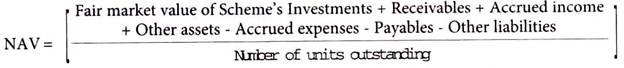

The performance of a particular scheme of a mutual fund is denoted by net asset value (NAV). As defined in the AMFI booklet, ‘net asset value’ is the market value of the assets of the scheme minus its liabilities. The per unit NAV is the net asset value of the scheme divided by the number of units outstanding on the valuation date.

1. Sale Price:

It is the price paid when amount is invested in a scheme. It is also called ‘offer-price’; it may include a sales load.

2. Repurchase Price:

It is the price at which a close ended scheme repurchases its units and it may include a back- end load. This is also called ‘bid price’.

3. Redemption Price:

It is the price at which open ended schemes repurchase their units and close ended schemes redeem their units on maturity. Such prices are NAV related.

Mutual funds invest the money collected from the investors in securities markets. In simple words, NAV is the market value of the securities held by the scheme. Since market value of securities changes ever)’ day, NAV of a scheme also varies on day to day basis. The NAV per unit is the market value of securities of a scheme divided by the total number of units of the scheme on any particular date.

For example, if the market value of securities of a mutual fund scheme is Rs.200 lakhs and the mutual fund has issued 10 lakhs units of Rs.10 each to the investors, then the NAV per unit of the fund is Rs.20. NAV is required to be disclosed by the mutual funds on a regular basis – daily or weekly – depending on the type of scheme. NAV is the rupee value of one unit of a scheme of the fund.

NAV is calculated as follows:

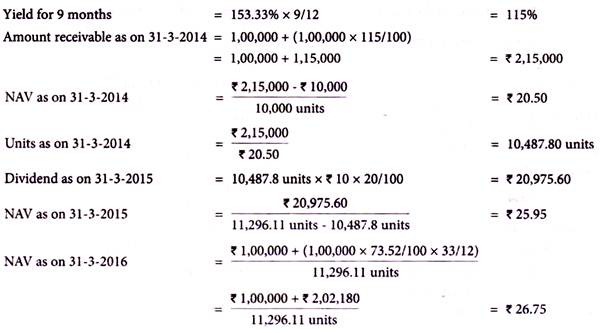

Problem 1:

Mr. X on 1.7.2013, during the initial offer of some Mutual Fund invested in 10,000 units having face value of Rs.10 for each unit. On 31.3.2014 the dividend operated by the M.F. was 10% and Mr. X found that his annualized yield was 153.33%. On 31.12.2015,20% dividend was given. On 31.3.2016 Mr. X redeemed all his balance of 11,296.11 units when his annualized yield was 73.52%. What are the NAVs as on 31.3.2014, 31.12.2015 and 31.3.2016?

Solution:

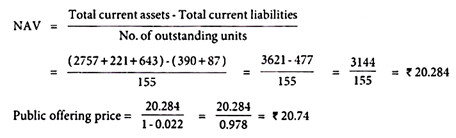

Problem 2:

Consider the following data of Sun India Mutual Fund (Growth Plan): (Rs.crores)

Value of investments 2757.00

Receivables 221.00

Other current assets 643.00

Liabilities 390.00

Accrued expenses 87.00

If the number of outstanding units is 155 crore and sales charge is 2.20% on the NAV, what would be the public offering price?

Solution: