After reading this article you will learn about:- 1. Analysis of Agricultural Project 2. Types of Agricultural Projects 3. Aspects 4. Economic Analysis 5. Financial Analysis 6. Costs 7. Benefits.

Analysis of Agricultural Project:

The analysis rests on:

(a) Technicians, like agronomists, soil scientists, civil engineers etc. use information and their judgment about the organisation and its administration. The economic information based on the farm accounts gives the picture of individual farms in financial terms.

From this information one proceeds to the economic analysis which has the broader horizon than just an individual farmer. This is popularly known as- “Farm management,” “Farm Business Analysis”, or “Economics of Farming”.

ADVERTISEMENTS:

Farmers are sometimes susceptible of the new investment in terms of risks and uncertainty and the data are collected by survey methods to know what they think of the new techniques.

Once the underlying technical facts have been marshaled and organisational and management judgment made, economic and financial analysis has a critical contribution to make. The inadequacy of the underlying contribution analysis has been forgotten because the information and judgment helps in making economic and financial analysis.

Types of Agricultural Projects:

1. Water Resource Development:

A capital intensive project. To reap the benefit of irrigation the farmer should not ignore the supporting services as extension, marketing, credit and transportation both for handling crop produced and supply of inputs needed. The economic analysis must take full account of all the attributes costs and benefits streams.

ADVERTISEMENTS:

2. Agricultural Credit:

It makes the viable commercial operation. To enable a larger number of farmers to make needed investment to improve their income and level of living.

3. Agricultural Industries and Commercial Development:

These projects help improve the adequacy and timeliness of input supplies and specialised services to farming, forestry and fisheries or else help improve the storage, processing and marketing systems.

Aspects of Agricultural Project Evaluation:

ADVERTISEMENTS:

(a) Technical Aspects:

Technical aspects which concerns itself with inputs and outputs of real goods and services.

(b) Managerial and Administrative Aspects:

These are the key to success or failure of the project and is difficult to evaluate.

ADVERTISEMENTS:

(c) Organisational Aspects:

Closely related to organisational and administrative aspects.

(d) Commercial Aspect:

This involves arrangement for marketing outputs produced by the project and arrangements for the supply of materials and services needed to build and operate the project.

ADVERTISEMENTS:

(e) Financial Aspects:

Deals with the revenue earning consideration of a project and also securing funds for it and its repayment and see if the project has become viable or not.

(f) Economic Aspects:

The economic analysis is directed towards whether it contributes significantly to the development of the economy as a whole and if it contributes greatly it is worth investing in such project the scarce resources having alternative uses.

Economic Analysis of an Agricultural Project:

ADVERTISEMENTS:

1. The main aim or interest is total returns or productivity or profitability to the whole society or economy. Regardless of who invests and who gets the benefit.

2. Capital resources should be invested where there are maximum economic growth and yields higher social or economic returns. The project which gives maximum return to capital is given high priority.

The economic analysis basically allows for remuneration to labour and other inputs at market prices or shadow prices which are intended to approximate true opportunity costs. Everything leftover is then compared to the capital needs necessary for the project.

Financial Analysis of an Agricultural Project:

1. Those who participate in the project such as farmers, business men, entrepreneurs, private corporations, public agencies are concerned returns to equity capital contributed by them it is called either financial or private return.

ADVERTISEMENTS:

2. In financial analysis we are much concerned about the income distribution and capital ownership. Here we measure returns to the equity capital contributed to the project by each of its various participants public or private. Financial analysis may be applied to the cost and returns of the various public entities which participate in the project.

Financial analysis is important when we return to a consideration of the incentives structure associated with the proposed project investment. A project in this light should be profitable to farmers although it is profitable to the entire economy.

3. Timing of return is also important.

Costs in Agricultural Projects:

The following are the cost items in the cost-benefit analysis:

1. Goods and service, although they are difficult to identify.

2. Labour—it is not difficult to identify.

ADVERTISEMENTS:

3. Cost of land (net value of production foregone). The identification would be with or without. What we calculate is the difference between what the enterprise was with which the land is presently occupied than what was produced under the enterprise earlier.

This is what is called incremental output. By this the economic cost of land under agricultural project grows out of this concept of what net value of production or opportunity cost.

There are three attributes to be allowed for value of land in an economic analysis:

(i) The value of land at its purchase price—a lump sum money invested in the purchase of land before the project started.

(ii) The value of land as a rental cost accounted year to year.

(iii) The value of land as an opportunity cost (value foregone).

ADVERTISEMENTS:

4. Taxes, these are the transfer of payments.

In the case of financial analysis, from the point of view of individual entity, all taxes are treated as cost. In the case of economic analysis, a return to the whole society, the taxes are transferred payments. The taxes in economic analysis are not deducted from the income stream as a cost. This applies for all forms of taxes.

5. Subsidies, pose special problem. For example, subsidy on fertilizer reduces the cost thus increases income. This is an incentive to adopt new technology and also on distributional ground. In financial analysis, subsidies poses no problem as subsidies reduce cost and money transfer goes to those who participate in the project.

In economic analysis, we adjust market prices to reflect the amount of any subsidy. Since subsidy reduces input costs, then we must add subsidy to market price of the commodity. If the subsidy operates to raise prices, then in economic analysis we deduct the amount of subsidy from the market value of the product before entering in our economic analysis.

Benefits of an Agricultural Project:

Benefit can arise either from increased value of or from reduced costs.

1. Increased Value of Output:

ADVERTISEMENTS:

The value of output increases by the following reasons:

(a) Greater Physical Production:

For example, irrigation project will increase production. In case of credit the farmers are enabled to buy inputs which would boost output. This will increase additional food intake by the farmers’ family or sold in the market.

(b) Quality Improvement:

For example, a dairy project helps in the processing of milk into milk products which has higher value (value addition), but estimate of benefit should be done cautiously.

(c) Change in Location and Time of Sale:

ADVERTISEMENTS:

In marketing for example, the storage facilities as a public undertaking will create time utility and when the price increases the sale could be undertaken again, as the road construction will trans-ship the products to distance market which will add place utility.

(d) Change in Form:

Processing of fruits, vegetables, animal products create form utility and also time utility which accrues benefit to the producers.

2. Cost Reduction:

Some projects act as cost reducing:

(a) Gains from Mechanization:

ADVERTISEMENTS:

Use of tractor or other machinery may increase or may not increase output but reduce the cost per unit of the products. Mechanisation may replace human labour reducing cost but human labour should find alternative source of employment.

(b) Reduced Transportation Cost:

Better transportation facilities in transferring agricultural produces from the point of production to the point of sale may reduce cost which may be shared by the farmer, transporters, and consumers.

(c) Losses Avoided:

Better equipment reduces loss with the increased efficiency.

3. Other Kinds of Direct Benefits:

For example opening school for both formal and non-formal education increases the earning capacity of the educated persons.

Secondary Costs and Benefits:

These arise outside the project and this should be used in economic analysis not in financial analysis. For example, some projects like building of dams increases the employment opportunity which increases income and has a multiplier effect.

Intangible Benefits:

Intangible benefits comprises of better income distribution, national integration, a better life for rural people and better national defense

Comparison of Costs and Benefits:

If projects are of long duration the project would have differently shaped the future cost and benefits and thus the alternative projects should be compared for its benefit.

The following are the discounting methods applied to agricultural projects:

(a) Benefit-Cost Ratio.

(b) Net present Worth.

(c) Internal Rate of Return.

There are undiscounted measures as well. These are:

1. Ranking by inspection,

2. Payback period,

3. Proceeds per Rs. of outlay,

4. Average annual proceeds per rupee of outlay,

5. Average income on book value of the investment.

(a) Benefit-Cost Ratio:

Benefit-Cost Ratio =

A decision on the discount rate is takes:

(i) The opportunity cost of capital—in UDCs it is 10-15 per cent.

(ii) Borrowing rate for the project which is to be financed.

(iii) Social rate of return which adequately reflects the time preference of the society as a whole.

The Benefit-cost ratio gives a green signal to investors when it is one or more than one.

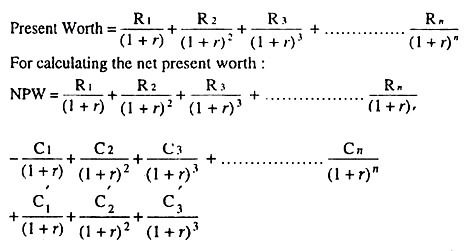

(b) Net Present Worth:

This helps to compare the present worth of the future revenue with the present investment. If the present worth of the future revenue is less than the investment, it would be unwise to invest money in resource services now to get the future revenue at the end of the certain number of years.

The formula for its calculation is:

Present Worth (P. W.) = R/(1+r)n

Here, PW is the present worth, R is the future revenue, r is the interest rate per annum, n is the number of years.

In case of the sequence of income over a period of years, the present worth of the future revenue viz., R1, R2 ………………….Rn, then the formula is:

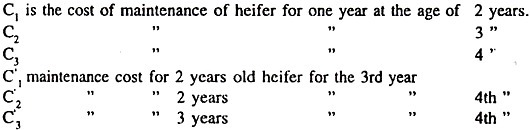

Where, R1, R2, R3 + ……………..Rn are the returns on attaining the age of 4 by the heifers (in this case the cattle is taken as example) (3).

(c) Internal Rate of Return:

This is also called marginal efficiency of capital. In this exercise the value of investment (Ir) of returns on investment or the present net value of the future marginal yields of investment and the present value (Ic) of cost incurred are equated. Thus, the yield becomes ZERO (0).

The rule for decision is that an investment, whose internal rate of return (I) is greater than the market of interest (ri), may be made, otherwise not.

Again, we compare the values of two projects by employing the market rate of interest. Whichever gives a better return is adopted.