In this article we will discuss about:- 1. Meaning of Transfer Pricing 2. Transfer Pricing in India 3. Transfer Pricing Methods 4. Case Study on Tarragon Chemicals and Transfer Pricing.

Meaning of Transfer Pricing:

Transfer price is the price at which two related parties undertake a commercial transaction between each other. The related parties are called associated enterprises. So, transfer price is the price at which an associated enterprise sells tangible or intangible properties, and services to another associated enterprise.

Two enterprises are associated when one of the two following conditions is satisfied:

i. One enterprise participates directly or indirectly in the management, control or capital of the other.

ii. Both enterprises belong to the same group or conglomerate, so that the same person participates directly or indirectly in the management, control or capital of both the enterprises.

Transfer pricing regulations use a concept called ‘arm’s length price’, which is the internationally accepted TP standard to be applied for tax purposes by MNCs and tax administration. OECD guidelines (article 9 of the OECD model tax convention) uses arm’s length price as do Indian TP regulations. Though the definition of related parties (and associated enterprises) is critical in Transfer Pricing, not all countries that have TP rules define the term.

Australia’s Income Tax rules apply to any transaction between parties that is conducted at a ‘non-arm’s length’ price, irrespective of whether they are associated enterprises or not. That is, the concept of related parties is irrelevant under Australian tax law. Canadian TP rules state that two parties are ‘related parties’ if they do not deal with each other using arm’s length price. French TP rules define associated enterprises as those that depend upon an overseas enterprise or those that control an overseas enterprise.

TP is used by an MNC to allocate profits between parts of the multinational group that operate in different tax jurisdictions. It also enables the MNC to identify those affiliates that are operating well and those that are not. TP has become increasingly important to host country governments because of its impact on their tax revenues. The Organisation for Economic Cooperation and Development (OECD) brought out TP rules for MNCs in 1995. The guidelines were revised in 2009 and 2010.

In November 2010, the OECD’s Working Party- began discussions on transfer pricing of intangibles. Countries have come up with their own transfer pricing regulations that seek to exert some control over pricing of inter-affiliate transactions by MNCs. Developed countries such as the UK and the USA have had transfer pricing regulations for decades. India introduced them in 2001 and they are broadly based upon the OECD TP guidelines for multinationals.

Effect of Transfer Pricing on Tax Liability:

Transfer pricing decreases the overall tax liability of affiliates, and increases overall profit after tax, because of the shifting of tax liability from a jurisdiction with a relatively higher tax rate to a one with a relatively lower tax rate. The greater is the differential in tax rates, the greater impact TP has on overall profit after tax. The combined tax payable by the group depends on two factors- the tax rates in host countries, and the transfer price. TP can lower the combined tax payable and increase combined post-tax profits. Illustration 1 ignores exchange rate risk by using only one currency.

Transfer Price and Tax Planning:

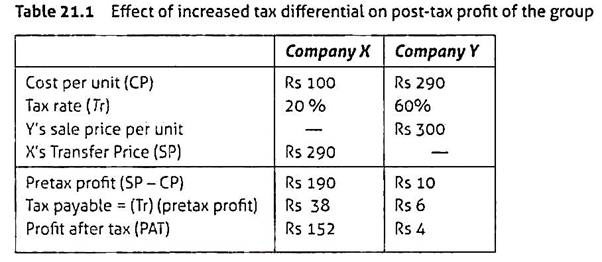

What would the combined tax payable and post-tax profits of X and Y be, if the tax rates changed? For a given transfer price, as the tax differential increases, the combined tax payable decreases and combined post-tax profits increase. That is, the reduction in the overall tax liability of both the companies increases as the tax differential between both countries increases.

Suppose X faces a tax rate of 20% (Table 21.1). The tax differential between the related companies has jumped from 20% (that is 60% – 40%) to 40% (that is 60% – 20%). At a transfer price of Rs. 290, X’s tax payable is Rs. 38 and Y’s tax payable is Rs. 6, and their combined tax payable is Rs. 44. X’s post-tax profit is Rs. 152, and Y’s post-tax profit is Rs. 4. For the same transfer price of Rs. 290, their combined post-tax profit jumped to Rs. 156.

Therefore, TP is an effective tax planning device that reduces the multinational’s overall tax liability and boosts the bottom line. But there is a loss of tax revenues for the country with the higher tax regime. In the above example, for tax rates of 40 % and 60 %, when the transfer price was raised to Rs. 290, company Y’s host country could collect only Rs. 6 instead of Rs. 60.

Tax laws relating to the treatment of transfer pricing vary between countries. In the USA, four methods are prescribed for transfer pricing of intangible assets- the comparable uncontrolled transaction method, the comparable profits method, the profit split method, and unspecified methods.

Under Indian tax laws, six transfer pricing methods are recognized—the comparable uncontrolled price method, the resale price method, the cost plus method, the profit split method, the transactional net margin method, and any other method as may be prescribed by the Board. The affiliate (tax payer) is permitted to choose the most appropriate method given the nature of the transaction. Where more than one price may be determined by the most appropriate method, the arm’s length price shall be taken to be the arithmetical mean of such prices.

Transfer Pricing in India:

The Finance Act 2001 introduced transfer pricing regulations and they came into effect from the assessment year 2002-2003. Their intention was to prevent shifting out of profits by manipulating prices (through under invoicing or over invoicing of related party transactions) in international transactions, which erode the country’s tax base. The regulations generated tax revenues of Rs. 600 crores in 2002-2003.

TP regulations are contained in Sections 92 to 92F, 271(1)(c), 271AA, 271BA, 271G of the Finance Act, and rules 10A to 10E of the Indian Income Tax Rules 1962. Section 92C requires the affiliate in India to calculate arm’s length price. Associated enterprises are required to keep information and documentation relating to international transactions, for eight years from the end of relevant assessment year. Every enterprise that entered into an international transaction in a previous year must submit an Audit Report from the Accountant in the prescribed form.

According to Section 92B, an ‘associated enterprise’ is one that has at least one of the following characteristics:

(i) Direct or indirect participation in management (through an intermediary) by another enterprise, such that the latter can appoint more than 50% of the Board of Directors or members of the governing board.

(ii) Direct control by another enterprise, or control through intermediary.

(iii) Direct or indirect ownership of capital in the enterprise by another enterprise, such that the latter has 26% of voting power.

(iv) An enterprise receives an advance of loan from another enterprise, which is not less than 51% of the book value of the total assets of borrowing company.

(v) An enterprise takes a loan of which at least 10% is guaranteed by another enterprise on behalf of the borrower.

(vi) Total dependence through technology transfer by one enterprise, on another enterprise possessing exclusive rights, for manufacturing (through ownership of the brand) or pricing of goods or articles by using know how, patents, etc. The technology transfer could be through knowhow, patents, copyrights, trademarks, license, or franchise. But it does not include technology for services such as software.

(vii) An enterprise depends on another for up to 90% or more for the raw materials and consumables, and the latter has influence over price and other terms of supply.

According to Section 92B, an international transaction attracts TP regulations. An international transaction is a transaction between two or more associated enterprises of which either both, or anyone is a non-resident. Therefore, in a transaction between an Indian company and its overseas branch, transfer pricing regulations do not apply, but a transaction between a foreign entity and its permanent Indian branch or between two Indian branches of a foreign entity falls under transfer pricing regulations.

The international transaction should relate to one of the following:

(i) The purchase, sale or lease of tangible or intangible property; the provision of services; the lending or borrowing of money; the allocation or apportionment of any contribution, cost or expense.

(ii) Any transaction that affects profits, income, losses or assets.

Section 2(11)(b) of the Income Tax Act defines an intangible asset as including know how, copyrights, franchises, licenses, patents, trademarks, or any other business or commercial rights of a similar nature.

Transfer pricing methods identify the ‘arm’s length price’—the price charged in an ‘uncontrolled’ transaction between the tax-paying firm and an unrelated party. The arm’s length price is used by the tax authority of a country to determine the tax payable in a controlled transaction.

Any income arising from an international transaction or allocation/apportionment of the expense from an international transaction shall be computed with respect to the arm’s length price, which is defined as the market value of a particular transaction ignoring the impact on pricing due to existence of special relationship between associated enterprises. This would avoid the creation of tax advantages or disadvantages that would otherwise distort the relative competitive position of either type of entity.

Transfer Pricing Methods:

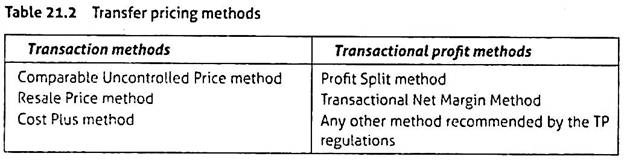

Arm’s length price can be computed using one of the six methods. They are broadly divided into two groups- transaction methods and transactional profit methods, each containing three methods (Table 21.2). The methods can also be categorized into three groups cost- based methods, market-based methods, and negotiated methods.

Countries vary in their recognition of TP methods—some are recognized but not others. Australia permits five methods – the comparable uncontrolled Price (CUP) method, the resale price method, the cost plus method, the profit split method, and the transactional net margin method. The methods are briefly described below. Canada also permits the five methods, but gives preference to the transaction methods, over transactional profit methods. The UK permits any TP method, and France and Sweden permit any method mentioned in the OECD’s TP guidelines.

1. Comparable Uncontrolled Price Method:

It compares the price charged for property or services transferred in a controlled transaction to the price charged for property or services transferred in an uncontrolled transaction in comparable circumstances. This is the most direct and reliable way to determine the arm’s length price.

2. Resale Price Method:

The arm’s length price is determined by comparing the price in an inter-affiliate sale with the subsequent sale price of the purchasing affiliate, and estimating the ‘reasonable profit’ that the purchasing affiliate should make. The ‘reasonable’ profit margin is deducted from the sale price to determine the arm’s length price.

Illustration:

X and Y are two related companies. X sells a product to Y at Rs. 1000 per unit. Y’s sale price is Rs. 1,800 per unit. Y is estimated to make a ‘reasonable’ profit of Rs. 300 per unit. The arm’s length price is Rs. 1,800 – Rs. 300 = Rs. 1,500.

3. Cost Plus Method:

The arm’s length price is the sum of the cost of manufacture (or providing the service) plus an appropriate mark up. The mark up is based on the gross margins earned by suppliers of the product (or service) in uncontrolled transactions. The arm’s length price also considers the functions performed by the supplier of the product (or service) and market conditions.

4. Profit Split Method:

This method is applicable where transactions are so inter-related that they cannot be evaluated separately for the purpose of determining arm’s length price of any one transaction. The profit to be split for the related affiliates is identified. Then this profit is split between the related affiliates in proportion to the contribution of each affiliate. The contribution is estimated on the basis of functions performed, assets employed (or to be employed) and risks assumed by each enterprise, using available reliable external data.

There are two types of profit split methods:

i. Comparable Profit Split Method:

The combined profit is allocated between both the parties.

ii. Residual Profit Split Method:

The operating income is first allocated between both the parties, followed by the allocation of residual profit.

5. Transactional Net Margin Method:

The net profit margin realized by an enterprise through an international transaction with a ‘related’ enterprise is computed in relation to costs incurred, or sales effected, or assets employed (or to be employed) in the enterprise. This net margin is compared with the net margin on a transaction with an unrelated enterprise (uncontrolled transaction). This is called internal comparison. If such comparison is not possible, the net margin that would have been earned in comparable transactions by an independent enterprise is used for comparison. This is called external comparison.

Case Study on Tarragon Chemicals and Transfer Pricing:

Tarragon Chemicals is an Indian MNC with three subsidiaries – Ajanta Chemicals located in Vietnam, Jeyaraj Chemicals in Cambodia, and Maruti Chemicals in Egypt. The corporate income tax in Cambodia, Vietnam, and Egypt is 30%, 25% and 20% respectively. Ajanta’s total annual costs are Rs. 3.5 million, Jeyaraj’s total annual costs (excluding purchases from Ajanta) are Rs. 1.5 million, and Maruti’s total annual costs are Rs. 4 million. Thirty percent of Ajanta’s output is transferred to Jeyaraj, 20% to Maruti, and the remaining is sold externally for Rs. 5 million. All of Jeyaraj’s output is sold externally for Rs. 7.3 million.

Though Vietnam is not an OECD member, it follows OECD TP guidelines and the ‘arm’s length’ principle. In Vietnam, all corporate taxpayers must prepare a form on their related party transactions. Vietnamese TP rules recognize arm’s length price computed in any one of the following five methods – the comparable uncontrolled price method, cost method, resale price method, comparable profits method, and profit split method. Egypt introduced TP rules in 2005. Cambodia did not have TP rules as of 2011.