Methods and Techniques of Controlling in Management. This article will further help you to learn about:

- Methods of Controlling in Management

- Techniques of Controlling in Management

- Controlling Techniques

- Modern Methods of Control

- Types of Control Methods in Management

- Types of Control Methods in Management

- Control Methods in Business

- Controlling Tools in Management

Methods and Techniques of Controlling in Management

An efficient control system requires that you must keep informed, make timely decisions, and take effective action. ‘Information’ is the key point in a control process. Since ‘taking action’, to be more precise, ‘taking timely action’ needs accurate and timely information – all the control techniques are evolved to obtain information.

For example- budgets give information about expected standards, CPM and PERT sets time standards for completion of a project, direct supervision gives idea about the performance of the organization, financial statements give information about the financial state of affairs of the organization which work as an indicator of the total performance, audit gives information about the extent the performance has been made and about the effectiveness of present systems, and of course the very basic requirement of information collection needs a sound Management Information System.

Here, we have discussed some of the commonly used tools in a controlling process:

Method # 1. Direct Supervision and Observation:

This is the age old technique of controlling whereby the supervisor himself observes the employees and work instead of relying the reports generated by the management information system. In this process he comes in direct contact with the workers and many a problems are solved during the time of supervision itself.

Moreover, getting firsthand experience of the state of affairs leads to better understanding of the situation in comparison to the impersonal reports depicting information in the form of data.

If the organizational set up is large and complex, it would not be feasible to directly supervise all the activities. However, this technique can still be used by occasionally supervising personally to have an idea of the accuracy of the information reports.

Method # 2. Budgets:

Budgets are probably the most widely used control methods. When budget is formulated, it’s a planning tool because it gives direction. The operating budgets indicate the goods and services the organization expects to consume in the budget period; they usually list both physical quantities (such as barrels of oil) and cost figures. The financial budgets spell out in detail the money the organization intends to spend in the same period and where that money will come from.

This way budgets provide managers with quantitative standards against which to measure and compare the actual performance. By pointing out deviations between standard and actual performance, they become control tools. Managers may take corrective action by using these deviations.

For example- if you use a personal budget for controlling your monthly expenses, you might find one month that your miscellaneous expenses were higher than you’d budgeted for. At that point, your options might include the following- cut back spending in another area, work extra hours to try to get more income, or call home for additional money.

Continuing with the budgetary control process, after preparation of the budget, the controller’s department in large organizations keeps records on expenditures and periodically prepares reports showing the budgets, actual expenditures, and differences (or variances, as they are frequently called).

For smaller organizations, this function is often handled by the owner-manager, the office manager, or an independent service organization such as a bank or accounting firm. After the report is prepared, generally it is sent to the people responsible for the particular area or function covered by the budget. It is at this point that variances must be analyzed and corrective action taken, if necessary.

In effective budgeting control systems, each manager meets with his subordinates to review variances and determine corrective actions. This process is repeated from the bottom to the top of the organization. At higher levels of management, written reports are often required that outline the reasons for variances and the corrective actions that are being taken.

Of course, it is entirely possible that the budget, which is actually only a forecast of expected results and requirements, may need revising. Normally for larger organizations a budget review committee (generally composed of the top executives of the organization) meets regularly to review and revise the budget. In the final analysis, preparation, administration, and corrective action taken on budget variances are key elements in successful strategy implementation.

Method # 3. Financial Statements:

The most commonly used financial statements are balance sheet, profit and loss account, cash flow statement and statements of sources and uses of funds.

Balance sheet, in its simplest form, describes the organization in terms of its assets, liabilities, and net worth. The message of balance sheet is – this is the financial condition of the organization at a given point of time. The profit and loss statement (or income statement) prepared regularly each month or each quarter is one of the most vital indicators of the organization’s worth and health.

This statement pinpoints each revenue and cost area. It is a good idea to have your profit and loss statement prepared so that it shows each item for the current period, for the same period last year, and for the current year-to-date. The comparative figures in P&L account serve very useful tool for control.

Cash flow and sources and uses of funds statements show where cash or funds came from during the year (from operations, reducing accounts receivable, and sale of investments, for example) and where they were applied (purchase of equipment, payment of dividends, and reducing accounts payable, for example). They should not be confused with income statements; cash flow statements show how cash or funds were used rather than how much profit or loss was achieved.

Financial statements are used by managers, stakeholders, and others to evaluate the organization’s performance. Within the company, managers will compare the current statements of their organization with earlier statements and with those of competitors.

People outside the company will use the statements to gauge the organization’s strengths, weaknesses, and potential. However, several types of key information for the evaluation of a firm are not provided by financial statements, and thus the usefulness of statements is limited.

Method # 4. Ratio Analysis:

For organizations as well as for individuals, financial performance is relative. An organization’s profits of Rupees 10,00,000 might be very high for a restaurant but very low for an oil company. For the “bottom line” on a financial statement to be meaningful, it must ultimately be compared with something else.

In ratio analysis, key summary figures from the firm’s financial statements or records are reported as percentages or fractions of one another. Such ratios can provide quick assessments of financial performance or condition. Today, as opposed to the recent past, ratios are easily and inexpensively developed by computer from the firm’s electronic records for timely use by managers.

The ratio analysis comparisons can be made in one of two ways- (1) comparison over a time period—the present ratio compared With the same organization’s ratio in the past (or with a future projection); and (2) comparison with other, similar organizations or with the industry as a whole.

The first type of comparison will indicate how the organization’s performance or condition has changed; the second type will suggest how well the organization is doing relative to its competitors. There are many kinds of ratio calories and many kinds of ratios. The ratios – most commonly used by organizations are profitability, liquidity, activity, and leverage.

One ratio, which is worth discussing separately, is Return on Investments Ratio. The rate of return on investment is an overall measure of the financial performance of an organization. It is calculated by dividing net income by total investment. ROI is an indicator of the overall performance of the organization.

Since a business organization is primarily set up to earn profits, ROI is a yardstick around which business decisions are taken. Suppose an organization’s ROI is 10% in a particular year, and it is considered as less than expected, it may try to locate the reasons for low ROI, or opt to change its business activities, or may take any other action as it deem fit.

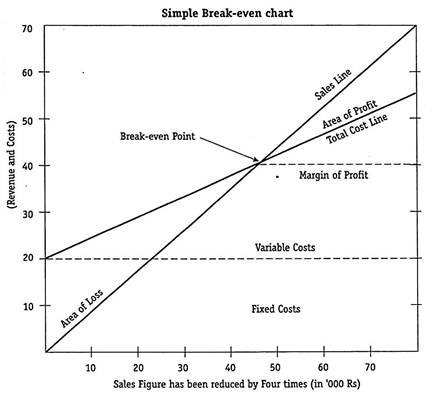

Method # 5. Break-Even Analysis:

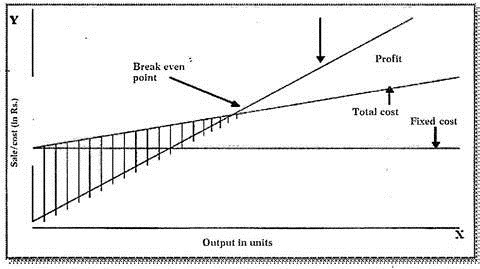

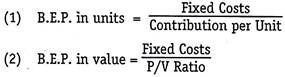

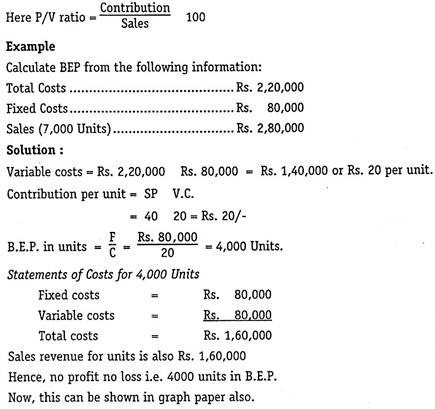

Break-Even point is the point of no profits no loss. That is, when we say that if an organization is able to sell 1,00,000 units of product X, it would be breaking even; it means that any sale below this point will cause losses and any sale above this point will bring profits.

Break-even analysis gives managers a rough profit and loss estimate for different sales volumes. As a control device, break-even analysis provides one more yardstick by which to evaluate company performance and provides a basis for collective action to improve performance in the future.

One of the virtues of break-even analysis as an operational tool is its simplicity. Unfortunately, the simple assumptions upon which break-even analysis is based may affect the accuracy of the results.

Method # 6. Audits:

Another frequently used method of control is an audit. Auditing has many important uses, from ensuring the fairness of financial statements to providing a critical basis for management decisions. We will discuss two types of auditing – external auditing and internal auditing.

i. External Auditing:

The traditional external audit is largely a verification process involving the independent appraisal of the organization’s financial accounts and statements. Assets and liabilities are verified, and financial reports are checked for completeness and accuracy. The external audit is a major systematic check against fraud within the organization.

For people outside the organization, such as bankers and potential investors, the external audit provides the major assurance that publicly available financial statements are accurate.

ii. Internal Auditing:

The objectives of internal audit are to provide reasonable assurance that the assets of the organization are being properly safeguarded and that financial records are being kept reliably and accurately enough for the preparation of financial statements.

Internal audits also assist managers in appraising the organization’s operational efficiency, and in evaluating how adequately the organization’s control system is working toward realizing organizational objectives. In modern times, the internal audit has taken various forms like management audit, systems audit, business process reviewing, etc. All these aim at cost control, inefficiency control, minimization of wastages and efforts.

Method # 7. Management by Objectives:

Management by Objectives (MBO) is another method used in both strategic planning and control. Based on the approach to objective setting, MBO is a system under which objectives are established for the organization as a whole, for functional areas within the organization, for departments within functional areas, and finally for individuals within each department.

In its most basic form MBO must meet the following three minimum requirements:

1. Objectives for individuals within an organization are jointly set by the superior and the subordinate.

2. Individuals are periodically evaluated and receive feedback on their performance.

3. Individuals are evaluated and rewarded on the basis of objective attainment.

Step 1 is used for planning purposes. Step 2 involves the control process. Step 3 is designed to encourage employees to direct their efforts toward the accomplishment of organizational objectives.

Method # 8. CPM and PERT:

The common slogan in business world is – time is money. And truly so, because costs are associated with time. Longer the duration of a given project, higher the costs for so many reasons like involvement of work team for a longer period, inflation effect of money, etc.

Several useful graphical and analytical methods have been developed that can serve as tools in controlling the process time. The most popular methods are the critical path method (CPM) and Program Evaluation and Review Technique (PERT). These are network planning and diagramming techniques.

The network shows graphically all the tasks that must be performed to execute a given project. It consists of all activities and events comprising the project and shows their interrelationships. An activity is the specific task necessary to complete a particular event and normally consumes time.

An event denotes a point in time and signifies the completion of all activities leading into the event. The final event with which the project finishes is known as objective event. The network shows the sequence governing the various activities. A new activity cannot start until the scheduled preceding event has taken place.

If independent of one another, two or more activities may take place simultaneously; if one activity depends upon another (or several others), it cannot start until the activities upon which it depends are all finished.

Because of the varying relationships, a network shows a number of more or less parallel paths, longest of which is critical path. It is critical because project cannot be completed in a lesser time than the time required by the longest path. If any activity on the critical path requires more time than was originally estimated, then the completion time for the entire project or task increases. But this critical path is unknown until each activity time is determined and entered into network diagram.

Both CPM and PERT establish critical paths. The major differences between CPM and PERT is the activity time estimates. CPM is used for projects whose activity durations are accurately known and whose variance in completion time is negligible. PERT, on the other hand, is used when the activity durations are more uncertain and variable.

During actual execution of the project, management can compare actual times taken, activity by activity, with forecasted times, thus making remedies in time consumption for the really critical and delayed activities.

Method # 9. Management Information Systems:

Managers need information to control the various organizational areas efficiently and effectively. For instance, in measuring actual performance, managers need information about what is, in fact, happening within their area of responsibility. Also, they need information about what the standards are, to be able to compare actual performance with the standard.

In addition, managers need information to help them determine acceptable ranges of variation within these comparisons. Finally, they rely on information to help them develop appropriate courses of action if there are or are not significant deviations between actual and standard. As you can see, information plays a vital role in the controlling process. But how does a manager get the information he needs?

Management Information System (MIS) is a system that provides management with needed information on a regular basis – Although there is no universally agreed-on definition of Management Information System (MIS), we will define it as a system used to provide management with needed information on a regular basis. In theory, this system can be manual or computer based, although all current discussions, including ours, focus on computer-supported applications.

Designing the MIS:

Just like there is no universal definition of an MIS, there is no universally agreed-on approach to designing a management information system.

However, the following steps represent the key elements in putting an MIS together:

1. Analyze the Decision System:

The first step is to identify all the management decisions for which information is needed. This should encompass all the functions within the organization and every management level from first-level supervisor to the chief executive officer.

2. Analyze Information Requirements:

Once the decisions are isolated, we need to know the exact information required to effectively make these decisions.

3. Aggregate the Decisions:

After each functional area and manager’s needs have been identified, those that have the same or largely overlapping information requirements should be located. Even though needs vary up and down and across the organization, redundancies often occur. Both sales and production executives, For example- may want feedback data on a given product’s quality level.

One executive, however, wants the feedback to ensure customer satisfaction, while the other wants it to control for variances in the production processes. By identifying these redundancies, management can create systems that contain the least amount of duplication and that group together similar decisions under a single manage.

4. Design Information Processing:

In this step, internal technical specialists or outside consultants are used to develop the actual system for collecting, storing, transmitting, and retrieving information.

How We Measure:

Four common sources of information, frequently used by managers to measure actual performance, are personal observation, statistical reports, oral reports, and written reports. Each has particular strengths and weaknesses; however, a combination of information sources increases both the number of input sources and probability of receiving reliable information.

Methods of Controlling (Traditional and Modern Methods)

Methods of control can be classified into two categories, namely, traditional control methods and modern control methods.

1. Traditional Control Methods:

The traditional control methods are explained as under:

(i) Budgetary Control:

Budget is an estimate of future needs. It helps in evaluating actual performance. It is an estimate of expenditure and results prepared for a fixed future period. A budget is an important tool of planning and control of future activities.

In other words, a budget is an estimate of future need arranged in an orderly basis, covering some or all of the activities of an enterprise for a definite period of time.

In a broad sense, a budget constitutes a statement of anticipated inflows and expected outflows (of any proposed course of action) in quantitative terms for a specified future period. It may be expressed either in financial or physical terms like machine hours, man hours, units or products, or in any other numerically measurable terms.

Budgeting is the process of preparing budgets whereas budgetary control is a device or technique of managerial control through budgets.

The Institute of Cost and Management Accountants of England and Wales defines a budget as “a financial and / or quantitative statement prepared prior to a defined period of time of the policy to be pushed during that period for the purpose of attaining a good objective”.

The Institute of Cost and Management Accountants of England and Wales has defined budgetary control as “the establishment of objectives relating to the responsibilities of executives to the requirements of a policy and the continuous comparison of actual with budgeted results, either to secure by individual action the objective of that policy or to provide a basis for its revision”.

Purpose of Budgeting:

Some of the basic general purposes for which budgeting are used are as follows:

1. To Develop an Organized Procedure for Planning:

Budget estimates are plans for a given time period. Budget forces managers to plan their activities for future in advance and try to achieve within the budgetary limits. It is a time-bound financial plan. Budgeting involves anticipation of results and expressing them in numerical terms.

2. Means of Co-Ordination:

Budgeting is also used for coordinating the activities of the various divisions of a business, e.g. Production is closely associated to sales. A sales budget can be prepared very easily after knowing about production programme of the enterprise. The preparation of budgets also aims at coordination of activities. The process of integrating various budgets into a master budget also highlights the importance of coordination.

3. Basis for Control:

Budgeting forces management to lay down objectives, goals and plans in numerical terms and thus provides a mean for evaluating performance according to plans established. Budget reports analyze the deviations and also suggest corrective actions. Hence, budget is used as a device for managerial control.

Individual budgets for each department helps the management to know separately the cost for each of them and thus exercise effective control over cost. The departmental manager therefore must try to curtail extra expenditure in order to control the cost.

2. To Increase Efficiency in the Field of Production:

Preparation of separate production budget helps in determining progress and efficiency of the production.

3. To Determine Capital Requirements:

Budgeting process determine capital requirements of the enterprise. This is possible through computing financial flows at different phases of all the operations of the enterprise as reflected in various budgets.

4. To Encourage Research and Development:

Comparison of actual performance with the budgeted goals and plans, and thorough analysis of deviations particularly are the key factors that provide a sound basis for research and development.

5. To Increase Utility of Cost Records:

Budgeting involves considerable use of cost information and records. Thus, budgetary controls give relevance to cost records and increase their utility.

1. Budgeting determine the objectives in numerical terms.

2. It directs organizational activities towards greater efficiency, productivity and profitability.

3. Expenditure beyond budgets is not incurred without prior sanction. Thus, expenditure can be scrutinized before it is incurred.

4. It provides the management with an overall view of the activities of the organization.

5. It enables the organization to simplify its objectives and policies in operational and realistic terms.

6. The management can eliminate unproductive activities and minimize waste by preparing budget.

7. It helps the top management in measuring the efficiency of departments and individuals and taking corrective actions.

8. It facilitates control by exception.

9. Budgeting is also very useful in “profit planning”.

The following are the important types of budgets:

1. Master Budget:

Master budget is a summary budget incorporating all functional budgets and is prepared for the organization as a whole. The object of this budget is to secure overall co-ordination in the budgetary programme. The master budget is generally divided into two parts- a forecast income statement and a forecast balance sheet.

2. Flexible Budget:

A budget which is prepared at a time for varied levels of operation is known as a flexible budget.

3. Fixed Budget:

A fixed budget is one which remains unchanged irrespective of the level of activity in a business organization.

4. Functional Budget:

The functions of an organization are Production, Sales, Marketing, Finance Personnel administration, etc. and for every such function an independent budget is prepared which is called functional budget.

5. Sales budgets including selling and distribution costs budgets.

6. Production and manufacturing budgets.

7. Purchase Budget.

8. Capital Expenditure Budget.

9. Administration Expenses Budget.

10. Research and Development Budget.

11. Cash Budget.

(ii) Cost Control:

Consists of techniques such as:

1. Cost accounting.

2. Standard costing.

3. Break-even point analysis.

The profits of a business organization depend very much on the cost of production. Cost of production helps in determining the profit earned by a firm. The management, keeping in view the nature of the industry, designs the cost accounting procedures, methods and records for effective cost control and cost reduction.

Cost accounting is the process of accounting for cost. It is the formal mechanism by means of which cost of products or services are ascertained and controlled.

2. Standard Costing:

Standard costs are usually associated with a manufacturing company’s costs of direct material, direct labour, and manufacturing overhead. It is a method of cost accounting which standard costs are used in recording certain transactions and the actual costs are compared with the standard costs to find out the amount the reasons of variations from the standard.

Ex- standard cost of different items like labour, raw materials direct expenses, overheads is determined in advance and same is compared with actual cost. If deviation is found in both, cost is controlled by taking corrective measures.

Break-even analysis is concerned with the changes in fixed costs, variable costs, sales volume, sales prices and sales mix and their effect on profits. Basically, it is an analysis of three different factors-cost, sales volume and profit. In other words, the volume of sale at which there is no profit or loss is known as breakeven point.

The break-even analysis is used by the manager for the following purposes:

i. To determine profit at different levels of activity.

ii. To ascertain the impact of change in cost on profit

iii. To ascertain sales volume to produce the desired profit.

iv. To find out the selling price per unit for a particular break-even point.

v. The graphical presentation of the break-even-analysis is called the break even chart.

vi. The break even chart shows the break-even point i.e. the point at which there is no profit no loss.

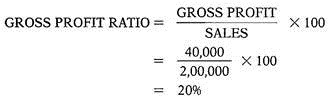

(iii) Financial Ratio Analysis:

All business organizations prepare Profit & Loss A/c and Balance Sheet to reveal the financial position of the organization. The financial ratio’s denotes the proportion established between two or more variables or items included in the financial statements. Ratio Analysis is the relation between various elements of financial statements expressed in mathematical terms.

Ex- Gross Profit ratio expresses the relationship between the Gross profit and sales. If Gross profit of firm for year 2012 is Rs.40,000 and its sales is Rs.2,00,000; then the gross profit ratio will be calculated as under –

Here, 20% indicates that gross profit is 20% of sales. With the help of ratio analysis technique, firm may be able to know about its profit position, investment decisions, etc. It helps to understand profitability, liquidity, solvency of a firm.

The most commonly used ratios are:

1. Gross profit ratio

2. Net Profit ratio

3. Liquidity ratio

4. Current ratio

5. Debt equity ratio

Management compares the results derived from calculated ratios with predetermined standard ratios and in case deviations are found then corrective measures are taken by finding out the reasons of deviations.

(iv) Internal Audit:

Auditing is careful examination of accounts and other documents. Internal auditing signifies regular and independent appraisal of the accounting, financial, and other operations of a business by a staff or internal auditors.

In other words, it is the auditing for the management conducted by the staff, specially appointed for the purpose, to ensure that the work of the concern is going on smoothly, efficiently and economically.

Internal auditors also examine the plans and policies and the performance of the management According to the Institute of Internal Auditors, USA, “Internal auditing is an independent appraisal function established within an organization to examine and evaluate its activities as a service to the organization”.

(v) Statistical Control:

Statistical data and reports have become the most common controlling device. This control technique rests on the science of statistics and sampling method. The statistical data is analyzed in which the use of percentages, averages, probability, and trend analysis is made. It proves useful in inventory control, production control, and quality control. Statistical control charts are prepared with the help of collected data.

It helps in visualizing the trend and weaknesses in the respective areas of operation and necessary remedial steps are suggested. Charts and diagrams are used by the production, sales, purchase, and personnel and even more frequently by the executive heads of companies to depict the correct information.

Ex- Rise or fall in total sales or use of materials, changes in price of materials, etc. can be easily shown with the help of charts, diagrams.

2. Non-Traditional / Modern Control Methods:

Modern Methods:

Following are the modern methods of control:

(i) Zero Base Budgeting:

It is a method of preparing budget put forward by Peter A. Phyrr in USA in 1970. The key element in ZBB is future-objective-orientation of past objectives. It is defined as an operative planning and budgeting process which requires each manager to justify his entire budget in detail from zero-base.

This budget requires the managers to re-justify the past objectives, goals, targets, projects etc. and to give priorities for the future. This budget provides an opportunity for the managers to examine, evaluate, review each organizational activity. ZBB cuts down wastage, and reduces the cost of production because every budget proposal is evaluated on the basis of cost benefit analysis.

The following steps are implied in zero-base budgeting:

1. Identify business objectives i.e. define proposed activities of an enterprise

2. Create and evaluate alternative methods for accomplishment of each objective

3. Evaluate alternative funding levels.

4. Set priorities.

The network techniques are used in planning and scheduling of large projects.

The two major techniques are:

(a) CPM (Critical Path Method)

(b) PERT (Programme Evaluation and Review Technique)

These techniques help in planning, coordinating and controlling the network of the interdependence of activities. Under these techniques, a project is divided into different activities and these activities are then arranged in a logical sequence so that the project to be completed within shortest period of time. These techniques help the managers to minimize the time and cost involved in a project.

There are two network techniques:

Critical Path Method, an important network technique for management control, was developed by Walkar of Dupont to reduce time for periodic maintenance. The CPM aims at planning and controlling the various sequences of event and activities. It gives one time estimate for the completion of each activity.

CPM identifies both time and cost estimates. It is more appropriately used where standardized activities are required to be performed for the completion of the project. Under this technique a project is broken into different activities and their relationships are determined. These relations are shown with the help of diagram known as network diagram.

A network is a graphical representation of a project representing the sequence of well- defined activities and events. The Network diagram or flow plan may be used for optimizing the use of resources and time.

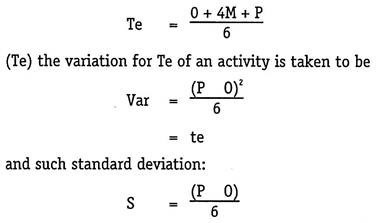

(b) Programme Evaluation and Review Technique (PERT):

PERT is a technique used to plan and control a complex project that is represented as a network of events and activities, with time estimates given to complete each activity. PERT is also called as time-event network. Such a technique involves planning, monitoring and controlling of projects. It is a network of various events and activities in a project with the estimated time given for completion of each activity.

An event is the beginning or the ending of the activity. It is represented by a circle in the network. An event by itself does not use time or resources. An activity is the time taken by an operation between two events, that is, it represents the time taken to complete an event. It is represented by an arrow.

PERT is employed in construction of ships, buildings and highways, in the planning and launching of new projects, in the publication of books, in the installation and debugging of computer systems.

The whole process involved in the preparation of PERT / CPM is as follows:

1. Identification of activities.

2. Sequential arrangement of activities.

3. Time estimates of activities.

On the basis of analysis, critical activities are determined. These are represented by the critical path which shows that if activities on this path are not completed in time, the entire project will be delayed by the time the event is delayed. Thus, the earliest or latest starting time of an activity can be calculated on the basis of these estimates.

Both PERT and CPM are used either to minimize the total time, total cost, cost for a given total time, time for a given cost, or to minimize idle resources. The fundamental difference between the two methods is that if CPM assumes the duration of every activity to be constant, in PERT uncertainty in the duration of activities is allowed.

Advantages of Network Techniques:

The PERT & CPM techniques of control provide the following benefits:

1. It provides an analytical approach to the achievement of project objectives which are defined clearly.

2. It assists in avoiding waste of time, energy and money on unimportant activities.

3. It enables managers to plan the time and cost associated with the completion of a complex project.

4. It enables managers to point out the deviations at the point of occurrence and take timely action to correct the deviations.

5. It aims at improving the communication system in the organization so that people performing different events have to be in constant interaction with each other.

Management audit is a systematic examination, analysis, appraisal and evaluation of the functioning, performance and effectiveness of various management processes and functions of an organization. It critically examines the full management process.

To check the efficiency of the management, the company’s plans, objectives, policies, procedures, personnel relations and systems of control are examined very carefully.

Management auditing is carried out by a team of experts. Usually they collect data from past records, members of management, clients, employees, etc. and analyze it and draw conclusions about the managerial efficiency and performance.

Appraisal Areas:

The American Institute of Management has identified ten categories of appraisal areas to be used under any comprehensive management audit programme.

1. Economic Function:

This category includes appraising public value of the company in relation to different interest like consumers, shareholders, employees, suppliers and the communities in which it operates.

2. Corporate Structure:

Here, the effectiveness of the corporate structure is shown to accomplish organisational objectives.

3. Health of Earnings:

It is concerned with determining the income itself and also appraising the extent to which profit potential of the company’s asset has been realized.

4. Service of Shareholders:

Here, the management audit team determines the company’s service to the shareholders with reference to minimization of risk, reasonable return, capital appreciation over a period of time.

5. Research and Development:

For huge companies particularly, evaluation of its research policies is crucial to management audit. Research and development success is evaluated in terms by looking at the role of policy in company’s past progress and how successfully these policies are executed by the company for its future progress.

6. Directorate Analysis:

In this appraisal area, three elements usually considered are:

(a) The quality of each director and his contribution to the board.

(b) The extent to which director’s work as a team.

(c) Whether the directors act as trustees for the organization.

7. Fiscal Policies:

The key factors under this category of appraisal are providing, controlling and managing practically the use of funds.

8. Production Efficiency:

Production efficiency is equally vital to manufacturing as well as non-manufacturing companies. The appraisal of machines and materials management is taken into consideration.

9. Sales Vigour:

There are significant changes in the sales practices and marketing principles adopted by different companies. Marketing goals if properly determined can help in evaluation of sales vigour.

To appraise the sales vigour, the following three bases are used:

(a) To what extent past sales potential has been realized.

(b) Development of sales personnel

(c) To what extent present sales policies of the company will realize future sales potential.

10. Executive Evaluation:

The quality of executives and their management philosophy need to be evaluated separately. The American Institute of Management has found three personal qualities as being essential elements for business leaders. These qualities are ability, industry and integrity.

Good management demands that executives should work, together in harmony, and ensures company’s continuity by sound policies, decisions, procedures and programmes relating to different activities of the enterprise.

Techniques of Controlling in Management : Top 14 Techniques

There are several different methods by which managers can exercise the control function. Some are quite basic, while others deal with employee attitudes. Most firms use some combination of these methods.

Some of these techniques can be described below:

Technique # 1. Personal Observation:

Direct personal contact and observation is an effective means to check the performance of subordinates. The manager or a supervisor can periodically observe his subordinates, their work methods and their results. His mere presence can exert a controlling influence.

Observation leads to evaluation of work. It encourages employees to perform well. Theo Haimann observes, “Although personal observation is time consuming and might look inefficient on the surface, there is no substitute for it in the control of the activities of the subordinates.”

Technique # 2. Setting Examples:

It is said that “an example is always better than precept.” Being an example helps control results. In his role as leader, the manager should put his ideal behaviour in directing his subordinates. He must share the work with subordinates. A manager can teach by his actions and behaviour.

Technique # 3. Records and Reports:

Records and reports have considerable control value. They can provide a good means for measuring the performance and results. But they can also hinder the work if they are too numerous, burdensome and time- consuming.

Technique # 4. Policies and Procedures:

Policies and procedures reflect the past experiences of many managers. They are guides for managers to use in controlling the behaviour and output of workers.

Glueck says, “They are one kind of feed-forward control device.” Policies can provide a means of self-control. They are a primary instrument of coordination and control. Glover writes, “A business policy is am established guiding canon governing business activities.”

Technique # 5. Charts and Manuals:

Organisational charts provide a clear understanding about the relationship and the grouping of position and functions. Progress charts permit each department to measure the performance of its employees against past results. These help forecast performances and facilitate comparison with the company as a whole. Various types of manuals also serve the purpose of management control.

Technique # 6. Standing Rules and Limitations:

By establishing rules, the managers can control and prohibit undesirable activities and behaviour. Standing orders tell employees what to do under given set of conditions. Likewise, standing procedures spell out the sequence of events. In cases where subordinates are given ample freedom in decision making, it is desirable to place definite limits beyond which they may not go without express permission.

Technique # 7. Written Instructions:

Written instructions through circular letters, bulletins, notes, etc. are also used to check the subordinate’s performance. Written instructions should be given clearly so that there may be no misunderstanding about their purpose.

Technique # 8. Censure:

It is negative approach to control, but it may be very effective in certain situations. It is any form of criticism or disapproval. It may be reprimand or ridicule for the careless employees. It should be used with wisdom and understanding, otherwise it can become a dangerous weapon.

Technique # 9. Disciplinary Action:

Censure is a simple form of disciplinary action. When an employee repeatedly makes mistakes or has become a chronic absentee, may be given a warning of disciplinary action against him. In serious matters, employees can be suspended to control their irregular behaviour. Sometimes, the threat that disciplinary action will occur may also create a controlling influence.

Technique # 10. Control Unit:

The control unit or ‘control section’ is a recent device to control the overall performance of the organisation. It is sometimes called the management control department. It supplies the facts to top management to make possible orderly and efficient administration. It may recommend methods and ways for increasing operating efficiency. It establishes standards of work. It constantly reviews directives, methods and policies.

Technique # 11. Social Control Devices:

Some social control methods existing in business organisations are in the form of rules, regulations or sanctions. Among social control devices, according to McFarland, are norms, customs, conventions, unwritten laws, habits, practices, status and prestige systems etc. These are organizationally determined values which check the behaviour of employees.

Technique # 12. Rewards:

Rewards are the positive ways to control the behaviour. These may be as simple as a verbal “thank you” to employees. Generally, these are in the form of promotion, pay systems, employee benefits, profit sharing or other incentives. Reward is linked with performance and motivation. It is also related with performance evaluation and work satisfaction. It helps in achieving the work targets in accordance with the preset standards.

Technique # 13. Budgets:

Budgets are plans in numerical form. They can provide an effective means of controlling operations. Actual performance is measured and compared against budgeted standards. Budgets are sometimes binding and the manager is expected to bring performance in line with the budget when deviations occur. Budget stands as a limitation on the activities falling within its scope.

Technique # 14. Accounting:

Accounting is a significant device of control. It lays down for recording the business transactions and also serves as a controlling measure for day-to-day business operations. The accounting system can help in checking the past figures and deciding the best action to be followed in the future.

Methods of Controlling in Management (with control aids)

For having effective control of an organisation it is important to know for a manager that what are the areas of control, and tools and techniques of control. There are a number of devices which helps in controlling. These devices have been developed by various management experts and experienced managers. In other words we can call these devices as control aids.

The important control aids are as follows:

1. Budget and Budgetary control system

2. Different control systems like –

(i) Responsibility accounting.

(ii) Control by exception.

(iii) Self-control.

(iv) Management information system.

3. Break – even analysis

4. Special Reports and Analysis

5. CPM/PERT

1. Budget and Budget Control System:

Budget:

What is budget? Budget is a plan or programme of future action which is prepared on the basis of estimates or forecasts made for coming operating period. In other words, budget in as expression of a firm’s plan in financial form for a period of time in future, it is an estimate of the future needs calculated for a definite period.

It anticipates income for a given period and costs as well as expenses of obtaining this income are set or limited with the idea of earning a desired profit or as an aid in controlling losses. Budget is essential in every walk of life. It is essential in national, domestic and business field. In our personal life also. We prepare budgets about the utilisation of the funds available.

A budget which is formulated for the organisation as a whole is known as Master Budget. Budget prepared for various functional areas of an organisation such as sales, production, distribution and finance are known as Functional budgets or Operating budgets. It is advantageous for both larger and small organisations. It helps in planning evaluating, coordinating and implementing the plans and motivating the employees of the organisations.

Budgetary Control:

It is a system of controlling costs which includes the preparation of budgets, coordinating the departments and establishing the responsibilities, comparing actual performance with that budgeted and acting upon results to achieve maximum profitability.

The following are two important definitions of budgetary control:

(1) “Budgetary control in a system which uses budget as a means of planning and controlling all aspects of producing and /or selling commodities or services.”……J. Beatty

(2) “Budgetary control is a system of controlling costs which includes the preparation of budgets, coordinating the departments and establishing responsibilities, comparing actual performance with the budgeted standards and acting upon results to achieve maximum profitability”.

From a careful analysis of above definitions, the following important aspect of budgetary control can be ascertained by an efficient and competent manager:

(1) Planning- It implies the planning of activities for each department, after planning, the forecasts are made and budgets are finalised.

(2) Co-ordination- It involves the co-ordination among various department plans and budgets and then preparation of a master budget for the whole organisation.

(3) Recording- It involves recording of actual performance for the sake of comparison and control.

(4) Comparison- It is an essential feature of control process. It involves the comparison between budgeted standards and actual performance, determining deviations, if any and their analysis.

(5) Appraisal and follow up- After an analysis into the probable reasons of deviations are follow up actions taken. It involves taking the necessary steps in order to improve the situation and prevent further deviations.

Business Operations and Budgetary Control:

Budgetary control is an important technique of directing business operations in a desired direction. It is planned to assist the management in the allocation of responsibility and authority, to aid in making estimates and plans for the future, to assist in the analysis of the variations between estimated and actual results and to develop basis of measurement or standards with which to evaluate the efficiency of operations.

The following are some important contribution of their system to the overall control of business operations:

(A) Helpful in Improvement in Planning:

(1) It is an intelligent consideration of future events.

(2) It gives stability in business organisation.

(3) Helpful in delegation of authority and responsibility.

(4) It is a tool of clarity of objectives.

(5) It helps in the best utilisation of resources.

(6) It enhances the collateral value of the enterprise.

(1) It promotes a balanced producer of activities.

(2) It motivates mutual co-operation and team spirit.

(3) It motivates the people.

(4) It brings co-ordination among business policies, plans and procedures also.

(C) Tool of Comprehensive Control:

(1) It is helpful in the control of performance and costs.

(2) It increases efficiency in communication system.

(1) It assists in standard costing.

(2) It evaluates the performance.

(3) It involves the co-ordination among various department plans and budgets.

(4) It is as essential feature of control process.

(5) It involves the comparison between budgeted standard and actual performance.

Thus, we see that budgetary system is advantageous for all types of organisation – whether large or small. Some people are of this opinion that due to uncertainties”, budgets, become impracticable. But the principal reason for this is the attitude of rigidity towards the system.

Whether, the benefits are realised and to what extent, depends very much on the system and the attitude of the management. If budgets are administered wisely the benefits are bound to occur, the system to be followed, should be designed according to the characteristics of organisation.

C. T. Horngreen has said – “If budgets are administered wisely, they compel management planning to provide, define expectations for judging subsequent performance and promote communication and co-ordination among the various segment of the business.”

Blocker and Weltmer have observed – “Budgetary control is planned to assist management in the allocation of responsibility and authority, to aid in making estimate and plan for future, to assist in the analysis of variations between estimates and actual results and to develop base of management or standards with which to evaluate the efficiency of operation”.

According to John G. Glover and Coleman L. Maze – “The primary purpose of budgeting is to aid in systematic planning and control of company operations from period to period. It is primarily a system of communication.”

A performance budget is an input / output budget or cost and results budget. It shows costs making with operations. Although it has been observed that the terms programme budgeting and performance budgeting refer to the same concept, some distinction can be made between the two programme budgeting measures, total costs of programmes or activities, performance budgeting measures both cots and activities.

If we analyse the historical development of this performance budgeting we will come to this point that this budgeting originated in the U.S.A. in 1960 when defence budgeting led to the thinking of ways and means of linking outputs to inputs. Afterwards, this became popular in many government departments outside the U.S.A. Now this budgeting is being used in business and other organisations besides government departments.

In India, performance budgeting was discussed in 1964 and later on it was adopted. This budgeting emphasises non-financial measures of performance which can be related to financial measures in explaining changes and deviations from planned performance. In this the performance measurements are useful for evaluating past performance and for planning future activities.

This budgeting results into the following:

(1) It facilities better, appreciation and review of organisational activities by the top management.

(2) It correlates the financial and physical aspects of every programme or activity.

(3) It improves budget formulation, review and decision-making at all levels of the organisation.

(4) It makes possible more effective performance audit.

(5) It measures progress towards long-term objectives.

This budgeting is a new concept in business and non-business budgeting. It was introduced for the first time in preparing the in divisional budgets of Texas instruments of the U.S.A. in the year 1971. After that this was adopted by the State of Georgia in 1973. Since then it is becoming popular in various States of U.S.A. and other countries.

In India this system of budgeting has been adopted only a few years ago. Now, it has been adopted by many departments of government of India and also by states like Maharashtra and Rajasthan. Some public undertakings have also studied its utility and are adopting this concept. Under this each manager is required to justify his entire budget in detail from zero bases. Each manager states why he should spend any money at all.

Basic Steps in ZBB:

The process of ZBB involves four basic steps and are as follows:

(1) Identification of decision units – It means the cluster of activities or assignments within a manager’s operations for which he is accountable.

(2) Analysis of each decision units – This should be done in the context of total decision package;

(3) Evaluation and ranking of all decision units- This is done in order to develop the budget request and to make it more effective.

(4) Allocation of resources to each unit – Allocation work must be done on the basis of ranking i.e. in doing allocation work; emphasis is placed upon resource allocation according to the contributions of each decision unit.

Advantages or Benefits of ZBB:

Firms and organisations have achieved a number of advantages or benefits from this system, important among them are as follows:

(1) This system has been considered as effective allocation of resources.

(2) It is an improvement in productivity and cost effectiveness.

(3) It has been considered as more effective means to control costs.

(4) This system avoids and eliminates various unnecessary activities.

(5) It gives a good picture and better focus of organisational objectives.

(6) It is very helpful to the top management and saves time of the top management.

Demerits or Limitations of ZBB:

Although this new system has various merits written above but it has certain problems and limitations which are as under:

(1) This system leads to more extra paper work.

(2) Managers and workers feel difficulty in identifying decision packages.

(3) In this there is a tendency to establish minimum level of efforts etc.

To conclude it can be said that these difficulties can be overcome when an organisation gains an experience of ZBB.

2. Different Control Systems:

Under this system four basis systems have been discussed in short and are as follows:

(i) Responsibility Accounting:

Responsibility accounting is a sophisticated name for the entire exercise of:

(a) Fixed responsibility on executives in accordance with the objectives of the organisation.

(b) Measurement and evaluation of actuals by means of systematic accounting.

(c) Comparison, calculation and analysis of variations.

(d) The basic emphasis in responsibility accounting is on the accounting function which constitutes the basic framework for the information system.

Under this system of control, the costs are assigned to responsibility centres rather than to products. These responsibility centres are nothing but executives who shoulder the responsibility. Therefore, the main emphasis in responsibility accounting is by tying the accounting control system with the organisation and responsibilities.

(ii) Control by Exception:

‘Control by Exception’ is another system of management control which is being adopted by various organisations. This refers to the control action initiated by a controlling authority on the basis of information from the controller. The time of executives, particularly at the top level, is very valuable and should not be wasted on immaterial details.

Hence, a top executive should not be provided with immaterial details, their attention should be drawn to prominent and noticeable variations. It is for the controller to decide as to which variations are significant and which are insignificant.

(iii) Self-Control:

Peter F. Drucker has discarded the term ‘control’ and has advocated the use of term “self-control.” According to this concept, the executive should be free to correct themselves. Once the variations are noted. It is necessary for a higher authority to exercise control and initiate, since the corporate objective and executive targets are fixed before-hand. The corrective process could be automatic and could be taken by the responsible executive himself. Thus, the system of self-control is just like ‘management by objectives’ which is self-generating and self initiating.

(iv) Management Information System:

Management Information system or management reporting system is also known as “Feedback” system of control. This refers to systematic and authentic information provided to the various level of managements to enable them to control action. This is particularly important is case of the control of executives at higher level of management.

3. Break-Even Analysis:

Break-even analysis is concerned with finding the points at which revenues and cost agree exactly. In other words – “The Break-Even Point (B.E.P) is the sales volume at which there is neither a profit made nor a loss incurred, i.e. Cost being equal to revenue.” It is a neutral point. Sales below this point show loss and sales in excess of this point show profit.

Further, it has been said that the term ‘Break-even point’ means the quantity or level of output on the sale of which there would be no profit or loss; i.e. it represents the position at which the marginal profit (or contribution) is just sufficient to cover fixed overheads. When output is above this level, profit is earned and when output falls below this level a loss in incurred.

The break-even analysis is principally concerned with the cost-volume-profit analysis. It magnifies a set of inter-relationship of fixed costs, the level of authority and sales mix to the profitability of the concern. Essentially, it is a tool of financial analysis. Where by the impasse on profit position of the changes in volume, prices, costs and this can be estimated with reasonable definiteness and accuracy.

This analysis is an improvement over the ratio technique of financial analysis. While the ratio analysis is concerned with the forecasting of data and as such provides an invaluable information on many types of managerial decisions.

In the words Martz and Curry “Break-even analysis indicates at which level costs and revenue are in equilibrium.” Thus, break-even analysis in associated with the calculation of break-even point. This B.E.P. may be described as a specific level of activity or volume of sales which breaks the revenues and costs evenly. It is also known as no-profit-no-loss points’. This point can be calculated mathematically also and charted on a graph paper also. If the B.E.P. in shown on the graph paper it will be called by the name of break-even-chart.

Martz and Curry have said that – “Break-even chart is an analysis in graphic form in relationship of production and sales profit.”

The break-even point can be expressed in terms of units produced, in presence of plant capacity or in account of sales.

This can be calculated in two ways:

(A) Equation Technique:

(1) B.E.P. in units PQ = F + VQ

Here –

P stands for selling price per unit

Q stands for quantity of goods sold.

F stands for fixed costs.

V stands for variable costs per unit.

Q stands for quantity of goods produced and sold.

(2) B.E.P. in value S = F + V

Here –

S stands for sales.

F stands for fixed costs.

V stands for variable costs.

(B) Contribution Technique:

Advantages of B.E.P.:

It is helpful in solving the following problems:

(1) What volume of sales will be necessary to cover –

(i) A reasonable return on capital employed.

(ii) Preference dividends.

(iii) Ordinary dividends.

(iv) Reserves.

(2) To compare a number of companies by arranging probable earnings from each in order of magnitude.

(3) It is helpful in the determination of the price of a product which will give the derived break-even-point and profit.

(4) It helps in the calculation of costs and revenues for all possible volumes of output thereby aiding in fixing budgeted sales.

(5) Variable cost per unit can be calculated quite easily from a break-even-chart.

Thus, we see that Break-even analysis is a useful management guide. It helps the management in determining the most profitable prices for the products of an enterprise. It helps the management in the optimisation of profits and maximum utilisation of resources. In the nutshell, the break-even analysis technique provides a fillip to the management to accelerate the volume of production to earn maximum profit.

The break-even analysis in based on number of assumptions which are rarely found in real life. Hence it’s managerial. Utility becomes limited.

Its main limitations are as follows:

(1) The first and the most important limitation of the break even analysis in that both cost and revenue shall be taken into account to determine the break-even point.

The one without the other has no meaning. But this analysis pre-supposes that prices do not change while in actual life, price does change as a result of several factors e.g. change in demand, fashion or style etc.

(2) This analysis assumes that all the costs can be divided into fixed and variable costs; they vary in a linear fashion and that the principle of costs variability applies to them. All these assumptions do not hold true.

(3) This analysis ignores the time lag between production and sales, the quantum of production may be kept constant, but the sales are bound to vary from period to period. This feature of sales reduces the significance of the break-even analysis as a management guide.

(4) Factors like plant-size, technology and methodology of production have to be kept constant in order to draw an effective break-even chart. But it is not found in actual life.

(5) This analysis does not take into account the capital employed in the production and its cost which is an important consideration in profitability decisions.

(6) The sales-mix has not been considered as a constant variable.

(7) The valuation and allocation of costs in a company are normally and usually arbitrary. So, it reduces the utility of this analysis.

4. Special Reports and Analysis:

This includes three observations:

(1) Routine accounting and statistical reports

(2) Operational audit and

(3) Personal observations.

(1) Routine Accounting and Statistical Reports:

This is also known as special reports which help in analysing particular problems of a particular area. These reports provide necessary information for control in general. But there are some areas where these may fall short of requirement, particularly in the case of specific problem or contingency. For this purpose, an investigating group may be assigned the job to go in detail of the problem and to prepare a report for this purpose. The problem in this case is generally of as non-routine nature.

(2) Operational Audit:

This is also known as internal audit it has been considered as an effective tool of managerial control. This audit is being carried out by managers themselves or by the special staff appointed for this purpose. This audit is much broader in scope and covers the whole range of activities of the organizations.

Operational audit in addition to ensuring that accounts properly reflect the facts, it also appraises policies, procedures, use of authority, quality of management, effectiveness of methods, special problems and other phases of operations, the latter being more emphasised in the present day operational audit.

Further, it feeds managers with a perennial supply of control information. It also scrutinises the applicability and relevance of policy, procedure and method of which have a tendency to become absolute.

Such a scrutiny helps in choosing a suitable working procedure and methods. The introduction of this audit tones up morale and working efforts of all members in the organisation as it involves the risk of being exposed before the management and people try to avoid errors of omission and commission.

(3) Personal Observation:

We have seen the various devices of managerial control such as budgets, statistical tools, audit, reports and recommendations are quite helpful in managerial control, managers should not forget the importance of control through personal observation. It has been suggested that managers should hold discussion with the persons whose work is being controlled and they should visit the actual place of operations.

There are certain kinds of information that can be conveyed only through face to face contact, personal observation and conversation. When a man is new to any job, a supervisor will like to watch his work more closely than he would, that of an experienced operator. Managers, after all, have responsibility of achieving organisational objectives whatever control devices they use. This largely involves measuring of human performance.

5. CPM and PERT:

i. CPM (Critical path method);

ii. PERT (Programme evaluation and review technique).

i. CPM (Critical Path Method):

This is an important tool in production, planning and scheduling. This is used for scheduling special projects where the relationship between the different parts of projects is more complicated than that of a simple chain of task to be completed one after the other. The method CPM can be used at one extreme for the very simple job and at other extreme for the most complicated tasks. It is the most versatile planning and control technique used in business.

It was first employed in U.S.A. in 1958 by the E. I. du Pont de Nemours Company. It is applied in these projects where activity timings are relatively well-known. It is used for planning and controlling the most logical sequence of activities for accomplishing a project. In this the project is analysed into different operations or activities and their relationships are determined and shown on the network diagram. The network of flow plan is then used for optimising the use of resources and time.

An eminent management writer has written that – “A CPM is a route between two or more operations which minimises or maximises some measures of performance. This is the sequence of activities which will require greatest normal time to accomplish. It means that the sequence of activities which require longest duration are singled out.” It is called a critical path because any delay in performing the activities on this path may cause delay in the whole project. So such critical activities should be taken up first.

The main purpose and objects of the study of CPM as a tool of production process are:

(1) To find the difficulties and obstacles of the course of production process.

(2) To assign time for each process.

(3) To ascertain the starting and finishing times of the work, and

(4) To find the critical path and the minimum duration time for the project as a whole.

ii. PERT (Programme Evaluation and Review Technique):

PERT is a time event network analysis technique designed to watch how the parts of a programme fit together during the passage of time and events. It involves the application of network theory to scheduling problems.

In PERT we assume that the expected time of any operation can never be determined exactly. This was developed as a research and development planning tool to estimate timings of various activities with enough certainty. It is being used by many big organisations for conducting the initial review of new projects.

It helps in planning the time and resources in case of projects. It can be employed with great advantage in those cases (e.g. non-repetitive project, research and development and defence projects). Where a project cannot be defined easily in terms of time and resources required.

It is employed in construction of ships, buildings, and highways, in the planning and launching of new products in the publication of books, in the installation and debugging of computer systems. These systems are used in conjunction with computers.

A computer programme is employed that permits, calculations to be made without reference to a flow chart or diagram. This technique was first used in 1957-1958 in U.S.A. as a tool of planning the “Polaris Missiles program.”

Brooz, Allen and Hamilton in association with the U.S. Naval Department. It involves basic network technique which includes planning, monitoring and controlling of projects. In addition to its use schedule, planning and control the network concept in PERT provides the frame work for treating a wide range of project management problems, recognising this fact the navy special project office of U.S.A. extended. The PERT to include the elements of cost and technical performance.

These two techniques are basically variations of network methods. The network is essentially a graphic, mathematical plan of actions and provides as intelligible visual picture of the goals to be achieved and their inter-relationships. It presents a clear-cut picture of the sequence in which each activity will occur and total time, the programme will take. It provides a simple clear and easily understandable description of the project in view.

The two broad categories name i.e. PERT and CPM are now-a-days used synonymously, though there is some relevance to the distinction from the historical point of view and emphasis in application. For example –

(1) PERT is used where the emphasis is on shortening and monitoring project execution time without attaching too much importance to cost implication.

(2) CPM is used where the emphasis is on optimising resources allocation and minimising overall cost for a given project execution time.

PERT as we are aware in a method of planning and controlling the time it takes to perform a task are defined and then laid out graphically in a network. Together with the steps the required times are also plotted.

The planning task in enhanced by the ability to shift the steps in order to shorten the time. Control is exercised by comparing the plan to actual performance. CPM involves identifying the sequence of events that must be accomplished to achieve a desired objective in a minimum of time.

Area of Application of the Techniques:

These techniques may be applied in the following areas of profitability:

(1) Development of new products and process.

(2) Construction project such as building bridges, dams, plants etc.

(3) Manufacturing of ships, missiles etc. which though to some extent are repetitive in nature, yet every time requires a fresh view on planning and execution.

(4) Major maintenance and overhauls of plants, where it is important to keep the downtime to a minimum.

(5) Organisation of conferences, programmes, etc.

Further, it has been said that the techniques have been developed basically for large projects, yet they may also be used with advantage for small projects as well.

Preparation and Construction of Network Diagram:

A network diagram basically consists of arrows and circles. Before we start the constructions of a network, a few definitions and concepts may be studied and taken into consideration.

(1) Activity:

Arrows in a network basically represent activity i.e. a job which consumes resources like material, money or time.

Good example of activity has been said and is as follows:

(a) Dig foundation.

(b) Installation of a boiler.

(c) Prepare reports of the project etc.

(2) Node:

Circles in the network are called nodes and represent events. Events do not consume resources. An event is an identifiable point in time at which something has happened. An activity is bounded on both sides by events.

Examples are:

(a) Started the digging of foundation.

(b) Completed the digging of foundation.

(c) Boiler installed.

(d) Report prepared etc.

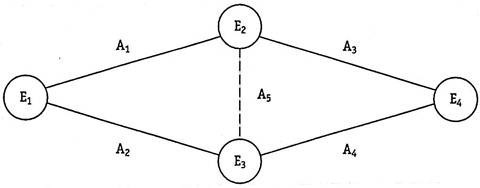

In the above diagram –

(a) A1; A2; A3; and A4 are activity.

(b) E1; E2; E3; and E4 are events.

(c) A5 represented by dotted arrow, is a dummy activity, it in itself does not consume any resources and is used to represent precedence relationships between different activities.

It represents the following logic:

(a) Activity A1 and A2 can happen simultaneously.

(b) Activity A3 can occur only after completion of activity 1.

(c) Dummy activity A5 represents that activity; A4 cannot be started before completion of Activity1 As such A4 cannot be started before completion of both activities A1 as well as A2.

Basic Rules for Construction of Network:

(a) One and only one arrow represents each completely defined activity.

(b) The activity is governed only by need for convenience and need for clarity.

(c) The start or termination of an activity is represented by nodes or a circle.

(d) Only the relative positions of arrows with common function have significance. Arrows originating at an event indicate activities that can begin only when all the activities terminating as that event have been completed.

(e) If an event is taken as precedence over another, but there is no activity to connect them, a dummy arrow represented by dotted line is used.

(f) For clarity, thick arrows or different coloured arrows are used to show critical path activities after they have been identified through analysis.

(g) Events are differentiated by numbers. No two events can have the same number. Each event which indicates termination of an activity, has higher number than the event, that indication start of the some activity.

(3) Critical Path:

Every project can be broken into convenient number of smaller activities as such that the project is completed when each and every activity has been completed. These activities have among themselves precedence and dependence relationships.

All these activities are represented in network form. In the network there in a single event called as ‘Start event’ which denotes the beginning of the project. Similarly, there is single event known as ‘end event which depends upon the completion of the project.

As such in a network there could be several different sequences of activities from ‘Start event’ to ‘end event’. Each of these sequences is termed as ‘path’. A critical path in a network is that sequence which is longest in terms of time. This means that project cannot be completed in less time than the time of the critical path.

(4) Earliest Start Time:

It is the earliest time for each activity at which time the activity can be started. The earliest state time for ‘start event’ is always taken to be zero. As such the earliest ‘start time’ for all activities that originate in ‘start event’ is zero. We shall denote in with TE.

(5) Earliest Finish Time:

For any activity, it’s FE in its TF + activity duration.

(6) Latest Start Time (LST):

This is the latest time at which an activity can start if the project were to finish at target time. LS for any activity is given by its TE – activity time.

(7) Latest Finish Time (LFT):

Latest finish time is the latest time at which an activity can be completed if the project were to finish at target time. For ‘end event’ of the project LF = Target time.

(8) Slack:

It is the difference between ‘Latest start time’ and the ‘Earliest start time’ or ‘Latest finish time’ and ‘Latest start time’ Slack is also known as ‘Float’. Similarly, for each ‘node’ or ‘event’ ‘Earliest start time’ and ‘Latest start time’ can be defined.

(9) Earliest Event Time:

‘Earliest event time’ is the time an event can occur. To find the earliest time for an event, we find the maximum of the earliest times of the immediately preceding events. Plan the duration of intervening activities.

(10) Latest Event Time:

It is the latest time which an activity can occur without increasing the duration of project (critical path time) for all the events on critical path.

Earliest Event Time = Latest Event Times.

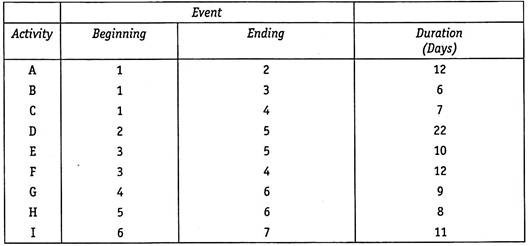

Example – A project has been broken up into nine activities.

The activities and their duration times are as follows in the following table given:

Calculation of Earliest Times:

For events (1) – ‘Earliest event time’ as well as latest event time and for any subsequent event, the earliest event time in calculated as –

Maximum – Earliest event time of immediately preceding event + of the activity duration time of the corresponding activity.

For example earliest event time for event (2) calculated as-

Earliest event time of event (1) + Duration of time of activity (1, 2).

In this case there is only one event, i.e., event (1) which immediately precedes event (2) This EST for event (2) = 0 = +12 which is shown in above event (2)

Similarly for event (4) the EST becomes 18.

Maximum of – 0 + 7 =7

6 + 12 = 18

and is shown in the rectangle about event (4). The earliest event times for other events are shown in the appropriate rectangles and the EST for the end event is calculated to be 53. This means that the entire project cannot be completed in less than 53 days.

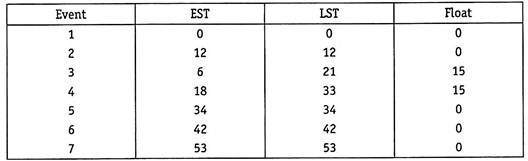

Calculation of Latest Event Times (LST):

The LST for the ‘end event’ is taken to be EST of the ‘end event’ or any given project time whichever is greater. For example LST will be taken to be equal to EST = 53 days.