After reading this article you will learn about:- 1. Introduction to Negotiation 2. Definition of Negotiation 3. What is not Negotiation? 4. Elements of Negotiation 5. Understanding the Framework of Negotiation 6. Getting Ready for the Negotiation 7. The Various Tactics used in Negotiations 8. The Strategy of Negotiation 9. The Types of Negotiation 10. Negotiations Involving a Trader.

Contents:

- Introduction to Negotiation

- Definition of Negotiation

- What is not Negotiation?

- Elements of Negotiation

- Understanding the Framework of Negotiation

- Getting Ready for the Negotiation

- The Various Tactics used in Negotiations

- The Strategy of Negotiation

- The Types of Negotiation

- Negotiations Involving a Trader

1. Introduction to Negotiation:

Now we will study the various aspects of negotiations as one would face in trade related business activities. The idea is to highlight the basic but essential elements necessary in understanding and sharpening the instincts and the art of negotiation.

Negotiation is an integral part of our life. We negotiate as individuals, as groups, as associations, and as nations, the level or scope of negotiation expands accordingly. As individuals we negotiate for something that we can have or use, as a nation we negotiate for something that has direct and/or indirect impact for whole of the nation.

We negotiate for almost everything that we want to have or give, at home or outside, at work and at leisure, in peace or at war. This process has no ending and when we talk about the international trade, the negotiation becomes part of our routine rather a means of survival. It will not be too much if the entire business activities are defined as a simple process of negotiations.

We negotiate all the times whether we are buying, selling, joint venturing, financing, fixing salaries and benefits, labour contracts or in simple words doing anything, which can be converted in terms of money and/or time. The basic idea behind any negotiation is to derive maximum advantages for ourselves and give in as little as possible. Sometimes we negotiate ethically and sometime unethically.

We use various tactics to bring home an advantage as against our opponent. Lies deception and distraction though sound negative attributes but we do use them in the process of negotiation. They are all but part of the total concept of negotiation.

One can dare say that an individual without the basic abilities of negotiation would find it hard to survive.

2. Definition of Negotiation:

Negotiation is a process in which two or more parties try to gain maximum advantage on the basis of mutual consent.

The basic idea is to create an economic advantage against the opponent. It is the beginning of a process of drawing advantage and it ends with the signing of a mutually agreeable terms and conditions binding on either side for a duration in which the transfer of goods and services are exchanged fully and finally to the satisfaction of the contracting parties.

Negotiations do not promote conflict or undue favour rather it embeds a sense of fulfillment of certain needs of the contracting parties. Negotiation is directly linked with the need factor. Before starting of this process each party knows exactly what it needs and what it desires and through negotiation they try to fulfill them. The need factor is not a limitless identity, it has its bottom and the ceiling line.

The process of negotiation is carried out above this bottom line. How much above this bottom line would depend on the negotiator’s skills. The negotiator tries best for attaining something above the level of needs, which is the bare minimum and up to the level of desires that is the maximum other extreme end of what he wants to have.

The breakdown of negotiation happens only when one of the parties realizes that what he is getting is below the bottom line – for a given set of situation.

Needs and desires are the two ends of the anticipated requirements and Wants is a sort of floating point in between these two extremes. Needs represents the minimum possible requirements, desires represent the maximum possible requirements and wants is just that requirement which can makes the negotiating trader feel satisfied for agreeing to click the deal.

3. What is not Negotiation?

(a) Intimidation of any form and misleading, dictation and obedience, force and punishment is also not negotiation.

(b) Concealing and double standards are also not negotiation.

(c) The sense of negotiation vanishes when one of the parties has the safety of escape route but others are enclosed.

(d) In negotiation no one always gives and no one always receives, if one does then it is not negotiation.

(e) Implementation of the negotiated part is very important; if it cannot be implemented then also it is not negotiation.

(f) If negotiating parties have askew attitudes and pre-determined notions, than also it is not negotiation.

(g) Negotiation is not equal distribution.

4. Elements of Negotiation:

When you are trading at the international level, you are constantly communicating and negotiating not only with your buyers but also with your sellers and your success would depend on your negotiating skills. The basic ingredients required for basing the skills are called the elements of negotiation.

The Negotiations in a Trade Conductive Atmosphere are Confined to Following Elements, Called the Elements of Negotiation (EON):

(i) Price,

(ii) Quality,

(iii) Quantity,

(iv) Delivery conditions and delivery alternatives,

(v) Payment conditions and payment alternatives, and

(vi) Monetary returns, immediate and/or anticipated in near future.

Above six elements of negotiation can be grouped into three basic factors, Price Payment and Money/returns elements can be termed as “Finance”, Quality and Quantity can be termed as “Product” and the third element can be termed as “Delivery”. So we have three basic factors to concentrate, the Product, Delivery and the Finance, and all our negotiations have to be directed towards them and from them.

MOP and TRIF:

In any business negotiations one factor which occupies the top position is the net return to the organization, this is important not only for those who own but also for those who make it run and support it from outside like shareholders. The negotiators should never forget that he is duty bound to give some returns to the organization.

For this job he is guided by the expected or targeted margin-of profit (MOP) which is directly or indirectly related to the Total Resources Input factor (TRIF). These two factors assist the negotiator, especially the trader-negotiator, to mark territory for negotiation.

(a) Margin of Profit (MOP):

Let us represent the three basic EON of the buyer side (Finance, Product, and delivery) as Fb, Pb, and Db. Similarly for the seller side as Fs, Ps and Ds. The Fb + Pb + Db would then represent the buyer’s/importer’s Package of the Deal (POD) and Fs + Ps + Ds would represent the seller/exporter side package. In an ideal situation where there is no profit or loss the two sides would balance each other,

(Fb + Db + Pb) = (Fs + Ds + Ps) — (1)

Under these conditions though apparently there is no profit margin, but if the negotiations or without any negotiations, such situation arises and parties agree to shake hands, then they look for areas where they can cut corners to create some margin of profit after signing the contract.

The areas that can generate MOP are:

(a) Ocean freight rate negotiation with the shipping companies for discount.

(b) Packing and packaging.

(c) Raw material costs.

(d) Local transportation costs.

(e) Price cut on the bought out components and sub-assemblies.

(f) Zero defect production.

(g) Pre and Post shipment credits.

As a matter of fact this practice of “cost reduction” is an integral part of the production/marketing efforts of any world class organization. Organizations that outsource major part of components like automobile makers, electrical goods manufacturers, computer hardware manufacturers or even the organizations involved in the service sector.

They all strive to create imbalance in the said equation so that the following conditions are achieved.

From the buyer/importer point of view,

(Fb + Db + Pb) – (Fs + Ds + Ps) = Margin of profit (MOP) —(2)

From the seller/exporter point of view,

(Fs + Ds + Ps) – (Fb + Db + Pb) = Margin of profit (MOP) —(3)

During the entire course of negotiation the negotiating parties try hard so that they do not face a situation of equation (1). Their efforts are directed to see to it that the MOP never reaches zero level and is always a positive digit in their favour.

The situation of a trader involved in negotiation would try his level best to avoid situations resulting in equation (1) because if it arrives they would be the first targets to be hit. Their services tend to lose importance if their involvement cannot give the negotiating parties a situation of equation (2) or (3) as the case may be.

But despite what is mentioned in the above paragraph, there are specific situations under which one of the party under negotiation, including the trader might be compelled to negotiate a deal, or they do so under a pre-calculated strategy, in which the MOP is either zero or near to zero or even a net negative digit.

It means either they are working at no profit or loss (near to zero level in which he covers only the necessary over heads) or at net loss.

Such special situations are due to:

(a) When they think a small loss at the initial stage might open up doors to greater business in the future.

(b) It can help them to establish business association with a bigger customer.

(c) This situation also arises when a small and/or a losing deal give him credentials of not only as quality supplier, but also being a supplier to so and so global organization. The deal is treated as the license fee or the advertising fee for future growth of business.

These decisions are very sensitive and ought to be taken very cautiously and never as an impulsive reaction.

(b) Total Resources Input Factor (TRIF):

A negotiator trader has to understand the difference between gamble and risk. Business is not a game of cards, it is an exercise in risk management with its limits clearly defined.

The negotiator who goes to the negotiating table knowing his limits, knowing what he can and what he can’t, has greater tendency for success then otherwise. In order to know what the negotiator can and can’t do, he has to understand the Total Resources Input Factors (TRIF) behind the deal that he intend to negotiate.

This TRIF must include as the minimal:

(a) The net fixed overheads of his set up.

(b) The communication cost factor.

(c) The transportation cost factor.

(d) The anticipated follow up cost factor.

(e) The total time spent and/or expected to be spent on the deal.

(f) The developmental cost factors direct and indirect.

(g) The currency risks.

(h) Banking charges.

(i) Insurance charges.

All the above elements have to be translated in to money values. Their net sum would indicate the minimum TRIF that must be generated out of the deal so that the overall net return at bare minimum and do not eat the internal resources of the organization.

Thus the Equations Arrived at in the Last Section can be Redefined as Under:

Note:

Let us indicate the TRIF of the exporter as (TRIF)E, and that of the importer as (TRIF)I.

(i) Situation of No Profit No Loss

For an importer/buyer:

(Fb + Db + Pb) – (Fs + Ds + Ps) = (TRIF)-I —(4)

For an exporter/supplier;

(Fs + Ds + Ps) -(Fb + Db + Pb) = (TRIF)-E —(5)

(ii) Situation of Profit:

For an exporter/supplier;

{(Fs + Ds + Ps) – (Fb + Db + Pb)} – (TRIF)E = Margin of profit. (MOP) — (6)

For an importer/buyer;

{(Fs + Ds + Ps) – (Fb + Db + Pb)} – (TRIF)I = Margin of profit. (MOP) —(7)

Depending on the specific situations above equations become the guiding principles of negotiations with the concerned parties. These becomes the bottom line of negotiation, anything negotiated above this line would give net return to the negotiator/organization.

Summing up the above, the net elements of negotiations are the EON, MOP and TRIF. The negotiators have to use them judiciously for formulating is strategies for negotiation.

After fixing the elements the next step for a negotiator is to draw up the frame work of negotiation.

5. Understanding the Framework of Negotiation:

Why certain negotiations succeed and others fail? The reason lies in the selection of the operating framework under which they start negotiations.

The only condition for this frame work to succeed in letting the negotiating parties to achieve mutually acceptable terms and conditions is that each party has open mind of what they can give up and what they must receive, meaning there is a “give and take” feeling on both the sides.

Though each has firm idea of what they cannot give. This portion of “what they cannot give” has to be lesser then total expectations from the negotiation process.

The main parts of this framework are two opposing sides say side A and side B and if a trader is involved than he becomes the third party. At first we shall consider the situation of two opposing parties.

The ingredients:

1. Two parties with different wants and desires wanting to reach an agreement.

2. Constitution of each party (leader, technical support, commercial support, general support).

3. The backup data with each party.

4. List of what they can give and what they cannot give.

5. List of what they want to achieve.

6. List of what minimum they must achieve.

7. Mutual intension to reach agreement.

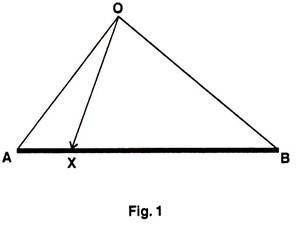

The operating side of the framework is as shown in the following diagram:

In the above diagram:

OA = What the party A wants to achieve

OB = What the party B wants to achieve

AB = The extent of the target to be achieved.

OX = The hypothetical moving line on AB indicating what is achieved by each party

Limitations:

OX cannot overlap either on OA or on OB meaning no one party can achieve 100% of what they require and the other party losing everything of what they wanted to achieve, since in that case the whole process would become anything else but negotiation.

Many times parties sit across the negotiation table and even after weeks/months/years the situation never changes since no party shows inclination to give up any part of what they wanted to achieve, each party trying to achieve 100% of what they wanted. The most important and living example of such negotiations is found between India and Pakistan over Kashmir, there are several other similar examples in the world.

The above examples are different from business negotiations. In business negotiations the agreements are expected to be reached by the negotiating parties on mutual consent.

However if a situation develops where one party gets away with 100% and forces the other party has to sign the agreement, than they can do so but they sooner or later would tear up the agreement and move away from the set frame work in other directions away from the party showing monopolistic situation without fulfilling the contractual obligations.

Such cases normally may land up in courts but the party, which backed out, has reasons for doing so.

In business the survival of the organization is of prime importance. One can supply the goods/services so long he is allowed to live and service the contract. If servicing the contract means death of the organization or even “hardship” than the suffering party can justify in the court of law their inability to meet the contractual obligations. They might either ask for renegotiation or termination of the contract.

A word of caution is also for the party, which is in a monopolistic situation (a large importer and a small exporter). It is in the favour of the larger party to let the smaller party to make some profit (or teach them, guide them on this account) to survive because only than they can survive and supply.

6. Getting Ready for the Negotiation:

A good negotiator plan, organizes, and executes his operation very systematically. He has the information, skills and fineness for interpretation structuring and formulating his strategy. He formulates the strategy with such agility that on surface he retains the looks of a gentleman with calm and cool posture.

But beneath he is all the way scheming doing the calculations combinations and permutations to arrive at an optimum level of acceptance which benefits not only himself but the side that he is standing for.

In order to conduct the negotiation successfully the trader has to prepare for the event and back up data and understanding on following points would assist him to be prepared well in advance:

(i) The base of negotiation is information, so try best to have as much as possible the information on what you have and what you want to have.

(ii) Acceptance limits of what you want to gain from the negotiation.

(iii) Ready information on individual elements of your needs and wants and their variations in terms of money.

(iv) Information on the opposite side as to what they have and what they might need.

(v) All successful negotiation simply recognize and fulfills the needs. The negotiating parties in a successful negotiation always come out with some degree of satisfaction This fact should very clear in your mind when you go for negotiation. Nobody can have everything during negotiation and one must be prepared for the give and take situation for concluding the negotiation on a positive note.

(vi) Time, is another element of negotiation instrument—one has to ask himself whether he is ready for the negotiation and only if the answer is 100% in affirmative the process of negotiation be initiated. If you feel that you are not ready for the negotiation and want to gain time, then be specific to the other party or use the two golden words for negotiation the consultation and conferring to gain more time.

(vii) Find out what are your deadlines and make sure they are suitably camouflaged from the opponent, for if he comes to know of them he can use them to put pressure on you for making decisions which may or may not be in your favour. So that keep track of these dead line with your internal clock to proceed systematically.

(viii) As your deadlines are important to you so are the deadlines of your opponent important to them and that is what you have to dig out. Finding the deadlines is first step and the second step is to manipulate the circumstances around your opponent creating pressure zones around them so that they feel the pressure of the situation.

The human mind under stress always tries to find the release points to go back to normal state. This is the situation you have to create and exploit.

(ix) Before the start of the actual negotiations always have the dummy runs with in your own group, trying to figure out the details of the opposing side especially on the following four points:

(a) Who are the people involved on the other side and what is the line of authority, who is the key person and how he reacted in similar situations in the past?

(b) What could be their main objective, do they really want to conclude or will try to gain time, or in nut shell how serious they are?

(c) What are the options open to them?

(d) Can they make decisions binding on their organization?

The above information can be collected by looking into the past records and from the individual experience of others involved in the business. As a matter of fact if you are involved in a long term trading business and face the known opponents at regular intervals then it might not be difficult to gather the relevant information.

As you maintain your business records you must maintain a folder each on your competitors and update it regularly.

It is important for you to know not only the strength but also the weakness of your competitors. You have to know not only what they have lost but what they gained and whether they have the capacity to take more. Sometimes it is advisable to let your competitors walk away with a business so that you get a chance to grab a much better business.

These are delicate decisions and ought to be taken very carefully after evaluating all the known facts about yourself and your competitors. That is why maintaining a fact file on your competitors is so vital, unless you know your competitors you cannot win over them or manipulate the circumstances for your advantage.

(ix) Write down what you want to achieve. As a trader your basic interest should be to gain some degree of net profit out of the negotiation. The degree of profit would totally depend on what the other side can allow you to have for they too have their alternative options.

If you were the only option then perhaps there would have been no negotiations at all, but in today’s world and with the communication and data information tools available, the options are numerous. So at the onset you have to put one thing in your mind that the optimum line is always the bottom line that you have to achieve and what you achieve above that bottom-line is a mark of your negotiation skills.

(x) The last but the most important point to keep in mind is the continuity of your actions. The proposed negotiations be always treated as the first and you as the negotiator has to make sure that irrespective of the outcome of this negotiations room and doors are always left open for future negotiations.

A negotiator is continuity in him and unless he cannot maintain it, he will be facing the dead wall and someone else would be walking away with the business.

The negotiator has to guard himself and has to conduct himself in such a way that what he is asking for or aiming for has in built potential for more to follow may be in some different direction. He has to plan his gains in such a way that it leads the way to new contacts and contracts.

Your opponent is your opponent for a given set of circumstances but he might not be in a different set of circumstances, so make sure when he leaves the negotiating table he leaves in a happy note to come back again. Remember in business circles one never leaves, one always leaves to come back again.

7. The Various Tactics used in Negotiations:

Before starting the chapter on strategy let us review some of the most common tactics used in negotiations. The basic purpose of negotiation is to gain an advantage in the form of a sale done or in the form of favorable terms and conditions for the execution of a sale deed or even to minimize the damage anticipated due to non-fulfillment of contractual obligations etc.

Whatever be the cause the effect is always directed towards extracting the best for our self. The beginners in this field find themselves in very awkward position especially when it comes to hiding the facts. They break in very easily when confronted with a seasoned opponent. Their innocence and ignorance of the ground rules of the negotiation process is their biggest enemy.

The question of morality and truthfulness is always prominent in their thinking process. A beginner with keen senses learns fast. Generally every success is taken for granted but every failure is questioned because it results in loss of business to the organization.

I had been doing the negotiation process for over 32 years in many commodities and services and have seen ups and downs still there were many occasions when my superiors would put this question right across my face “Who is paying you the salary ? ” or “On whose side are you?”. The reason why such questions are put up by the management is related to Ethical and Unethical aspect of negotiation.

When we are negotiating it is difficult to mark the areas of ethical and unethical behavior. It all depends on the opposite side’s movements and the situation that we find ourselves in during the negotiation process. For example, to lie is unethical, but to lie so that a serious situation can be avoided cannot be termed as unethical.

Similarly when the customer turns down your offer saying that he had much better offers from others where as he had non, so he is lying, but it cannot be termed as unethical since it is his duty to extract the best out of you.

The ethical and unethical character traits are related to our personality and in negotiation we project our personality. It is this impression that categorizes us as ethical or non-ethical negotiators. Most of the successful negotiators carry the batch of ethical negotiators and are respected by the opponents. They are able to link up business and create new areas of opportunities.

On the other hand the opponents do not respect the people who are labeled as unethical negotiators and they are prone to taking high risks. The negotiation process is one of the closed end type and they are seldom able to open up new areas of opportunities, for them the present situation is the most important one and winning is their sole objective. They are rigid in their attitude.

The negotiation tactics are transitional phases, which help the negotiators to reach their destination or desired goals. These are used in negotiation process by both the sides but a skillful negotiator is able to out-smart the opponent and extract better advantage as compared to his opponent. They are powerful tools and need very expert handling.

8. The Strategy of Negotiation:

Conquest by strategy is the highest form of victory:

This is true for a battlefield and also for a negotiation room or channels. As a statement it explains the resources at our command, the objective to be achieved and the various alternatives to reach the predefined goal. As an action plan it states the various alternatives and the least rout using the minimum of the resources and time with maximum impact for achieving the objective.

It takes into account all possible and conceivable actions of the opponent, the known and apparent strengths and weaknesses of the opponent. If it is a negotiation between a buyer and multiples of sellers than it also takes into account the buyer’s psychology, capacity, financial strength, past performance etc.

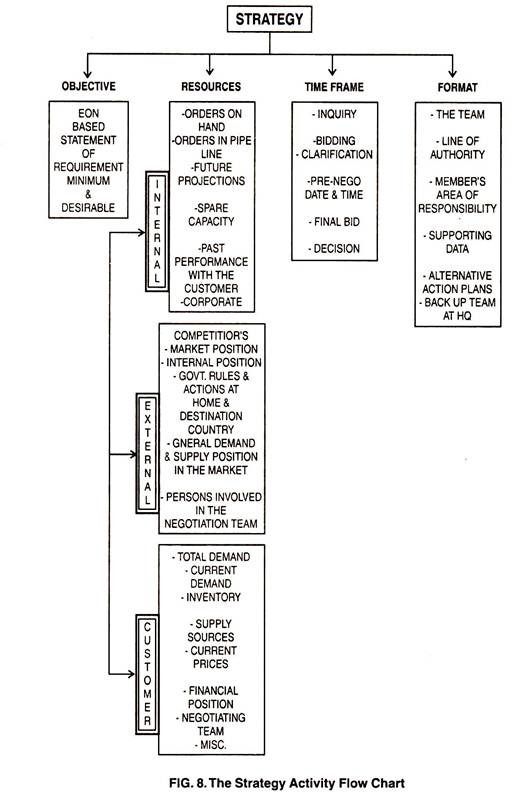

The basic elements of strategy are:

1. Objective:

You should have crystal clear objective. It should be a clear cut statement indicating what you want to achieve from the negotiation. Without this firm statement your position would be like that of a lost person. It is like the final destination.

Consider a case when you are at the railway station. If you know where you want to go than perhaps you will buy the ticket up to that destination, board a particular train starting at a particular time and arriving at a particular time at the destination.

When the destination comes you will know from the name and from the time elapsed that the destination has arrived. Now consider a case when the person boards the train but has no idea about the timing to the destination. So the chances are that either he will overshoot or undershoot, in both cases he loses time.

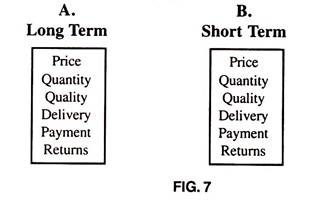

For strategic planning another variable is added in the form of:

a. Long term.

b. Short term.

Long term generally refers to bulk business stretched over specific time frame say yearly or longer and is of recurring in nature. Short term refers to spot or one time type business and can be stretched over couple of months but it is non-recurring type.

For any objective statement under A or B there are five sets of variables in price, quantity, quality, delivery, payment and returns. These five variables have sub-variables as well,

Price:

EX-WORKS, FOB, FAS, C&F, CIF etc. for bulk or packed. If packed then specify quantity each pack, or if containerized specify in 20′ or 40′ containers.

Quantity:

Make a decision on minimum and maximum acceptable Quantity and then make discount structure on increased Quantity load.

Quality:

Generally the quality levels are decided at the earlier stages of preliminary discussions and or negotiations, but it is advisable to prepare quality level price formats. This variable is much in use in steel business.

Within given international standards of steel the percentage of elements has slight variation like min and max. Certain elements are very expensive like nickel and chromium. Even one per cent variation has greater impact on the final price.

Similarly the physical properties like strength elongation and Yield point also play important role in final price determination. Knowing the customer’s past purchases some alternatives can be worked out at this stage so that if the customer diverts the negotiation in any of these areas the trader/negotiator must have readymade figures for countering the proposals.

Alternatively if the product in question has different quality levels than the negotiator has to prepare relevant price structures for them.

Delivery:

Be specific whether it is counted

From the date of the contract or

From the date of the receipt L/C

From the date of opening of L/C

Generally the standard delivery period is specified by the manufacturers, however different delivery options must be considered like immediate, extended or based on fixed frequency like monthly, quarterly, half yearly etc. Sometime quantity aspect can be linked to these delivery periods. The decisions are made depending upon company’s current position and future projections.

Payment:

The most common payment method is by way of Letter of Credit or simply the LC, which should be confirmed, without recourse, at sight, for 100% of the contract amount.

There are some variations, like:

(i) Payment at sight.

(ii) Payment at 30 or 60 or 90 or 180 days sight.

(iii) Payment on collection basis.

(iv) Payment by Telegraphic Transfer or TT remittance.

a. After receipt of goods.

b. After confirmation of the shipment.

(ii) & (iii) involve bank interest for the duration and this has to be added to the net cost. The first is the most common form of payment and as far as possible stick to it during negotiation. The last one is most beneficial to the importer since this way the LC opening charges can be avoided. This alternative must be used in situations when competition is on neck to neck basis and a few DLS can be the deciding factor.

Return:

This refers to the commission part for the trader negotiator. It is indicated as % figure of the net volume of the contract. Generally for short-term business the net return is on the higher side and for long term business on the lower side. The net figure is a variable factor. It is fixed at the beginning of the negotiation and is touched only when there is no alternative.

Business is not charity, so the trader negotiator has to make some degree of profit for his survival in the market place. It is advisable to keep the minimum figure in mind when going for negotiation. Use it as the last card during negotiation.

However there are cases when a trader might forgo total commission but he does it on purpose and that is to make an entry into the business especially for the spot type of business. But for long term business the minimum figure is a must.

2. Resources:

There are two types of resources:

i. Internal.

ii. External.

The internal resources would include:

i. Financial position.

ii. Committed production, present and future.

iii. Available capacity.

iv. Future expansion projects.

v. Expected orders with identification, for

a. Assured.

b. Probable.

vi. Corporate policy.

vii. Market feedbacks on the customer specific and in general on the Company’s quality, service and availability.

viii. The negotiating team formation.

The external resources would include:

A. Competitor’s data, as much as possible, on the same pattern as above.

B. Market situation in general covering.

i. Total demand.

ii. Current demand.

iii. Inventory level.

iv. Supply sources and their demand & supply position.

v. Current price level and anticipated movement.

vi. Govt., policies having bearing on the market/product under focus.

3. Timeframe:

Any negotiation has a set time pattern, it has a beginning, and an end the total cycle is called the Time Frame. It is composed of various segments and an expert negotiator knows and understands their individual importance and their collective impact on the net outcome of the process of negotiation.

As matters of fact non-of the segments can be taken for granted. Because besides you there are many others as well trying for a winning combination and if you are not vigilant they might steal the cake right under your nose.

Generally any negotiation will have following segments:

(a) Inquiry stage.

(b) Bid preparation stage.

(c) Bid submission stage.

(d) Evaluation stage.

(e) Elimination stage.

(f) Negotiation stage.

(g) Decision stage.

(h) Agreement formation stage.

(i) Confirmation, enforcement, and execution of the contract stage.

Each stage has a set time period after which it passes over to the next one. In present competitive market situation at any given opportunity a number of competitor fights for the larger share of the business and try to outsmart others. Like what Winston Churchill said “We have lost a fight and not the war”.

Same situation exists in business. The fights are the various stages of negotiation and the final war is the agreement stage. One party might be losing ground in the initial stages or in between but a vigilant party will always roll back its position in the right course at the right time through skillful manipulation and negotiation.

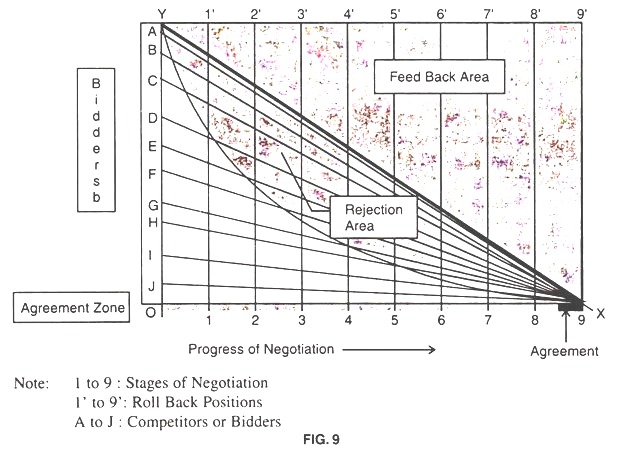

In Figure 8 a hypothetical case is described covering the said stages. This presentation should give a general idea how the system works.

Case:

A multi million dollars project involving technology plant and material sales, is divided into various segments each representing a time bound progressive activity staring from the inquiry till the signing of the agreement. The basic purpose is to make the readers realize the importance of the correct timing for action/counter actions to stay in and beat the competition.

The OY axis indicates the number of negotiators or bidders and the OX axis indicates the various stages of evaluation and elimination towards the final agreement stage. The number of bidders gets progressively reduced as the negotiation process advances. The elimination round starts on the technical parameters. In the first round all the non-conforming bids are eliminated.

There after starts the technical evaluation & elimination round. At this stage various clarifications and counter comments are asked from the bidders. At the end of this round the bids conforming to the minimum technical parameters are taken up for further consideration.

A short list of bidders is prepared who qualify for detailed techno commercial negotiations. This is the stage of serious consideration for those bidders who are left out, they have to use all available avenues to find out the reasons and prepare counter action strategy for remaining in the run.

The process continues till a final list of best two or three most suitable bids are left in the run. The selected bidders are invited for detailed discussions.

The bidders know each other and try best to outwit each other. At the end of techno commercial negotiations either the bidders are asked to submit final price keeping in view the changed technical parameters of their bids (if any) or a decision might be taken on the best bid for further detailed negotiation for formation of agreement.

Should the discussions fail due to any reason, the next best bid is taken up for consideration. This is the time when the other bidders mount highest pressure to stall and or roll back the situation so that their bids are taken into consideration.

There are cases when the national govt., of the bidders might intervene especially in cases when the funds are from those countries partly or in full in the form of untied credits and/or from the international financing institutions.

The projects falling under World Bank credit line are not falling under this category since the evaluation procedure is very refined and transparent. For instance in 1998 the Japanese govt., questioned the validity of NTPC recommendations in awarding a mega power project to an Indian bidder M/s Bharat Heavy Electricals Ltd. against the second lowest bidder from Japan. In this case the funding was partly financed under the Japanese untied aid to the Indian govt., till writing this para the outcome was not known.

9. The Types of Negotiation:

The process of negotiation can be carried in the following ways:

1. Verbal form of negotiation.

(a) Face to face negotiation.

(b) Negotiation over telephone.

2. Written form of negotiation.

3. Mixed form of negotiation.

This is the final stage when the negotiators face each other to conduct the act of negotiation. Face to face do not mean that they sit across the table, their interaction could be over phone fax telex letter or even couriers in any form.

This interaction could be split into two parts, the verbal form and the written form. The verbal form would include the face to face or over the telephone and the written form would include the letters, telex, fax or E-mail etc.

Both these types of negotiations have their own advantages and disadvantages and they have specific occasions when one form has preference over the other. The verbal form is always followed by written form but it may or may not be the case for written form to be followed by the verbal form.

The written form on one hand can seal the negotiation but verbal form opens it up. The best negotiation is the one in which always what is discussed is put in writing, so whether you do the verbal negotiation or the written, the final form is always the written form which only can take the shape of an agreement.

The written form of negotiation always gives you time and flexibility for checks and rechecks for the extent of what you are going to say and commit. The same is not possible in verbal form in which case you have to spontaneously evaluate before committing or saying, retracting comments is some time not only embarrassing but also cause loss of face or even reputation.

So whether you negotiate verbally and or in writing there are some thumb rules to be followed so that you do not fall in to a trap of your own creation or the one crafted by your opponents.

In the following lines we shall learn the basics of doing negotiation on the above forms. For better understanding the concept is explained in points form.

The Verbal Form of Negotiation:

In this case there are two sub divisions, one in which the negotiating parties sit across the table and negotiate, the second one is when they use electronic medium in the form of telephone including the “chat mode on the Internet” but excluding e-mail (E-mail will come under written form of negotiation).

(a) Face to Face Type of Negotiation:

What to do and what not to do for positive results during face to face negotiations:

(i) Spell out the underlying points that form the background.

(ii) Clearly refer to the last meeting points on the issue.

(iii) If there is an anticipated problem, set it right before your opponents have the opportunity to bring it out in their own version, for, if you sorted out yourself you may do so without creating more problems, but, if your opponents do so they would ensure that something is left behind to start all over again.

(iv) Be clear in your thoughts and perceptions.

(v) What is not clear to you will definitely be not so clear to your opponents so better not let it creep up in the negotiations.

(vi) Sometimes it is better to show ignorance and let the opponent do the talking, the more he talks the more he divulges and it is up to you to catch the information that he throws as he moves.

(vii) Get clarifications, when you are clear, more so when you are not so much clear. When your opponent is giving clarifications try to understand as best as you can. Change the topic, drag for some time on any relevant or some irrelevant issue and come back on the original point and get more clarifications.

Mentally compare the two sets of clarifications. If they tally more or less then take the clarification as true, otherwise point out the deviation in the clarifications and get clarifications. Repeat the process till you fully understand that what the opponent is saying is correct.

(viii) The communication theory says that 100% perfect communication is extremely difficult to achieve in practice especially for verbal form of communication. What we say and what we wanted to say, and, what we hear and what we understand that we heard is not always same either through intention or unintentionally.

Similarly what we understand and what was intended to be understood may also not be the same. While conducting verbal form of negotiations this factor must never be overlooked. You have to make sure that they is in no communication gap between you and the other party.

This can be achieved by repeating your point of view in different ways and then making sure that the other party has understood exactly in the same way as it was intended to be. This way the communication gap can be narrowed down to minimum.

(ix) Prepare a brief of the main issues on a piece of paper as a reminder to you on the scope of negotiations. This may also help you to monitor the progression of the negotiation, the moment you feel the negotiation is getting off track, bring it back to the main course.

(x) During the course of negotiation you have to be alert for the point at which the desired aim of negotiation has just been reached for that is the moment to conclude the negotiation.

(xi) The moment you conclude the negotiation put in writing what has been agreed, signs and seal never to reopen any point; the reopening of any point would restart the negotiation process all over again. Remember adjustment for one point may disturb the others, an agreement simply means that all the points have been systematically balanced to each other and the moment you change one all get upset and a new process has to be formed.

(xii) Be a good listener, best negotiators are best listeners as well, the more you listen the more you will know, the more you talk the more you give. The biggest problem with people is that they tend to talk and try to dominate the meetings; this is just what a good opponent would be expecting from you.

When we talk we give chance to the opponent to think and ask questions, the more we replay the more he asks to the extent that he drags out much more critical information from you which otherwise you would never divulge.

That way you make him more powerful party in negotiation. Best way is to listen and listen attentively, make notes, analyze and try to understand what the other party is saying. This gives you additional information to explore alternatives, which were not considered earlier.

(xiii) Never show your emotions for they tell a lot what you hide just keep cool and composed posture.

(xiv) Do not lose temper; the only party to lose tempers must be the other party and not you.

(xv) Whenever in doubt just ask yourself as to why you are at that place and what you wanted to do. Get rid of your doubts by asking focused questions not only to remove your doubts but also to obtain more useful information.

Never ask any question just to test the knowledge of the opponent, this tendency can damage the atmosphere and can lead to false start or create diversions. The questions that you ask must have relevance to the stage of negotiation process.

(xvi) Never have any pre-conceived notions and do not make any assumptions about what the opponent is planning or thinking.

(xvii) Never act smarter than the opponent. Always assume that everyone present across the negotiating table is smarter than you. Because the moment you start feeling that you are smarter than the other side, you virtually stop paying attention to the other party.

(xviii) Never be satisfied by the wording ‘ No Problem’ from the opponent. This statement simply means the opponent is trying to skip a particular point to which he doesn’t want to commit at that stage but surly sooner or later he will come back to that point but after gaining some degree of advantage from you.

To a ‘No Problem’ statement you must rephrase your statement and get his comments again, if you have properly rephrased your revised statement the opponent is bound to comment differently and closer to the factual answer.

(xix) The most commonly used phrase during negotiation is ‘ Your price is too high’ or ‘ can you offer better than that’. The buyers to extract better deal from the supplier commonly use this type of language. If you face such a situation always ask ‘ who is offering better price ‘ or ‘ How much is my price high and compared to whom’.

For the next statement you must ask ‘ what better deal that you are thinking of ‘ or ‘ with whom you are comparing my offer’. You can further ask for detailed terms and conditions of the other offers that the buyer had received and is equating your offer with them.

Such types of questions and counter questions can open up the opponent and you can get a better understanding of what exactly he wants and how closer you can go without altering your basic offer to him.

(b) Negotiation over the Telephone:

This is one of the most common tools used by the negotiators and the most powerful one as well. During the discussions on Communication, detailed coverage was given to telephonic communication; basics do apply in this case as well. It can be most powerful instrument in the negotiation process, but if not handled properly it can be the most destructive also.

Telephonic negotiations if not handled carefully can bring more harms than good. This rout of negotiation is generally used after sending the basic offer by a written medium like letter, fax, E-mail. This is a sort of follow up action to find out the status of the offer. The buyer when ready normally will put up specific questions and that is the beginning of the tele-negotiation.

Following are the additional tips useful in tele-negotiation:

(i) Keep the offer copy ready in front of you.

(ii) Mark on the offer what additional information that you could not incorporate earlier.

Like:

a. If you have made an offer on FOB basis, than find out the CIF and C&F prices as well,

b. Discount structure,

c. Quantity discount structure,

d. Alternative delivery schedules,

e. Customer list,

f. Quality assurance details,

g. Alternative grades/spec/price/del etc.

h. Packing details and alternatives like shipment by break bulk and containerized,

i. Vessel availability,

j. Offer validity extension,

k. Current and future market situations,

l. Alternative payment methods, like at sight, at 60 days sight, at 120 days sight, etc.

m. Miscellaneous information.

(iii) Make a note of the possible questions anticipated and answers thereof.

(iv) Before making the phone call to the right person at the customer side, try to find out the status through other sources within the customer’s organization.

(v) Make sure you are not interrupted once you start the discussions with the customer over the phone.

(vi) As the discussions progress, keep writing down on a piece of paper and at the end of discussions repeat the points covered to the other party to confirm that what you have understood and said is exactly what the other party has understood and said.

(vii) After the discussions send a confirmation letter to the customer covering what was discussed and agreed with date and time of discussions.

(viii) If some information is to be supplied later on, confirm the timing and follow up strictly.

(ix) Make sure no body with in your organization tries to duplicate or add to what you have already discussed because in some cases the customer or somebody else in his organization might try to contact somebody else in your organization to gather restricted or unrestricted information.

(x) If due to some reasons you cannot agree to what the customer wants and you feel he is about to disconnect or terminate the discussions, leave your best offer with him and get confirmation as to when you can call him again. If he gives you the time and date than be sure the negotiation will restart again and the doors are not closed on you. Use the time gap to invite him over any pretext.

Written Form of Negotiations:

(i) Know exactly the what, when, how-much and at what price, are your wants.

(ii) Know exactly at that particular moment of time how closer your opponent is to your wants.

(iii) Know exactly the net difference in absolute terms of what you want and what the other side has given you so far.

(iv) Know what are the options with you.

(v) Analyze the options and chart out plans of action.

(vi) Know the strength of your defences and decide the lines of attack.

(vii) Prepare your contingency plans.

(viii) Make sure all your eggs are not in the same basket, if they are, partition them.

(ix) After you have done the above homework the time for action on the paper is ready for you.

(x) Remember what you are writing, is to the point, in simplest of the language, direct, has no room for any alternative interpretation, does not ring any alarm bell and most important, it conveys your sincere desire to proceed and conclude the deal.

(xi) Make sure the written proposal reaches the destination right in time.

(xii) Reconfirm the proposal has indeed reached the party intact and the other party acknowledge having received it.

(xiii) Whenever you communicate through fax telex or even letters, send copies using other means to make doubly sure.

(xiv) Put a time limit for the response and if the response does not come in time make direct contact to know the reaction. Remember in trading no communication is always a sign of bad things to come, and also in trading slow and steady never wins the game—they always lose the game. So while negotiating, make sure you do not follow these two proverbs.

The Mixed Negotiations:

Generally the negotiations are not always either in verbal form or in written form; they are a mixture of both, one has to know when to resort to which form. The negotiation is the ultimate of all earlier approaches to form an understanding on a subject. When the understanding reaches a point from where the two sides must resolve their differences is the point from where the negotiators must start to do so.

This is like the final approach for landing. Up to that point the negotiations may have been carried out in the written and or verbal form but the final or the concluding stage more or less takes place in the verbal form. The conclusion of the verbal form is again the written form in the shape of an agreement.

Thus we see the written and the verbal forms of negotiations go hand in hand but the written form always takes the final credit. So it would not be wrong to say that one must master the verbal form of negotiation for perfecting the written form, and vice versa, and learn to use them at appropriate time and in appropriate form both are two operational units of the same identity.

10. Negotiations Involving a Trader:

Traders play a vital role in the global trade; the period between fifties and nineties was dominated by the global trading organizations. The Japanese trading firms dominated the scene. They were thriving

on three major tools in the global trade, the communication, information and cheap and abundant finance.

But with the entry of the Internet during late eighties and early nineties they started loosing their powers. The final jolt was the banking reforms initiated by the World Bank which introduced banking reforms so that the free flowing funds at dirt cheap rates were no longer available to these global trading firms.

That was the time their role to some extent diminished. Most of the global trading firms are scaling down their operations since the 1990-1991 period. Till date many have perished and those that survived are redefining their operations and restructuring to withstand the impact of changing trading environments.

Despite these limitations the trading firms have deep roots in the economic and commercial fabric of the global trade so the fittest are still surviving and taking active role in the world trade but with different approach.

Instead of being Import/Export organizations they developed into more focused organizations specializing in core businesses of investment, development, financing, research, and marketing. As such whenever we study the global trade the role of these catalysts of the trade cannot be neglected.

The basic operational side of business for these global trading firms has not changed much. They still do their business as an individual identity or by being associated with either the importer or the exporter.

The position of the global trader could be along with side A or with side B or in between them. In other words they can act as intermediary for either of the parties, or even act as the prime contractors. Let us consider these three situations briefly.

Situation-1. “Trader as the Prime Contractor”:

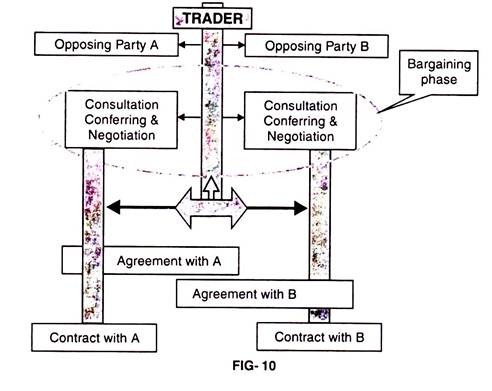

For a hypothetical situation we will position the trader in between the two opposing sides, from this position the trader would be doing the negotiation with both the sides simultaneously or one by one, he would be following the steps of consultation conferring and bargaining with both the parties all aimed at arriving at a negotiated settlement in the form of an agreement which he will convert in to contracts with both the importer and the exporter.

In fact there will be two contracts one between the trader and the exporter, and the second between the trader and the importer. This situation can be represented as in fig. 10.

In the above hypothetical situation the trader is acting independently with the parties, the importer and the exporter. Under such conditions the trader finally takes title to the goods.

He negotiates with the exporter and buys the goods/services for a price under one contract, and then re-negotiates with the importer to sell the goods / services for a price under another contract. The price difference between the two contracts is the profit/loss margins of the trader.

The risk involved in this situation is the highest for the trader. The trader is expected to negotiate the best terms from the seller (best quality, right quantity, lowest price and most favourable payment terms) and he would transfer the title to the buyer at revised best terms, which would include the same quality quantity, but at highest price.

The risk factor involved in this transaction is the price movement during the intervening period.

If there is slump in the market and prices crash or if the market firms up and prices shoot up, the resulting difference between these two extreme conditions would be the extent of risk that the trader would be taking in this level of transaction and his approach to negotiation would be guided by this factor.

As a matter of fact the traders tend to take minimum of the business risk, and whatever risk they take they off load as soon as possible to the other parry so that the period they sit on the risk is minimized and so is the net risk to them.

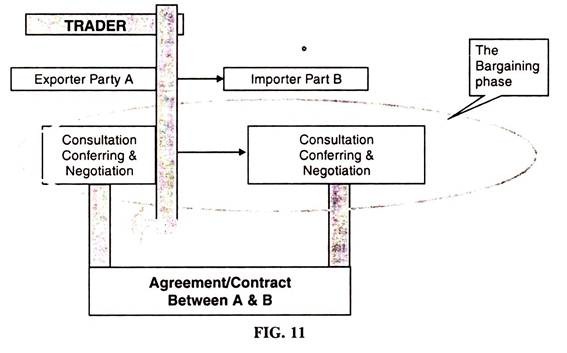

Situation 2:

In this situation the trader does not take title to the goods but acts on behalf of either the exporter or the importer. In the diagram given below the trader acts on behalf of the exporter. In the following two situations the trader bargains with the opposing party but the party that he stands with the only consults and confers.

Situation 3:

In this last situation the trader acts on behalf of the importer. The risk factors are the same as those of the earlier case.

In the above situations the risk factors are rather minimum because the trader only acts in both the situations on behalf of either the exporter or the importer. The title remains with the related party and changes hand with mutual agreement.

The role of the trader is limited to bringing the two parties closer to each other and the scope of the negotiation is limited mainly to detailed commercial terms and conditions because on the quality the trader had already settled quantity and price prior basic understanding.

When the contract is signed it will be between the exporter and the importer. The name of the trader generally does not appear on the body of the contract, or at the most he is mentioned as the coordinator for the related business.

In these two situations the two sides know exactly what the other had offered whereas in the first situation only the trader knew what each party has offered and at what price the deals have been concluded with them. The role of the trader in these situations could be better understood to that of specialized service.

This service makes the things easier for the party that he is working with and his utility would depend on the quality and continuity of service that he renders. The trader in these two situations would heavily depend upon his capabilities for communication skills, depth of information, and past experience to help his chosen party to get the best out of the negotiation from the opposing party.