast majority of whom reside in the United States, Canada, Europe, or Asia. Reports also suggest that the majority of America’s population shops online. Most online shoppers tend to be male, married, and college educated, and between 18 and 40 years of age. Online retail spending for 2003 is estimated at $52 billion, with an average annual growth rate through 2007 estimated at 21 percent.

Technology has spawned major changes in the customer service arena. Many of the touch-tone consumer hotlines of the 1990s were r placed in the early 2000s by “virtual agents” that answer calls and use speech recognition technology to either resolve a question or transfer the customer to a “real person” who can. Studies suggest that these systems improve response time has much as 40 percent.

Whereas some consumers appreciate the increased speed and are enamored by many agents use of accents and even flirtatious personalities, others feel awkward about “talking to a computer pretending to be a person.’ Interestingly, some U.S. companies have addressed the frustration by utilizing fewer technology-based systems and transferring incoming calls to their consumer hotlines and technical support centers directly to representatives in countries such as India, where labor costs are much lower.

Technology also affects global business operations. For years, manufacturers in technologically advanced nations established operations in developing countries with low labor and/or raw material costs. These expansions have generally been welcomed because they bring financial resources, opportunities for workforce training and development, and the chance for the host country to acquire new- technologies. In many cases, this interaction has benefited the developing country over the long term, lost notably in the cases of emerging nations such as Mexico, Brazil, India, and China.

However, leaders in developing nations are not always satisfied with the results of global business expansion because anticipated economic and social benefits do not always materialize, such as specialized business development assistance, the establishment of research and development (R&D) facilities, and the hiring of locals in managerial and other professional positions. On-the job training notwithstanding, the overall long-term contribution to the host country is sometimes questioned by leaders in the developing nations.