This article throws light upon the eight steps in strategy formulation in management. The steps are: 1. Setting Basic Objectives 2. Identify Opportunities and Risks 3. Evaluating Alternative Resource 4. Formulating Alternative Strategies 5. Evaluating these Alternatives 6. Establishing Basic Strategy 7. Implementing Strategy 8. Evaluating Strategy.

Step # 1. Setting Basic Objectives:

The firm initially sets provisional objectives. The reason is easy to find: until the measures needed to achieve them have been defined it is not transparent whether these objectives are feasible — or necessarily desirable — when looked at against various elements that are likely to be involved in attaining them. Nevertheless, to start with, a set of objectives makes enormous good sense.

Step # 2. Identify Opportunities and Risks:

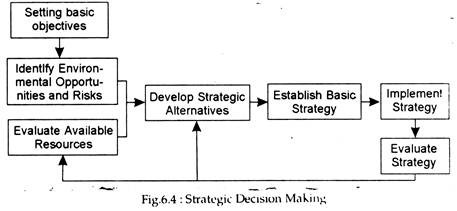

In Step 2 a firm has to consider how possible future changes in the external environment are likely to affect the planning and decision-making exercises of the firm. Assessment of environmental trends seems to be a very important step in the process of strategy formulation as shown in Fig. 6.4.

The stress should be on economic and competitive conditions. The manager’s major concern is the direction, of market forces over the long run.

Assessment of the competitive situation is often more difficult than it seems at initial look. The following example reveals this danger:

In reality a firm is often killed by a competitor it did not know or did not take seriously. IBM, which did not make manual typewriters, destroyed Underwood’s leadership position in the typewriter business with its electric typewriter. Yet for many years Underwood paid more attention to its traditional rivals, Smith-Corona and Royal-McBee. IBM was seen as a remote outsider with a special luxury product, not as a serious and dangerous challenger.

Appraisal of significant technological changes has led to the practice of technological forecasting. This practice brings together the predictions of experts on anticipated scientific and technological developments. One of the well-known methods, known as the Delphi method, takes initial individual predictions from a group of selected experts.

The essence of the method has been stated thus: “Each of these individuals expresses his (her) own judgement on some expected scientific breakthrough, without conferring with the other panel members. In this way, the process tries to avoid rapid agreement without careful thought. The individual predictions are then grouped and returned to the experts, who make a second round of predictions. The process is repeated a number of times in getting to some range of predictions that may be usable.”

Step # 3. Evaluating Alternative Resource:

The next steps are to take stock of the situation of the firm (its available resources).

In evaluating available resources, the manager is concerned with strengths, weaknesses and the extent to which resources are committed on a long-term basis. Firms with relatively little debt have superior resources available for expansion. Firms ‘locked in’ to long-term projects, on the other hand, may lack financial resources for new investment opportunities.

Personnel resources are also critical for use in exploiting opportunities requiring specialised technical, managerial or professional talent. A managerial staff may have great depth, or it may be thin. It may possess experience that limits it to one speciality, or it may be broadly professional.

Flexibility and versatility of technical, professional, and managerial talent are important constraining factors that limit opportunities for strategic change.

Step # 4. Formulating Alternative Strategies:

In the next step a company has to formulate possible strategies for the future of the business, in particular how to use the potential of the firm to exploit new or unexploited market opportunities with data concerning environmental (external) risks and opportunities with data concerning available (internal) resources.

In the case of a running concern, one alternative is to continue doing what it is already doing. This approach seems to be the best, but only for a time. A corporation may eventually modify its strategy because of the inevitable changes in the environment. Other alternatives are needed for serious consideration and comparison with the status quo.

The development of strategic alternatives is a creative process that requires a vision of the various possibilities for meeting the needs of the industry. One should have necessary courage to propose drastic changes in strategy, the accepted way of doing things. Changes pose difficulties even in contemplation, because of traditional and comfortable patterns of thinking and operation.

Some major strategic alternatives might include the following:

1. Continuation of present strategy

2. Diversification;

3. Merger;

4. Specialisation;

5. Liquidation;

6. Geographical expansion.

Thus, consideration of alternative strategies is an important part of the process of strategy formulation. As Smith has put it: “Reluctance to consider more than one possible course of action is probably the most pervasive weakness in strategic management, and a frequent means of perpetuating policies that have been overtaken by the changing course of events”. In short, the fact remains that “consideration of alternatives is ultimately the key to devising a successful, if not the best, strategy”.

Step # 5. Evaluating these Alternatives:

The process of evaluating alternatives encompasses two things: (a) financial evaluation in the sense of trying to assess the relative profitability and other financial consequences of different strategies, and (b) less quantifiable aspects of how they might affect the position of the company. A retrenchment programme, for instance, might look quite favourable structure and industrial relations may also be important facts to take account of.

Step # 6. Establishing Basic Strategy:

Having evaluated the alternatives, a decision must be made as to the strategy to be adopted and detailed plans must be drawn up as to how to implement it. However, the decision as to which strategy to adopt is difficult and requires much subjective judgement.

The difficulty in making this choice arises from the three things:

(a) The fuzzy nature of the problem,

(b) The existence of the unknown that will become known in the future, and

(c) The paucity of available information.

Individual managers also possess personal values and ambitions that inevitably affect strategy determination. One manager may wish to gain or hold a given share of the market. Another may emphasize product specialization or social values.

Whatever factors are included in the strategic decision, it is important that such a decision be made and that it be made clear to members of the organisation. Otherwise, the company’s direction will remain unclear and the management team will tend to move in various (diverse) directions.

The strategy decision determines any changes to be made in the deployment of company resources. If a new strategy is to be followed, company assets have to be a time-consuming process because of the fixed nature of many assets, and rapid changes are likely to be costly.

Longnecker and Pringle have made a related point in this context. They have noted that “Redeployment of assets concerns more than financial and physical assets. Management groups, for example, have educational and experimental backgrounds that are related to existing strategy. Modification of that strategy may require changes in the management staff.”

Step # 7. Implementing Strategy:

In general, strategy is implemented as the organisation develops specific plans to carry out the overall strategy. If a firm decides to enter a regional market, for instance, somebody has to set up the distribution system and see that it starts operation before long.

Strategy is normally implemented by middle and lower management. Even though overall strategy is decided (determined) by top management, because of the fundamental importance of the decision, they need the strong support and active involvement of middle and lower management to make the strategy a success.

Step # 8. Evaluating Strategy:

Finally, no strategy is final. There is need for periodic evaluation of competitive strategy to prevent deterioration and obsolescence of the basic strategic approach.

The environment changes in various ways, and continuing criticism of existing strategy helps to locate weaknesses in it at the earliest possible moment.

An evaluation process necessitates criteria and the firm’s strategic goals should be formulated so that they can be used for judging the effectiveness of strategic decision with the passage of time.

Three most important criteria that may be used to evaluate strategic performance are:

1. Market-share goal;

2. Rate-of-growth goal;

3. Profit goal.

In each area, management may use its own stated goal, past performance, or the record of competitors and of the industry as a whole. A strategic goal might be stated as an increase in market share from 15% to 20% of the industry’s sales.

A rate-of growth goal proposes a growth rate that is considered within the scope of company resources. However, achievement of these first two goals does not guarantee realisation of the third — the profit goal. The profit goal may be stated in terms of return on investment, earnings per share, or in other ways.