A project report on Multinational Corporation (MNC). This report will help you to learn about:- 1. Introduction to the Multinational Corporation (MNC) 2. Strategies for Launching a Multinational Corporation 3. Multinational Manager 4. Host Country 5. Management Functions 6. Managing People.

Project Report on Multinational Corporation (MNC)

Contents:

- Project Report on the Introduction to Multinational Corporation (MNC)

- Project Report on the Strategies for Launching a Multinational Corporation

- Project Report on the Multinational Manager

- Project Report on the Multinational Corporation and Host Country

- Project Report on the Management Functions in a Multi-Corporation

- Project Report on the Managing People in a Multinational Corporation

Project Report # 1. Introduction to the Multinational Corporation (MNC):

An MNC is an organisation doing business in one or more countries. These are international firms, having headquarters, (decision-making centres) in one country and sales offices and, in most cases, manufacturing facilities in many countries. They usually define their scope of operation as global.

Examples of MNCs are Pfizer Inc., Xerox Corporation, Coca Cola Company and IBM. These countries experience the bulk of their sales turnover outside the U.S.A.

MNCs are not only large, but they are growing as well. The MNC is the only organisation which has the resources and scope to think, to plan, and to act with worldwide planning of markets and resources. Many international opportunities require capital and technology at a scale only large MNCs can supply.

The globalisation of markets was perhaps the most important theme of business strategy in the 1980s. The creation of the United States of Europe (in the form of the single European market) may be another great achievement of the 1990s.

These two events and many others will make global management a topic of great interest to all. To achieve long-term business success, organisations must successfully adapt to a competitive environment based on worldwide competition.

MNC Decision:

The decision to go international is no doubt a major one.

Although various issues are involved the move to becoming an MNC essentially involves three primary decisions:

1. International market to be served:

Targeting a country (or countries) for international expansion involves considering various aspects of the prospective country’s environment such as market size (both current and potential) in the prospective host country, the country’s consumer wealth (per capita income and the pattern of income distribution), and the ease or difficulty of doing business in the market.

In assessing this latter criterion, international firms have to consider such factors as geographical location, language commonality, governmental business relations and the availability of the required skilled and other types of manpower. An overall evaluation of the prospective host country is based on various cultural, economic and political environments.

2. Products or services to be marketed:

In general, MNCs select those products (or services) that have performed well in their domestic market and introduce them into their chosen global market. This is known as the shot-in-the-dark method.

Other firms utilise a phased internationalisation approach, i.e., many utilise more analytical and ‘ desperate approaches to product or service selection. Marketing measures travel to the selected host country and conduct product market research to determine consumer needs in the overall product area in which the company does business.

Then the managers coming back have with them research and designs or product that fits the consumers’ needs. The new product (often some variation of the company’s product line) is then introduced into the host country.

In the language of Donnally:

“Regardless of the approach taken by an organisation, a successful international product (or service) requires primary attention to the needs, preferences and idiosyncrasies of the consumers in the selected host country”.

3. Mode of Entry:

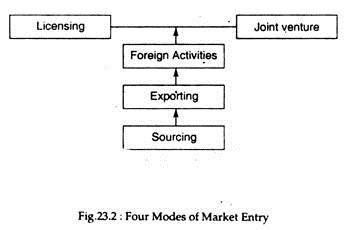

After selecting the market and product (or service) for international expansion an organisation must decide specifically how it will enter its selected market. Fig. 23.2 illustrates the three basic sequential strategies involved in market entry. These strategies are different but they have one thing in common: each strategy increases commitment to the international venture.

i. Sourcing:

This refers to the practice of using labour and raw materials in countries where labour costs and prices of raw materials are at the lowest possible level. In this context we use the term global resourcing.

ii. Export:

It is the easiest way to enter an international market because export involves selling a product without establishing manufacturing facilities elsewhere. Exporting involves a basic task: promotion to stimulate demand for the product, collecting revenues, making credit arrangements for sales and shipping the product to the market.

Furthermore, for small companies, exporting is the least complicated and least risky strategy for entering a foreign market. Since all production takes place at home, the strategy involves little or no change in the organisation’s basic mission, objectives and strategies.

In case any problem arises in the host country, an exporting organisation can quit easily and quickly. Small firms, having limited resources, also prefer the simplicity of exporting, relative to other strategies.

However, exporting is no doubt a very challenging task. When an agent is appointed to handle most or all of the exporting tasks, the organisation has little control over the overall exporting situation (i.e., over such factors as product price, advertising and distribution).

If the company itself handles most of the exporting tasks, it has to contend with differences in language, taxes, government regulations, customers inspections, different transportation systems and time differences.

iii. Foreign activities:

With an increase in the volume of exports, the firm may decide that it can now justify its own foreign subsidiary. The decision usually involves establishing production and marketing (distribution) facilities in the host country. This strategy differs from direct investment because it involves some form of association with a local firm or individual. This association may take two forms, viz., licensing and a joint venture.

Project Report # 2. Strategies for Launching a Multinational Corporation:

1. Joint Venture:

Perhaps the most popular strategy for launching a business abroad is joint venture. Under the joint venture agreement, a business joins with local investors to create and operate a business in the host country. Each investor is a partner and shares the ownership of the new venture.

An example of this is McDonald Corporation’s global expansion. Now, it has more than 2,000 outlets outside the U.S.A. The company requires that “its overseas partners adhere to the company’s strict production standards. While providing them freedom to be creative in marketing, new products and aspects of the outlet’s decor. Such autonomy enables the partner to develop an outlet that centres to local tastes and culture”.

Advantage:

The most important advantage to be secured from a joint venture is a low-cost and almost risk-free approach to establishing production and marketing operations abroad than direct foreign investment. Substantial gains can be reaped when partners with complimentary abilities pool their skills and resources in manufacturing and marketing a product.

Disadvantage:

The most important weakness of a joint venture is as approximately high rate of failure. The proximate cause seems to be various difficulties of joint ownership and management. The success of joint venture requires that two partners from different countries and cultures join hands and work together in setting common objectives and strategy and in operating the new business. However, emerging differences in management and cultural styles are likely to create major conflicts between the parties, as can different objectives for the ventures.

In the context, Donnally has put forward the following suggestions:

“Given the inherent difficulties of joint ventures, a company must thoroughly evaluate and carefully select joint venture partner. Selection has to be based on such factors as compatibility of venture objectives, similar value systems and mutual respect. Partners should reach agreements concerning mechanisms for resolving disputes and the specific roles of each partner in managing the venture”.

2. Direct Investment:

This is the most effective way for a global enterprise to begin producing a product without any association with a host country partner (investor), and is booming in international business.

Advantages:

There are various reasons for selling up or buying better facilities overseas, (a) Cost reduction. Prima facie, due to worldwide sourcing, direct investment reduces manufacturing costs due to lower labour and other costs; (b) Tariff avoidance. Secondly, direct investment enables a business to avoid various tariff and non-tariff barriers imposed on exports; (c) Building markets and maintaining control. Thirdly, direct investment is an effective means for building major national markets and for maintaining total control over international operations; (d) Image and confidence building. By paying taxes in the host countries, by providing jobs to the local people, a foreign firm can build confidence among consumers and receive more favourable treatment from the host government.

At the same time, direct investment entails a full commitment to an international venture. This is why when problems arise in the host country (e.g., market decline, economic depression, government instability), leaving the country is often very difficult and costly.

Project Report # 3. Multinational Manager:

Environment of the Multinational Manager:

In today’s business environment, top managers in global companies are faced with a challenge due to the pressure of diverse elements such as the mixed-economies of the Indian type involving nationalised enterprises that enjoy unequal advantages; the interdependence among economies of the industrial nations strongly affected by variances in trade patterns and exchange rates; the conflicting potential interests that affect trade and monetary policies; and, above all, widely varying social customs and contrasting cultures.

All of these elements converge with the international corporation aspiring to conduct business worldwide. Effective international management requires even more careful consideration and appreciation of potential differences in culture, politics, economic systems and societies, and last but not the least, technology.

Culture of the Multinational Manager:

Culture is no doubt a very complex environmental influence since it encompass diverse things such as knowledge, beliefs, laws, morals, customs and other habits and capabilities an individual acquires as part of society, it differs a great deal across national borders.

So the manager of a truly global enterprise must adapt its managerial practices to the specific and unique aspects of culture in each host country. So, the management of an multinational company must be “culturally sensitive in its business practices and learn to bridge the cultural gap that exists between its ways of management and business and those of the host country.”

In making these adjustments, management must be aware of the following three aspects of culture:

(i) Cultures are learned:

Culture is the totality of a human being — the sum of what humans learn in common with other members of the society to which they belong. Differently put, culture includes such diverse things as all types of learning and behaviour, the customs that people have developed for living together, their values and their beliefs of right and wrong.

(ii) Cultures vary:

Cultures differ across societies. Different social objectives are differently used. This is why we often find that behaviour valued in one society may not be much important in another. This cultural diversity influences individual behaviour by affecting individual perception.

(iii) Cultures influence behavior:

We find diversity in human behaviour in almost every human activity. Religious activities and feelings, beliefs, values, customs, work habits, food habits, social activities vary endlessly with cultural environment. Behaviour differences among people of different countries arise mainly due to cultural differences.

Culture is likely to affect behaviour in various ways. For example, the cultural environment determines the relative importance of needs and the means through which they are satisfied. Likewise, culture influences attitudes of individuals concerning the importance of work, authority, material possessions, competition, time, profit, risk-taking and decision-making.

Project Report # 4. Multinational Corporation and the Host Country:

Economic Influences:

Economic influences of a host country that substantially affect a multinational corporation’s performance include income levels, economic growth, inflation rates, and balance of payments. For this it is necessary for the multinational corporation to be constantly aware of each host country’s economic stability.

This can be accomplished through close monitoring of the role of inflation and currency stability. It is so because price differences can be a major factor in deciding whether the economic situation of a country fits the product or service a company is considering to market.

Politics:

Two major political influences in a host country environment that can substantially affect all of the management functions of an multinational corporation and can frequently determine the ultimate success of a multinational corporation’s international operations are : the characteristics of the host country government that strongly affects a multinational corporation and the concept of political risk, including how MNCs forecast and cope with political uncertainty in their international settings.

Concerning the host government, three factors most significantly influence, an MNCs operations and performance:

(i) Government attitudes:

Host country governments express their attitudes concerning international imports and investments with actions that can greatly help or hinder an MNC. Governments in LDCs like India that encourage investment often provide incentives to persuade foreign companies to establish manufacturing facilities there. Such incentives are often provided by LDCs who want access to the managerial skills, technology, capital, jobs and educational and marketing skills that an MNC can provide.

However, LDC governments often set requirements that seek to obtain as much value as possible for the MNC without affecting the country’s sovereignty. Most LDCs require ‘equity dilution’, where the majority ownership of the MNCs factory in the host country is transferred to a host country investor within a specified time period.

Again countries like India set a strict limit on foreign ownership of an MNC facility. India limits foreign ownership of a local factory to 51% and must approve the operation’s production capacity and entry into new markets. In 1977, IBM and Coca Cola company were forced to leave India.

The former left because the Government of India refused to agree to IBM’s worldwide policy of total ownership of its subsidiaries. The latter left India because it refused to comply with the government’s requirement that the company disclose its coke formula to its Indian partners.

Some LDCs also require that an MNC hire a minimum number of local citizens for employee and managerial positions to boost the area’s employment. Other LDCs require that the MNC sell its technology to local businesses. Many host countries set a limit to the amount of funds that an MNC can transfer out of the country.

(ii) Efficiency of Government:

MNCs have also to deal with the inefficient bureaucracies in many countries. Often, hardly any assistance is provided by foreign governments to MNCs. Customer handling procedures are inefficient and burdensome, and market information virtually does not exist. Systems of law in each country also vary enormously across nations.

(iii) Government stability:

The stability of the host country’s government exerts the maximum influence on an MNC. Highly unstable governments can jeopardize an MNCs operations. In most circumstances, an MNC may face expropriation due to change of government. The new government may force an MNC to exit without compensation. Nationalisation may occur, where the government forces the MNCs to sell its facility to local buyers.

In 1974, for instance, Saudi Arabia nationalised all the foreign operations in the country’s oil industry. Political risk due to government instability (such as unanticipated changes in the host country’s political environment) introduces a degree of uncertainty into an MNC’s operations in a host country. Macro-risk involves potential changes affecting all MNCs operating in a host country; micro-risk encompasses changes that affect only certain industries or firms.

Technology:

Technology affects at least four important variables such as production, jobs, interpersonal relationships and the structure of the organisations. And, it establishes an MNCs competitive edge.

A company’s technological superiority in multinational operations is often the major reason for its direct financial investment and commitment to international business. And, it is the task of international managers to determine how the levels of technology in foreign countries might affect their operations and sources of raw materials, energy and transportation.

Project Report # 5. Management Functions in a Multi-Corporation:

A. Planning Function:

The planning function of MNCs is different from those of domestic company. This is largely due to the fact that there is often a conflict between corporate objective [such as favourable balance of payments (BOP) or an improved standard of living of its citizens] and the economic and political objectives of the countries in which the firm operates. Conflict mainly arises due to profit motives.

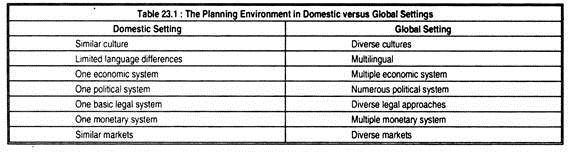

Some of the earnings of the foreign subsidiary must be returned to the MNCs headquarters. This outward flow of earnings may have a negative impact on the host country’s BOP. This is why most governments impose restrictions on MNCs. Table 23.1 presents some factors that can complicate the planning environment for the manager of an international firm. The larger the number of different factors, the more complex is the planning environment.

B. Organising Function:

After a company decides to go international and its planning function is on, an organisational structure must be devised to provide a structure of jobs and authority for achieving the organisational objectives. Organisational structures are also to be adapted to local conditions. Organisational effectiveness depends largely on flows of information.

And, it becomes more and more difficult to maintain these flows as geographically dispersed decision centres are established. This simply means that an MNC should have an effective worldwide communication system for transmitting information throughout the organisation.

Three Designs:

MNCs follow three organisational designs or employ three organisational structures:

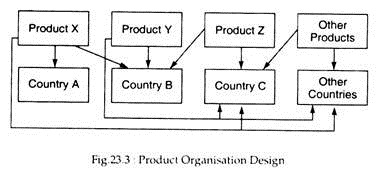

1. Product design:

An MNC following this type of structure assigns to a single unit the operational responsibilities for a product or a product line. This type of structure is widely used in MNCs having diverse product lines that are being marketed in geographically dispersed areas. Fig. 23.3 illustrates such a structure.

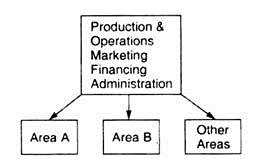

Geographical design:

This design is used by firms which do not have highly diversified product lines. MNCs using this design group all functional and operational responsibilities into specific geographical areas. Under this arrangement the area managers are given decentralised decision-making authority and they coordinate practically all of the operations within their geographic areas. The geographic design is illustrated in Fig. 23.4.

Fig 23.4 : Geographic Organisation Design

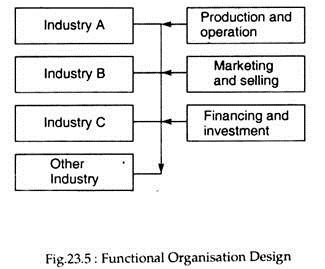

3. Functional design:

Under this organisational system, managers at the corporate headquarters, who report to the chief executive, are given global responsibilities for such functions as production, marketing and finance. Such manager is given the authority to plan and control global operations within the function he(she) manages.

This type of design is appropriate for MNCs having a limited product line and is used mainly by oil and gas in industries. The basic objective is to avoid duplication of effort. Such a design is illustrated in Fig. 23.5.

No organisation is suitable for all MNCs or for companies that operate only at home. For instance, geographical design is not suitable for an MNC in a high-technology industry. Instead, it would go for a functional design. A product design is not usually used by a company with relatively inexperienced managers.

Another factor that influences the organisation function of an MNC is the degree to which management is home-country oriented, host-country oriented, or global-oriented. In the ultimate analysis, organisation of a firm in foreign countries depends on how management views itself and the organisation.

C. Leading Functions:

Leading is an essential function in any type of organisation inasmuch as leaders are individuals who positively influence the behaviour of followers. Exercising influence in solving problems in international markets is sine qua non of successful global operation.

Leaders are of two types: formal and informal. Formal leaders are given positions of formal authority. Whether one is a leader or not depends on whether one is able to exercise the influence in various organisationally sanctioned positions of authority. By definition, a leader can help motivate others to complete tasks.

MNCs also have informal leaders or individuals who become influenced because they have special skills, expertise or charisma that meets the needs of others. The leaders of an MNC — formal and informal — are the influence centres of authority.

Exactly who is a leader and who is a follower is not always transparent. This is why we observe that of the four management functions, leadership is perhaps the most studied and least understood.

However, as more globalisation occurs, it will be necessary for MNCs to determine how leadership works in different countries.

D. Controlling Function:

The controlling function is extremely important in an MNC. The degree of complexity of the function increases as a company becomes more and more global. However, all types of control, viz., preliminary, concurrent and feedback can be applied in MNCs. However, implementation of control in the international environment requires the three basic conditions needed domestically: standards, information and design.

Standards:

In establishing standards for an MNC, due consideration has to be given both to overall corporate objectives and to local conditions. This necessarily involves bringing local managers into the planning process. These people are very useful at the controlling stage because they can provide input useful in establishing standards that contribute to organisation objectives without causing inter-cultural conflicts.

Information:

Correct information has to be provided. Such information should report actual performance and permit appraisal of that performance against standards. Here also problems arise due to differences in currencies and different rates of inflation in different countries. All these make it difficult to measure performance accordingly.

Finally, the long distances between subsidiaries and headquarters may, contribute to too much information — or too much irrelevant information — being fed into the MNCs decision of support system. This may create confusion and may adversely affect the decision-making process.

Management Action:

The final step of the controlling function is management action to correct deviations. Various possible actions can be thought of ranging from totally centralising decisions where all operating decisions are made at corporate headquarters — to giving complete autonomy and independence to international units.

In most cases, actions are taken by international managers with specific guidelines from corporate headquarters. But the fact remains that effective managerial control of a global enterprise is extremely complex but of strategic importance to an MNCs — its current operation and long-term survival.

Project Report # 6. Managing People in a Multinational Corporation:

Since motivational incentives and styles of leadership are influenced by diverse factors, effectiveness in managing people can vary from country to country. Effective management of an MNC requires managers who understand the needs, values and expectations of people in the nations in which the MNC operates. This is so because people’s attitude toward work, competition in the marketplace and perceptions of authority may vary greatly across cultures.

The leadership style, and motivational techniques that may be effective in industrially advanced countries like America, Canada and Great Britain probably would not work well in India, Taiwan, Mexico and other LDCs.

Due to differences in culture, the dominant needs of the people in different countries do differ. And due to substantial differences between the leadership styles and ways of doing business in many countries, an important issue in managing the MNCs facility in a host country is whether local or expatriate managers should start the facility.

An expatriate is an MNC employee transferred to the facility from the MNC’s home base or from a facility in some other countries. So far, the effectiveness of expatriate managers has been limited because of difficulties in adjusting to environmental differences in the host country and the lack of human relations skills required for effectively managing abroad.