After reading this article you will learn about decision making under different circumstances:- 1. Decision Making under Certainty 2. Decision Making under Risk 3. Decision Making (Or Problem Solving) under Uncertainty.

Decision Making under Certainty:

Certainty implies that all the facts are known for sure. It is assumed that there is complete and accurate knowledge of the consequences of each choice (or of the nature of future conditions). It is decision making under certainty if only one state of nature is relevant. Decision making under certainty occurs when the manager knows the state of nature that will occur with complete certainty, that is, when a probability of 1.0 can be assigned to a specific state of nature.

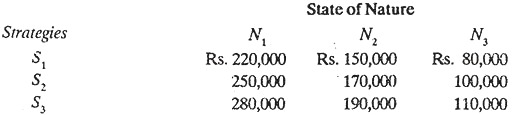

The meaning of the term certainty is that for each alternative there is one and only one value of the pay off. All we need do then is to find the alternative which has the best pay off and this is the alternative which should be selected. The decision criterion is simply to select the alternative with the best pay off. Consider the following pay off matrix.

A pay off matrix is a logical grouping of possible outcomes in a problem. Outcomes can be expressed in rupees (profits, costs etc.), units or some other appropriate measure. In a payoff matrix, the intersection of each row and column gives a specific outcome i.e., the consequences of choosing a particular strategy (row), given that a certain state of nature (column) occurs.

In other words, the manager’s measure of utility or pay-off measure for each outcome is associated with each combination of strategy and state of nature. Strategies are those variables (controllable) that are within the manager’s control, such as appropriate actions to be taken (including the decision to do nothing). The future events that can occur for the strategies must be identified.

These events, which are termed states of nature, represent those variables (non-controllable) that are beyond the control of the manager, such as economic conditions or a competitor’s actions. The payoff matrix above, shows the profits. The manager knows with certainty that N2 state of nature will occur. Therefore, he will select strategy S3, since it offers the highest return. The decision criterion for certainty is to select that strategy with the largest payoff based upon a given state of nature.

Example 1:

An industrial enterprise can sell 500 units of products to another concern at a price of Rs. 40 per unit. If the enterprise has excess capacity, should the order be accepted?

Solution:

(i) The evaluation criterion in this case will be – the maximization of profit.

(ii) The alternative courses of action are

(a) To accept the order.

(b) To reject the order.

Order can be accepted only if it increases the profit, otherwise it will be rejected.

(iii) The next step in the process of decision making is to find the incremental expenses of producing 500 units.

The relevant expense model is:

E = x + 500y.

Assume that an additional equipment, worth Rs. 10,000 (... x = 10,000) is required to be bought for accomplishing the order and the variable cost associated with making one unit is Rs. 30, (... y = 30).

Thus the total relevant expenses of filling the order are:

E = Rs. 10,000 + 500 x 30 = Rs. 25,000.

(iv) A comparison of the incremental revenues, i.e. [Rs. 40 x 500 (units)] = Rs. 20,000 and incremental expenses, E, i.e., Rs. 25,000 indicate that the order should not be accepted.

Decision Making under Risk:

Decision making under risk refers to situations where there are a number of states of nature and the manager knows the probability of occurrence for each of these states of nature, (based upon past experience etc.). An inventory decision problem for optimum stocking of machinery replacement parts is an example of decision making under risk, because historical data en parts replaced can be compiled for a certain period of time.

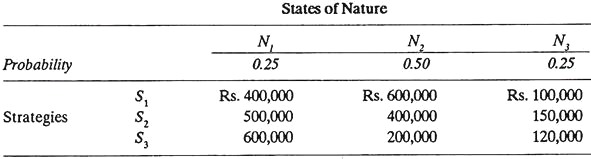

Another example is that of a food processing firm that grows its own crops; based on the firm’s past experience with planting three types of crops in a particular area of the country, the following pay off matrix has resulted, over the past years, for the three states of nature (where N1 = good weather, N2 = variable weather and N3 = bad weather).

In terms of data given for this problem, the strategy with the largest pay off is to be selected.

The equations for computing expected pay offs for the strategies (ES) are as follows:

ES1 = Rs. 400,000 (0.25) + Rs. 600,000 (0.5) + Rs. 100,000 (0.25) = Rs. 425,000

ES2 = Rs. 500,000 (0.25) + Rs. 400,000 (0.5) + Rs. 150,000 (0.25) = Rs. 362,500.

ES3 = Rs. 600,000 (0.25) + Rs. 200,000 (0.5) + Rs. 120,000 (0.25) = Rs. 280,000.

Because the expected payoff is greatest for the first strategy, this then is the strategy to select.

Decision Making (Or Problem Solving) under Uncertainty:

Whereas in decision making under certainty, only one state of nature is relevant, with decision making under uncertainty, one can expect to enumerate a finite number of states of nature. The character of uncertainty is associated with the fact that, one, then acknowledges a total inability to estimate the likelihood of occurrence for each of these states of nature. Under uncertainty, the event that will occur (the state of nature) is not known for sure.

Under uncertainty, the consequences of each choice cannot be defined by a correspondence relationship even within a probabilistic framework. Decision making under uncertainty requires that the person responsible for making decisions should use his judgment. He must make sure that which outcomes are more likely than others and combine this knowledge with the consequences associated with the various decisions.

Such a process lies behind the familiar willingness to take a calculated risk Decision making under uncertainty refers to situations where the probabilities of occurrence for the various states of nature are unknown. Business problems of this type arise when no past experience is available for determining the probabilities of occurrence for the various states of nature. Problems that deal with new products, increasing plant capacity, and floating new stock issues are examples of decision making under uncertainty.

The choice of a specific decision criterion under uncertainty is determined by:

i. The size of the company,

ii. The company’s objectives and policies,

iii. The feelings of the manager or

iv. Some other logical basis.

Example 2:

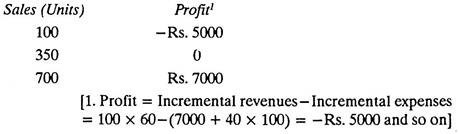

A business enterprise has a project of making and selling a new product. It associates a fixed cost of Rs. 7000 and a variable cost of producing a unit, as Rs. 40. The product can be sold at the rate of Rs. 60 per piece. The level of sales is uncertain i.e., it is not sure whether 100 units (will be sold) or 350 or 700 units will be sold. Should the enterprise go for the project or reject it?

Solution:

(i) The relevant expense model will be

E = 7000 + 40y. …(i)

(ii) Alternatives are

(a) To make and sell the product and accept the related profit or loss.

(b) To reject the project.

(iii) If the product is made and marketed, the profit for each level of sales is

(iv) Since the level of sales is not certain and different levels of sale involve profit and loss, the decision maker has to act with imperfect information.

Under such conditions the Bayes Decision Rule is extremely useful for making business decisions.

The Bayes decision process is an orderly and consistent technique and a logical way of bringing both the decision maker’s judgment and the economic consequences of a given action to bear upon the decision.

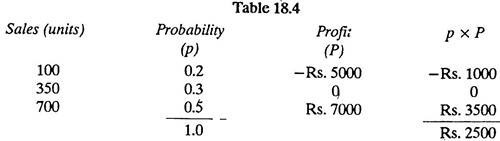

As per the procedure of the Bayes decision rule, the decision maker, depending upon his judgment, feelings and experience, assumes probabilities of occurrence of the three levels of sales, e.g., he may feel that

For 100 units the probability is 0.20;

For 350 units the probability is 0.30; and

For 700 units the probability is 0.50.

With these probability values, the decision maker constructs the following table:

The expected profit for making and marketing the product is Rs. 2500. Thus as per the recommendations of Bayes decision rule the enterprise should go for the project.