The following article will guide you about how to mitigate interest rate risk.

Introduction:

Of the two components of interest rate risk, price risk can have a sudden and dramatic impact on your fixed income portfolio. The reinvestment risk is slow and long drawn in its effects. In the long run, interest rate scenarios change and you will most certainly get better opportunities to reinvest your income.

As regards price risk, the best way for you to protect yourself against it is to understand the present economic condition proactively in terms of your fixed income portfolio. While this may involve extensive analysis, we would try and help you understand a few key factors that can be looked for to arrive at broad conclusions.

Repo and Reverse Repo Rates are the ‘policy rates’ for the Reserve Bank of India (RBI). ‘Policy Rates’ means that the RBI uses these rates to manage day-to-day money supply in the banking system. The reason this is important is because availability of funds with banks determines their ability to make available credit facilities to borrowers.

Availability of credit in turn determines the ability of the economy to expand and grow. These rates also tend to set a benchmark for other short term instruments like the inter-bank call market, the CBLO markets and certificate of deposits (CDs). The prevailing tone of RBI policy (increasing rates or reducing rates or no change) will set the tone of yields in fixed income securities with short term maturities.

Then we have the Government of India making new borrowings every year to fund its budget deficit. The interest rates on these borrowings will depend on how much and how badly the government needs funds. If the government is in dire need of funds or if it has large amounts to borrow, it will offer higher interest rates.

Higher interest rates on government securities will obviously also cause the interest rates on corporate borrowings to rise. In effect, the interest rates on long term maturities will increase. Government borrowing has implication on short term interest rates too.

If the government borrows in large amounts, it is going to spend it in large amounts too. This will create surplus money in the economy which in turn will fuel demand for various products. To keep a tab on price levels the RBI will begin to raise policy rates.

All this was to explain you how and why the interest rates move the way they do. Now the strategy to manage interest rate risk is to understand the current interest rate scenario and act accordingly.

Some of the strategies for you are:

If you see that the government is going to borrow large amount in the coming year,

I. It may be time to move out of your investment in long term debt funds and move into short term debt funds and money market funds.

II. No doubt, an increase in short term yields will affect these funds too. But since their duration is small, the price impact will also be small.

III. Once the borrowings actually start to happen, and interest rates start to rise, you can once again shift to longer maturities.

By doing this, you would have protected yourself from price impact of rising interest rates and would still be able to earn higher interest rates once you shift back to long term maturities.

If you sense that the government is going to reduce its borrowings in the coming year,

I. Remain invested in the long term debt funds to earn from the price impact of falling interest rates.

II. You can shift out of your investment in short term funds and move into long term funds to take full advantage of price impact.

III. When interest rates fall, both short and long term maturities will rise in value. But long term funds will rise more in value than short term funds.

IV. Long term means more risk. Once interest rates have come down, you can move back your money to short term and money market funds as the interest rate differential from investing in long term funds may not necessarily justify its risks.

By doing this, you would have taken full advantage of the price impact of falling interest rates.

How to Mitigate Credit Risk:

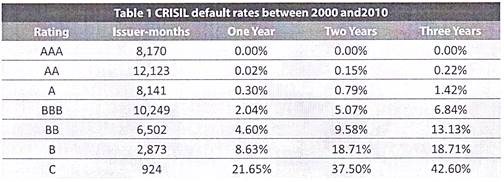

Unless there is an event as profound as the global financial crises of 2008, credit ratings can be considered as the best tool to manage credit risks. The table below provides an idea of the default rates of issuers in various rating categories as per the credit ratings issued by CRISIL. This will give you a broad idea of the extent to which credit ratings provide information about the credit quality of a particular issue.

Thus, it can be inferred that:

a. The 1-year, 2-year and 3-year cumulative default rates on AAA rated instruments are zero. In fact (it is beyond the table above) there has not been any default on a long term instrument rated AAA.

b. The 1-year cumulative default rate on AA rated papers (including AA+ and AA-) is 0.02%, for 2-years it is 0.15% and for 3-year period it is 0.22%. That is to say, the default rate on AA rated securities is miniscule- over a 3-year period, out of every 100 issuances, default is less than 1.

c. The cumulative default rate on A rated instruments (including A+ and A-) is 0.3% for 1 year, 0.79% for 2 years and 1.42% for 3 years. That is to say, over a 2-year period, out of every 100 issuances rated, less than 1 issue has defaulted and over a 3-year period, slightly more than 1 issue (1.42) has defaulted.

d. The default rate on BBB rated papers is higher, 6.84% over 3 years i.e. over a 3-year period, out of every 100 issuances rated, almost 7 issues have defaulted.

As can be seen above, the best way to mitigate credit risk is to invest in the higher rated instruments which have the lowest probability of default.

In addition to the credit ratings, investors (including institutional investors in some cases) often rely on their perception of a particular issuer in making their investment decisions. For example- a debt issue of a subsidiary of an old reputed business house would usually receive a positive response from the investor community even if its rating is less than top grade.

Again, a debt issue of a large public sector bank may receive a very good response from the investors irrespective of its credit rating. You too can rely on your and in general, the market’s perception but ensure that you don’t get carried away beyond a certain extent.

Avoid anything less than Top-Grade in Short Term Instruments:

The rating of short term instruments depends more on the liquidity position of the issuer than the long range fundamentals. Thus, even the slightest doubt on repayment ability of a short term instrument (reflected by the credit rating) is not taken too well by the investors.

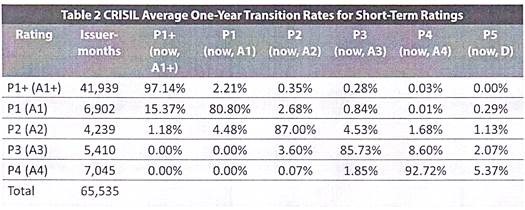

To give you an idea of the rating transitions in the short term credit ratings, the table below summarizes the rating transitions in the short term credit ratings between 1988 and 2010 issued by CRISIL.

Thus, it can be inferred that:

a. P1 + (now re-christened A1 +) which is the highest short term credit rating and comprises the majority of the outstanding short term ratings, has a stability of 97.14%, on an average, over the period 1988 to 2010.

That is to say, out of every 100 issues with short term rating of P1+ (now re-christened A1+), 97 issues remained P1+, about 2 were downgraded to P1 and less than 1 (0.66 to be precise) were downgraded even below.

b. Issues rated P1 show a stability of 80.8% and there were upgrading of 15.37% i.e. a total stability was 96.17%. 3.82% was downgraded, including 0.29% to P5, which is default category.

As is seen above, the ratings at the higher levels (up till A1) are largely constant (unless there is a positive transition or upgrade). The percentage of such higher rated instruments getting downgraded is few and far between. So, the point to remember is that in the case of short term ratings, avoid any instrument with a rating below A1.

How to Mitigate Inflation Risk:

Inflation risk is probably the most subtle as well as all-pervading. It is something that we, especially as ones living in a fast developing economy, just can’t afford to ignore.

It may sound disheartening, but the fact is that you cannot manage inflation risk in a fixed income security. Fixed income securities are a poor hedge against inflation.

However, before you jump to conclusions, there are a few points that we wish to make:

a. One way of mitigating inflation risk is to invest in inflation-indexed bonds. The interest rate on these bonds is linked to the prevailing inflation rate of the economy (usually, the Consumer Price Index released by the statistical agency of the country).

Thus your interest income will increase in the period in which the inflation rate increases. However, the overall yields on inflation-indexed bonds are usually lower than those on comparable non-inflation indexed bonds.

The lower yield is to account for the added inflation benefit. Thus, in reality, your interest income may not actually be higher than other bonds but the only difference would be that it would change positively with the changes in inflation.

b. Equities are said to be a good hedge against inflation. However, while your inflation risk is mitigated, you must remember that you take on several other risks that you would want to avoid.

c. The fact that inflation eats into your purchasing power is no good reason to not invest at all. Think about it this way- You invest in a fixed deposit which earns you an interest at 8.5% while the inflation rate is 12%. In such case you lose 3.5% in real terms.

However, had you not invested your money in the fixed deposit, it would probably be left in your savings account earning you an interest of about 4%. In this case, your real earnings are -8.5%. In financial terms, the guiding principle is that every penny saved is a penny earned. So, it is better to minimize the inflation loss rather than give up risk mitigation all together.

d. Even if you invest in an inflation indexed security, the inflation is usually measured based on a standard statistical parameter such as Consumer Price Index which measures the price effect of a standard basket of goods and services. The basket may not contain all the goods and services that you use and may not even be in the same proportion.

e. In a developing economy like ours, inflation is a phenomenon that is bound to exist. It may even eat away a portion of your purchasing power. But you should never get cynical and argue that that ‘if inflation is anyway to take away my returns, I better consume my savings today rather than invest it for future’.

You should always remember that if you consume everything today, you might be left with nothing in the future while if you save (even if inflation rate is more than the return rate) you would still be left with something in the future.

With this, you would now have recognized the risks as well as the rewards of investing your money in the fixed income securities. This will help you recognize the investment risks, evaluate whether you are willing to take those risks and accordingly make better investment decisions.