This article throws light upon the three important key functions of organisational control process. The functions are: 1. Financial Control 2. Inventory Control 3. Quality Control.

Function # 1. Financial Control:

Financial controls are important for various reasons. The most important reason is that financial data are the index of a firm’s success and prestige. Financial results give a broad picture of a firm’s overall success for the simple reason that profitability is a broadly visible signal to other firms in the industry and also the investing community.

The most popular techniques of the financial control are:

(i) Return on investment (ROI),

(ii) Ratio analysis (RA),

(iii) Profit and loss control and

(iv) Budgets.

i. Return on Investment:

This technique was first used by Du Pont in the USA. Its virtue lies in the fact that it permits a common evaluation of the performance of different organisational units. Return on investment (ROI) is the net profit owners (shareholders) receive on their investment in a firm.

(ROI) is a technique of overall corporate control. It is also a measure of corporate effectiveness. As the name indicates, ROI examines profit or return from a particular investment. It can be for the firm as a whole, for a division, for a particular project or product, or even for a machine.

The ROI is expressed as:

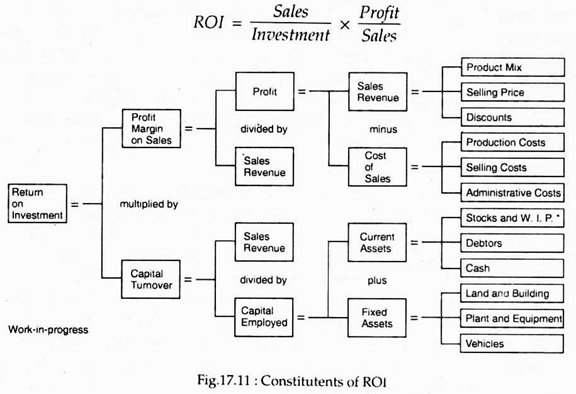

ROI = Sales/Investment x Profit/Sales

A more comprehensive break-down of the system is shown in Fig.17.11.

The line at the top determines the profit margin on sales, including production, selling and administrative costs. The net profit figure is obtained by deducting total cost from total sales revenue. The profit margin on sales is then arrived at by dividing net profit by total sales.

The line at the bottom determines the total assets turnover ratio. This is calculated by adding current assets to fixed assets, which equals total capital employed (investment).

Merits and defects:

The ROI system has an, important virtue – it can encourage management to adopt an integrated approach to assess organisational efficiency. For example, if the ROI is low (relative to that of competitors or the organisation in the past) managers can go back to the past to discover possible sources of the problem, e.g., a low turnover ratio.

Secondly, the ROI measure focuses on matters of primary concern to investors. It is a longer-term control measure than others such as budgets or profit and loss control. Thus it often plays a much more important part in top management decisions than it does at lower levels of management. (Lower-level managers usually look more regularly at budgets and profit and loss figures).

However, too much pre-occupation with ROI can lead to problems. For years together, Du Pont used a 20% ROI as a minimum for approving new product projects. This control technique caused the firm’s management to forego expansion into other lines such as xerography and instant photography. At the same time a total disregard for ROI may also be harmful over a long period of time.

Moreover, James A.F. Stoner has noted that there are also two possible dangers in using the system. Prima facie, a satisfactory ROI may actually conceal weakness.

As Stoner puts it:

“An inefficient use of manufacturing assets, for example, might be offset by a particularly effective sales campaign and still result in a satisfactory ROI.”

If sales return to the normal level, the continued inefficient use of manufacturing assets will cause a sharp drop in the ROI. As soon as managers become aware of these possibilities, they have to set additional standards and controls at each point in the system.

Secondly an undue concentration (or focus) on this crucial variable with its emphasis on current sales and capital utilization may dilute or overshadow the company’s long-term goals. Stoner suggests that current return on capital may at times have to be sacrificed in order to build a firm foundation for future expansion.

However, such pitfalls may again be overcome by establishing additional standards and controls for the organisation’s other goals and activities.

ii. Ratio Analysis (RA):

Ratio analysis (RA) simply involves selecting two or more components of a firm’s financial statement (income statement and/or profit and loss account) and expressing their relationship as a percentage or ratio. Management can determine which ‘red flags’ need to be watched more carefully (or closely) by comparing these ratios with those of other firms belonging to the industry.

iii. Profit and Loss Control:

Most large firms are organised on a divisional basis and have delegated considerable amount of authority to each division. An important step in maintaining control and still permitting autonomy of these divisions is to establish each as a separate profit center. In addition to providing divisional autonomy the step of subdividing accountability has made profit and loss managing much more effective.

iv. Budgets:

Budgets are probably the most widely used technique for planning and control.

In the words of Joseph A. Littner:

“Budgets are an exceedingly valuable tool for top management in assessing performance of divisions and departments in the company as well as for evaluating overall corporate performance. Monthly and sometimes weekly comparisons of actual cost of revenue performance against budgeted figures give all managers a consistent standard for measuring performance and a beginning point for diagnosis of problems.”

Function # 2. Inventory Control:

Inventory represents a major portion of many organisations’ capital investment. Cost of such investment includes inventories of raw materials to be used in producing goods, inventories of finished goods, and inventories of spare parts for machinery and equipments. Costs of inventory results from the cost directly associated with the items.

They also include costs of financing warehouse space, financing the purchase of the items, and other ‘administrative costs’, as well as lost interest and ‘opportunity costs.’

Inventories of finished goods that do not move for quite sometime (such as books) are very expensive. It is also costly not to have inventory on hand when a customer needs it or when an important production run is scheduled or to have key machine shut down because it will take several days for a spare part to arrive.

Costs connected with inventory control include the following:

a. Items in inventory;

b. Waste, spillage, or damage;

c. Freight charge;

d. Security expenses — guards, insurance, alarm systems;

e. Obsolescence;

f. Storage cost — building Space and maintenance; and

g. Administrative costs — wages and salaries for moving items into and out of store, keeping accurate counts, maintenance of store equipment, procurement and accounting for inventory items.

Three other, less traditional, items of costs are:

h. Shortage cost — the cost when not having an item on hand shuts down machines, and stops production and assembly lies;

i. Opportunity cost — the loss connected with the non-availability of an item needed because of investment of funds for other purposes;

j. Interest cost — interest expenses incurred when borrowing to carry inventories.

Purposes of inventory control:

Inventory control systems serve three managerial purposes:

1. Establish the maximum and minimum amounts of inventory to have available.

2. Keep inventory levels and costs at a desired minimum, while maintaining the proper safeguards over materials, and sustaining the proper flow of materials to places and people who need them.

3. Provide feedback about the movement of inventory and changes in inventory levels.

4. Signal management when items reach or fall below the minimum (required) level.

An inventory control system seeks to maintain an orderly flow of supplies, raw materials, or finished goods, through an office, shop or factory. Because items in any inventory represent costs, they need to be controlled.

Function # 3. Quality Control:

Quality control (assurance) is the process by an organisation insures that its finished products (services) meet the expectations (specifications) of consumers (clients). These expectations may take the form of taste (of a fast food like egg-roll), cleanliness (of a room in a hotel), noise (of a table fan), durability (of a car parts), quantity (of a bottle of soft drink), soon.

Activities involved:

The quality control function involves one or all of the following fundamental steps:

a. Setting standards:

Standards and specifications are set to establish the quality objectives to be measured or evaluated.

b. Inspection:

Materials, parts, products, and services are inspected. In this method of quality control, products are checked and examined against the standards designed for them. Inspections may be done by people, machines or a combination of both. Measuring instruments or inspection devices are used for objective and measurable comparison of actual quality to the established standards.

c. Statistical techniques:

Sampling techniques and analyses are often used to indicate whether quality is sufficiently under control.

Sampling requires only a percentage of items to be checked. This is based on the implicit assumption that a random sample is representative of the possible defects of the whole group of products.

d. Testing:

Testing may be a form of inspection. It applies to raw materials, work in the process of manufacture, and finished goods.