In this article we will discuss about risk and return on investment.

Risk and Required Return:

The expected rate of return of an investment reflects the return an investor anticipates receiving from an investment. The required rate of return reflects the return an investor demands as compensation for postponing consumption and assuming risk. The required rate of return of an investment depends on the risk-free return, premium required for compensating business and financial risks attached with the firm’s security.

The required rate of return also reflects the default risk, managerial risk and marketability of a particular security. Investors are generally risk averse. If odds of winning or losing are identical, they are likely to reject the gamble. Why anyone would want to expose himself to a risk without a corresponding return.

A rational investor would have some degree of risk aversion, he would accept the risk if he is compensated adequately for it. The greater the risk, the greater the compensation one would require. This compensation is in the form of increased rate of return. Investments which carry low risks, such as high grade bonds, will offer a lower expected rate of return than those which carry high risk such as common stock of a new unproven company. When one formulates an investment plan, this risk-return trade-off is an important consideration.

In determining the level of expected return one wishes to receive, he will also be determining the level of risk which one will have to accept. Conversely, in accepting a certain level of risk in designing a portfolio, the level of expected return is also get determined.

It may be difficult to quantify these levels, but one would at least have to think on a relative basis; that is a low, medium, or high degree of risk. There is a positive relationship between the amount of risk assumed and the amount of expected return. That is, the greater the risk, the larger the expected return and the larger the chances of substantial loss.

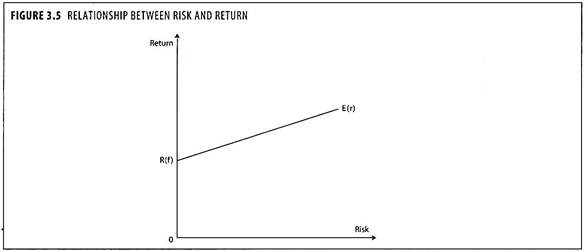

One of the most difficult problems for an investor is to estimate the highest level of risk he is able to assume. Any such estimate is essentially subjective, although attempts to quantify the willingness of an investor to assume various levels of risk can be made, the relationship between the amount of risk assumed in managing a portfolio of securities and the amount of expected return can be graphed as following in figure 3.5.

Risk is measured along the horizontal axis and increases from left to right. Expected rate of return is measured on the vertical axis and rises from bottom to top, the line from 0 to R (f) is called the rate of return on risk less investments commonly associated with the yield on government securities. The diagonal line from R (f) to E (r) illustrates the concept of expected rate of return increasing as level of risk increases.

The example shows a linear relationship between risk and return, but it need not be linear. Most of the theoretical work on portfolio management assumes a linear relationship between risk and return which may be true for an efficiently run competitive market in developed economies, but in developing countries like ours with administered interest rates and many other restrictive regulations, this linear relationship generally does not hold.

Risk-Return Relationship:

The entire scenario of security analysis is built on two concepts of security: return and risk. The risk and return constitute the framework for taking investment decision. Return from equity comprises dividend and capital appreciation.

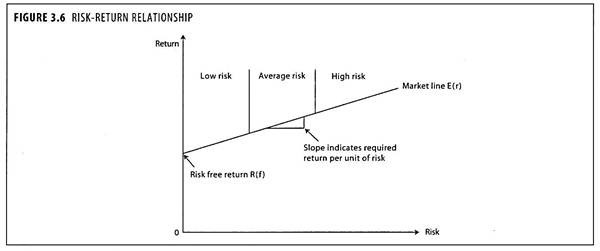

To earn return on investment, that is, to earn dividend and to get capital appreciation, investment has to be made for some period which in turn implies passage of time. Dealing with the return to be achieved requires estimate of the return on investment over the time period. Risk denotes deviation of actual return from the estimated return. This deviation of actual return from expected return may be on either side -both above and below the expected return. Figure 3.6 represents the relationship between risk and return.

However, investors are more concerned with the downside risk. The risk in holding security-deviation of return- deviation of dividend and capital appreciation from the expected return may arise due to internal and external forces. The fact that investors do not hold a single security which they consider most profitable is enough to say that they are not only interested in the maximization of return, but also minimization of risk.

The investors increase their required return as perceived uncertainty increases. The rate of return differs substantially among alternative investments, and because the required return on specific investments change over time, the factors that influence the required rate of return must be considered.

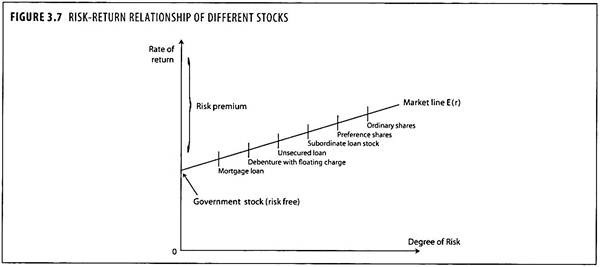

The slope of the market line in figure 3.7 indicates the return per unit of risk required by all investors Highly risk- averse investors would have a steeper line, and vice versa. Yields on apparently similar stocks may differ. Differences in price, and therefore yield, reflect the market’s assessment of the issuing company’s standing and of the risk elements in the particular stocks.

A high yield in relation to the market in general shows an above average risk element. Given the composite market line prevailing at a point of time, investors would select investments that are consistent with their risk preferences. Some will consider low risk investments, while others prefer high risk investments.

Costing and Risk:

The word ‘costing’ relates to the ascertainment of cost of capital from different sources like equity capital, preference capital, debentures, long-term loans etc. The most crucial decision of any company is involved in the formulation of its appropriate capital structure.

The best design or structure of the capital of a company obviously helps the management to achieve its ultimate objectives of minimizing overall cost of capital, maximizing profitability and also maximizing the value of the firm. These will in turn help to maximize the earning per share. It is thus apparent that the design of the capital structure of a company may have some bearing on the profitability of that company.

Capital structure decisions assume vital significance in corporate financial management due to their influence both on return and risk of the shareholders. The close nexus between optimum/judicious use of debt and the market value of the firm is well recognized in literature. Whereas an excessive use of debt may endanger the very survival of the corporate firm, a conservative policy may deprive the corporate firm of its advantages in terms of magnifying the rate of return to its equity owners.

Risk-Return Trade Off:

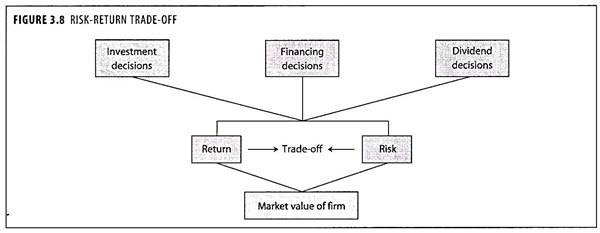

The prime objective of Financial Management is maximize the value of the firm, which is possible only when well balanced financial decisions are taken. The management should try to maximize the average profit while minimizing the risk. The projects promising a high average profit are generally accompanied by high risk.

Managers should accept such projects only if they will induce an increase in stock price. It is known that ‘higher the return’, other things being equal, ‘higher the market value’ and vice versa. Hence, it should be kept in view that risk and return go together. The risk-return trade-off is illustrated in figure 3.8.