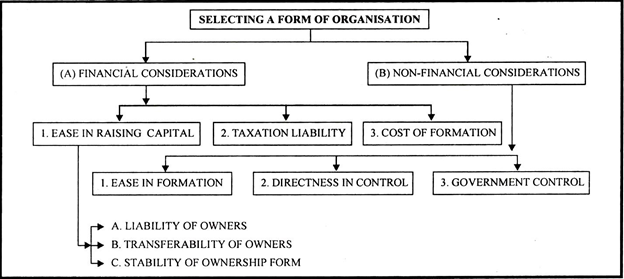

This article throws light upon the top two factors influencing the selection of a particular form of ownership. The factors are: 1. Financial Considerations 2. Non-Financial Considerations.

Factor # 1. Financial Considerations:

Financial considerations are mainly concerned with the raising of capital, taxation liability and cost of formation.

These factors have been studied as such:

(A) Ease in Raising Capital:

One of the important financial considerations is the capacity for raising capital. The funds are raised either from owners or from outside sources. The outside sources may include debenture-holders, financial institutions, commercial banks, etc. The capacity of raising funds is influenced by the liability of owners, ease in transfer of ownership and the suitability of form of organisation.

(i) Liability of Owners:

The raising of creditor’s capital is influenced by the liability of owners. In case the business debts are not met from business assets then property of owners may be used to pay business debts. Different forms of organisations have varying liabilities of owners. In sole-proprietorship the liability of owners is unlimited.

The personal property of the owner can be used to meet business obligations. From the owners point of view this may not be a favourable factor but outsiders extending loans and credits to the business favour unlimited liability. They can claim their debts from the property of owners if their claims are not met out of business property.

In partnership form of organisation also the liability is unlimited. The partners can be required to pay business debts if these are not paid from firm’s assets.

Following is the sequence for meeting various obligations:

(i) Business creditors have priority of payment from business assets.

(ii) Personal creditors have priority over personal assets.

(iii) After meeting personal debts, remaining assets can be used to pay business liabilities.

(iv) After meeting business debts, remaining assets can be used to meet personal liabilities.

A partnership firm may have a case in raising funds from outsiders. The lenders have the advantage of claiming their unpaid debts from personal assets of partners.

In company form of organisation the liability of members (shareholders) is limited only to the nominal value of shares held by them. They are not liable to pay business debts except to the extent of unpaid balance on their holdings. The limited liability of shareholders provides them protection against obligations of the business. In no case their personal property can be seized for meeting unpaid business dues.

The only exception in this form is of Guarantee Company. In this case the members guarantee to pay a specified amount of money at the time of winding up of the company. The creditors under this form are clear that dues can be claimed only against business assets.

From the point of view of liability the creditors or lenders will prefer sole-proprietorship and partnership forms of organisation whereas owners will like to have limited liability under company form of organisation.

(ii) Transferability of Ownership:

The transferability of ownership is also an important factor which influences the selection of a particular form of organisation. There is no restriction on transfer of ownership under sole-proprietorship. The process may be time consuming because of long-drawn negotiations and difficulties in valuing the business. In partnership form of organisation too there is no legal restraint on transfer of one’s share to another.

Section 27 of Partnership Act has put one restriction that no partner can transfer his share in the business without the consent of other partners. Even if there is no objection from remaining partners to the transfer but valuing the business assets, goodwill, etc. is not an easy task.

The negotiations for transfer may also take too much time. In contrast to these forms of organisation the transfer of ownership (shares) in a company is an easy affair.

The members can transfer fully paid shares to any person without any permission from the company. There are restrictions on transfer of interest in a private limited company but a public limited company cannot restrict such transfer.

Any provision in the Articles of Association of a public company restraining transfer of shares is void. From the point of view of transferability of shares the company form of organisation is most suitable.

(iii) Stability of Ownership Form:

The stability of ownership form of organisation is also an important consideration in influencing rising of capital. Form of ownership which has continuous succession is certainly preferred to those which have uncertain life.

A sole-proprietorship form of organisation exists only so far as owner is there. It dies with the death of the proprietor. Even if sole-proprietorship is continued by some successor, it will not be the same business. The new owner will have his own attitude and way of working.

A partnership firm can be dissolved by a mutual agreement. It can also be dissolved on the death or insolvency of a partner. It may be said this form of organisation too has less stability. The company form of organisation has perpetual secession.

Its existence is not distributed by the transfer of shares or death of shareholders. Shareholders may come or go but the company goes on. It can also be wound up under certain situations but its continuity is much longer as compared to other forms of organisation.

A comparative analysis of various forms of ownership, company form of organisation is better than other forms of organisation. It has more ease in raising capital and the chances of existence and expansion are better than those other forms of organisation.

(B) Taxation Liability:

Tax liability is another important factor is selecting a particular form of legal organisation. However, in some cases taxation burden may be ignored altogether. If a business is to be run on a small scale basis then sole-proprietorship will be a suitable form of organisation.

On the other hand, if a concern is to be set up on a large scale basis then company form of ownership will be a suitable form because only a company can raise huge funds. In such cases taxation liability is immaterial because a particular form of legal ownership will be the only suitable form. However, when there is a freedom of choice then taxation burden is certainly considered.

The income from a sole-proprietary concern is taxed on a slab system as the income of the owner. It has a tax free limit beyond which tax has to be paid. An partnership firm can be taxed in two ways: when it is registered under Income Tax Act and when it is unregistered. A registered firm is taxed as a separate entity first and the share of partners becomes a part of their income.

The rate of tax on a registered firm is nominal. An unregistered firm is taxed as a separate individual and the share of partners is added to their income only to determine the rate of tax. Tax liability of a company is heavier as compared to other forms of ownership.

It is taxed as a separate legal entity and does not have any tax exempted income. A flat rate of tax is used for taxing corporate income. The tax paid by a company is not deemed to be the tax paid by the shareholder.

A comparative study of taxation burden on various forms of organisation shows that a company pays more taxes. Its income has to pay double taxation. In comparison other legal forms of organisation have less tax burden.

(C) Cost of Formation:

A sole-proprietary form of organisation has no legal requirements. A person can start his business without incurring any expenditure. A partnership concern can also be started easily. Partnership Deed is the only document prepared by the partners. The registration of a partnership is also a simple affair.

A company form of ownership requires lot of formalities to be completed at the time of its registration. A number of documents have to be submitted to the Registrar of Companies for getting a company registered. Some legal expenses are also incurred for getting a company incorporated.

Though a company form of ownership requires large sums of money at the time of starting it, as compared to other forms but this expenditure is not given much weightage in selecting a particular form because registration costs are incurred only once in the life of the enterprise.

Factor # 2. Non-Financial Considerations:

Though financial factors are important and influence a decision about various forms of legal ownership but non-financial considerations too are important. The considerations like ease in formation, level of ownership control and government regulations also are taken into accounting while selecting a particular form of organisation.

These factors are discussed as such:

(A) Ease in Formation:

Sole-proprietorship is very easy to form. There are no legal formalities to be performed. Anybody wishing to start a sole-trade concern can do so without loss of time. There is no need to seek any permission from the government. A partnership firm can also be easily formed. No formal documents are required to be prepared.

A simple agreement among partners is sufficient to start a partnership firm. A partnership deed is not necessary though it is advisable to prepare it. Even the registration of a firm is optional. The registration procedure is also simple.

An application in a prescribed form along with some fees is to be submitted to the Registrar of the area. After satisfying the provisions of section 58 of Partnership Act, the Registrar makes an entry in the Register of Firms.

The company formation is not an easy task. A number of documents are prepared and submitted to the Registrar of Companies.

Following documents are required for registration:

(i) Memorandum of Association.

(ii) Articles of Association.

(iii) A list of directors, their full address and occupations

(iv) A written consent by the Director that they have agreed to act as such.

(v) A statement of authorised capital.

(vi) A statutory declaration by the Solicitor or a Chartered Accountant or an Advocate of Supreme Court or High Court that all the provisions of the Companies Act have been complied with.

In case these documents are found in order, the name of the company is entered in the register. These formalities not only take too much time but a number of expenses are also incurred. So, company incorporation is costly as well as time consuming.

(B) Directness in Control:

The managerial aspect of any form of organisation is very important. Sole- proprietary form of legal ownership is the most suitable of all the organisations. The management is in the hands of one person. The proprietor directs and controls every aspects of the business.

He may employ persons to assist him for different tasks. The proprietor can plan various activities as he likes. There is no interference in management from any quarter.

The partnership form of ownership is not well managed as compared to others. All partners take part in management and very often there is a lack of co-ordination among them. Every partner acts as an agent of the firm. The acts of partners bind the firm to the outsiders. Any wrong action on the part of a partner may create difficulties for the firm. If the number of partners is more then there may be less cohesion among them.

The management of a company is entirely in the hands of a group of persons elected by the shareholders. There is a separation of ownership and management. The shareholders elect the Board of Directors for managing the company.

If the shareholders feel that these persons are not managing the company well then new persons can be brought in through elections. The management of a company is well functionalised and it has better direction and control.

(C) Government Control:

The control of government or regulations regulating the business may not directly influence the selection of a particular form of organisation. It is the different forms of ownership which attract different government controls.

A sole-proprietorship or a partnership firm does not attract government regulations. A business under these forms of ownership can be started without performing any legal formalities. A company, on the other hand, attracts many provisions of Statutory Acts.

From incorporation to actual work a company will have to follow the guidelines of the Companies Act. This is essential because companies have more economic stakes and the interests of a large number of persons are involved.

There are no restrictions on taking sole-trade and partnership concerns to other states but a company does not have this freedom. There is a flexibility in operations in sole-proprietorship and partnership forms of ownership.

These concerns can change their activities without any permission from the government. But a company cannot take up a work which is not given in its Objectives Clause. From regulation point of view a company form of ownership has to operate in a prescribed way and cannot violate laws and procedures meant for it.