The investor who invests in mutual fund units can receive returns in the following two ways:

1. Capital Appreciation:

Profit earned on sale of units at a higher NAV than the original cost.

2. Income Distribution (Dividend ):

ADVERTISEMENTS:

When a fund makes a profit on its investment, this profit will be given to investor as a dividend which can be reinvested in the fund or retain it in the form of cash.

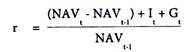

Return on Mutual Fund:

Where,

ADVERTISEMENTS:

r = Return on mutual fund

NAVt = Net asset value at the time period ‘t’

NAVt-1 = Net asset value at time period ‘t-1’

It = Income at time period ‘t’

ADVERTISEMENTS:

Gt = Capital gain distribution at time period ‘t’

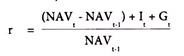

Required Return on Mutual Fund Investment (as a percentage):

Where, R1 = Personal Return of investor

ADVERTISEMENTS:

R2 = Mutual Fund earnings.

Effective Yield on Mutual Fund Investment:

The performance of a scheme is reflected in its net asset value (NAV) which is disclosed on daily basis in case of open- ended schemes and on weekly basis in case of close-ended schemes. The NAVs of mutual funds are required to be published in newspapers.

ADVERTISEMENTS:

The NAVs are also available on the websites of mutual funds. All mutual funds are also required to put their NAVs on the website of Association of Mutual Funds in India (AMFI) www(dot)amfiindia(dot)com and thus the investors can access NAVs of all mutual funds at one place.

The mutual funds are also required to publish their performance in the form of half-yearly results which also include their returns/yields over a period of time i.e. last six months, 1 year, 3 years, 5 years and since inception of schemes.

Investors can also look into other details like percentage of expenses of total assets as these have an affect on the yield and other useful information in the same half-yearly format. The mutual funds are also required to send annual report or abridged annual report to the unit holders at the end of the year.

Problem 1:

ADVERTISEMENTS:

A mutual fund that had a net asset value of Rs.10 at the beginning of month -t made income and capital gain distribution of Rs.0.05 and Rs.0.04 per share respectively during the month, and then ended the month with a net asset value of Rs.10.03. Calculate monthly return.

Solution:

Calculation of Monthly Return on Mutual Fund:

Where r = Return on the mutual fund

ADVERTISEMENTS:

NAVt = Net assets value at time period ‘t’

NAVt-1 = Net assets value at time period ‘t-1’

It = Income at time period ‘t’

Gt = Capital gain distribution at time period ‘t’.

By substituting, we get:

Problem 2:

Mr. A can earn a return of 16 per cent by investing in equity shares on his own. Now he is considering a recently announced equity based mutual fund scheme in which initial expenses are 5.5 per cent and annual recurring expenses are 1.5 per cent. How much should the mutual fund earn to provide Mr. A, a return of 16 per cent?

Solution

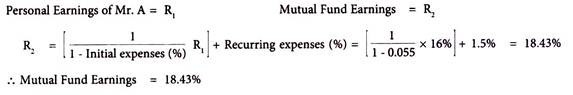

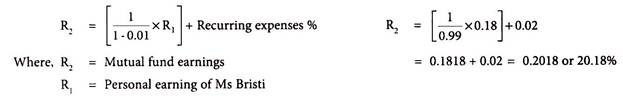

Problem 3:

Ms. Bristi can earn a return of 18% by investing in equity shares on her own. Now she is considering a recently announced equity based mutual fund scheme in which initial expenses are 1% and annual recurring expenses are 2%. How much should the mutual fund earn to provide Ms. Bristi, a return of 18%?

ADVERTISEMENTS:

Solution:

Problem 4:

Mr. Saurav Ganguly can earn a return of 20% by investing in equity shares on his own. Now he is contemplating recently announced new equity-oriented mutual fund scheme in which initial expenses and annual recurring expenses are 5 per cent and 1.5 per cent respectively. How much should the mutual fund earn to provide Mr. Saurav Ganguly, a return of 20%?

Solution:

Where, R2 = Mutual fund earings

ADVERTISEMENTS:

R1 = Personal earing of Saurav Ganguly

Problem 5:

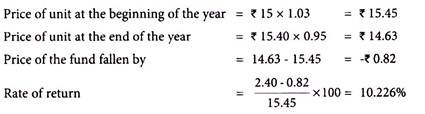

The NAV of each unit of a closed-ended fund at the beginning of the year was Rs.15. By the year end, its NAV equals Rs.15.40. At the beginning of the year, each unit was selling at a 3% premium to NAV. By the end of the year, each unit is selling at a 5% discount to NAV. The fund paid year end distribution of income and capital gains of Rs.2.40 on each unit. Calculate the rate to return to the investor in the fund during the year.

Solution:

Problem 6:

Ms. Vasuda is considering an investment in a mutual fund with a 2% load. As another alternative, she can also invest in a bank deposit paying 10% interest. Her investment planning period is 3 years. What should be the annual rate of return on mutual fund so that she prefers the investment in the fund to the investment in bank deposit?

Solution