Three main methods of estimating national income: (i) the census of products method, (ii) the census of income method and, (iii) the expenditure method!

The Census of Products Method or Output Method:

This method measures the output of the country. It is also called the inventory method and involves the assessment, through census, of the gross value of production of goods and services produced in different economic sectors by all the productive enterprises in the economy. (For instance, the producing sectors in India are agriculture, forestry, fisheries, mining, industries, transport, commerce and other services.)

To the aggregated value of total output, real income earned from abroad is added (i.e., add the net difference between the value of exports and imports). And indirect taxes like excise and customs duties, plus depreciation allowances are to be reduced from the total obtained. Thus, to this net difference of the income earned from the rest of the world, a symbolic expression for this method may be given as follows:

Y = (P – D) + (S – T) + (X – M) + (R – p)

Where,

Y = Total income of the nation,

P = domestic output of all production sectors,

D = depreciation allowance,

S = subsidies,

T = indirect taxes,

X = exports,

M = imports,

R = receipt from abroad, and

p = payments made abroad.

Mostly, this method is adopted in the calculation of national income. However, there are certain precautions against the danger of double counting, etc., which must be strictly avoided if a correct result is to be achieved.

The following precautions are necessary:

1. To avoid double counting, we must add only the final products. Raw materials and intermediate goods should not be included, as that would lead to double counting.

2. Goods for self-consumption by the producer should be excluded; they have not been marketed, so it is difficult to ascertain their true market value.

3. While evaluating the output, changes in the price levels between the years must be taken into account. It is usual to denote national income with reference to prices of a particular year.

4. Indirect taxes, included in prices, are to be deducted for getting the exact value of the products. Similarly, subsidies given by government to certain products should be added in evaluation of the product.

5. Add the value of exports or the income earned abroad and deduct the value of imports.

This method is widely used in the underdeveloped countries, but it is less reliable because the margin of error in this method is large. However, in India, this method is applied to agriculture, mining and manufacturers, including handicrafts. But the census of product method is not applied for the transport, commerce and communication sectors in India.

Value added vs. Final Goods Approach:

There are two approaches to avoid the possibility of double counting in the measurement of GNP:

(i) Final goods method, and

(ii) Value added method.

In the final goods method of estimating GNP, only final values of goods and services are computed, ignoring all intermediate transactions. Intermediate goods are involved in the process of producing final goods — the final flow of output purchased by consumers. Thus, the value of final output includes the value of intermediate products. Hence, to avoid double counting, only final values relating to final demand of the consumers should be reckoned.

For example, the price of bread incorporates the cost of wheat, flour etc. Wheat and flour are both intermediate products and are not treated as the final consumer’s demand. Their values are paid up during the process of production. In the value of final product, bread, the values of these intermediate goods are hidden.

Hence a separate accounting of the values of intermediate goods, along with the accounting of the value of final product, ‘ would mean double counting. To avoid this, the computation of the value of final products only has been suggested.

Another method, however, is the “value added” method in which a summation of the increase in value (the value added), at each separate production stage, leading to output in final form, gives the value of GNP.

To avoid double counting of intermediate goods, one must carefully estimate the value added at each stage, of the production process. From the total value created at a given stage, we should thus subtract all the costs of materials and intermediate goods not produced in that stage. Or, the value of inputs, at a given stage, should be deducted from the value of output.

Even the value of inputs purchased from other firms or sectors should be subtracted. In short, GNP is obtained as the sum total of the values added by all the different stages of the production process till final output reaches the hands of consumers to meet the final demand. The point may be clarified further with the help of an illustration as given in Table 3.

Table 3 Value Added Method:

|

(1) Production Stages |

(2) Firm |

(3) Sales Receipts |

(4) Cost of intermediate goods |

(5) Value added (Net Income) (3) – (4) |

|

1. Wheat 2. Flour 3. Bread 4. Trading |

Farmer Flour Mill Baker Merchant |

500 700 900 1000 |

0 500 700 900 |

500 + 200 + 200 + 100 |

|

Total: |

Sum of value added |

= 1000 |

In Table 3 we have assumed a much simplified method or model of an economy, producing only a single final product, bread. In satisfying the consumers’ final demand for bread, it is assumed that there are four productive stages. First, a farmer cultivates wheat and sells it at Rs. 500. Thus, Rs. 500 is the value added to the economy’s output. We assume that this wheat is purchased by the flour mill to grind into flour. The mill sells the flour to the baker and fetches Rs. 700. So, its net income is Rs. 700 – Rs. 500 = 200. Thus, in turning wheat into flour (that is, the creation of form utility), the value added is Rs. 200.

The baker bakes a quantity of bread out of the flour and sells it to the merchant for Rs. 900. In the process, the value added is Rs. 200. The merchant renders trading service of creating place and time utility, and thus sells the stock of bread to the final consumer at Rs. 1,000.

The net income of the merchant is Rs. 100 which is his profit for merchandise business, a “productive” activity. Thus, the value added is Rs. 100 in the economic system. Obviously, the sum total of value added at each stage of production, Rs. 500 + 200 + 200 + 100 = Rs. 1,000 is the final value.

Evidently, the value of that product is derived by summation of all the values added in the path of the productive process. To avoid double counting, either the value of the final output should be taken in the estimate of GNP or the sum of values added should be taken. Value added is the difference between value of output and input at each given stage of production.

The final product method reckons the quantum of goods and services and the aggregate of their values (measured at market prices) at the end of the year, while the value added method measures the flow of output and takes the sum total of net values created at each production stage during the year.

Apparently, both the methods give the same results, because both relate to the same phenomenon, though each in a different manner. Some economists, however, prefer the value added method on the following counts:

(i) It provides a method to check up or tally the accuracy of GNP estimates.

(ii) It enables us to know the contribution of each productive sector to the creation of GNP. Thus, national income at industrial origin can be easily compiled from the value added approach. Again, it is also helpful in constructing the input-output table and tracing inter-industry transactions.

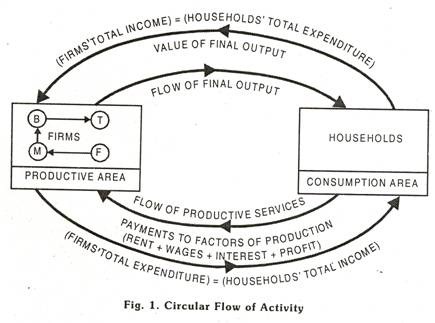

Circular Flow of Activity:

Incidentally, the economic system contains the flow of goods and services in the transactions between two economic sectors: households and firms. There is a circular flow of economic activity. Households sell their productive services as factors of production to the firms and earn their income. Thus, firms’ spendings become households’ income. Households buy the final goods and services produced by the firms. Thus, households’ total expenditure becomes the income of the firms which is equal to the value of final output by the firms.

The ranges of transactions which take place within the boundaries of firms — “the productive area” — are regarded as intermediate transactions or inter-industry relations. Values are created in the productive area. All net values added together determine the value of the final output, i.e., GNP. The final output flows from the productive area of firms to the consumption area of households. This point has been illustrated diagrammatically in Fig. 1.

In Fig. 1, one can observe that intermediate transactions occur within the productive area or firms. It represents intermediate transactions from the farmer (F) to the flour mill (M), to the baker (B), to the trader or merchant (T) — all taking place within the boundaries of the firms. The firms sell their final output to consumers — the households. Thus, there is a flow of final goods from the productive area or firms to the consumption area of households. Households’ total expenditure = the value of final output – the income of the firms’ sector. Again, there is a flow of productive services of factors from households to firms. The factors are rewarded in the form of rent, wages, interest and profits. The total factor income = the aggregate value of factor services = the total expenditure of firms = the total income of households. In short, total expenditure of firms = total income of households and total expenditure of households = total income of firms = the value of final output. Thus, the final value of output is just the same as final expenditure. It follows thus:

Total output = Total expenditure … (1)

Again, total expenditure = total income … (2)

Total output = total income … (3)

Census of Incomes Method:

In this method, income of all factors of production is added together. The data are compiled from books of accounts, reports, and published accounts. The following classification of incomes is considered as comprehensive:

(a) wages and salaries, (b) supplemental labour income (social security, etc.), (c) earnings of self-employed or professional incomes, (d) dividends, (e) undistributed profits, (/) interest, (g) profit of state enterprises. However, transfer payments like gift subsidies etc. are to be deducted from the total of factor incomes. Thus, National Income is equal to the factor incomes minus transfer payments.

This method is also called the Factor Cost Method. Thus, the national income of a country, at factor cost, is equivalent to the sum total of the disbursements of their (factors) income. The symbolic expression of this method is as follows:

Y = (w + r + i + n) + (X – M) + (R – P) where

w = wages, r = rent, i = interest, n = profits.

However, certain precautions are necessary while following this method.

1. All transfer payments (government and personal) like gifts pension, etc., are to be deducted. Similarly, gambling, being transfer activity is to be excluded.

2. All unpaid services (like services of housewife) are to be excluded. Thus, only those services for which payments are made should be included. Financial transactions and sales of old property (including land) are to be excluded, as they do not add anything to the real national income. Thus, all capital gains and losses which are related to wealth, but not to real income, should be excluded.

4. Direct tax revenue to the government should be subtracted from the total income as it is only a transfer of income. Or else, it should not be reckoned at all.

5. Similarly, government subsidies should be deducted.

6. Add the value of exports and deduct the value of imports.

7. Add undistributed profit of companies, income from government property, and profits from public enterprises.

In India, the National Income Committee used the income method for adding up the net income from trade, transport, public administration, professional and liberal t arts, and domestic services. Since, under Indian conditions, due to lack of popularity of personal accounting practices, it is difficult to ascertain the personal income of individuals, the income method is not wholly practicable.

The Expenditure or Outlay Method:

National income on the expenditure side is equal to the value of consumption plus investment. In this method, we have to: (i) estimate private and public expenditure on consumer goods and services, (ii) add the value of investment in fixed capital and stocks, with due consideration for net positive or negative inventories, and (iii) add the value of exports and deduct the value of imports. This method is not as popular as the previous ones.

To express it in symbolic terms,

Y = (С + I + G) + (X – M) + (R – P)

Where,

С = Consumption Expenditure,

I = Investment Expenditure, and

G = Government Purchases.

The Bowley-Robertson Committee has suggested the adoption of the Census of Products Method for major sectors of India, and the Census of Income Method for some minor sectors, while the National Income Committee relied mainly upon the Census of Income Method. However, none of the above methods alone is perfect. Therefore,’ an integrated computation of them will give a wider perspective of the estimate.

The process of calculation of national income (by using the above discussed three methods) has been illustrated in a summarised way, with hypothetical data of an imaginary economy, in Table 4 (A, В and C).

To be more realistic on this purposely assumed that the results in are not identical due to incomplete the expenditure statistics are taken as between expenditure statistics and statistics is regarded as a residual table.

Table 4 Estimate of the National Income of Country X during a given year

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

С Output Method |

Rs. (Crores) |

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

Agriculture, Forestry and Fishing |

250 |

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mining and quarrying |

100 |

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

Manufacturing |

200 |

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

Construction |

100 |

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

Gas, electricity and water |

50 |

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

Transport and communication |

200 |

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

Distributive Trades |

300 |

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

Insurance, banking and finance |

200 |

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

Public administration and defence |

150 |

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

Other services |

100 |

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

Total domestic output |

1,800 |

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

Less: Stock appreciation |

– 250 |

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

Residual error |

-50 |

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

Net property income from abroad |

100 |

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

GNP at factor cost |

1,600 |

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

Less: Capital consumption |

– 150 |

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

National income |

1,450 |