After reading this article you will learn about:- 1. Introduction to Global Strategy for Markets 2. The Need Factor 3. The Investive Phase 4. Prospecting 5. Product Approach.

Introduction to Global Strategy for Markets:

The domestic markets are the most protective one here the markets and the logistics can be controlled directly and indirectly with much ease, the problem arises when the borders are crossed.

Across the borders unknown factors haunt the traders and marketing establishments alike, the major reason is the stretching of the management control and decision making process. Market research is the only available tool that can lessen the unknown and convert them into areas of opportunities. Both of them use the similar checklist for decision-making.

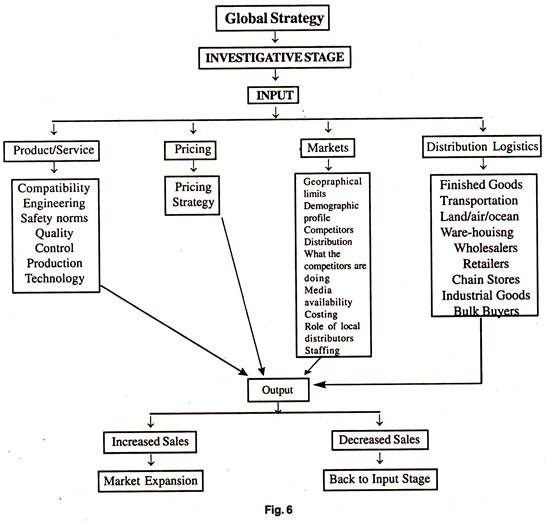

In fig. 6 a broad outline of the global strategy is explained, it is common to both the global trader and the manufacturer/exporter. The global strategy is divided into two stages, the input stage and the output stage. Input strategy is divided into four groups—product, price, marker and the distribution logistics.

Further each of these groups has sub-groups and each element of the sub-group plays vital role in decision making and for the overall success or failure of the strategy. These elements are the variable for a given market and product/service.

The function of the trader or the marketing person is to find just proper combination of these variables so that net output of the strategy is the establishment of the overseas business in a positive and profitable manner. If the output is less than the expectations then something was wrong at the planning stage and the whole cycle has to be repeated to fix the faults and try again.

It must be noted that international markets do not give many chances for trials and re-trials. The first time impact has to be positive and result oriented. To overcome this shortcoming of the market generally the pilot runs are made in the market to have a feel of the response and to readjust the marketing mix.

This is also called seeding stage. Two or three pilot runs help the exporter to identify the flaws in his mix and prepare for the formal launch of the product in the market. Many consumer goods and consumer durable goods companies conduct the market audits after each pilot run to measure the impact of the promotional efforts.

This audit helps not only in judging the viability of the strategy but also the consumer reactions to the pilot runs. The importers of bulk items of standardized configuration also use this policy of pilot runs.

Each pilot run helps the importer to judge the exporter’s capabilities and performance in reproducibility of quality, quantity, and delivery. If the exporter can maintain his performance on these three accounts the importer opens the doors for bulk and regular business for him.

Formulation of the proper global marketing/trading strategy is basic research. The success of the strategy would depend on the accuracy of the research. Large organizations engage specialized research firms to do this job, but small to medium organizations can do it themselves by following simple but logical sequence of combination of the key factors into a working model.

The demand and supply in any given market is the net effect of the need factor. Unless the need exists there cannot be any potential. So before we proceed any further let us understand this factor.

The Need Factor for Global Strategy:

The need factor is directly related to the potential that exists in the market specific. A prospecting trader studies the demand and supply relationship in continuity. This study has two segments one relating to the market and the other relating to the product. For a study of a market it is necessary that the two segments be studied together, each being the complementary of other.

A market represents a collection of needs whether these are related to producers (means of production, production, products, and means of distribution) or consumers (means of consumption, consumption, products) It simply indicates the potential which you have to find and act upon to translate it in to a business reality.

If any need cannot be translated into a net potential then it is not worth trying it. Thus when you embark upon the investigation you have to ask yourself whether the product that you intend to work with has the need potential in the specified consumer segment in the specific market.

A product that is satisfying any specific need of some of the consumer in the market is a product fit for investigation. But the problem arises when the need factor is in its dormant stage and awareness is not felt by the consumer or the market, the strategy for such needs is different and must be dealt with in different ways.

This aspect of the need will be kept for other occasion, what we are concerned now is the need, which has proven market trail in one form or the other. In order to identify the need potential of the products we can basically take two approaches one starting with the market the other starting with the product.

Common factor between the producers and the consumers is the product and these products just represent the needs of the market as well as that of the producers and consumers. Thus the identity of product is of prime importance, the market just exists to service the consumption. So whether you identify the market or the consumers what you are really doing is placing the product in a market where it can be consumed.

The Investive Phase of Global Strategy:

This is the stage for searching the markets for given products, or investigating the potential of markets for what they import and export. Both the manufacturers and traders engage extensively in this phase for their business development.

Prospecting is more appropriate for the traders and marketing for the manufacturers. The basic idea in both cases is the same for overseas market entry, development, retention, and expansion. Let us consider the prospecting first followed up by the marketing.

Once the need factor has been identified the next step is to investigate the flow of goods (import and export) and the pattern of internal consumption. The incoming flow of goods can be in the form of raw materials, finished goods, or anything in between them.

The outgoing flow of goods can also be in the form of finished goods, raw materials or anything in between them. The consumption of goods again would be in the form of raw materials, finished goods or anything in between them. In brief what needs to be studied is what goes into the market, what goes out of the market and what is retained within the market.

For a global trader the first two segments represent areas of opportunities which he can exploit in normal trading practice, but for the third segment (internal consumption) would require deeper involvement. This is also the area that attracts the marketing companies and is dependant on the consumer and consumer durable goods.

The area of operation for macro studies can be as small as a specific market segment or the whole of the market. In the context of international trading the area for macro level is generally taken to be the country as a whole.

Our study would be confined to find out what it imports what it exports, what it produces, and what it consumes internally. This study will show us whether the country has an inward looking or an export oriented economy and what we can sell into it and what we can buy from it.

The list could be very exhaustive so the traders normally match the demands with the supply that is under their control either directly (working for a manufacturer) or indirectly (finding suppliers). The list gradually narrows down to few selected leads on which the trader concentrates.

The above investigation and conclusions are different from the manufacturer-exporter whose interest would be confined to specific segment that matches with what he can offer or take from the market.

Prospecting of Global Strategy:

Prospecting is a market study in search of identification of needs and finding means to fulfill those needs profitably. This is the action phase when a trader uses his knowledge to find opportunities and interact with them in order to transact a business deal.

The prospecting can start with finding the market for a given product and/or service and vice versa. Whatever be the approach the main objective of prospecting is to find ways and means of doing the business, profitably.

Finding the buyers and the sellers and capitalizing on the opportunity is the lifeline of a trader. His entire operative system is tuned to just these three basic elements. Sometimes the opportunities come all of a sudden and sometimes concealed.

The trader uses his manipulative powers to identify and isolate them and if nothing seems to work he creates them. A trader knows whenever there is a seller there has to be a buyer, wherever there is need there are opportunities.

A producer has no existence without the consumers similarly a need has no existence without the relevant opportunities. The area of opportunities lies between and around the buyers and the sellers and the trader begins his prospecting in these areas only.

How the Prospecting is Conducted?

A prospecting trader studies the demand and supply relations in a given situation and this study centres on the markets and/or the products. The prospecting can be conducted either by finding the market for a given product or finding the product for a given market or in many cases by a mixture of both the approaches.

At initial stage we are assuming that the product has the in-built qualities and can stand up in the international market. In practice the market studies come first followed by the product. Each market has a potential, the prospector’s job is to find that potential and also to find how that can be fulfilled.

In the same way each product has a potential market and the job of the prospector is to find that market. It must be understood that market and consumers, products and producers are co-related to each other.

Markets cannot survive without products and the consumers cannot survive without the producers. This inter-relationship is the guiding force behind the prospecting and a trader knows this fact, all his actions are conducted on this assumption only.

The prospecting is conducted in two phases:

(i) The market approach phase, and

(ii) The product approach phase.

The market approach is usually adopted by the traders and the product approach by the manufacturers. For a trader the task is to survey the market to find out the need factors and then to find ways and means to fulfill those needs. The starting point for a manufacturer or the marketing man is the product that he is producing and/or marketing.

So the manufacturer or marketing man tries to find the markets for his products and/or tries to engineer the products for the market specific. The same approach the traders also take sometimes for market identification, they may work for a given manufacturer for promoting his products.

In a given market there are three things to be identified, the demand, the supply and the consumption pattern. This can be done at the macro and micro levels. In the macro approach the markets are studied as single unit and their demand/supply lines are identified.

The analyses of the points of consumption are done at the micro level. The area and scope of market is not confined to specific geographical area, it could be as small as a segment of a city or as large as the country itself.

This would indicate the potential of the given market unit as a whole. This is a very general type of study and indicates the movement of the goods and services and their consumption pattern. It helps the investigating firm to draw conclusions for the prospective market, and plan for action through marketing strategies.

Market Approach:

In this case the starting point is the market and not the product. In the market approach the global markets are scanned to find what they require and how he can meet those requirements. This is a macro level investigation.

Macro-Level Based Investigation:

In this exercise the country is considered as the single unit for investigation which gradually narrows down to the particular product(s). Having identified the product and/or groups of products the trader looks for the suitable suppliers that can match the requirements. At this stage it is quite likely that some of the manufacturers might have their own tie ups in the specified markets.

The trader has to be selective in his approach, he has to select the right manufacturer for the right product, which has the capability to penetrate in the selected market and can withstand the competition from the other competing products.

The main steps covered for this investigation are:

Step-1. Country Profile of the Target Market:

General Background Covering:

Population

Political situation

GDP

GNP

Per capita income

Economic condition

Social conditions

Type of economy

Language used in domestic business and exports

Telecommunication

Transport rail/road/air

International ports

International airports

Miscellaneous information

Step-2. Imports and Exports:

(i) Commodity wise imports and exports

Imports and exports of selected products

Importers of the specific product(s).

Exporters of the specific product(s).

(ii)Details of the related individual importer(s)

Details of the related individual exporter(s)

Step-3. Sources and destination

Step-4. Past present and future demand and supply conditions

Step-5. Related distribution channels and their availability

Step-6. Price structure of the competing products.

Step-7. Miscellaneous information not covered above.

Data Source:

The bulk of the data comes from the secondary sources and only in very specific cases the live field investigation is done together at the micro level.

The majority of the secondary sources are the various journals, product related associations’ publications, statistics of the foreign trade, annual publications or the year books of the related trade, WTO statistics, IMF reports, studies done by the Chamber of Commerce of the concerned countries, export promotion authorities’ periodicals, the yearbooks published by the publishers of the Encyclopedia Britannica etc.

In some of such sources one can source the required data. The more in-depth studies and data availability horizons expand as one conducts the studies and gains experience.

The macro-level investigation gives broader idea of the market concerned and the flow of goods to and fro the market. The next phase of investigation involves the micro level study of the specific markets and products of interest to the global trader. As such the investigation is also based on market and product.

Micro-Level Based Investigation:

In this phase following points are investigated in details.

(a) What is bought or imported relating to the selected commodity group(s)?

(b) What is sold or exported relating to the selected commodity group (s)?

(c) What is produced and consumed relating to the selected commodity within the specified market or the country?

Commentary:

(a) What is bought or imported relating to the selected commodity group(s).

1. Technical parameters

2. Sources

3. Volume or quantity

4. Prices

5. Frequency of purchases

6. Physical movements

7. Past, present and future expectations

8. Factors affecting the purchases

9. Technological inputs affecting the system

10. Socio-economic factors

11. Miscellaneous factors

(b) What is sold or exported relating to the selected commodity group (s).

What is produced must be sold. A part of the production goes into the domestic market and some in the overseas markets. How much one sells in the domestic and overseas markets depends on the individual producer and the domestic market.

In many cases when the domestic market is booming producers divert their focus on the domestic market but keep presence in the overseas markets unless they have some to export a fixed volume of their production.

But now a situation in the emerging economies the trend is bent towards exports because they more or less produce for the export markets. Take the case of Taiwan, Korea, Hongkong, Singapore, Malaysia, Indonesia etc. These countries have their production on the export markets. Their products are specific.

Their domestic markets do not suffer because of tilt but benefits in the sense that the producers tend to quality products at competitive levels, the domestic if do not get the full benefit of the international price it gets the benefit of international quality. For such to find the export markets is not so difficult as to those countries, which want to find the export markets what they produce.

Therefore when we are trying to find what a specific market/country exports we have to take into account the net status of the country’s production base, whether the industry covering the commodity group is basically export oriented or domestic market oriented. Investigation for the former is rather easy and that of the later a tiring job.

The investigation in this case covers following points:

1. Volume of exports

2. Direction of exports

3. Usage sector (industrial or consumer)

4. Who are the known importers?

i. What are the other sources of those importers?

ii. What is the past, present and future business potential

5. Frequency of exports (peak and lean periods)

6. Technological innovation in the commodity group

7. Economic condition of the importing countries and/or the importers

8. Factors affecting the demand

9. Transport conditions from the source to the destination

10. Industry condition at the source country, industry conditions at the destination country

11. Any government policies at the source and the destination countries affecting the trade in the commodities under investigation

12. Any legal requirements at the destination countries

13. Any known cartels affecting the trade in the commodity groups under investigation

14. Distribution channels like wholesalers and retailers

15. Any miscellaneous factors not covered above but having direct or indirect bearing on the trade in the commodity.

(c) What is produced and consumed relating to the selected commodity within the specified market or the country.

In most of the countries the domestic markets are the prime areas triggering the production and consumption cycles which run under the relevant government policies and the available resources. The large domestic markets easily attract the overseas producers and investors.

It also take a larger share of the imports that go directly into the production cycle leaving the export front as a standby arrangement. This is truer for the natural products like the minerals and the agricultural products but as the value addition on them increases, the compulsion of domestic markets starts to decrease provided the goods thus produced can stand up the international market.

Whether one is investigating raw material, industrial goods, consumer durable goods or consumer goods one has to keep in mind and be vigilant for the chain of command. In many cases this chain of command is not traceable on the surface but has undercurrents, which affect the decision making process for demand and supply.

A production or consumption base in a given market though apparently appear to be free operating type but has its decision making process tied under the unseen strings that are operated else-where.

This happens in the case of joint ventures, technology transfer cases, export oriented units or units which heavily depend on a particular base or raw material supply which is not under their control or any other specified or unspecified restrictions which affect the free decision making process of the domestic unit.

If the investigator is not careful in isolating and identifying the chain of command then his estimations on the strengths and weaknesses of the domestic unit will give him misleading data, which can prove contrary to his expectations at the hour of reckoning. Simple production and consumption data is not always easy to understand the market. There is much more to it than just the statistics.

Product Approach:

The product approach generally follows the market approach but not always. The different categories of products require different routes. If we are dealing with industrial products and those which undergo some process to be converted into ultimate unit of utility to the consumers.

The domestic markets at first show the way. The industry that consumes them in the domestic markets, would be the same that would consume in the overseas markets. Thus the main task of the prospector is to just find those consumers and also to find out how they meet their requirements.

The prospecting in this case is done by identifying industries in the overseas target markets using the same or similar product than to find out how the industry in general and few cases in specific, are meeting their requirements. The last part of the study is the specific product that is intended to be marketed in the selected overseas market.

The various steps involved in this type of investigation are:

Step-1. Product:

i. What is the product?

ii. Name

iii. Specifications

iv. Uses

v. Price structure (EX-works, FOB)

vi. Availability

vii. What types of industries require this product?

Step-2. The Manufacturer:

Details of the organization, production capacity, line of products, markets, quality control, customer service etc. All such information is available in the company’s general or product catalogue. This catalogue is one of the sales tools for the international markets. It is your ambassador so make it as attractive and informative as possible.

Step-3. The other Manufacturers:

What is the market position/share of the selected manufacturer as compared with the other manufacturers in the domestic and export markets?

Step-4. The Markets:

i. What are our target markets?

ii. In the target markets where are the consumption centres/industries located.

iii. From where they are getting similar product.

Step-5. The Importers:

List of the potential importers

What is the individual requirements of these end users?

How are they importing the product?

Are there any special relationship between the manufacturers and the specific importers/consumers?

Step-6. The Comparison:

How is our product compared to the competitors’ quality, price

Step-7. The Tariffs:

What is the custom tariff structure for the product in the importing country, and whether the other countries enjoy any special treatment?

Efforts must be focused on indirect trade barriers in the specified market because they affect the exports to that country.

Step-8. The Distribution:

What is the system of distribution in the target market? Other than the direct business, is there any other organized distribution channel available in the importing country, and, whether some of these channels can be utilized for pushing our product?

Product Based Micro-Level Studies:

This study will show you what is the product that you want to export and what you can do to make it acceptable in the target market. There are two things associated with any product, the cost factor and the convenience factors both referred to as CF.

The study of these two factors will answer the most important question from the importer as to why the importer should import from you. The overseas importer wants to get the best price and better quality that is why he prefers to target you on cost and convenience.

Your CF must be clearly differentiated as against your competitors. In the following lines we shall discuss those CF elements and explain how they are important to your business in the overseas markets.

The various salient features are as follows:

(a) Technical parameters,

(b) The product,

(c) Available quantities domestic vs. exports,

(d) Frequencies of availability,

(e) Dependability of availability,

(g) Time cycle of availability within the plant, for domestic market and for exports,

(g) Price tag, and

(h) Stability of the price tag.

(a) Technical Parameters:

This part mainly deals with the technology, process and the plant/equipment involved in the production of the product. The TP is more or less a constant feature. In very rare case new technology is evolved all of a sudden, every new technology always casts its imminent shadow much in advance before it hits the market.

In fact every technology has particular set of relationship with the associated products and new technology is an indicator innovation and of new products.

The electrical tube technology gave way to radio but the transistor technology not only gave us the radio but opened up doors to many more products and the advent of chip on which thousands of transistors can be loaded opened up the floodgates in the electronic sector.

Similar developments that regularly occur in other fields as well like in steel making the Direct Reduction Process is now competing with the traditional steel making rout of blast furnace.

These technology changes are costly and a time consuming process, from the time they are patented to the time innovation in them takes place to percolate in the consumer segment, is a matter of years and in the meantime the traditional ways continue. So for our study the TP part is taken more or less as constant but the plant/equipment are variables and they have direct affect on the product.

Find out what are the plus points in your process and the plant/equipment, how you have modified and improved through in R & D activities, how you do the controls and monitoring, how you ensure the quality, and how you bring in the safety and longer operational life, what are the standards that you use and can use, whether your plant has the credentials from any recognized inspection institute like the ISO – 9000 or the ASTM standards etc.

These credentials are confidence-building activities and act as your sales points when you are dealing with overseas customers. Many organizations have this information in their sales leaflets or the product/organizational catalogues.

Papers with such information are not only your credentials but also act as your true ambassadors. You must always remember that knowing of what you have is not enough, your buyers must know what you have, and they must get confidence in you by knowing it.

(b) The Product:

Your product is your soldier unless it is fighting fit it will not be winning the wars for you in the battlefields. There are various areas information on which is of immense interest to you and to your buyers (your competitors).

Some of the most common points on which you must have knowledge on your products is as follows:

(a) Application (uses, conditions of use),

(b) Range,

(c) Unique features,

(d) History of the product since its inception and what modifications were made in it and what benefits or advantages were gained through such modifications,

i. Why such modifications were made,

ii. What was the market response to such modifications?

(e) How is your product compared to your competitor’s?

i. Technically

ii. Commercially

(f) What is the current market reputation of your products?

i. What was the reputation in the past?

ii. What are you doing for the future?

(g) What market share you command in the domestic market

(h) What exposure your product had or is having in the international market

(i) What are the competing products in the domestic market?

(j) Do the competing products have overseas markets or are they belonging to overseas controlled corporations operating in your country.

(k) What are the weaknesses of your product and what is your action plan for their modification.

The information on point (k) is very crucial, the more you know the better for you, the less you know the better for your competitors. The above points cover more or less complete information that you can have on your product. This information profile has many points that require regular up dating for survival in the markets, domestic and/or international.

(c) Available Quantities Domestic vs Exports:

Any firm embarking upon the export front has to answer to themselves;

i. Do we have the product?

ii. Do we have the price competitiveness?

iii. Do we have the quantities to sustain the export markets?

The first point has been answered earlier and the second point we tackle at a later stage in this chapter. That leaves us to the moot question of availability of net quantities for the export markets. If the exports are taken up as a buffer zone to supplement the domestic markets but then such firms do not go far enough in the export markets.

In the domestic markets one does have the flexibility but in export markets there is none—either you are there or you are not there. The overseas buyers always have the multiplicity of sources. His main concern is whether he can get the required material or products in time or not.

His intentions on acceptance of quality and price have been done before arriving at this stage. The fear psychosis plays a role in his assumptions due to the long distances involved and the presence of national borders. So when you decide upon the entry into the export market you have to ensure that your efforts are backed up by minimum physical quantities.

The lure of the domestic markets always plays a significant role in pulling the exportable portion back into the domestic stream. But firms, which earmark minimum volume of production for the exclusive use of exports, do not face such problem.

Their problems are how to take out from the domestic portion or to enhance the production. The later decision involves capital investment but former one is easily manipulative. However the firms, which are basically export oriented, do not face these problems, for them it is the question of survival.

(d) Frequency of Availability:

Frequency of availability differs from quantity availability. The frequency depends on the production cycle and the seasonal demand on the production base. This is more relevant for the agro products, which have fixed sawing, and harvesting seasons.

Wheat, rice, cotton, sugar, fruits etc., are few of the examples of such products. Their availability in the market is forecasted according to their harvesting pattern but with modern forecasting systems countries store and maintain huge stocks and the shortages are fed from these stocks in the lean and the non availability periods.

But again these stocks do depend on the quantity and arrival of the stuff in the market. On the other hand availability of the manufactured goods more or less depends on the raw materials and the subsequent production.

The sources raw materials are generally naturally occurring materials which are not in direct control of the manufacturers, they are made available to the manufacturers under specific contracts. For example the iron ore required tor the production of steel is a mineral product. The mining company and the steel producing companies need not be the same.

The problem is more critical when both are located in different geographical areas. Another example could be when the manufacturer is dependent on the supply of components including the sub assemblies (CKD: complete knock down or SKD: semi knock down).

The car manufacturers are the best example of such system followed by the electronic system manufacturers like audio and video goods. In the recent times even the sports goods are also falling in this category when the manufacturer sets up assembling units in various countries all of which depend on the components supply from the parent company.

The petroleum refineries are another example of the manufacturers for they depend on the crude oil suppliers. The availability of the manufactured goods in all these cases and many more similar cases depend on the availability of the raw materials. Thus the frequency cycle of the manufactured goods would depend upon the frequency cycle of the availability of the raw material.

(e) Dependability in Availability:

The dependability in availability depends on two factors—one is explained in the above sub point and the other depends on the commitments of the manufacturers either to the market specific or the consumer specific. Here the distinction is to be made between the domestic markets and/or consumers and the overseas markets and/or the consumers.

This is a corporate policy decision area and if the corporate decision is made for the overseas markets and/or the consumers the degree of dependability would be higher as compared to the situation where it is not there.

When the commitment for the overseas markets and/or consumers is not there then the availability would depend on the demand and supply situation in the domestic market. Most of the manufacturers adopt such policies, they take the export markets as a medium of divergence.

In short runs this policy may appear good but when exports are taken as prime target areas of thrust then the corporate policies have to be oriented in this direction. This dependability in availability acts as catalyst in the promotion of international sales.

Therefore when you are looking towards the export markets for the expansion of your business then proper corporate policy commitments are essential or rather your first step towards export market development exercise.

(f) The Time Cycle of Availability:

This is another factor, which needs thorough investigation before an attempt is made on the export front. This factor is associated with the delivery element of the business and sometimes it is not given its due credit.

Before proceeding any further on this sub-topic let me explain the net difference in the Delivery and Time Cycle of Availability. When we talk about the delivery we generally mean how long it would take for the goods required to be delivered to the buyer in the way he desires.

In this case the time element is taken into account from the time the goods leave the factory doors and upto the destination, but in the case of TCA the time required for the goods to reach the factory exit point is also taken into consideration and it stretches right upto the final point where it is exposed to the ultimate consumers which means that in TCA there are two time cycles:

1. Time cycle within the factory.

2. The time cycle between the point of delivery at the manufacturer’s and exit point right upto the point of consumption or at a place convenient to the ultimate customer. The study of these two time cycles makes better sense.

Without the knowledge of the internal cycle you cannot make any commitments with 100% surety that, not only the time commitments would be honoured, but you also get an indication as to when the next time cycle should be planned so that the availability of the goods at the final point of exchange is not compromised.

Let us indicate the time cycles of availability as TCA, time cycle within the factory as CI and the out-side as C2, then

TCA = C1 + C2

So when you are calculating your TCA you must take into consideration the time required for a product to be ready within the factory and the time required for the product to be moved right up to the delivery point specific to the consumer.

In this calculation no hypothetical figures or someone said so and so, are to be considered. The data has to be based on hard facts based on first hand information. It is generally found that in many cases this cycle overshoots its specified targets.

This happens when TCA has been worked out on hypothetical data and not on real hard facts. Some times TCA figure is given out without even bothering the hypothetical values of the TCA, this is the worst situation and many organizations not only lose the business but also lose the customer.

Remember losing a business is no big thing because you can always come back to try again but if you lose the customer then to whom you will come back again to do the sales.

In the sellers’ market the TCA to some extent loses its significance but now a days the markets are generally of buyer’s or consumer’s markets. This is due to the availability of wide range of compatible products.

The overseas markets are no different than the buyer’s markets. The problems are compounded by the time and distance factors. These two factors make the buyers very uneasy and suspicious.

For the overseas markets it is said that delayed delivery is a dead delivery. The concept of Just in Time (JIT) is gaining momentum. Though there are no hard facts available but in general the JIT delivery system covers about 40% and the rest 60% of the total goods move in the global trade.

JIT system is more prevalent in the automobile sector where the car makers have to depend for over 50% of the components requirements on the outside vendors. These vendors have to maintain constant flow components truck line like a chain, looping around the point of consumption and point of production.

Therefore the in depth study to find out what are the precise time cycles within the factory and outside the factory are very essential.

C1: The Time Cycle within the Factory:

There are many factors affecting the TCA within a factory and it varies from factory to factory depending upon the technological inputs and the innovations thereof. The technological inputs might be a constant factor but the other one is not and most of the factories closely guard their innovative inputs in the methodology and applications from the outsiders.

This time cycle is closely related to their costing system and in a competitive market they try to get an edge over their competitors through this factor.

Basically this time cycle (CI) would depend on the total time taken to turn out the finished product from the time the raw materials are fed into their process system and up to the time the finished goods or the goods that the firm intends to market are ready at the delivery point of the firm.

For certain goods there is a fixed time cycle which cannot be altered. But on top of this fixed time cycle there are fringe cycles, which can be shortened or elaborated. This situation arises when the destination markets require specific packing, labeling, or certain test certifications or even at times the third party inspections could be the requirement of the destined market or even the ultimate customer.

All these fringe cycles have to be meticulously calculated and added on to the fixed time cycle to arrive at a reasonably correct figure of C1. Within a plant the workload is planned in advance and once the processing starts it cannot be interfered.

It is the time when the planning is being done, the priorities are fixed for customer specific or the market specific. When dealing with the exports generally the export cargo get top priority not because they are high profit generators but because they represent the organization across the national borders and are the means of confidence building block in the international markets.

Thus when calculating the C1 for the export market try to segregate its CI from that of the domestic market and never let it be shadowed by the domestic pulls. It would be advisable to add some contingency time factor in the calculation of C1 to safeguard against any unforeseen circumstances.

The C2 factor is the net time cycle from the factory gates to the loading port, from the loading port up to the destination port.

There will be many segments of this time cycle some directly under your control and some out of your control, let us see the various time segments covering the C2 factor:

C2. (i) Factory to the port

(ii) Port clearance, inspection, documentation etc.

(iii) In case of a containerized cargo then the stuffing time would be an extra segment.

(iv) The loading rate in the ship.

(v) Availability of the ship or the vessel.

(vi) The voyage time up to the destination port.

The above six points are the very basic segments that would constitute the total time cycle for C2. It must be noted that depending upon the terms of the offer this time cycle would vary.

For example if the offer to the foreign buyer is on FAS basis (free alongside the vessel) then time calculation would be limited up to C2-iii, and if it is on FOB basis (free on board) then the time calculation would be up to C2-v, and lastly if it is on C&F basis (cost and freight) then the calculation would be up to C2-vi.

So depending on what type of offer or the contract that you have made the calculation of C2 would be done accordingly. Here again some time for any contingencies must also be added to the overall time cycle of C2 to take care of the unforeseen developments.

Thus we see that in the calculation of CI and C2 we have added some extra time factor (say alpha) which would indicate the maximum time that is required for the goods to reach the destination point and the minimum time would be the total time minus the alpha segment. This would be the tolerance limit of operations.

The net sum of the C1 and C2 would give us the TCA. When dealing with the export markets you have to be very firm for the values of C1 and C2 and the resulting TCA.

Many exporters have failed to capitalize on the potentials that an export market offers just because they failed to keep up their commitments on agreed TCA, for the exporters this was a figure but for the importer it was a commitment on which he based his production or distribution.

You can understand the importance of this factor from a very simple example at home. Suppose you do not have food and you ordered it to a vendor to be delivered at noon but the vendor brings it at night or the next morning, what would be the condition at your home? Similar would be the condition of the importer.

Your TCA is as important as your quality and price, you cannot get away from any of these three. TCA is in fact a reliability factor; it decides whether you will continue in the market or will be out of it, sooner or later, depending on the market conditions. Considering the present day market situation of cut throat competition, be sure if you are not in time then someone else would be there before you realize it.

This is a situation when you stand to lose a customer and in business deals losing a customer is the worst kind of situation. You can afford to lose 100 business opportunities with a customer because there is a chance to come back again, but if you lose the customer to whom you will go back again – not that customer at least.

(g) The Price Tag:

Pricing your products is not as simple as it might look, it is not just summing up of the different cost elements like the raw material cost, processing cost, packaging, forwarding, taxes, handling charges, export benefits, profit margins etc.

All these are the elementary or the basics of pricing. These can tell you what could be your price, but in the export markets it is not your price that will get you the contract but price that a buyer or an importer is willing to pay for your product or services that is the price that you have to work out for getting the contract.

Sometimes it might not be feasible for you to meet the required price line then you have to watch out who else, if not you, could get away with the job and how, perhaps the postmortem could show a lead and you become wiser next time.

But before you fix the price tag on your product or service you have to arm yourself with the prevailing market conditions in the target market. You have to find out the price tags of your competitors in that market and you have to find out how are they able to maintain the price line.

Maintaining the market share and the price line are related to export marketing strategies. It must be noted that the price tag is not an isolated, unilateral or charitable exercise in view of the current global trade unification movement that came into force on 1st of January 1995 in the form of World Trade Organization and has gained momentum in the new millennium.

Amongst its various provisions there is one dealing with the anti dumping laws? The anti dumping laws under WTO regulations are very explicit and the exporter is advised to refer to the relevant portion and be vigilant for the circumstances under which the importing country can impose the counter measures to safe guard their domestic industry.

Recently India has faced such situation in the USA, EU and the Canadian markets for its steel flats and stainless steel products. The days are gone when you could fix any price for your products to capture the export markets, now a days there has to be rational justification for your pricing.

No doubt this situation is very harsh on the developing countries when they have to face the developed countries in the market place for the manufactured goods. As the old saying goes that when one door is closed on your face ten doors are opened elsewhere. No one maker can satisfy the whole of the market, always some pockets are left untouched or left behind as not so prospective.

These miscalculations and wrong notions creates the areas of opportunities which went un-noticed by those who passed by but for others with keen eyes these were the areas of the rising sun. Your success in the export market would very much depend on identifying such areas and making best use of the situation.

In no way the meaning of such situations should be taken on its face value but a studied and well calculated approach is the best way to go about for prospecting and capitalizing on the opportunities present in those areas. Your price tag is just a base, whether it fits in to those markets or not you have to investigate at first.

If it exceeds the expectations then you have to trim it or find ways to re-define your tag to suit the market conditions. No product is an absolute identity and so is any market, always there is room for adjustments and those who learn it fast they reap the harvest.

So remember in export markets your calculated price tag has little relevance, you have to modify it to suit the market conditions. How you can do it will be discussed in the market portion which follows after this sub chapter, but for this point on price tag it must be noted that it is a flexible figure.

Market pressures bring in various innovating means covering the full spectrum of the production and distribution systems. If your product is selling and selling well then there could be no need for any innovating manipulations.

But as we move from the sellers’ market in to the buyers markets such manipulations become essential part of the marketing strategy. We just do not give up if our price is high but we reopen our whole system to find out where we can cut the corners to bring the price tag in the winning position.

In general the areas that we focus attention are:

i. Does the product have any utility feature which is undesirable from the customer point of view and if removed the product still holds its intended utility to the customer?

ii. In house component production costs versus bought out from the subcontractors

iii. In house raw material and components inventory costs versus the inventory at the subcontractors

iv. Is the methodology of production correct or any alternative route is available which is more cost effective?

v. What is the material wastage level generation in the present production system, is it justified, can it be brought down further to still lower levels?

vi. What is being done with the wastage materials, are we getting back anything in money values?

vii. Has the production system reached its limits of productivity, or can the productivity still be increased to higher levels?

viii. Is the system working most efficiently, or, are we adding cost due to inefficiency?

ix. What is the condition of the plant and equipment, how old is it compared to competitors?

x. If the plant is old then what will it cost to recondition it versus newer generation?

xi. Has the production technology changed since the production line was set up and how efficient is the new technology?

xii. Can the organization afford to go in for new technology?

Well above are just a few of the questions answers to which would contain the solutions for your price tag—the effective and the winning one. How you answer these questions would depend upon your compulsions and motivations for the export ventures, the more motivated you are the better would be the answers and healthier would be your price tag.

(h) Stability of the Price Tag:

Having found the right price tag for your product and for a market is the beginning of the exercise in the export marketing, the most important point to be considered is how to maintain it over longer periods of time especially if you are supplying the basic materials of production, components or subassemblies to an OEM buyer and that too in a very competitive market.

In such markets the OEM is fighting against stiff competition and he cannot beat the competitors unless his price structure is not only stable but penetrative as well. Once a negotiated price line is fixed the buyer or the OEM importer would structure his prices accordingly.

No doubt he too will be doing in-house research to find ways and means to cut his costs to the ultimate consumers. This cost cutting would give him an edge over the competitors or it might improve his profitability margins. If your price line is not stable then it would put pressure on him to either reduce his margins or put pressure on you to maintain your price line failing which he would be looking elsewhere.

The moment your buyer starts looking elsewhere would mean you too start looking elsewhere for new partner. Under such situations all the developmental work that you did to cultivate that buyer would be an avoidable exercise in time and money resulting in losing the potential customer. Losing a customer is more sinner then losing the deal.

As such it would be advisable to be vigilant on your price front and you have to find ways and means for maintaining it for a stretch of time that normally could be a year or part thereof depending on your understanding with the buyer. Once the price line is fixed it becomes the reference point for any future escalations.

When you are dealing with overseas customers there are many hurdles between you and the overseas buyer especially the inflation, currency fluctuations, local laws, custom tariffs and the market and economic conditions both at the exporter’s and the importer’s sides.

These are the factors on which the exporter or the importer does not have direct control but at least the exporter can make some makeshift arrangements to safeguard his price line. The laws and tariffs are annual phenomena, but inflation and the currency fluctuation are seasonal.

Inventory planning and buildup are in the exporter’s control and so is his operational flexibility. The judicious use of these factors can bring some stability in the price line at least for the contractual period beyond which lies the negotiating table to fix another price line. But if all these exercises fail and your price line starts cracking in between the contractual period then the fixation of it was indeed faulty.

Never let this situation occur in your calculations. Under the revised international trade laws there is provision of hard-ship clause. The exporter can seek to invoke this clause to protect his business which otherwise might be ruined if he has to carry out the contractual performance.

Generally the buyer’s tendency is to cut and re cut the price line and the seller’s tendency is to lift it as much as possible without breaking the line and sometimes it is a desperate situation. In one of such situation the desperate exporter commented to the buyer “Skin me as much as you can but you have to leave some skin on me for my survival for if I survive only then I can service you”.

This is an extreme case of desperate situation but very often it pops up at the negotiating table and a sensible buyer knows the turning point beyond which he cannot go any further, if the intentions are clear.

As an exporter you too have to know your limitations and when you work out your price line take full consideration of these limitations and only then you would be able to draw the realistic price line and be able to maintain it.

By-Products of the Investigations:

While making these types of studies keep focused on the PURPOSE. When these investigative studies are conducted plenty of non related data is bound to come up. Treat such data as the by product and keep it on the side lines from the main studies.

May be some such data might have hidden opportunities in some unrelated fields and could be taken up later on as secondary studies. Mostly global traders make use of such data for secondary business potentials.

Example:

Dry Cell:

For instance when you are investigating the market for say a dry cell, you are indirectly also studying the market for:

Materials:

Zinc, manganese, chemicals that go in the making of these.

Dry Cells End products:

The products that use these dry cells.

Technology/Equipment:

When you interact with the manufacturers of the dry cells you also observe the methodology and technology that they use. If you happen to have a customer who requires that technology you can initiate the business communication, or, if you come upon a new source of technology, you can offer it to the existing manufacturers.

Also keep in mind that any technology is machine based so list of machines give you another lead for potential business, source Thus one investigation gives you further basic data for another 3 or four related industries and/or products.