This article throws light upon the top two techniques for monitoring managerial performance. The techniques are: 1. Management Audits 2. Human Resource Accounting.

Technique # 1. Management Audits:

Just as financial audits are checks of an organisation’s financial and accounting procedures, a management audit is a check of an organisation’s management procedures. To be more specific, a management audit is a complete review and evaluation of the organisation’s total set of activities from a managerial perspective.

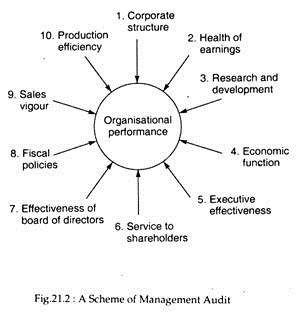

The most frequently used management audit is the one developed by the American Institute of Management (AIM). The AIM programme collects data about an organisation by using a number of techniques. The data are used to assess ten vital dimensions of organisational performance.

As shown in Fig. 21.2. these dimensions are corporate structure, health of earnings, research and development, economic factors, executive effectiveness, service to shareholders, effectiveness of the board of directors, fiscal policies, sales vigour and production efficiencies.

The organisation is assigned a rating along each dimension. The maximum potential rating for executive effectiveness is 2,400, whereas health of earnings has a maximum potential score of 600. Out of a potential maximum of 10,000 points, the AIM programme defines an excellent level of organisation performance as a score of 7,500 or higher.

After completing the management audit, the auditing team submits a report to management. Then, the company management is left with the option to take any action deemed appropriate. If a company’s structure gets a poor rating, there is a clear indication that re-organisation is needed.

Likewise, if research and development were given a low score, management might adopt guidelines for channeling more funds into R&D activities. Similar actions could be pursued for each component of the audit results.

Management audit is, no doubt, helpful for the appraisal of management. But, it has drawbacks, too. It takes a long time and involves subjective evaluations as well as objective appraisals. This is why most companies are reluctant to adopt it as a means of assessing and controlling performance.

There is no real possibility of this technique becoming as widely used and recognised as the financial audit. But, it is a potentially helpful weapon for managers seeking to control organisational performance.

Technique # 2. Human Resource Accounting:

The second important technique of measuring and controlling organisational performance is human resource accounting (HRA). This technique was developed to fill a void in traditional accounting techniques. It seeks to make a better assessment of the value of human resources than existing techniques.

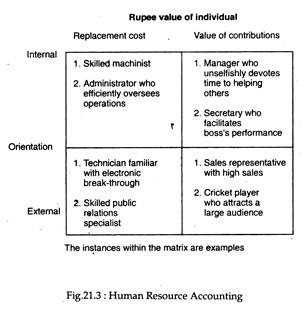

According to Rensis Likert, who did pioneering work on HRA, human resources can be assessed along two dimensions: the money value of the individual and the extent to which his (her) contributions are internal or external. These perspectives are presented in Fig. 21.3.

The rupee value of an individual can be expressed in one of two ways: Replacement costs are those that the company would incur in replacing the individual: hiring, training and termination costs. The other way to place a rupee value on individuals is to estimate their contributions to the organisation.

It is also possible to view human resources as being oriented internally or externally. Employees whose jobs are oriented toward the organisation itself represent internal assets. Individual aptitudes, skills and experience pertinent for such jobs are internally oriented. In a like manner, individual leadership ability, decision-making power and administrative efficiency are also internally oriented.

By contrast, the externally oriented assets that employees represent focus more on the individual in relation to the environment. For example, individual abilities to relate effectively to customers, suppliers, unions, government officials and shareholders are important external assets.

Fig. 21.3 also gives examples of the kinds of employees who are likely to be emphasised in HRA from the perspective of orientation and money value.

HRA is relatively new and various problems are associated with it, specially problems of measurement. Therefore it is not as widely practiced in contemporary organisation as are standard financial accounting procedures. Managers are more aware of HRA, however, and it may be more widely used with the passage of time.

At present, its primary value is to reinforce the idea that an organisation’s human resources are as valuable as (if not more valuable than) the financial assets listed on company balance sheets.

Performance appraisal could be used to rank organisational participant to facilitate HRA. In a like manner the appraisal of individual managers in an organisation could be a useful component of a broader, more comprehensive audit.