Everything you need to know about the techniques and methods of inventory management. Inventory management and control refers to a system, which ensures the supply of required quantity and quality of inventory at the required time.

At the same time, it prevents unnecessary investment in inventories. The aim of inventory management is, therefore, to neither hold too much nor too little inventory, and also to obtain a correct balance between these two extremes.

Good inventory management is essential to the successful operation for most organizations because the amount of money invested in inventory represents, and the impact that inventories have on daily operations of an organization.

The cost of carrying inventory is used to help companies determine how much profit can be made on current inventory.

The techniques and methods of inventory management may be grouped under:- 1. Quantity Based Techniques 2. Classification Based Techniques 3. Record Based Techniques.

Some of the techniques and methods of inventory management are:-

1. Re-order Point 2. Economic Order Quantity (EOQ) 3. ABC Analysis 4. Inventory Turnover Ratios 5. Aging Schedule of Inventory 6. Determining Stock Levels 7. VED Analysis 8. HML Analysis 9. Inventory Reports 10. Inventory Valuation 11. FSD Analysis 12. Just-In-Time Systems Approach 13. FSN Analysis.

Tools and Techniques of Inventory Management for Business, Organizations and Firms

Techniques of Inventory Management – Re-Order Point, EOW, ABC Analysis, Inventory Turnover Ratios and Aging Schedule

On the basis of objectives of inventory management mentioned earlier, the major problems faced by inventory management are to determine:

(a) Level of inventory at which new purchase order should be placed,

(b) Quantity of material which should be purchased by each purchase order, and

(c) Type of control required for each type of inventory.

Various techniques of inventory management are adopted to find the answers of these problems.

The main techniques are:

(1) Re-order Point

(2) Economic Order Quantity (EOQ)

(3) ABC Analysis

(4) Inventory Turnover Ratios

(5) Aging Schedule of Inventory

Technique # 1. Re-Order Point:

The re-order point is that inventory level at which an order should be placed for replenishing the current stock of inventory. Both the excessive and inadequate level of inventory are not favourable for business. Therefore, re-order level should not be set up very high or very low.

Re-order point is calculated by the following formula:

Re-order Level/Point = Lead Time × Average Usage

Lead time is the time period between the date of placing order and the date of receiving delivery. Lead time may also be called procurement time of inventory.

Average usage means the quantity of inventory consumed daily. Therefore, re-order point can be defined as the inventory level which should be maintained for consumption during the lead time.

For example, Lead time in a business is 15 days and average daily usage of inventory is 2,000 units.

Re-order point of the business will be:

Re-order Point = 15 days × 2,000 units = 30,000 units.

It means that an order for replenishing stock of inventory should be placed as soon as the level is reduced to 30,000 units so that new goods enter the stock before the existing stock is consumed and the manufacturing process continues.

Safety Stock:

In determining re-order point, we have assumed that lead time and average usage rate have been correctly estimated. But in actual practice, both of these factors are difficult to predict accurately. Receipt of inventory may be delayed beyond the estimated lead time due to strikes, floods, transportation problems etc. Similarly, actual usage of inventory may be higher than the estimated average usage rate. Due to these reasons, the firm can face the problem of stock-out which can prove to be costly for the firm. To guard against stock-out, the firm may maintain safety stock.

In such situation, the re-order point will be:

Re-order Point = (Lead Time × Average Usage) + Safety Stock

Safety stock is determined on the basis of comparison between carrying cost of maintaining additional stock and stock-out costs. Carrying Cost include storage costs, handling costs, insurance expenses etc. Stock-out costs are losses due to being out of stock. These losses are due to factors like decrease in sales, strained relations with the customers etc. Stock-out costs are also called opportunity costs.

High level of safety stock reduces the risk of being out-of-stock but increases the carrying costs. On the other hand, low level of safety stock though decreases the carrying costs but risk of being out-of-stock increases. Therefore, level of safety stock should be determined after a trade-off between these costs.

Technique # 2. Economic Order Quantity (EOQ):

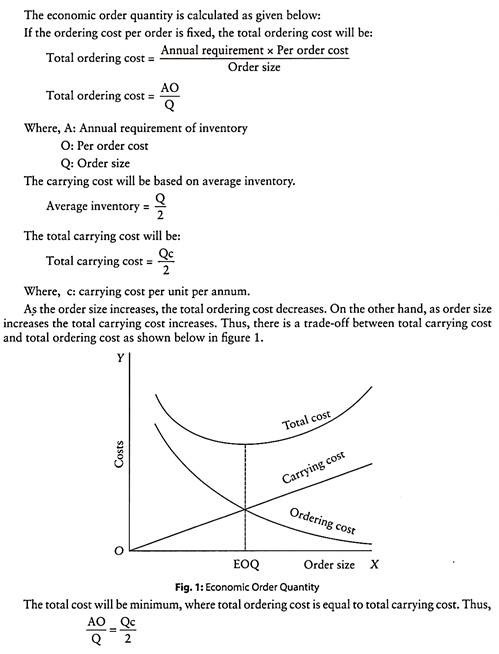

Economic order quantity is that quantity of material for which each order should be placed. Whenever the inventory level comes down to the re-order point, a fresh order is placed for procuring additional inventory equal to the economic order quantity. A key issue in the inventory management is to determine the economic order quantity.

Purchasing large quantities at one time and keeping the same as stock, increases carrying costs of inventories but reduces ordering costs of inventories. On the other hand, small orders reduce the average inventory level thereby reducing the carrying costs of inventories but increasing the ordering costs because of increased number of purchase orders.

Therefore, determination of economic order quantity is a trade-off between two types of inventory costs:

(i) Ordering Costs

(ii) Carrying Costs

(i) Ordering Costs:

Ordering costs include costs of placing orders and costs of receiving delivery of goods such as clerical expenses in preparing a purchase order, transportation expenses, receiving expenses, inspection expenses and recording expenses of the goods received. These expenses are generally fixed per order placed, irrespective of the quantity of the order. Total ordering costs are calculated by multiplying the ordering costs per order by number of orders placed during the year. If the number of orders placed is large, the higher will be the ordering costs.

But if the firm purchases in large quantities by each order, the number of orders will decrease and therefore, the total ordering costs will be smaller. In order to calculate the number of orders, the total purchase requirement during the year is divided by the quantity per order.

(ii) Carrying Costs:

Carrying costs include costs of maintaining or carrying inventory, such as godown rent, maintenance of building, insurance expenses of inventory against fire and theft, loss due to pilferage and obsolescence of inventory, clerical and accounting costs for handling the inventory, opportunity cost of funds locked up in inventory etc. These costs vary with inventory size. Larger the quantity of goods purchased each order; the higher are carrying costs because average level of inventory also increases and vice versa.

The behaviour of carrying costs is contrary to that of ordering costs. In case of purchases in large quantities, carrying costs increase but ordering costs decrease. On the other hand, if goods are purchased in small quantities, carrying costs decrease but ordering costs increase due to increased number of orders.

The sum of ordering costs and carrying costs represents the total costs of inventory. Economic Order Quantity is that order quantity at which the total of ordering and carrying cost is minimum.

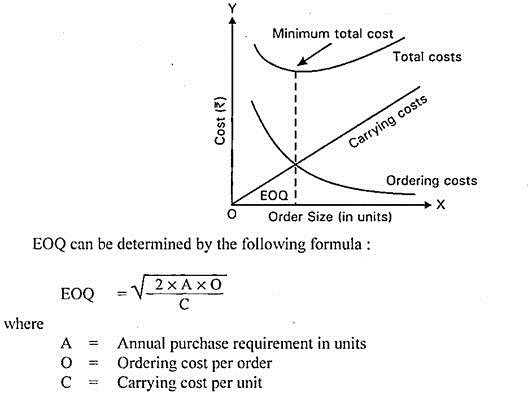

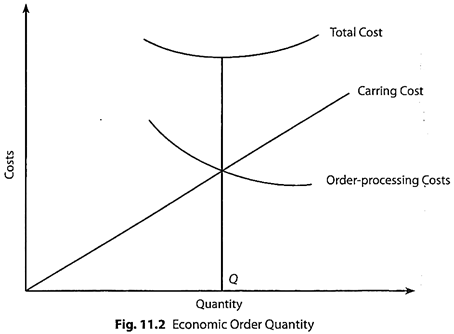

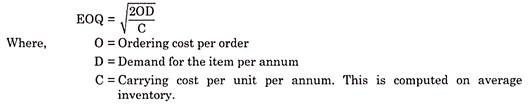

EOQ can be explained with the help of following diagram:

Technique # 3. ABC Analysis:

ABC analysis is a technique of controlling different items of inventory. Usually a firm has to maintain several different items as inventory. All these items are not equally important. Therefore, it is not desirable to keep same degree of control on all these items. The firm should give more attention to those items whose value is higher in comparison to others.

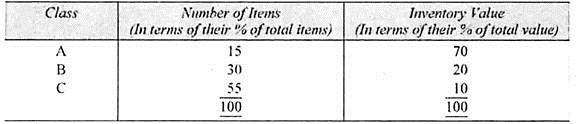

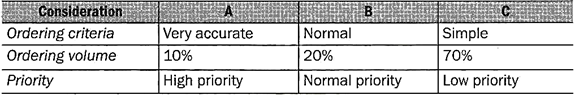

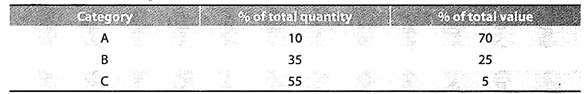

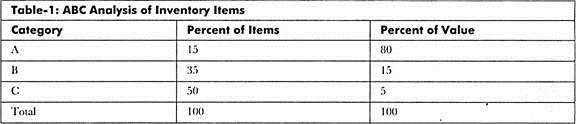

Under ABC analysis all the items of inventory are classified into three categories – A, B and C on the basis of cost involved. In category ‘A’ those items are included which are small in number, say, 15 percent of the total items but they are quite valuable, the value being 70 percent of the total value of inventory.

On the other hand, items which are quite large in number, say, 55 percent of the total items but carrying little value, say, 10 percent of the total value of inventory are classified under category ‘C’ Category ‘B’ stands midway and consists of items which are 30 percent in number and 20 percent of the total value.

Thereby, all the items can be classified as follows:

Control on items included in category ‘A’ should be most rigorous and intensive because by special attention on 15 percent of the items, 70 percent of the investment in inventory can be controlled. The category B deserves less attention than A but more attention than C. Items falling in category ‘C’ should be paid minimum attention. However, it is necessary to have some control on category ‘C’ items also because some items though very inexpensive may be very critical to whole manufacturing process and non-availability of those items on time may halt the production.

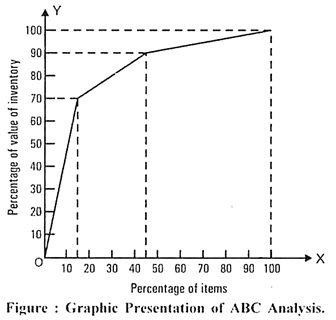

ABC analysis can also be presented in the form of a diagram as follows:

Technique # 4. Inventory Turnover Ratios:

Certain items of inventory are slow moving. It means that their consumption is quite slow and capital remains locked up in such items for a long period. As a result, carrying costs continue to incur on such items. Therefore, inventory management should identify such items and try to reduce investment in inventory of such items. Slow moving items can be identified with the help of inventory turnover ratios.

A very low turnover ratio of an item of raw-material will indicate that the consumption of that item is quite slow. Similarly, a very low turnover ratio of an item of finished goods shows that the sale of the item is quite slow and it stays in the warehouse for a long time. On the basis of this information, the management can take necessary steps to reduce the inventory of such items.

Technique # 5. Aging Schedule of Inventory:

Another technique of ascertaining the slow moving items is to prepare an Aging Schedule of Inventory. Under this technique, all the items of inventory are classified into several age groups as on a particular date on the basis of dates of their purchase or manufacture.

Techniques or Methods of Inventory Management – Quality Based Techniques, Classification Based Techniques and Record Based Techniques

Good inventory management is essential to the successful operation for most organizations because the amount of money invested in inventory represents, and the impact that inventories have on daily operations of an organization. The cost of carrying inventory is used to help companies determine how much profit can be made on current inventory.

The following inventory management techniques can help an organization in optimizing the cost of inventory and its effective management:

A. Quantity Based Techniques:

Inventory management is a risk process as businesses needs to avoid lost sales due to out of stock merchandise, and reduce the expense of overstocking the wrong product or over-ordering the wrong inventory.

Quantity based inventory management techniques focuses on determining correct amount of inventory required for business operation with an objective to reduce inventory levels and control inventory operations.

Determining Stock Levels:

Holding a high amount of inventory for a long duration is not idea for a business because of inventory consumes storage space and further it is subject to risk obsolescence and spoilage. On the other hand, holding low amount of inventory can also be disastrous, because the business runs the risk of losing out on potential sales and potential market share as well.

Therefore an effective way of overcoming this problem is maintain balanced stock levels which are described as follows:

i) Minimum Level:

Signifies minimum level of stock to be maintained regularly, In case stock goes below this level there is danger of stopping the work due to shortage of material. Therefore, the management should give top priority to the acquisition of new stock.

ii) Re-Order Level:

Signifies the level fixed between minimum level and maximum level. Once the stock reaches reorder inventory level the company would place a new order or start a new manufacturing run.

iii) Maximum Level:

Signifies the maximum stock level the business concern must maintain, the inventory and the quantity must not be exceeded this level without specific purpose. In other words the maximum stock level is quantity above which the stock of any item should not normally exceed.

iv) Danger Level:

Signifies the level below the minimum level, when this level of stock is reached the products halts and therefore immediate measures should be taken by the to acquire the stock.

B. Classification Based Techniques:

The lack of inventory classification and proper handling can lead to incongruities between physical and record inventories. Therefore this techniques emphasis on classifying the inventory based on its merit and requirement in business operations. Once an inventory item is part of a classification, each classification group has its own inventory control methods.

(i) ABC Analysis:

ABC analysis is a technique of categorizing items and determining how much attention each item should receive. In ABC analysis, managers divide items into three. ‘A’ category items constitute 10% of inventory and account for 70% of inventory cost. The B items are similar to the A items except that there is less frequency i.e., about 20% of the inventory item contributes about 20% of value of consumption.

The goal for C items is to have more stock in large quantities i.e., 70% of inventory item contributes only 10% of value of consumption and therefore it should be readily available for production.

(ii) VED Analysis:

VED Analysis means Vital, Essential and Desirable analysis. The VED analysis is done to determine the criticality of an item and its effect on production and other services. If a part is vital it is given V classification, if it is essential, then it is given E classification and if it is not so essential, the part is given D classification. For V items, a large stock of inventory is generally maintained, while for D items, minimum stock is enough.

(iii) HML Analysis:

In HML analysis inventories are classified into three categories on the basis of the value of the inventories.

This classification is as follows:

High Cost (H) = Item whose unit value is very high

Medium Cost (M) = Item whose unit value is of medium value

Low Cost (L) = Item whose unit value is low.

C. Record Based Techniques:

Record based techniques organizes ” inventory records ” is a detailed listing, a complete inventory records provides a complete picture of the inventory set up and this picture is very helpful for assessing the needs of business.

(i) Inventory Reports:

One of the most important elements in gaining control of inventory is to draft a reports that records information about inventory. Preparation of timely inventory reports provides information regarding quantity to be procured and allows deciding which stock to keep and which to be cleared fast.

(ii) Inventory Valuation:

Effective management of inventory plays a decisive role in deciding a firm’s ability to operate with good profit margins. In order to achieve this proper inventory valuation mechanism is required, an inventory valuation facilitates a company to determine a monetary value for items that make up their inventory.

There are three basis approaches to valuing inventory they are as follows:

(i) First in First out Method (FIFO) — sold in the order in which they are purchased or produced.

(ii) Last in First out Method (LIFO) — newer inventory is sold first and older remains in inventory.

(iii) Just-in-time (JIT) — ordering inventory only as they are needed in the production process.

Techniques of Inventory Management – EOQ Model, ABC Analysis, Inventory Turnover Ratios and VED Analysis

Effective management of inventory requires a sound system of inventory control. Inventory control is a system which ensures supply of required quantity and quality of inventory at the required time without unnecessary investment in inventory.

The main techniques of inventory management are given below:

Technique # 1. Economic Order Quantity (EOQ) Model:

An important decision in inventory management is how much quantity should be ordered and how many times in a year. The quantity ordered should be such that the cost of acquiring inventory or ordering cost and the cost of holding inventory or carrying cost are together minimised.

(i) Ordering Cost – It means the cost of placing an order. It decreases as the quantity purchased per order increases. Fewer the number of orders lesser the ordering cost.

(ii) Carrying Cost – It refers to the cost of keeping items in stock e.g. interest on capital investment, storekeeping expenses, insurance premium, etc. It increases with the size of order.

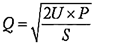

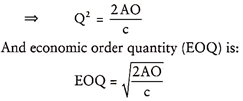

Economic order quantity can be determined with the help of the following formula:

Where,

Q – Economic order quantity

U – Quantity purchased in a year

P – Cost of placing an order

S – Annual cost of storage per unit

When to Order Inventory?

In order to decide when to order an inventory, one has to decide:

(i) Order Lead Time – Average time that elapses between placing an order and receiving the goods.

(ii) Usage Rate – The average rate at which the inventory is drawn down over a period.

(iii) Reorder Point – The level at which a new order must be placed so that the inventory is replenished before the stock reaches zero level (stock out).

A reorder point is estimated by using the formula:

Reorder Point = Usage Rate x Lead Time

Suppose a company uses 10 units of an item per day (usage rate), and the order lead time is 15 days, a new order must be placed when the inventory level reaches 150 units (reorder point 150 = usage rate 10 x lead time 15) so that the inventory is replenished before a stock out occurs.

Though maintaining large inventories involves carrying costs, the placing of an order also involves order-processing costs consisting of the cost of materials (stationery, stamps, etc.) and purchase establishment expenses. If the ordered quantity is large, an order has to be placed less often. But as the order size increases, the carrying costs also increases. Thus, the total order-processing costs increase when the size of individual orders is reduced, and carrying costs increase when the order quantity is increased. The situation is depicted in the Fig. 11.2.

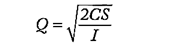

A balance between these two opposing costs – carrying costs and order-processing costs — can be achieved by computing the Economic Order Quantity (Q) with the help of the formula –

Where,

C = the annual usage (or demand) of the item, in units.

S = the cost to place one order.

I = annual carrying cost per unit.

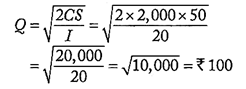

Suppose the annual usage of an item is 2,000 units, ordering costs are Rs. 50 an order, and the carrying costs are Rs. 20 per unit per year then the Economic Order Quantity is Rs. 10,000.

The formula for EOQ is however based on the assumptions that:

(i) Ordering costs is constant, i.e., it does not vary with the size of the order;

(ii) The cost of carrying an additional unit of inventory is constant;

(iii) There are no quantity discounts available; and

(iv) The usage or consumption is in a steady state and is known with certainty.

Technique # 2. ABC Analysis:

It is the technique of exercising selective control (control by exception) over inventory. It is based on the assumption that a firm should not exercise the same degree of control over all items of inventory. Rather it should exercise greater control over more costly items and lesser control over less costly items.

Accordingly, inventory items are classified into three categories as under:

(i) Category A – These are the costliest items of inventory

(ii) Category B – These are less costly items

(iii) Category C – These are the least costly items.

The pattern of three types may be as follows:

Utmost attention is paid to category A and its level is strictly controlled. Ordinary Store routine is adopted for category B while category C items may be ordered in bulk to minimise ordering and handling costs.

ABC technique saves time and effort in inventory control. But this technique does not take into consideration the significance of different items in the production process and the relative scarcity of different items.

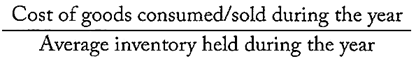

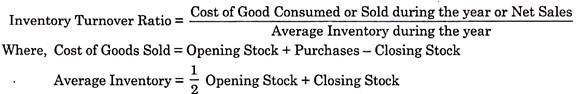

Technique # 3. Inventory Turnover Ratios:

Such ratio may be calculated for each item of inventory with the help of the following formula:

Comparison of such ratio with those of previous years will reveal the following items of inventory.

(i) Slow moving Items – These are items with a low turnover ratio. These items should be kept at the minimum possible level.

(ii) Dormant Items – These are items having no demand. Losses can be reduced by scrapping them.

(iii) Obsolete Items – These items have become out-dated. They should be immediately discarded.

(iv) Fast Moving Items – These items are very much in demand. Adequate inventory of such items should be maintained to ensure uninterrupted production and sales.

Technique # 4. VED Analysis:

This is also similar in principle, the only difference is that it finds out materials and components that are valuable, which are essential and which are desirable. This classification helps in sizable reduction of inventory.

Techniques of Inventory Management – ABC Analysis and EOQ Model

The objective of inventory management is to minimise the cost of inventory. Hence, appropriate techniques should be applied in managing the inventories in the firm.

Two important techniques of inventory management are explained below:

1. ABC Analysis

2. EOQ Model.

1. ABC Analysis:

This technique is used when inventory is controlled on the basis of values of items. In this technique, various items of inventory are categorised into three groups of priority.

Then, managerial efforts are made to control the inventory in proportion to the priority. The high value and low volume items are included in category A, items with intermediate value are included in category B and the remaining items are included in category C.

The categorisation of items has been explained below:

Category A:

Items having high value and low volume are placed in this category. These items constitute only a small percentage of total inventory or volume, but they have very high share in total value of inventory.

Category B:

The medium value items are included in this category. Their share in total value of inventory is almost equal to their share in total quantity of inventory.

Category C:

The low value and high volume items are included in this category. The share of these items in the total quantity of inventory is very high, but their share in total value of inventory is very small.

ABC analysis is very important technique in controlling the inventory in a firm. However, it should be used with thoughtfulness as the items are categorised on the basis of their value and not on their relative importance.

2. Economic Order Quantity (EOQ) Model:

The EOQ model is used in a firm to find the optimal size of inventory. The optimal size of inventory is the order size which is placed every time. If more than optimal size quantity of inventory is ordered the carrying cost will be high. If less than optimal size quantity of inventory is ordered, the ordering cost will be high.

The EOQ model of determining the optimal order quantity that minimises the total cost of inventory is based on the following assumptions:

1. The annual consumption of inventory of the firm is known and is constant.

2. The ordering cost per order is fixed and is constant over the year.

3. The carrying cost of inventory per unit per annum is constant.

4. The consumption of inventory is uniform through the year.

5. The carrying cost and ordering cost are the only costs incurred on inventory procurement.

6. The inventory is supplied instantly.

Reorder point:

The reorder point is that level of inventory at which an order is placed to replenish the inventory.

The following formulae is used in calculating the reorder point:

Reorder point = Lead time x average daily usage + Safety margin

The lead time is the time taken in delivery of inventory after placing the order.

Techniques of Inventory Management – Used by the Finance Manager

There should be an organized approach to inventory management to balance out the anticipated costs and benefits of holding inventories.

The finance manager may be required to answer the following questions to ensure competent management of inventories:

1. Are all the items of inventories equally important, or some of the items are to be given more attention?

2. What should be the size of each order or each replacement?

3. At what level should the order for replenishment be placed?

Various techniques practiced by the finance manager to manage the inventories are discussed as follows:

1. Stock Levels:

Carrying too much or too little inventories is unfavorable for the business. If the inventory is too little, the organization would face regular stock-outs involving high ordering cost. On the other hand, if the inventory level is too high, the situation of over inventory arises. Therefore, the well-organized inventory management requires that the organization should keep the optimum level of inventory where the inventory cost is the least.

The various stock levels maintained by an organization are discussed as follows:

i. Minimum Stock Level:

Represents the rate of inventory that must be maintained all the times. If the inventory is less than the minimum level, then the production of goods may hamper due to shortage of materials.

The formula to calculate minimum stock level is as follows:

Minimum Stock Level = Reordering level — (Normal consumption x Normal reorder period)

ii. Reordering Level:

Refers to the rate of inventory at which the organization places the reorder of raw material. In other words, when the amount of raw material reduces to a certain level, then new order is forwarded to get materials again. The order is forwarded before the amount of raw material depletes to a minimum stock level. Reordering level or ordering level is fixed between minimum level and maximum level of inventory.

The formula to calculate reordering level is as follows:

Reordering level = Maximum consumption x Maximum reorder point

iii. Maximum Stock Level:

Refers to the maximum amount of inventory that an organization should keep with itself. The organization should not go beyond the maximum stock level because it would unnecessarily increase the cost of holding inventory. In addition, over-stocking would block working capital that results in wastages of material.

The formula to calculate maximum stock level is as follows:

Maximum stock level = (Reordering level + Reordering quantity) – (Minimum consumption x Minimum reordering period)

iv. Danger Level:

Refers to the level beyond which inventory should not fall in any case. If the danger level arises, then the immediate steps should be taken to replenish the stocks, even if more cost incurs in arranging the materials.

Danger level is determined by the following formula:

Danger level = Average consumption x Maximum reordering point for emergency purchases

2. VED Analysis:

The VED analysis segregates inventories into three categories in the decreasing order of their criticality. In the VED analysis, V stands for vital items whose shortage may block the production process. Therefore, V items should be stored sufficiently to maintain smooth business operations. E denotes essential items that are regarded indispensable for efficient business operations.

Therefore, the organization must ensure the adequate availability of E items. D stands for desirable items that do not influence the production instantly but accessibility of such items would lead to more effectiveness. The VED analysis can be very valuable to capital-intensive industries. As it scrutinizes the items based on their criticality, it can be used for raw materials that are difficult to procure.

3. FSD Analysis:

The FSD analysis segregates the items into three categories in the decreasing order of their usage rate. In the FSD analysis, F stands for fast moving items and such items are exhausted with a short period of time. S signifies slow moving items whose usage rate is low; therefore, the existing stock of S items lasts for two years or more. D stands for dead stock whose usage rate is negligible because the organization does not foresee any additional demand of such products.

Stocks of fast moving items must be taken care of constantly and replenishment orders must be forwarded in time to prevent stock-outs. Slow moving stocks must be evaluated very cautiously before any replenishment orders are placed.

The amount of reorder of such items must be decided after taking into consideration the future demand. Dead stock of inventory signifies money spent that cannot be realized. Therefore, once such items are recognized, hard work must be made to find all substitutes used for it, or else, it must be disposed of.

4. Just in Time (JIT) Inventory Management:

JIT inventory management, as its name advocates, means all inventories, including raw materials, work in progress, and finished goods. In other words, raw materials are expected just in time to be used to manufacture finished products; and finished products are manufactured in time to be supplied to the consumers.

In this approach, the flow of goods is restricted by what is expressed as pull approach to produce the products. The pull approach ends at final assembly stage of the production process. After that, an indication is sent to concerned department to deliver the precise quantum of parts and materials required for further assembly of products. In this way, the smooth flow of parts and materials is maintained with no inventory build-up at any point.

The successful operation of JIT inventory system has the following requirements:

i. The organization must have limited suppliers.

ii. The suppliers must be bound under long-term agreements and prepared to make repeated deliveries in small lots.

iii. The organization must develop a system of total quality control.

iv. Poor quality of raw materials or parts cannot be accepted.

v. Workers must be multi-skilled in the JIT environment.

In JIT inventory control, the inventories are obtained and introduced in production process at the right time. This involves proficient purchasing, very dependable suppliers, and a well-organized inventory-handling system. One thing that has made possible JIT inventory control is the introduction of the Internet.

The Internet provides assistance in the supply chain management of standard inventory items. A number of exchanges have designed for Business-to-Business (B2B) transactions. If you need to procure a certain type of chemical for production process, you can indicate your precise need on the Internet chemical exchange. Various suppliers would then bid for the contract.

This auction technique considerably reduces the paperwork and other costs involved in searching the best price. A number of B2B exchanges already exist for a wide variety of products. However, the raw material in question must be relatively standardized for an Internet exchange to work well for you.

In the context of the EOQ model, the idea with JIT is to reduce setup costs. It assists in reducing certain traditional fixed costs; however, at times, it may reduce variable costs. For example, JIT inventory control is used in machine tool shops. Along with computer-aided manufacturing, the setup for a new production plant can be accomplished in a matter of minutes in less cost.

As a result, the spindle time of a lathe or milling machine increases significantly. When the order costs in the EOQ, formula are reduced, the EOQ, drops and less average inventory needs to be maintained.

5. A B C System:

The ABC system is a widely used classification technique to identify various items of inventory for the purposes of inventory control. This technique is based on the assumption that an organization should not exercise the same degree of control on all items of inventory. An organization should keep a more rigorous control on items that are costly while less-expensive items should be given less control effort.

On the basis of cost, various inventory items are categorized into three classes, such as, A, B, and C. The items included in group A require large amount of investment. Therefore, inventory control should be made stringent by adopting advanced techniques. The group C consists of large number of items of inventory, which involve comparatively small investments.

The items of group C require minimum level of control. The investment incurred in items of group B is moderate, thus, it deserves less attention than A but more attention than C.

The ABC analysis divides the total inventory into three classes using their percentage value. The class A constitutes 15%, class B includes 35%, and class C contains 50% of the total inventory. However, the actual break-up of inventory may vary from situation to situation.

The preceding categorization is represented in Table-1:

Class A is made up of items that are either very expensive or used in massive quantities. Thus, these items, though few in number, contribute a high proportion of the value of inventories (80%). Class B items are neither too few nor too many in number. These items are neither very expensive nor very cheap and constitute only 15% of the total value of inventory. Class C contains relatively large number of items used in very small quantities. Therefore, such items do not constitute more than a negligible fraction of the total value of inventories.

Class A items merit a tightly controlled inventory system with constant purchase and store management. Class B items merit a formalized inventory system and periodic purchase and store management. The organizations use relaxed inventory procedures for class C items.

6. Economic Order Quantity (EOQ) Model:

The Economic Order Quantity (EOQ) model provides answers to the two basic questions related to inventory management.

These questions are as follows:

i. What should be the size of the order?

ii. At what level should the order be placed?

When an organization orders huge inventory with an intention to reduce total ordering cost; the carrying cost increases. In view of such a relationship, if the organization wishes to minimize the overall cost of inventory, it needs to consider both the ordering cost and carrying cost. After determining the acceptable cost of inventory, the organization compares the cost with the benefits of the inventory. The optimal level of inventory is the one that minimizes the cost and maximizes the benefits of the inventory.

The optimal level of inventory is popularly referred as EOQ. Therefore, EOQ may be defined as the level of inventory order, which reduces the total cost related with inventory management.

The EOQ model is based on the following assumptions:

i. The forecasted consumption for the inventory, usually for one year, is known.

ii. The consumption is even throughout the year.

iii. The orders placed to replenish inventor)’ stocks are received at exactly that point of time when the level of inventory becomes zero.

iv. The costs associated with the inventory, such as ordering cost and carrying cost, can be distinguished.

v. The cost per order is constant regardless of the size of order.

vi. The carrying cost is a fixed percentage of the average value of inventory.

The total costs of ordering and carrying cost can be mathematically calculated by using the following formula:

T= [{(B / Q) x A} + {(Q / 2) x C}]

where,

B = Annual consumption

Q = Quantity ordered

A = Cost per Order

C = Percentage carrying cost x Price per unit

T = Total cost of ordering and carrying

The EOQ can be mathematically calculated by using the following formula:

EOQ= √2AB / C

Techniques of Inventory Management – With Graphs, Formula, Examples and Calculations

Inventory management and control refers to a system, which ensures the supply of required quantity and quality of inventory at the required time. At the same time, it prevents unnecessary investment in inventories. Designing a sound inventory management system is actually a balancing operation. It is the focal point of many seemingly conflicting interests and considerations, both short-range and long-range.

The aim of inventory management is, therefore, to neither hold too much nor too little inventory, and also to obtain a correct balance between these two extremes. The efficiency of inventory management affects the flexibility of the firm. Inefficient procedures may result in an unbalanced inventory, sometimes out of stock or overstocked, necessitating excessive investment. These inefficiencies ultimately have an adverse impact on profits.

Efforts should be made to place an order at the right time with the right source to acquire the right quantity and quality at the right price. In managing inventories, the firm’s objective should be in consonance with the wealth maximization principle.

In order to ensure that enough inventory or stock is held by an organization to meet both its internal and external demand commitments economically, the finance manager needs to decide –

(a) How much to buy at a time? This refers to the size of the order to be placed at a given point of time.

(b) When should the order be placed? This refers to the reorder point, that is, at what level of the current inventory, an order should be placed.

There are various techniques that help a finance manager in taking these decisions. All inventory models no matter how complex, address themselves to the problems of timing and magnitude of replenishment.

Some of these techniques are discussed below:

Technique # 1. The Economic Order Quantity (EOQ) Model:

How much inventory should be added to replenish existing inventory, is one of the major inventory management decisions. If the firm is buying raw materials, it has to decide the lots in which inventory is to be purchased or replenished. If the firm is planning a production run, the issue is to decide as to how much production to schedule.

These problems are called order quantity problems, and the task of the firm is to determine the optimum or economic order quantity, also called economic lot size. The economic order quantity is that size of purchase order, which tends to minimize the total of ordering and carrying, costs.

The economic order quantity (EOQ) model helps to determine the optimal order size that minimizes total inventory costs. It is an inventory-related equation that determines the optimum order quantity that a firm should use in its inventory management effort, given a set of production cost, demand rate and other variables.

The purpose is to minimize variable inventory costs. The important costs used in this model are the ordering cost, and the cost of carrying (or holding) a unit of inventory in stock. All other costs such as, for example, the purchase cost of the inventory itself, are constant and therefore not relevant to the model.

By using this model, the firms can minimize the costs associated with the ordering and the holding of inventory while ensuring its availability whenever needed.

The EOQ model is based on the following assumptions:

(a) The usage of a particular item for a given period (usually a year) is known with certainty and the usage rate of the product is even throughout the period.

(b) The moment inventories reach the zero level, the order for the replenishment of inventory is placed without delay. There is no time gap (lead time) between placing an order and getting its supply.

(c) The cost per order of an item is constant and the cost of carrying inventory is also fixed and is given as a percentage of the average value of inventory. This implies that no cash or settlement discounts are available, and the purchase price is constant for every item.

(d) There are only two costs associated with the inventory, and these are the cost of ordering and the cost of carrying the inventory.

Given the above assumptions, the EOQ model may be presented as follows:

Since it is assumed that the inventory falls to zero before it is replenished, the average inventory becomes EOQ/2. This formula was developed by Ford W. Harris in 1913 whereas R. H. Wilson is given credit for the application and in-depth analysis of this model.

The graphic presentation of the same is as follows:

In Fig. 18.1, the costs are on the Y-axis and the order quantity on the X-axis. The straight line which commences at the origin is the carrying or holding cost curve, the total cost of carrying units of inventory. As we order more on the X-axis, the carrying cost increases in a proportionate manner.

The downward sloping curve which commences high on the Y-axis and decreases as it approaches the X-axis and moves to the right is the ordering cost curve. This curve represents the total ordering cost depending on the size of the order quantity. Obviously the ordering cost tends to decrease as the order quantity is increased, thereby resulting in fewer orders, which need to be placed in any particular period of time.

The sum of carrying cost curve and the ordering cost curve is represented by the total cost curve and the minimum point of the total cost curve corresponds to the point where the carrying cost curve and the ordering cost curve intersect.

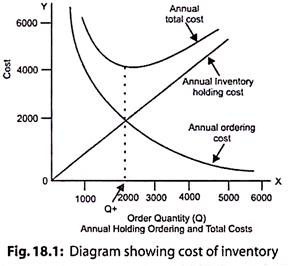

Example:

ABC Ltd. is engaged in sale of footballs. Its cost per order is Rs.50 and its carrying cost unit is Rs.3 per unit per annum. The firm has a demand for 10,800 units per year. Calculate the order size, total orders required during a year, total carrying cost and total ordering cost for the year. What shall be the total cost if the firm places order for (a) 400 units; (b) 1,200 units?

The total cost for the order size of 600 units (EOQ) is Rs.1,800. The total cost increases to Rs.2,250 if the order size is increased to 1,200 units; and if the order size is decreased to 400 units, which is below EOQ, then total cost is Rs.1,950. This is more than the total cost for the order size determined by the EOQ model. At the EOQ level, the increase in carrying costs is completely offset by the decrease in average ordering costs bringing the total cost to minimum.

Despite the equation’s relative simplicity, it is still a core algorithm in the software packages that are sold to the largest firms in the world. The EOQ formula may be modified to determine production levels or order interval lengths, and is used by large corporations around the world, especially those with large supply chains and high variable costs per unit of production.

While the EOQ model is useful for determining optimal order size, the assumptions on which it rests are not realistic, as they are not likely hold in actual practice.

Therefore, limitations of the EOQ model are as follows:

(a) The EOQ model assumes that demand for a product is spread equally over a period, but in practice there may be seasonal fluctuations in demand for a product. Therefore, application of the EOQ model may result in order quantities that are insufficient to guarantee supply at times of peak demand.

(b) The model assumes that there is no lead time between placing an order and getting its supply. However, in reality, instantaneous replenishment is not possible.

(c) It assumes purchase price and ordering costs of inventory units to be constant throughout the year. However, these costs may vary on account of inflation or due to the change in quantity of the order. It does not take into account quantity discounts.

(d) The EOQ model also assumes that holding costs per unit are constant, that is, they vary in line with quantities held. However, this may not be realistic. Holding costs may include some elements, the costs of which are stepped up with the increase in quantity; for example, if inventory reaches a level where another member of staff is required to control it, there is a stepped increase in costs.

(e) The effectiveness of the basic EOQ model is limited by the assumption of a one-product business, and the formula does not allow combining different products in the same order.

Although all the assumptions do not hold exactly, this is a commonly used model for inventory management by most of the firms. There are several variations of the EOQ model, depending on the assumptions made about the inventory system.

Even when some of the assumptions are violated, EOQ model may still be used as a starting point for analyzing an optimum level. For instance, when the purchasers following EOQ model have the opportunity to avail a quantity discount on order sizes greater than their EOQ, they need to base their decision on the net effect of the decision on their income.

A typical quantity discount has the following three effects on the income of a purchaser:

(a) A saving in the form of reduced price.

(b) A saving in the form of reduced ordering costs.

(c) A loss in the form of increased total holding costs of inventory.

A decision to avail the quantity discount should be taken only if the net effect of the above components on the income is positive. The total inventory cost for the annual level of demand (including holding costs, ordering costs and purchase costs) should be compared with two order sizes: one for the order size determined by EOQ model and the other for the order size that enables the discount. Only if the total cost is lower in the latter case, quantity discount should be availed.

Technique # 2. Reorder Point:

The Economic Order quantity model is designed to help in deciding how much to order. One of the assumptions of the EOQ model is instantaneous replenishment and the firm places the order only when the existing level of inventory falls to zero. However, in reality, there is always a time lag between placing and procuring an order.

The purchasing process should be so planned that replenishment inventory arrives just as the last of the on hand inventory is used. Only then will it result in uninterrupted operations of the business enterprise. Therefore, the other aspect of the inventory management is when to order. The determinant of when to order in a continuous inventory system is the reorder point. It is the inventory level at which a new order is placed.

The reorder point may be different for every item of inventory, since every item may have a different usage rate, and may require different periods of time to receive a replenishment delivery from a supplier.

For example, a firm may elect to buy the same item from two different suppliers; if one supplier requires one day to deliver an order and the other supplier requires three days, the firm’s reorder point for the first supplier is when there is one day’s supply left on hand and for the second supplier, it is when there is three days’ supply left.

The determination of the reorder or order point is based on the following factors:

(a) Usage- Usage refers to the quantity of inventory that is used or sold each day.

(b) Lead Time – The lead time for an order is the time in days it takes from the placement of an order to when the goods arrive (or produced). Many a times, firms project a constant average for both usage and lead time.

(c) Safety Stock – The quantity of inventory on hand by a firm in the event of fluctuating usage or unusual delays in lead time is called safety stock. The level of safety stock depends on the fluctuations in the demand for the item, the risk the firm is willing to take for stock-outs and the unexpected variation in the lead time.

Under Certainty:

If usage is entirely constant and lead time is known with certainty, the order point is equal to normal daily usage multiplied by normal lead time:

Order Point = Normal Daily usage x Normal Lead time

To illustrate, if M/s Raghav & Co. uses 400 units of auto components per day, and these can be supplied in four days, then M/s Raghav & Co. should reorder, when the stock of auto components reaches 1,600 units as shown below –

Order Point = 400 x 4 = 1,600 units

The order point formula minimizes the investment in its inventory and reordering is planned in such a way as to ensure that the orders arrive at precisely the time the inventory reaches zero.

Under Uncertainty:

The above formula, however, does not take into consideration unusual events such as variations in production schedules leading to variation in daily usage, defective products provided by suppliers, erratic shipping schedules of the supplier, and late arrival of units shipped leading to variations in lead time.

To provide for these types of events, managers carry a “buffer” or safety stock of items to protect the firm from stock- outs. Therefore, when a safety stock is maintained, the reorder point is computed as –

Reorder Point = Maximum Usage x Maximum lead time

= Reorder level under certainty + Safety Stock

Safety Stock = Increase in usage x Normal Lead time + Maximum usage x Increase in lead time

Alternatively,

Reorder Point = Maximum daily usage x Maximum lead time

Safety stock size should be determined based on how crucial the item is in production or to the retail business, the item’s purchase cost, and the degree of uncertainty related to both usage and lead time.

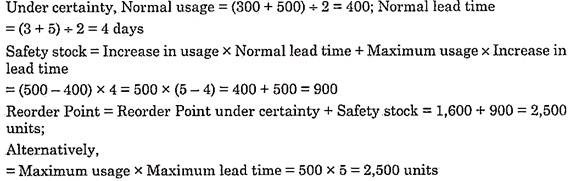

Continuing the earlier example, assume that M/s Raghav & Co., uses 300—500 units of auto components per day, and these can be supplied in 3 —5 days, the reorder point is computed as follows –

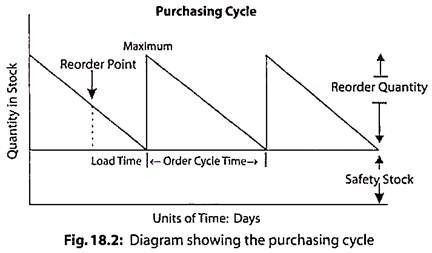

Therefore, M/s Raghav & Co. should reorder auto parts when there are 2500 units on hand. The reorder point can also be explained with the help of Fig. 18.2 given below.

In this figure:

(a) Line R represents the reorder level.

(b) Line S represents the safety stock.

(c) AB represents the lead time.

(d) Q is the order placed.

If the demand or usage rate is constant and the lead time is known, the orders are placed at equal intervals of time but before the inventory falls to zero. During the lead time, the remaining inventory in stock gets depleted at a constant demand rate, such that the new order quantity arrives at exactly the same moment as the inventory level reaches zero.

Technique # 3. ABC Analysis:

ABC analysis involves a perusal of a range of items such as finished products, items lying in inventory or with customers that have different levels of significance and thus, should be handled or controlled differently.

It is an inventory categorization method which consists of dividing items into three categories, A, B and C – “A” being the most valuable items, “C” being the least valuable. This method aims at drawing managers’ attention towards the critical few (A-items) and not on the trivial many (C-items). ABC method is also known as ‘stock control according to value method’, ‘selective value approach’ and ‘proportional parts value approach’.

The ABC approach states that, when reviewing inventory, a firm should rate items from A to C and exercise control as follows:

Group A includes items with highest annual consumption value. It accounts for about 10—20% of total inventory items, but represents about 70—80% of the annual consumption value of the firm. These items should have tight inventory control, secure storage areas and better sales forecasts. Reordering of such items should be frequent, so that the stock-outs are avoided.

Group B consists of items which may constitute about 15—20% of the store items and represents about 25—30% of the total value of stores. A reasonable degree of care needs to be taken in order to control these items. These are important, but not critical, and do not pose sourcing difficulties.

Group C consists of about 60—75% of the total items that cost about 5% of the total value. This can be referred to as residuary category. These are standard, low-cost and readily available items. Minimal controls are required for this category of items.

ABC analysis puts emphasis on “where the value is”. By focusing efforts on higher value inventory, a firm can assign proper resources to attain the optimum inventory levels, reduce inventory costs, and ensure that the customers’ needs are fulfilled. If this method is applied with care, it ensures a considerable reduction in the storage expenses and it is also helpful in preserving costly items.

ABC concept is applied to inventory management as a rule-of-thumb. It is popularly known as the “80/20” rule. It says that about 80% of the rupee value, consumption-wise, of an inventory remains in about 20% of the items. Thus, the managers need to prioritize their attention on items that have high consumption value.

Steps in ABC Analysis:

The steps involved in ABC analysis are as follows:

(a) Calculate the annual usage value of each item by multiplying the number used with the price of the item.

(b) Arrange the items in descending order according to the usage value.

(c) Compute percentage of total usage value for each item.

(d) Classify the items in the three categories on the basis of their value and take appropriate action.

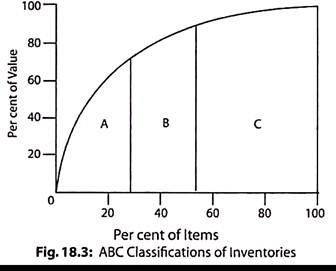

The ABC analysis is explained with the help of the following Fig. 18.3:

In Fig – 18.3, the horizontal axis shows the percentage of items while the vertical axis depicts the percentage of cost. In the figure, Group A items represent about 25% of items with 75% usage value. Group B items represent about 25% of items with 20% usage value. Group C items represent about 50% of items with 10% usage value.

Technique # 4. Inventory Turnover Ratio and FSN Analysis:

In any manufacturing industry, all items are not needed with the same frequency. Some materials are required quite regularly, yet some others are demanded occasionally. Then there are some materials that may have become obsolete and might not have been demanded for year’s altogether.

FSN analysis groups them into three categories as Fast-moving, Slow-moving and Non-moving (or dead) stock respectively. Inventory policies and models for the three categories have to be different. While performing this particular analysis, the turnover ratio of each item has to be calculated because the items are sorted and analyzed according to their turnover ratios.

Inventory turnover ratio establishes relationship between average inventory and cost of inventory consumed or sold during the particular period. This ratio measures the number of times a firm’s average inventory is sold/used/replenished during a year. A higher turnover rate indicates that the material in question is a fast-moving one. A low turnover rate, on the other hand, indicates over-investment and locking up of working capital in undesirable items.

Inventory turnover ratio may be calculated in different ways by changing the numerator, but keeping the same denominator. For instance, the numerator may be materials consumed, cost of goods sold or net sales.

Based on any one of these, the ratio differs from industry to industry and is given by the following formula:

A comparison of the current year’s inventory ratio with those of previous years will unfold the following points relating to inventories:

(a) Fast-Moving Items:

This is indicated by a high inventory ratio. This also means that such items of inventory enjoy high demand. Obviously, in order to have smooth production, adequate inventories of these items should be maintained. Otherwise, both production and sales are adversely affected through the uninterrupted supply of these items.

(b) Slow-Moving Items:

This is indicated by a low turnover ratio. These items are, therefore, needed to be maintained at a minimum level.

(c) Non-Moving or Dormant or Obsolete Items:

These refer to items having no demand. These should be disposed of as early as possible to curb further losses caused by them.

The turnover ratio may also be used to find out the holding period of inventory. By dividing the number of days in a year by turnover ratio, the number of days for which the average inventory is held may be ascertained. If the number of days of two different materials is compared, it is possible to know which is fast-moving and which is slow-moving. Inventory turnover ratio and FSN analysis can be effectively used to maintain right investment in inventories and prevent over-stocking of slow-moving items.

The FSN method is considered to be important because of its ability to identify the following types of items:

(i) Active items which require reviewing regularly.

(ii) Surplus items, stocks of which are higher than their rate of consumption.

(iii) Non-moving items that are not being consumed.

The last two categories are reviewed further to decide on the disposal action so that their stocks are reduced by appropriate disposals and the productive capital is released for other operating activities.

Technique # 5. VED Analysis:

This analysis represents the classification of items based on the criticality in terms of their effect on production function. Several factors contribute to the criticality of a spare part. If a spare part is for a machine on which many other processes depend, it is treated as vital for the organization.

Also, if a spare part is, say, an imported component whose procurement lead time is very high, its non-availability may mean a heavy loss. Similarly, spares required for fighter aircraft at the time of war are of great value in terms of fighting capability. In general, the criticality of a spare part may be determined from the production loss that is likely to occur due to the unavailability of that spare part.

Based on the criticality, spare parts are conventionally classified into three classes:

(a) Vital,

(b) Essential and

(c) Desirable.

(a) Vital (V):

A spare part is termed as vital, if its non-availability stops the production and/ or a very high cost is involved if the part is procured on emergency basis. Their shortage cannot be tolerated as their stock-outs cost is very high. For example, bearings for a kiln in a cement plant are considered to be vital.

(b) Essential (E):

A spare part is considered to be essential, if due to its non-availability, moderate loss is incurred. Their shortage can be tolerated for a short period. For example, bearings for motors of auxiliary pumps is classified as essential.

(c) Desirable (D):

A spare part is considered to be desirable if the production loss is not very significant due to its non-availability. They do not cause any immediate production stoppage and their stock-outs costs are nominal. Most of the parts fall under this category. For example, gaskets for piping connection.

The VED Analysis helps in focusing the attention of the management on vital items and ensuring their availability by frequent review and reporting. Thus, the downtime losses are minimized to a considerable extent.

The VED Analysis is very useful in categorizing items of spare parts and components. In fact, in the inventory control of spare parts and components it is advisable for the organization to use a combination of ABC and VED Analysis. Such control system would be found to be more effective and meaningful.

Technique # 6. Just-In-Time Systems Approach:

Just-In-Time (JIT) inventory is a strategy to increase efficiency and decrease waste by receiving goods only as they are needed in the production process, thereby reducing inventory costs. In other words, JIT inventory is a management system in which materials or products are produced or acquired according to their demand. This approach to managing inventory has become very popular in the early 21st century as suppliers and retailers collaborate to control inventory costs while meeting customer demands.

This approach reduces the amount of inventory that a firm maintains. It allows firms to reduce their overhead expenses while always ensuring that parts are available to manufacture their products. For instance, General Motors operates using a JIT inventory, relying on its supply chain to deliver the parts it needs to build cars.

The parts that are needed to manufacture the cars, do not arrive before or after they are needed; rather, they arrive just as they are needed. The Bailey Seat Firm supplies GM with all the seats it needs for the production of its full size trucks. The Bailey Seat Firm and General Motors work closely together so that the seats arrive at the assembly plant just as they are needed for each truck being built. The seats are never stored at GM plant waiting to be installed in the trucks. The seats are delivered to the plant and are immediately installed in the trucks.

Advantages and Disadvantages of JIT Approach:

JIT method, when applied, offers the following advantages:

(a) Lower Warehouse Costs:

Storing excess inventory may cost a lot of money, and reducing the amount of inventory you keep on hand may reduce your carrying costs as well. Firms that implement the Just-In-Time inventory model may be able to reduce the number of warehouses, they maintain, or even allow them to eliminate those warehouses altogether.

(b) Better Supply Chain Management:

The Just-In-Time inventory model may also help firms to be more efficient and competitive in the way they handle their supply chains and use their parts to assemble products for their customers. A more efficient supply chain may provide lower costs throughout the manufacturing process, and those lower costs may then be passed on to the customer. These lower costs may make the firm’s products more affordable, and help the firm gain a larger market share and stay ahead of its competitors.

(c) Better Customer Satisfaction:

Implementing the Just-In-Time inventory management model allows a firm to serve its customers faster and more efficiently. Firms that use the Just-In-Time model have a greater level of control over the entire manufacturing process, making it easier to respond quickly when the needs of customers change.

(d) Less Waste:

When a firm uses the traditional method of inventory management and control, it may end up with unsold items. The company may need to slash prices on that unsold inventory just to get rid of it. This may reduce the perceived value of the firm’s other products. The Just-In-Time inventory model reduces this waste and helps the firm respond more quickly to what its customers need.

However, JIT does suffer from limitations. The major risk is that a simple fault in the supply system may cause stock shortages.

Some of the other risks under the JIT approach are:

(a) A supplier that does not deliver goods to the firm exactly on time and in the correct amounts may seriously impact the production process.

(b) A natural disaster may interfere with the flow of goods to the firm from suppliers, thereby leading to halt in production almost at once.

(c) A firm may not be able to immediately meet the requirements of a massive and unexpected order, since it has few or no stocks of finished goods.

Thus, a considerable amount of supply chain management is needed to make Just-In-Time inventory control work properly.