After reading this article you will learn about the records to be maintained in the stores.

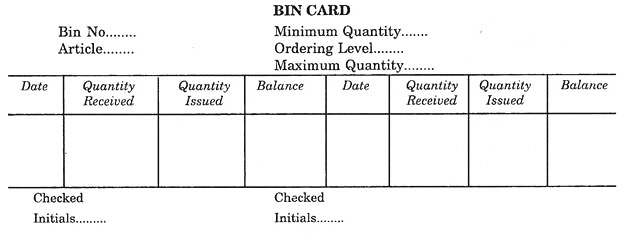

1. Bin Card:

This is a card which is attached to each bin, rack, shelf or other container for stores. A record of all materials entering or leaving the bin and balance of material in hand is kept in this card. These cards are entered by the store-keeper and only the quantities are recorded.

These should tally with the quantities of material as shown in the relevant account in the stores ledger. This will enable the store-keeper to ascertain the quantity of any material in stock and remind him to requisition of fresh stock, when the minimum stock has been reached.

In some factories duplicate bin cards are being used. In such cases one card is attached to the bin and the duplicate card is kept by the store-keeper on his table for ready reference. Bin cards are checked from time to time by the inspectors and they put their initials on these cards and take down the discrepancies.

Now-a-days in big industries, to avoid delay in production, an ordering level or safety level is also introduced between the maximum quantity and minimum quantity. At this ordering level, orders are placed for the purchase of material and if by chance material is not received and minimum quantity is reached in the stores then some alternative arrangements are urgently made.

A sample of bin card proforma is given below:

2. Receipt of Materials:

1. Material is received in the stores from;

(i) Outside suppliers,

(ii) Production department, and

(iii) Various departments as return of material on material returned note.

When a purchase order placed, a copy is sent to the stores. This helps in planning necessary arrangements for receipts, like unloading etc.

2. When the material is despatched by the supplier, its intimation is also received in the stores, which indicate expected date of receipt of material, so as to enable stores for organising quick and easy clearance.

3. On receipt of supply, it is tallied from the purchase order and despatch intimation and other documents. It is physically verified regarding quantity, size etc. If required, material can be unpacked for physical verification.

4. After physical verification, ‘Store Receipt Vouchers’, generally known as SRVs are prepared and sent to the inspection department.

5. After inspection of material, if it is acceptable, inspection department records the certificate on SRV and return back to the stores, with intimation to the purchase and accounts department.

6. Stores department sends the material to the custody.

7. Rejected material is retained in the rejection cell till they are returned to the supplier or replaced by him.

Receiving Inspection:

In order to maintain quality of the product, inspection should be carried out in following stages:

1. Receiving inspection.

2. Manufacturing inspection.

3. Inspection during assembly.

4. Functional testing.

Receiving inspection units should be fully equipped so as to ensure that a thorough check can be exercised at the time of receipt. For this purpose necessary instruments should be available. Many firms accept materials on basis of certification from the vendors who have proved reliable in the past.

3. Issue of Materials:

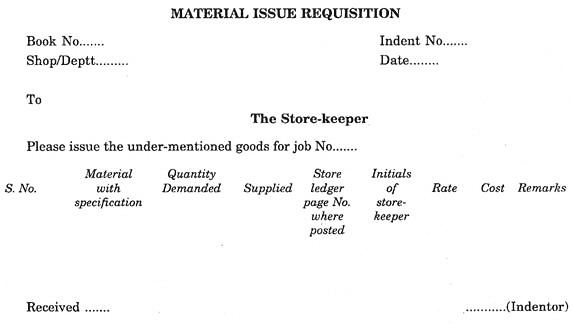

1. Materials are issued only on receipt of a properly authorised withdrawal form, which is usually called a ‘Material Issue Requisition Form’ or ‘Store Issue Voucher’ i.e., SIV.

2. On receipt of SIVs, store department issues the materials and records the quantities disbursed.

3. A copy of SIV, duly entered by the stores regarding issue of material, is then sent to the accounts department for pricing and entry in the stock ledger.

4. One copy of SIV is sent to the department who has initiated it for withdrawal of material.

Indent on Store:

It is also called material issue requisition. An important rule, which should be strictly followed is not to allow any materials to pass from the stores department into the works except upon the authority of written requisition. These indents or SIVs demands upon the store-keeper signed by authorised person to issue the material to bearer, to be charged to a particular job or department specified therein.

Such indents on stores are made out in triplicate from bound books supplied to each department. They contain the date, the necessary particulars of the stores requisitioned, such as quantity and description, order or job number to which the material is to be charged, department number, signature of the indentor, space for the initial of the issuing store-keeper and the signature of the person receiving the material.

As it is in triplicate, the original copy is sent to the cost department for costing, duplicate retained by the store-keeper and triplicate in the bound book by the Indentor as a permanent record. This can also be used in duplicate. In such cases, the original copy is sent to the cost department by the store-keeper after making the necessary entries. This is adopted only in small concerns.

A sample of indent on store is given below:

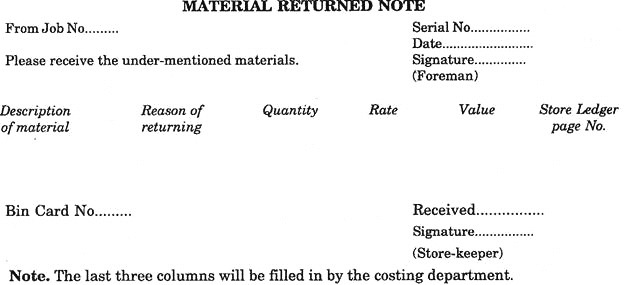

Material Returned Note:

Material issued for departmental use sometimes are not actually used and returned to the store-keeper. They must be properly recorded and their value may be duly entered in the store records and these values may be credited to the accounts of the department concerned by the cost department. For this purpose, Material Returned Notes are written out in triplicate.

Two copies being sent to the store-keeper along with the returned material. One of these is returned to the foreman with the store-keeper’s acknowledgement. The copy retained by store-keeper is entered by him on the bin cards and then passed on to the stores accountant to be priced and entered by him in the relative stores card.

It will then be dealt with by the cost department, the account of the department concerned being given credit in respect thereof.

4. Store Accounting:

Accepted materials are accounted for in the stores and their proper account is maintained. The account of stores is maintained by the store keeper in the same way as that of cash by the cashier.

Main objectives of maintaining proper accounts are:

(i) To indicate the quantity and values of stores held.

(ii) To provide information about values of receipts and issues.

(iii) To determine ordering level without physically checking the stock.

(iv) To keep account of total expenditure.

(v) To provide basis for material costing.

(vi) To help in locating and preventing wastage, pilferages, and misappropriation.

(vii) To help in keeping the level of inventory at a reasonable level.

It is desirable to know at all times as to how much working capital is represented by stores in stock. The value of stock is also needed to be shown in balance sheet as an asset. Value of the stock at the start and at the end of the accounting year is used in preparing profit and loss account.

Material Costing:

Material cost includes material price, freight charges, insurance, and taxes. Here material price means actual cost incurred by taking price quoted by supplier as the basis subtracting the discounts and adding any other expenses not covered in it.

Stores Accounting Records:

In order to maintain an efficient record to stores, following books and records will be required and these are maintained separately for different types of materials:

(a) Inward and Outward Registers:

When the material is dispatched by the supplier through rail, he will send its receipt issued by the railway authority, called ‘RR’. On the production of that receipt to railways material can be received by the consignee. A separate register is maintained by the store-keeper in which daily entries of R.R. received are made and known as “Inward Register”.

In the same way, when some material goes out of the store to other place, entries of R.R. are made by store-keeper in Outward Register and that R.R. is sent to the customer. On production of which, he can take the material from Railways.

(b) Stock Register:

These are:

(i) Dead Stock or Non-Consumable Register.

(ii) Consumable Register.

(i) Dead Stock or Non-Consumable Register:

This is maintained by store-keeper, in which entries of non-consumable articles such as all machinery, equipment, furniture etc. are made. The register shows complete details of articles together with accessories. The different items are entered on different pages. All transactions about a particular item are entered in one page.

(ii) Consumable Register:

In this, store-keeper maintains record of consumable stores received, such as coke, diesel oil, kerosene, petrol, lubricants, cotton waste, paints etc. The different items are entered on different pages. All the transactions about a particular item are entered in one page.

(c) Daily Receipt Register:

This may be in a register or loose leaf form. Whenever any material comes in the store, it is entered date wise in daily receipt register. Material is then inspected and if found suitable, is entered in Stock Register.

If the material is found defective, it will be rejected and either the material or its reports will be sent to the supplier. The incidental charges that are incurred will also be noted in daily receipt register.

(d) Issue Register:

This may be in register or loose leaf form. All stores issued are entered date wise in it by store-keeper. From the Receipt and issue register, store ledger is prepared by accounts section.

(e) Surplus Stock Register:

Sometimes such purchases are made, which do not come in use for long time, say 3 years. Such materials are then declared surplus and are recorded in a separate register called Surplus Stock Register.

Thus unnecessary material is removed from the Stock Register to facilitate easy handling.

(f) Suspense Register:

The defective item or items received in excess should not be placed in the bins but kept in “Suspense cell”, A separate register is maintained by store-keeper for all such items placed in suspense and is known as Suspense Register.

(g) Condemned Article Register:

Unserviceable material after use or obsolete material which is authorised to be condemned by authorized person is entered in this register and will be shown as stock until disposed off. The balance of condemned articles will be taken out from store ledger and will be shown condemned.

(h) Loan Register:

Sometimes non-consumable material is issued from store on loan for temporary period by the production of slip of authority. Before issuing, material is entered in this register and signature of the bearer is taken in this register and slip of authority is kept safe.

When the material comes back, slip is returned and entry of material received back is made in loan register.

(i) Empty Containers and Packages Register:

The record of empty containers and packages is kept in this register by store keeper. These should be disposed-off at convenient intervals by auction or otherwise to the best advantage.

The above mentioned are the various records which must be kept by store-keeper for easy and smooth handling of stores.