After reading this article you will learn about:- 1. Definition and Concept of Budget 2. Definition and Concept of Budgetary Control 3. The Objectives (Functions) of Budgets, Budgeting and Budgetary Control 4. Advantages of Budget, Budgeting and Budgetary Control 5. Preparation of Budget 6. Limitations of Budget 7. Budget as a Means of Planning, Control and Coordination 8. Operation (Working) of Budgetary Control.

Definition and Concept of Budget:

A budget is an instrument of management used as an aid in the planning, programming and control of business activity. A budget may be defined as a financial and/or quantitative statement, prepared and approved prior to a defined period of time, of the policy to be pursued during that period for the purpose of attaining a given objective. It may include income, expenditure and employment of capital.

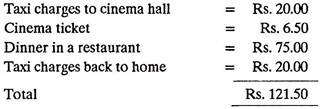

Based upon this definition, a recreation budget of a person for one fine evening may look as:

The budget is a statement showing the way the person plans to spend Rs. 121.50.

Thus budget is a written plan of action. A budget is used for cost control purposes and it is one of the most important overall control devices employed by management. A budget represents the financial requirements of different sections of the business during a given period to achieve an estimated profit based upon a given volume of sales.

A budget is based upon past statistical data and it predicts the estimated labour, sales, production and other management requirements for future, i.e., for a definite budgetary period (of time). A budget can be thought of as an overall plan for the operation of the business in terms of sales, production and expenditures. Thus budget acts as a coordinating device among the various functions of the business.

Definition and Concept of Budgetary Control:

Budgetary control makes use of budgets for planning and controlling all aspects of producing and/ or selling products or services. Budgetary control attempts to show the plans in financial terms. Budgetary control is the planning in advance of the various functions of a business so that the business can be controlled. Budgetary control relates expenditure to a section or department who incurs the expenditure, so that the actual expenses can be compared with the budgeted ones, thus providing a convenient method of control.

Budgetary control includes forecasts of income and expenditures (for the budgetary period) on equipment, machinery, manpower, materials, etc., necessary for the efficient production and distribution of estimated volume of sale. The budgetary control when applied to a business as a whole or to different sections within the business-compares actual performance and the predicted performance and thus enables all levels of management and supervision to know how their sections (of business) are moving towards the achievements of budgeted targets.

Is corrective action needed; should it be applied? Thus, budgetary control attempts to bring actual performance at par with the predicted performance by keeping a strict supervisory eye on the actual performance and by exercising a control, if necessary. Control follows the planning and co-ordination. Deviations from predicted plan or performance are noticed by comparing actual and budgeted performances and costs.

The differences between the two (i.e., predetermined and actual) figures-the variances-are analysed and an action is taken quickly, at the right time and in the correct place to correct the actual performance – as per the predicted or predetermined plan or performance.

The Objectives (Functions) of Budgets, Budgeting and Budgetary Control:

1. Budget should specify units to be produced, broken down into sizes and styles, as well as cost of production.

2. Budget should analyze all the factors affecting the sections/departments and the business as a whole.

3. Budget should facilitate planning within the company. It should help planning future income and expenses.

4. Budget should harmonise departmental programmes.

5. Budget should serve as a medium of propagating policies throughout the business enterprise.

6. Budget should hold back or control unwise expenditure.

7. Budget should help stabilizing production and harmonise production and sale programmes.

8. Budgeting should decide basis for expenditure of funds.

9. Besides planning, budgetary control should provide a basis for, measuring performance and exercising control-control means noting when expenditures fall outside the budget estimates, tracing down the cause of such variation and taking necessary corrective action.

10. Budgetary control should watch the progress of achievements of the business enterprise and evaluate policies of the management.

11. Budgetary control should pin-point those areas which are not working efficiently and according to the predetermined targets.

12. Budgetary control, after planning, should coordinate the activities of a business so that each is a part of an integral total.

13. Budgetary control should facilitate financial control; and control each function so that the best possible results may be obtained.

14. A budget should be flexible.

Advantages of Budget, Budgeting and Budgetary Control:

1. Policy plans and actions taken are all reflected in the budgetary control system. There is a formal recognition of the targets which the business hopes to achieve.

2. Not only departmental programmes are developed, over expenditures in departments are also curtailed and controlled.

3. Budgeting makes for better understanding, coordination and harmony of action in a business enterprise, because all departments take part in budget preparation.

4. The targets, goals and policies of a business enterprise are clearly defined.

5. Deviations from predetermined plans are brought to notice through variance analysis and corrective action is stimulated by reports, statements and personal contacts.

6. It provides management with a guide of daily activities; thus helps determining performance and efficiency of each department, thereby leading to improvement.

7. It informs management the progress made towards achieving the predetermined objectives.

8. It facilitates financial control.

9. Total capital required and price of an item (product) can be estimated in advance.

10. Budgetary control builds morale when operated in a truly managerial spirit, i.e., it should not acquire merely a clerical outlook (or approach).

Preparation of Budget:

Steps involved:

1. Formulate a budget committee which will take up the job of budget preparation.

2. The committee consists of chief executive as the chairman of the committee, a budget officer (who is a senior member of the accounting staff) and representatives of Sales, Production, Purchases and works engineering (maintenance, etc.) departments.

Consulting those who are responsible for operating the budget is good psychology; if employees participate in budget preparation they will automatically work hard to make budget a success.

3. The budget committee will create standard budget forms on which production plans, estimated income and costs may be inserted for each section or department of the business concern.

4. Committee asks accounting department to submit reports for the past years, showing a comparison of production costs, income and expenses by subdivisions and departments.

5. Each functional executive is asked to prepare and submit the forecast for his department.

The Production Manager prepares the production forecast, the Sales Manager, the sales forecast and so on.

Functional executives may take the opinions of Workers, Foreman, Salesman, etc., who remain in direct contact with the job.

The budget officer makes rule that all departments forecasts or estimates are accompanying with sufficient supporting data to provide basis for effective consideration by the budget committee.

An analysis of general business and market conditions is made with the help of the statistical department or from data supplied by commercial statistical forecasting agencies and government and trade reports.

The budget officer presents departmental budgets before the committee and transmits back to the departments the recommendations of acceptance or revision.

Forecasts submitted by functional (i.e., production, sales, etc.) executives, current market and trade data and estimates of future sales in the territories enable the budget committee to formulate general policies and plans for the budget period.

In consultation with functional or departmental executives, the budget committee reduces general policies of the concern to department plans. Actual departmental budgets are prepared and revised and they form the standards of performance for the budget period.

Limitations of Budget:

(i) Since budget is based on estimates, i.e., estimated sales, estimated costs, estimated business conditions, etc. it may need periodic revisions because estimates may not come out to be cent per cent true.

(ii) A budget may not work if the idea of budgeting is not sold properly to different sections of the business. Only the persons working in different sections can make an established budget, a success. Thus it should be a cooperative budgeting.

A budget cannot work until the desire to make it work is established in the minds of persons working in the different sections of a business concern.

Budget as a Means of Planning, Control and Coordination:

(a) Planning:

Planning implies looking ahead and anticipating probable difficulties. The budget plans production in accordance with sales estimates and at minimum cost. In addition, budget plans and forecasts the expenditures as regards production cost, plant utilisation, selling and distribution, purchases, etc.

(b) Co-Ordination:

Coordination means weaving together the segments of a business into a coherent whole in such a way that all parts operate at the most efficient level and produce maximum profit. Budget coordinates the efforts of all the sections, (e.g., sales, production, etc.) of the business to achieve the common goals.

A properly constructed and operated budget may have a constructive influence in bringing about a better understanding and team spirit among different persons working in a business enterprise. A proper budget may make them feel about the common goals which must be achieved unitedly for bringing profits to the concern and prosperity to them.

(c) Control:

Controlling means the systematic appraisal of results to ensure that actual and planned operations coincide or, if there are any deviations, the carrying out of corrective action.

A budget becomes a means of control when the actual business performance is compared with the predetermined performance. Every functional executive knows what was expected of his department and presently where his department stands.

If he feels that his department is falling behind than what was expected of, he prepares a report and reveals the points of difficulty so that the unfavourable situation may be analyzed and improved by taking suitable corrective actions.

Operation (Working) of Budgetary Control:

Good budgetary control necessitates establishment of accounting procedures to record actual operations in terms of sales, income, production, etc. within a department. The head of each department will receive a copy of the budget appropriate to his activity. Each month, he will get a copy of the departmental budget report. From the report, head of the department can visualise at once where he has over-or under-spent his budgeted allowance.

This enables head of the department to have a constant check on the operation. Unusual variations come immediately to his attention. The variations between actual and budgeted performance and the reasons for variation require a thorough analysis. It may appear that the department has been operating below strength and this caused increased over-time costs.

Monthly budget reports should be promptly issued to departments soon after the monthly period in question, otherwise adverse costs may go unnoticed for a longer time, and cause problem later on. Various department reports are summarized and consolidated by the chief budget executive or budget director in his regular report to the budget committee. On the basis of regular reports the budget committee may recommend revisions or changes in the budget.