Everything you need to know about the traditional techniques and methods of controlling. Traditional techniques are those which have long been used by the managers.

Management tries to ensure that the scare recourses at its disposal are efficiently and effectively utilized. The deviations from standard may be seen due to various factors of the organisations.

To attain the objectives of the organisation, management has to implement its plans and policies in a proper manner. If these plans are not implemented properly, the variations will be found there. These variations must be taken in notice by the management. The choice of the control technique is based on the deviations.

Some of the traditional techniques of controlling are:-

1. Personal Observation 2. Statistical Data 3. Special Reports and Analysis 4. Operational Audit 5. Control through Costing 6. Break-Even Analysis 7. Budget and Budgetary Control

8. Production Planning and Control 9. Inventory Control 10. External and Internal Audit 11. Standard Costing 12. Financial Statement Analysis 13. Auditing 14. Adoption of Reporting System 15. Profit and Loss Control.

Learn about the Traditional Techniques of Controlling: Inventory Control, Auditing, Financial Statement Analysis and a Few Others

Traditional Techniques of Controlling – Personal Observation, Special Reports and Analysis, Break-Even Analysis, Budget and Budgetary Control ad a Few Others

Following are the various traditional techniques of controlling:

Traditional Technique # 1. Personal Observation:

With the various devices of managerial control like as budgets, standard costs, statistical tools, audit reports and recommendations are very helpful in managerial control. Managers should not forget the importance of control through personal observation. Managers need to hold discussion with the persons, whose work is being controlled and they should visit the actual operations. There are certain kinds of impression and information that can be conveyed only through direct contact, personal observation and conversation.

When a person is new to the job, a supervisor will like to watch his work more closely than he/she would that of an experienced operator. Managers, after all, have responsibility of achieving organisational objectives whatever control devices they use. This largely involves measuring of human performance. Thus, the success of personal information as a control method depends upon how much information a manager can get through this process.

Traditional Technique # 2. Statistical Data:

It is an important method/technique of controlling various aspects of business operations. It involves in statistical analysis in terms of percentages, rations, correlations, averages etc. On the basis of such analysis, deviation can be evaluated easily and corrective action can be executed promptly. Such areas of control are production planning and control, quality control, inventory control, etc.

Traditional Technique # 3. Special Reports and Analysis:

Special reports and analyses help in particular problem areas for controlling purposes in this regard. While routine accounting and statistical reports provide necessary information for control in general, there may be some areas where these may fall short of requirement, particularly in the case of specific problem or event. For this purpose, an investigating group may be assigned the job to go into detail of the problem and to prepare a report for this purpose. The problem in this case is generally of non-routine type.

Traditional Technique # 4. Operational Audit:

Internal audit is an effective tool of managerial control. It is now coming to be called, the operational audit. Operational auditing, in its broadest sense, is the regular and independent appraisal, of internal auditors, of the accounting, financial and other operations of an enterprise. Although often limited to the auditing of accounts, in its most useful form operational auditing includes appraisal of operations in general, weighing actual results against planned results.

Thus, operational auditors, in addition to confirm themselves that accounts properly reflect the facts, appraise policies, procedures and use of authority, quality of management, effectiveness of methods, special problems, and other phases of operations.

Traditional Technique # 5. Control through Costing:

Standard costs are predetermined operation costs computed to reflect quantities, prices and level of operations. Control through costing involves the control over costs in the light of certain predetermined costs usually known as standard costs. Such standards are set in respect of total costs as a whole and its different components material, labour and overheads. Therefore, standard costing is a method of cost accounting in which standard costs are used in recording certain transactions and the actual costs are compared with the standard costs to final out the amount and reasons of variations from the standard.

Control through the standard costing involves the following steps:

(i) Setting of Standards – The standards is get for different components of cost separately. Such standards can be fixed on the basis of past records or through experiments, also known as engineering methods.

(ii) Determining the Actual Costs – It is to be determined from the cost accounting records, for the intent of comparison.

(iii) Comparing Standard Costs with the Actual Costs – In order to find out the deviations, this comparison is done. If in case, there are no variations, no further action is required.

(iv) Further Analysis – If the variation is beyond the specified limit, it is taken to further analysis and an endeavor is made to locate the reasons for such a variation.

(v) Further Planning – In the light of the reasons identified, further course of action is planned so that in future there is no such variation. This may require checking and revision of standards also if diets are not practical.

Traditional Technique # 6. Break-Even Analysis:

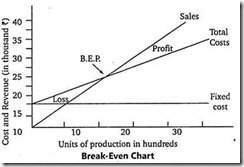

The break-even analysis is primarily concerned with the cost-volume-profit relationships. It magnifies a set of relationships of fixed costs, variable costs, price, level of output and sales mix to the profitability of the organisation. Break-even analysis is set mathematically by applying the formulae to follow the break-even point, contribution, margin of safety and profit volume ratio or graphically by break-even chart concerning the profitability of the organisation.

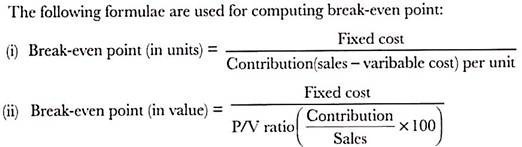

Mathematically, relationships can be expressed as follows:

Break-even point = Fixed costs/Contributions per unit

Contribution = Sale per unit – Variable costs per unit

Margin of safety = Total sale proceeds – Sales of B.E.P.

Profit = Sales – Total costs (fixed + variable) or

= Total contributions – Fixed costs

Graphically, relationship can be shown by break-even chart as shown in figure below:

Traditional Technique # 7. Budget and Budgetary Control:

Budgeting is the formulation of plans for a given future period in numerical terms. As such, budgets are statements of awaited results, either in financial terms as in revenue and expense and capital budgets or in non-financial terms as in budgets of direct-labour-hours, materials, physical sales volume or units of production. Sometimes it has been said that financial budgets represent the “dollarizing” of plans.

Budgetary control is elicited from the concept and use of budgets. Thus, budgetary control is a system which uses budgets as a means for planning and controlling entire aspects of organisational activities or parts thereof.

According to Terry “Budgetary control is a process of comparing the actual results with the corresponding budget data in order to approve accomplishments or to correct differences by either adjusting the budget estimates or correcting the cause of the difference”.

Traditional Techniques of Controlling – Personal Observation, Statistical Reports and Analysis, Budgeting, Cost Control, Production Planning and Control and a Few Others

i. Personal Observation:

Observation is the oldest method of the controls in which the actual performance is observed. This technique ensures that the entire employee performs their work as per the given standards or norms by spot overseeing and observation. The physical presence of the manager and his active involvement in work regarding the progress of work has certain influence over the performance and behavior of the subordinates working under his control.

This oldest control technique is very much effective also. In the observation method due to face to face contact, the important and first-hand information can be used by managers for management control. The technique is helpful for managers to understand the various aspects of performance work.

There are some limitations of this method like, personal observation is a time consuming process and it may have a negative impact on few cases. Although there is a pressure of unscheduled visits of the manager at work sight, but the employee morale become high due to freely interest with the manager or supervisor.

ii. Statistical Reports and Analysis:

These two are also very important instrument of control. Analysis of statistical data in the form of averages, ratios percentages and correlation play an important role in control production, quality and inventory. Statistical reports in the form of tables, groups etc., and trends by statistical reports and analysis are useful for managerial control. These reports ensure whether prescribed policies are being followed or not.

iii. Budgeting:

Budgeting is a very useful technique of control. Budgeting is the process of preparing and utilizing budgets to evaluate actual performance. A budget is a quantities (or) and monetary expression of business plans and policies for a definite period of time in future. It is an estimate of income and expenditures prepared in advance for a certain period of time in future.

The institute of cost and work accounts, under defines a budget as – “A Financial and/ (or) quantitative statement, prepared and approved prior to a defined period of time of the policy to be pursued during that period for the purpose of attaining a given objective”.

The main characteristics of a budget are as follows:

a. It is based on a future plan of action, but prepared in advance.

b. It includes the objectives to be achieved in future.

c. It is a statement expressed in monetary or quantitative terms.

A budget is very useful and effective tool of planning and control. The goals are represented in quantitative terms and job assignments of people are defined by budget. The budget determines the standard by which the actual performance can be compared and evaluated to find out deviations by planned expenditures or results.

The manager becomes able to take corrective measure for bringing actual results in conformity with the plans by such information. Budgets are highly useful in controlling the day to day operations of the organisation. Therefore, the budget making is a part of planning but administration of budget involves controlling.

iv. Cost Control:

Cost Control concerns with the control of all costs of an enterprise in order to achieve the cost efficiency of business.

The cost is classified in to fixed cost, variable cost and semi variable cost. Fixed cost is required to establish the plant and incurred over a period of time. This cost remains the same even there is increase or decrease in the production. The nature of semi variable is between the fixed and variable cost.

There may be different methods of recording cost for various products. In these methods, classification, recording and allocation of expenses may be done differently. In these methods the deviations in standard or budgeted costs and actual costs will be reported to the concerned officials for taking corrective measures. The cost standards are fixed for each product and actual cost records are also sent to the in-charge of the product. It is easy to find deviation and taking corrective action.

v. Production Planning and Control:

Production manager has another very important task of production planning and control. In this technique the production process is properly decided in advance and is carried out according to plan. This is the function of looking ahead, anticipating difficulties to be faced and the likely measures to remove them.

Flow of production is guided and controlled by production control to ensure the best way of production by scheduled plan and right quality. Control facilitates the task of manufacturing and ensures that everything should be according to plans.

vi. Inventory Control:

Inventory control is a system which ensures the right quality of material and inventory available in the right quantity at the right time and right place with the right amount of investment. Inventory control is necessary for the smooth and uninterrupted production at the minimum cost. The main purpose of inventory control is to maintain adequate supply of demanded material at the lowest total cost.

Inventory control takes place in three steps

a. Purchasing of materials.

b. Storing of materials.

c. Issuing of materials.

vii. External Audit Control:

This takes place when a qualified and independent chartered accountant act the financial accounts of an organisation under the companies Act, 1956, it is compulsory for joint stock companies. The objective of external audit control is to protect the interests of shareholders and other interested parties against manipulations and malpractices by management.

The external auditor is appointed in annual general meeting by shareholders. The auditor must certify that the profit & loss account and balance sheet of the company represents a true and fair view of the profit, loss or financial position of the company respectively. If the auditor is negligent in his duties or found guilty of any found he faces both civil and criminal liability.

viii. Break Even Analysis:

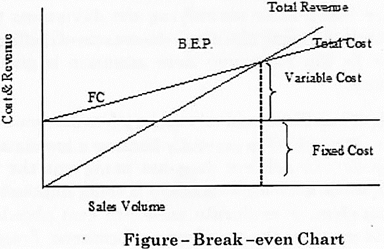

Break even analysis is an inter relationships between cost of production, volume of production and profits. Therefore, it is called as cost-volume-profit analysis. Costs are of two types- fixed and variable.

The relationships are depicted on a chart known as break even chart as shown in below Figure:

In this chart the x axis represents sales volume while Y axis represents cost and revenue. The Fixed cost line is horizontal to x axis and total cost line is drawn vertically from the intersection of fixed cost line at the x-axis. Revenue line is drawn through the zero point on the Y axis.

The point at which the total revenue line interests the total cost line is known as breakeven point. This is no profit and no loss point because total revenue is equal to total cost. Beyond this point the firms earns profit and below this point it incurs loss.

Contribution per unit = Selling price per unit – Variable cost per unit

Profit = (Contribution per unit x sales volume) – Fixed cost.

Break Even analysis is helpful technique of decision making and control, because it determines the profit, costs and sales. Break even analysis is also known as an invaluable tool of planning and control.

ix. Standard Costing:

Standard costing is an important technique of cost reduction and cost control. A standard for material, labor, overheads and other components of total cost is determined in this technique. Actual costs are measured and company with the standards costs and deviation are identified with their causes.

Corrective measures are taken after identifying the deviations from standard. Standard costing also detail the sources of inefficiency and wastage. In this technique more attention is given on controllable cost.

Although, it is difficult and expensive job to determine the standard cost. It must setup carefully because a low standard which everyone can achieve does not bring out the best performance, while a too high standard is being impossible to achieve. Therefore, a moderate standard cost should be determined to measure the standard performance. Frequent revisions of standard cost may be also done due to the change in business environment.

x. Financial Statement Analysis:

Profit and loss account and balance sheet are known as financial statements. Analysis of these financial statements provides trends in the performance of the business by which any one become able to know the health of the organisation. Although, statements and ratios are influenced by accounting policies and practices, therefore it is found variance in the control procedure from one period to another. Ratios are able to provide only trends; they do not provide the actual magnitudes.

Traditional Techniques of Controlling – 5 Important Traditional Techniques: Budgetary Control, Break-Even Analysis, Standard Costing, Personal Observation and a Few Others

Some traditional control techniques have been described as follows:

i. Budgetary Control:

Budgetary control means the use of a comprehensive system of budgeting to aid management in planning and controlling operations. It is the establishment of budgets relating to responsibilities of executives and the continuous comparison of actual performance with the budgeted performance for ascertaining variance and taking corrective action.

It is an effective device of control for management. It enables the manager to compare actual performance against predetermined budgetary standards and act accordingly to control the situation. It helps in fixing responsibility on the managers working at different levels. It provides allocation of resources for various operations and departments according to their requirements. It prescribes time-bound targets and determines a future course of action for achieving these targets.

Therefore, budgetary control involves the following steps:

a. Specifying targets for the achievement of objectives laid down in the plan;

b. Establishing budgets relating to responsibility centres;

c. Recording the actual performance of work;

d. Comparing the actual performance with budgeted performance to ascertain the variances;

e. Analysing the causes of variances;

f. Reporting the variances to management for corrective action and remedial measures;

g. Revising the budgets (if required).

ii. Break-Even Analysis:

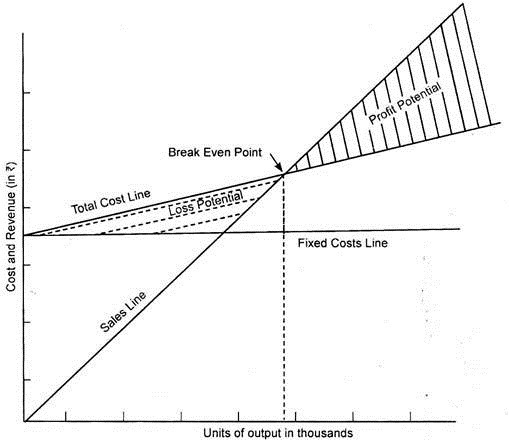

A break-even technique is commonly used to ascertain and control the behaviour of cost, revenue, and profit at various levels of activity. Break-even point refers to the volume of output at which total cost is exactly equal to total sales revenue. At BEP, an organization neither earns a profit nor suffers a loss.

This is the critical point of production at which total cost is fully recovered, and after this point, profit begins. It is an important device to explain the relationship between cost, volume, and profit. It serves as a tool for cost reduction and cost control. It provides basic information facilitating further studies on improving profits. It is the most useful tool of profit planning and control. It helps in ascertaining the soundness of an enterprise from its margin of safety and angle of incidence. It is also used for analysing risk implication of alternative courses of action.

iii. Standard Costing:

Standard costing is a technique of costing that uses standards for cost and revenues for the purpose of control through variance analysis. It facilitates effective cost control and provides information necessary for cost reduction.

Standard costing is the preparation and the use of standard costs, their comparison with actual costs and the analysis of variances to their causes and points of incidence. – [C.I.M.A. (London)]

Standard costing involves the following steps:

a. The setting of standard costs in full detail under each element of cost (i.e., material cost, labour cost, and overhead);

b. Measurement of actual costs;

c. Comparison of standard cost with actual cost to determine variances;

d. Analysing the reasons for deviations of actuals from the standards;

e. Presentation of variances to management for taking appropriate actions;

f. Revision of standards when necessary;

g. Corrective actions are taken to ensure that future performance will be in accordance with the predetermined standards;

iv. Personal Observation:

Under this technique, the manager personally observes the operations at the work place. The manager corrects the operation whenever he locates any wrong actions. As a result, employees work continuously to provide better performance. The physical presence of the manager and his involvement in work-situations has a definite influence over the performance of subordinates.

The manager can get relevant information on various aspects of work performance through face-to-face contact with subordinates. The manager can maintain work discipline among subordinates through direct supervision. On the other hand, subordinates can express their problems, difficulties, and suggestions regarding work environment. This helps a manager to understand various dynamics of the work being performed.

Personal observation is a time-consuming technique, and the manager may not have enough time to observe each and every employee. In some cases, it shows a negative effect. A self-controlled and disciplined employee may not like to be closely supervised. Moreover, the manager may be biased in evaluating the performance of his subordinates.

v. Statistical Reports:

Statistical reports are prepared in quantitative terms and used extensively for the controlling purpose in large organizations. Control is exercised by the management by measuring variations of actual performance from the standard performance. The preparation and use of statistical reports is very common to control a particular problem area.

Statistical reports can be prepared either by the functional managers within the organization or such reports can be prepared by any outside management consultant or practicing expert. In India, the National Productivity Council handles these assignments of special investigation and prepares special statistical reports. Statistical data relating to volume of production, costs, sales, expenses, etc., help the management in projecting the future. Such data are generally presented in the forms of tables, graphs, and charts. An analysis of past performance is made with the help of such data for control purposes.

Traditional Techniques of Controlling – Used by Managers

Traditional techniques are those which have long been used by the managers. Some of the important techniques under this heads are budgetary control, financial statement and ratio analysis, auditing, break-even analysis and report writing etc.

George R. Terry- “Budgetary control is a process of comparing the actual results with the corresponding budgeting data in order to approve accomplishments or to remedy differences by either adjusting the budget estimates or correcting the cause of the difference.”

The different budgets such as production budget, sales budget, overhead budget, labour budget etc. clearly indicate the limits for expenses and also the results to be achieved in a given period. It ensures effective co-ordination of the work of the entire organization. It promotes co-operation and team spirit among the employees.

ii. Standard Costing:

It is one of the techniques of cost control and it is being increasingly used by modern business concerns for the purpose of cost reduction and cost control. It involves a comparison of actual with the standards and the discrepancy is called variance.

iii. Break-Even Analysis:

It is useful in planning and control because it emphasize the marginal cost and benefit concept. It helps to make profit estimation at the different levels of activity, ascertaining turnover for desire profit and estimating the impact of the variations of fixed and variable costs. It magnifies a set of relationships of fixed costs, variable cost, price, level of output and sales mix to the profitability of the organization.

iv. Financial Statement Analysis:

Such as found flow analysis, cash flow analysis and ratio analysis help to know the financial performance and financial position of the business unit. The liquidity, profitability and solvency position of the business unit can be ascertained and efforts can be taken to maintain these factors in an optimum proportion.

v. Auditing:

It is the process of investigating financial and other operation of a business establishment. It may be carried out by internal and external members. It helps to scrutinize the applicability and relevance of policy, procedure and method which have a tendency to become obsolete. This helps in choosing a suitable working procedures and methods.

vi. Adoption of Reporting System:

Helps to analyze a particular problem and to take necessary corrective action over it. Reports may be prepared regarding taxation, legislation and its effect on profit, make or buy decisions, replacement of capital equipment, social pricing analysis etc. A manager can also exercise effective control over his subordinates by observing them while they are engaging in work. Personal observation helps the managers not only in knowing the workers attitude towards work but also in correcting their work and method, if necessary.

Traditional Techniques of Controlling – Top 8 Traditional Techniques of Controlling: Budgetary, Cost, Production, Inventory, Profit and Loss Control and a Few Others

I. Budgeting or Budgetary Control;

II. Cost Control;

III. Production Control;

IV. Inventory Control;

V. Break-Even Point Analysis;

VI. Profit and Loss Control;

VII. Statistical Data Analysis; and

VIII. Audit.

I. Budgeting or Budgetary Control:

A budget is a financial plan for a defined period of time. It is based on estimates of expenditure during the period and the proposed means to raise finance for the same. In this sense, it is a plan for coordination of organization resources and expenditure.

A budget is prepared for a certain future period. It states everything in precise, numerical terms. It is a statement of policies and plans to be pursued during a certain period to attain certain specified goals and objectives.

Giving Concrete Shape to Budget Proposals:

In a sales budget, for instance, the targeted annual sales of Rs. ten crore will be broken down into sales per month, per product, etc. The purchase budget would give quantities of material to be purchased and the sources from where these are to be financed. The labour budget would lay down the number of skilled and unskilled labour to be employed and the labour costs to be incurred. The manufacturing or production budget would indicate what quantities of different products are to be produced every month, quarter or year.

There will also be administrative and financial budgets. The administrative budget will deal with administrative costs as also the responsibilities to be discharged in budget period. The financial budget will deal with receipts and payments anticipated during the budget period on various accounts. Thus, a budget may be prepared in respect of each of the activities that will be undertaken to accomplish the sales target.

How Budget Control is Exercised:

Budgetary control is exercised with a predetermined objective in view, i.e., accomplishment of goals and objectives of the organization. It calls for sticking to a course of action that would enable realization of the budgeted targets. However, things do not always happen the way they are estimated in a budget.

Thus, whenever there are negative deviations from the budgeted targets, the manager should identify the causes thereof and then promptly decide and implement the corrective action to plug those deviations.

II. Cost Control:

Cost control means exercise of effective control over all expenditure—direct or indirect—of an organization to achieve cost effectiveness.

An organization incurs costs on various activities—production, administration and distribution. Some costs are incurred on regular basis—wages and salaries—others, now and then—overtime wages, excess expenditure on promotion of new products—and still others that, though real, are only deemed to be incurred like depreciation, provision for bad debts, other contingencies.

Further, there are costs which are based on volume of production—direct material, direct labour, transport—and others that do not—interest on borrowings, maintenance of factory and office buildings, and rent.

Different Systems of Cost Determination:

There are different systems to determine costs of goods and services. There are also different methods for classification, recording and allocation of costs. But all systems follow the same basic principle, i.e., to supply information as regards deviation from budgeted or standard costs to enable taking timely corrective action. Fixed and variable costs are carefully distinguished. Fixed costs do not vary with small fluctuation in activity, whereas variable costs vary directly in proportion to volume of activity.

To achieve this object, a carefully-designed elaborate system is used to keep record on daily, weekly or monthly basis. For example, there is daily, at times even hourly record of work performance and wage payments. Record of salaries is maintained on monthly basis.

Allocation of Costs to Relevant Activities:

Cost is allocated to each activity in respect of which it has been incurred. If it is cost referable to many activities—rent of factory building, salary of factory manager—it will be allocated to all activities which have benefited from the expenditure. Thus, if a foreman devotes three hours daily to supervising the work in Department A. and five hours on a similar job in Department B, the wages paid to he will be allocated to the two departments in proportion to the time devoted by him to each department.

The manager of each department and each activity is kept informed at regular intervals of the detailed costs incurred in respect of his area of responsibility and he can check these against the budgeted or standard cost.

In a mass production unit, control over direct costs is exercised through standard costing technique that compares actual costs with predetermined standard costs to highlight deviations. For control of indirect costs or overheads, budgetary control is used as the cost-control measure.

(1) Identification of Inefficient Operations:

Cost control measures facilitate identification of activities that are inefficient and hence unprofitable. Unprofitable activities may be improved or given up altogether and the time and resources can be diverted to profitable activities.

(2) Facilitates Cost Estimates and Submission of Tenders:

Cost control measures help in determining the estimates of costs, particularly when it comes to submitting tenders in response to advertisement by public or private undertakings.

(3) Zeroing in on Causes of Loss of Profits:

Cost control measures help to identify the causes of loss, such as, idle time, unusual spoilage or scrap, and under-utilization of plant and machinery. Diagnosis of a problem is half-solving it, the organization can initiate quick corrective action to put the operations back on track.

(4) Basis for Formulation of Production Policies:

Cost control provides a basis for formulating future production policies. It highlights the costs incurred and profits made from different processes and products. This serves as a valuable input in drawing future production policies and plans.

(5) Instrument of Perpetual Stock Control:

Cost control helps maintain optimum stock levels such that there is no shortage of finished goods to meet either dealer demand or piling up of finished goods in case of low demand.

(6) Source of Valuable Inputs in Vital Decision-Making:

Cost control measures enable the organization to take vital decisions such as – (a) Whether to make a product or to buy it readymade; (b) Whether to supply any order at price below cost; and (c) Whether to keep production of goods machine-based or labour-based.

(1) Cost Accounting System Quite Cumbersome:

It requires lots of information and data to maintain accurate records of costs involved in production of goods and services. Managers unfamiliar with interpreting the cost accounts may miss the woods for trees and fix the selling price too high or too low, in each case damaging business interests.

(2) Wrongful Allocation of Overheads:

There may be mistakes in allocation of overheads, intentional or otherwise. Overheads may be charged to a department even though it has derived no benefit from it. For example, overheads incurred by the central office may be allocated to branches, even though these may not be related to working of the branches.

(3) Cost Control Regressive, not Pragmatic:

A costing system, however well designed, can only provide information as to what has gone wrong. It gives little information about how to cut costs on unprofitable operations. Often reports are received so long after the deviation has occurred that remedial action becomes impossible to initiate.

III. Production Control:

Production Control involves systematic prediction and scheduling of production operations keeping in view the available human, material and technological resources of an organization to achieve production of the desired quality and quantity of goods and services on time.

Definitions of ‘Production Control’:

Production control means an act of monitoring and controlling any particular product or operation.

Production control is the process of planning production in advance of operations, establishing the exact route of each individual item, part or assembly; fixing starting and finishing dates for each important item and the finished product; and releasing the necessary order as well as initiating the required follow-up to effectuate the smooth functioning of the organization.

Production control means systematic planning, co-ordinating and directing of all manufacturing activities and influences to ensure availability of goods on time, of top quality and at reasonable cost.

Activities under Production Control:

Routing means the sequence of operations to be performed and the path which any manufacturing order is to follow. It will also include analysis of the materials required and to be procured for the purpose.

Scheduling means determining the time when activities relating to a project or manufacturing order would commence and the time when relevant individual operations will be performed.

Dispatching means directing the departments and workers concerned to begin work on particular projects and manufacturing orders, and authorizing issue of materials and tools for the purpose.

Follow-up means keeping track of the material requisitions and production schedule relating to a particular project or manufacturing activity.

(5) Techniques Employed to Implement ‘Production Control’:

Scheduling charts and Programme Evaluation and Review (PERT) are extensively used to implement production control. Computers are also used to process the orders from customers, ascertain the availability of ordered goods, maintain inventory records, and prepare production reports.

IV. Inventory Control:

Inventory control is also called stock control or materials management. It means controlling the kind, quantity, location, timing and movement of various commodities used in manufacture of goods.

Inventory Acts as Buffer and Reservoir:

Inventory acts as shock-absorber in times of variations in demand and supply of materials. It constitutes a reservoir whose level goes up with the arrival of new supplies of materials and reduces when materials are withdrawn for carrying out production activity.

In many manufacturing organizations, inventory of materials and semi-finished goods constitutes a high proportion of current assets and working capital. This necessitates effective inventory control to see that it does not exceed the optimum level.

Excess inventory represents thoughtless investment of financial resources of the business. It entails interest-costs on funds invested in inventory, besides other avoidable costs such as blocking of business space, insurance, spoilage and obsolescence. Fall in market price of inventory will denote loss caused by mindless investment in inventory. The golden rule to follow will be to keep inventory levels to the minimum possible.

Techniques to Implement Inventory Control:

(1) Proper Recording of Inventory Movements:

An important technique to exercise inventory control is to record all inventory movements in and out of stores. In other words, there should be systematic record of receipts from suppliers of materials and issue of materials to production centres. Besides, there should be proper record of defective materials returned to suppliers and those returned by production centres for the same reason.

(2) Establishing Requisite Inventory Levels:

An important means to implement inventory control is to lay down inventory levels relevant to different situations.

These may be as follows:

(a) Safety inventory level, i.e., quantity of materials or semi-finished goods which should always be kept in stock to provide for variations in usage, or insure against time-gap between placing of orders for materials and receipt of ordered materials, whether from external or internal sources;

(b) Maximum inventory level, i.e., the quantity level at which inventory of material and items should be pegged;

(c) Reordering level, i.e., the quantity of material upon reaching which further supplies should be ordered; and

(d) Danger level, i.e., the quantity of material at which orders for materials need to be urgently placed to restore the quantity to the established level to avoid interruption of production activity.

(3) Determining ‘lnventory Turnover Rate’:

Inventory turnover rate compares the inventory cost with the cost of sales (or sales itself) for a given period. Thus, if at the end of a year an organization has inventory costing lakh, and the cost of goods sold during the year is Rs. 100 lakh, then the inventory turnover rate is ten times.

In other words, during the year the organization sold ten times as much inventory as the inventory held at any time during the year. The higher the inventory turnover rate, the greater will be the efficiency rating of the enterprise.

V. Break Even Point:

Break even Point means the point when sales revenue is equal to the total costs (fixed costs as well as variable costs of the product units produced). In other words, at break even point, the organization neither earns profit nor incurs loss. Any sale of product units beyond this point will result in contribution margin to meet fixed costs.

Break even point analysis is an important control device. It shows the relationship between different volumes, costs, sale price, sales volume, and profits.

Before taking up break even point analysis, a brief reference to the terms relevant to calculation of break even point will be in order.

Fixed Overheads that Remain Constant Over a given Period:

Fixed overheads are the expenses which are independent of the volume of sales. They remain unchanged and do not fluctuate with the level of activity, unless additional production facilities are provided for increased activity. They relate to rent and interest on loans to acquire fixed assets like land and buildings, plant and machinery, depreciation and obsolescence, and salaries and wages paid to managers and workers not directly related to production activities.

However, while fixed overheads do not change with the fluctuation in activity, they do change on a unit basis. In other words, fixed overheads per unit will increase as the level of activity decreases, and they will decrease if there is increase in the level of activity.

For example, if the fixed overheads over a specified period amount to Rs. 50,000 and the number of units produced during that period is 1,000, the fixed overhead per unit will be Rs. 50. On the other hand, if the number of units produced during the year falls to 800, the fixed overhead per unit will increase to Rs. 62.50.

Variable Costs that Vary with Volume of Production:

Variable costs are the costs that are directly related to the volume of production, such as, direct material, direct labour and other variable expenses, like fuel used in production, carriage inward, and so on. Variable costs increase or decrease in direct proportion to the increase or decrease in production.

Contribution Margin Means Difference between Sales and Fixed Overheads:

Contribution margin means the excess of sales revenue over the variable costs of sales, also called the marginal cost, i.e., the cost of an additional unit, as indicated below –

Contribution margin = Fixed costs divided by Sales revenue – Variable costs or Marginal cost per additional unit produced

In marginal costing, fixed costs are not allocated to the product but charged against the operating period in which they are incurred. After deducting fixed costs from the contribution any surplus will be a net profit and a deficiency, a net loss. Thus-

Net profit/loss = Contribution margin – Fixed overheads.

Calculation of Break Even Point:

Break even point is reached when the contribution margin is equal to total cost, i.e., fixed overheads and variable costs of sales. It may be computed on the basis of units produced and sold, as follows –

Break even point in Units- Fixed overheads divided by Sale price per unit less Variable cost per unit

Break even point- Fixed overheads divided by Contribution per unit

Thus, if the selling price per unit is Rs. 300, and the variable costs per unit are Rs. 200, the contribution margin per unit will be Rs. 100. Now, if the fixed overheads during the year amount to Rs. 1,50,000, the business will reach break even point if it produces 1,500 units. If it produces less than 1,500 units, it will suffer loss; it will make profit only if it produces more than 1,500 units.

Let us illustrate this:

(a) Level of activity (Units produced and sold)- 1,200 units

Contribution margin (Rs. 1, 20,000) = Sales revenue (Rs. 3,60,000) less Variable costs of units, (Rs. 2, 40,000)

Net loss (-) Rs. 30,000 = Contribution margin (Rs. 1,20,000) less Fixed overheads (Rs. 1,50,000)

(b) Level of activity (Units produced and sold)- 1,500 units

Contribution margin (Rs. 1,50,000) = Sales revenue, Rs. 4,50,000 – Variable costs of units (Rs. 4,00,000)

Net profit/loss (Nil) = Contribution margin (Rs. 1,50,000) less Fixed cost (Rs. 1,50,000)

(c) Level of activity (Units produced and sold): 2,000 units

Contribution margin (Rs. 2, 00,000) = Sales revenue (Rs. 6, 00,000) less Variable costs of units (4,00,000)

Net profit (Rs. 50,000) = Contribution margin (Rs. 2,00,000) less Fixed overheads (Rs. 1,50,000)

Calculation of Break Even when There is a Limiting Factor:

A business can maximise profit only if it maximises manufacture of product units. However, sometimes manufacture of a product may become subject to a limiting factor. For example, if there is shortage of skilled labour, or lack of advanced technology, there will be restriction on number of units produced.

In such case, profit can be maximised by generating the highest contribution per unit of limiting factor, which is calculated as follows:

Contribution per unit of limiting factor minus Contribution margin as divided by Limiting factor

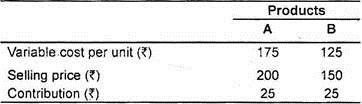

For example, if the manufacture of product A requires 6 hours per unit and manufacture of product B, 8 hours per unit, then contribution per unit of limiting factor can be calculated as follows:

On the face of it, both products seem to be equally profitable as the contribution margin in each case is the same, Rs. 25, but there will be a different conclusion if the limiting factor is taken into account.

Accordingly, product ‘A’ should rank higher than product ‘B’ in terms of the production programme because it takes fewer hours to manufacture it and the business will earn higher contribution margin from it to set off fixed overheads.

Break-Even Point = Fixed Overheads Divided by Contribution Margin as further Divided by Sales Ratio:

Dividing the fixed overheads by contribution margin to sales ratio will enable calculation of the relative profitability of different products. The way to do this is: Fixed overheads divided by Contribution margin per product as further divided by Sales revenue.

Evaluation of Break-Even Point Analysis:

Indicator of Efficiency and Effectiveness:

Ordinarily, under an effective control system, break-even point would not differ from the planned level. An adverse shift of the break-even point, if any, may be due to a variety of reasons, such as, law of diminishing returns, low contribution margin due to scaling down of prices in the face of competition, growth of the organization, inefficient management, etc. However, the fact remains that a shift in break-even point is a warning signal and must trigger necessary corrective action.

Not Always an Effective Indicator:

However, break-even point analysis cannot always be a reliable standard of performance. This is because it is based on certain assumptions which may not always turn out to be correct. First, it assumes that fixed and variable components of the total cost are easy to differentiate which is not always possible. Secondly, it assumes that there will be no change in the fixed overheads regardless of the change in volume of production and sales.

VI. Profit and Loss Control:

Aims to Compare Performance of Different Internal Units as also Competitors:

Profit and Loss Control refers to a control system under which sales, expenses, and profit or loss of each branch or “product division” is compared with those of other branches and product-divisions, as well as with historical records, to measure deviations and take necessary corrective action.

Assignment of Responsibility to Conform to Sales and Expenses Targets:

Under this system of control, the person heading a branch or product-division is tasked to conform to the sales and expenses targets. The person heading the branch or division, also called responsibility centre, is held accountable for its performance on this front.

Suitable for Retail and Multi-Product Business Houses:

Profit and Loss Control is a common method of exercising control in retail businesses, multi-product or multi-service organizations and organizations established at different places inside or outside the country.

VII. Statistical Analysis:

Comparison of Different Ratios:

Statistical analysis, another instrument of control, involves comparing ratios, percentages, and averages of different figures—sales, inventory and overheads—of different periods to measure variations, identify their causes and initiate necessary corrective action.

Ideal to Exercise Inventory, Production and Quality Control:

Analysis of statistical data to measure deviations and action for their correction will be especially helpful in inventory control, production control and quality control in respect of which it is possible to prescribe maximum and minimum limits of deviations. It will be easy to implement corrective measures if the deviations exceed the prescribed limits.

VIII. External and Internal Audit:

Aimed to Protect Investor Interests:

External audit is compulsory for all joint stock companies, cooperatives and trusts. The reason why government has made it compulsory is to protect interests of shareholders, members of cooperatives and beneficiaries of trusts.

Auditor Expresses Opinion on Truth and Fairness of the Results of Operations and Financial Condition of Audited Entity:

External audit is carried out by an independent chartered accountant who is under legal obligation to express his opinion on the truth and fairness of the results of operations and financial condition of the audited entity. He examines the accounts and other information as regards transactions of the entity to ascertain that these are maintained as required by relevant law and that there are no malpractices or manipulations by management.

Audit Report of External Auditor:

After examination of the accounts, books of account and other relevant information, and after obtaining necessary explanations from the officers of the audited entity, the external auditor presents his report to his appointers stating that (a) Profit and Loss Account or Income and Expenditure Account of the audited entity gives a true and fair picture of the results of its operations; and (b) Balance Sheet or Statement of Affairs of the audited entity gives a true and fair picture of the financial condition of the entity.

Internal Audit an Instrument of Control by Management of the Entity Itself:

Management of a joint stock company, cooperative or trust may also appoint an employee to carry out internal audit that includes review of accounting, financial and other operations of the entity to help the management. Internal audit aims to discover errors and fraud but it may also undertake analysis of the overall administrative system of the entity.

Internal Audit not Legally Compulsory Except for Specified Companies:

Internal audit is not legally compulsory but Companies (Auditor’s Report) Order (CARO) of 2015 has made it so in case of specified companies. An internal auditor performs his audit within the framework prescribed by the management and submits his report to it.