The below mentioned article will help you to prepare a project report on Small Scale Industries in India:- 1. Introduction to Small Scale Industries 2. Role and Scope of Small Scale Industries 3. Concept 4. Characteristics 5. Classification 6. Objectives 7. Procedure for Registration 8. De-Registration 9. List of Items Reserved for Exclusive Manufacture 10. Assistance Provided 11. Advantages and Other Details.

Contents:

- Project Report on the Introduction to Small Scale Industries

- Project Report on the Role and Scope of Small Scale Industries

- Project Report on the Concept of Small Scale Industries

- Project Report on the Characteristics of Small Scale Industries

- Project Report on the Classification of Small Scale Industries

- Project Report on the Objectives of Small Scale Industries

- Project Report on the Procedure for Registration of Small Scale Industries

- Project Report on De-Registration of Small Scale Industries

- Project Report on the List of Items Reserved for Exclusive Manufacture in Small Scale Sector

- Project Report on the Assistance Provided to Small Scale Industries

- Project Report on the Advantages of Small Enterprises to Underdeveloped Countries

- Project Report on the Problems of Small Scale Industries

- Project Report on the Development of Small Scale Industries

Project Report # 1. Introduction to Small Scale Industries:

The role of small scale industries is significant in the over-all growth of the economy of our country. The role of small scale industries has been emphasised, from time to time, keeping in view the over-all plan objectives of economic growth coupled with social justice. The small scale sector has a distinct advantage of low investment with high potential for employment generation.

In order to create substantial employment opportunities, the Industrial policy laid stress on effective promotion and development of cottage and small scale industries in the country. The small scale sector continued to show impressive growth. The production of small scale industries during 1988-89 was estimated to be Rs. 106875 crores at current prices (Rs. 82400 crores, at 1984-85 prices) and provided employment to about 113 lakh persons during the same period.

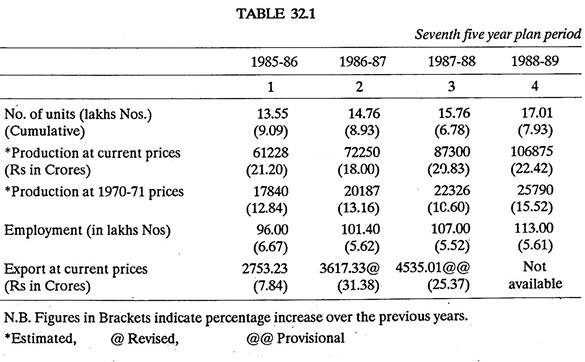

Exports from this sector were estimated at Rs. 4535.01 crores (provisional) during 1987-88 as against Rs. 3617.33 crores (estimated) during previous year. The exports of small scale sector in 1987-88 constituted about 29% of the total exports from the country. Table 32.1 shows the growth trend of small scale industries during the first four years of the Seventh Plan.

Project Report # 2. Role and Scope of Small Scale Industries:

(1) Small Scale industries provide vast scope for increasing employment.

(2) They are labour intensive and require comparatively little capital to start with.

(3) They help production of consumer goods and therefore can meet the demand for consumer products.

(4) They help reduction of prices.

(5) They accelerate the rate of industrial growth.

(6) They help in equitable distribution of national wealth.

Everyone, who has the spirit of enterprise in him, can contribute to the prosperity of the country by starting a small industrial unit.

Project Report # 3. Concept of Small Scale and Ancillary Industrial Undertakings:

A Small Scale Industrial Undertaking shall mean an industrial undertaking in which the investment in fixed assets in plant and machinery, whether held on ownership terms or by lease or by hire purchase, does not exceed Rs. 35 lakhs.

An Ancillary Industrial Undertaking shall mean an industrial undertaking which has both the following features, that is to say:

(a) The investment in fixed assets in plant and machinery whether held on ownership terms or by lease or by hire purchase, does not exceed Rs. 45 lakhs; and

(b) The undertaking is engaged or is proposed to be engaged in the manufacture or production of parts, components, subassemblies, tooling or intermediates or the rendering of services and the undertaking supplies or renders or proposes to supply or render at least 30% of its production or services, as the case may be to one or more other industrial undertakings.

Provided that no small scale or ancillary industrial undertaking referred to above shall be subsidiary of, or owned or controlled by, any other industrial undertaking. All such industrial units will be eligible to avail facilities such as credit on liberalised terms, allotment of factory sheds/plots in industrial estates, supply of machinery on hire purchase, participation in Government stores purchase programme, training and industrial extension services, allocation of indigenous raw material etc.

A tiny unit is an undertaking having investment in fixed assets in plant and machinery not exceeding Rs. 2 lakhs. When manufacture is carried out by the owner himself with the help of his family members or relatives or a few wage earners, it is said to be a cottage or household industry. Some such industries are handloom-cotton, Khadi, Gur, and Khandasari etc. A small scale industry, whether a tiny unit, a cottage unit or an ancillary industry, when set up in rural areas is referred to as a village industry.

How to Start a Small Scale Industry:

The steps involved in starting a small scale industry are:

1. Product Identification: Conduct Market Survey and study the products as regards their demand in the market. Check whether it is a seasonal product or it has demand throughout the year. Study similar products available in the market that can be probable competitors. Analyse them as regards their utility, quality and cost.

Find whether the product can be exported. Explore the possibility whether some product can be manufactured in collaboration with a foreign country. This provides readymade technical know-how and saves a lot of time and money otherwise wasted in developing a suitable method of manufacture.

Decide the product that you are going to manufacture, on the basis of:

(a) Market survey.

(b) Financial implications involved.

(c) Technical know-how available.

(d) Experience in the line, etc.

2. Preparation of preliminary project report to get rough idea on Machinery, raw material and financial requirements.

3. To decide form of ownership which may be sole-proprietorship or partnership etc.

4. To decide factory location.

5. To buy land or take built-up shed.

6. To invite quotations for machinery and equipment.

7. To prepare detailed project report which will include:

a. Analysis of Industry,

b. Present demand,

c. Future demand,

d. Requirement of equipment,

e. Raw material,

f. Labour,

g. Power,

h. Finance,

i. Breakeven analysis,

j. Profitability etc.

8. Apply for registration.

9. Plan finance.

10. Follow up sanction of loan.

11. Open bank account.

12. Place order for machinery.

13. Apply for Power.

14. Plan layout of machinery.

15. Apply for Income tax and Sales tax numbers.

16. Apply for (imported) raw material.

17. Recruit personnel.

18. Plan buying of raw material.

19. Conduct trial run to see whether the desired quantity and quality of product is Coming.

20. Decide on pricing policy.

21. Organise marketing.

22. Plan account keeping.

23. Plan commercial production.

Project Report # 4. Characteristics of Small-Scale Business:

(i) Small scale business is usually of proprietary character, i.e. the small enterprises are organised and run by individual entrepreneurs Nowadays partnership and co-operative forms of organisation are being adopted for promotion and growth of small enterprises.

(ii) Small enterprises are highly localised industries. They operate in a compact area.

(iii) Small enterprises require less capital. Capital invested in form of fixed assets-plant and machinery-shall not exceed Rs 60 lakhs and in case of ancillaries the limit is Rs. 75 lakhs.

(iv) Small enterprises are fundamentally labour-intensive units envisaging greater utilisation of available manpower.

(v) Small enterprises involve use of simple technology, intensive utilisation of individual skill leading to professional specialisation.

(vi) Small firms are optimum units employing limited number of workers.

(vii) Small firms cater to individual tastes and fashions and render personalised services to consumers.

(viii) Small firms are deemed as one of the ‘priority-sectors’ and are therefore eligible for Government assistance and patronage and also for concession and financing by banks, specialised finance corporations etc.

(ix) Small scale industries can be easily established without elaborate legal formalities.

(x) Small enterprises are flexible-capable of being adapted to changing tastes and demands.

(xi) Divorce between ownership and control does not exist in case of small enterprises and hence they are free from red-tapism and bureaucratic handicaps. Prompt and proper decisions are possible.

(xii) Shorter gestation period, moderate risks of loss, more intimate personal touch with labourers and consumers etc. are other characteristics of these industries.

Project Report # 5. Classification of Small-Scale Industries:

Small-scale industries are classified into five main categories:

(a) Manufacturing industries-producing articles for direct consumption as well as processing industries.

(b) Feeder industries-specialising in particular types of particular products and services, e.g., casting, electroplating, welding etc.

(c) Servicing industries-covering light repair shops necessary to maintain mechanical equipment.

(d) Mining or quarrying.

(e) Ancillaries-producing parts and components for light engineering products cycles, sewing machines, diesel engines, machine tools, mathematical instruments, office and household equipment, electrical appliances, air-conditioners, etc.

The Industrial Policy Resolution of 1977 envisaged the following classification of small-sector:

(a) Cottage and household industries which provided self-employment on wide scale.

(b) Tiny sector incorporating investment in industrial units in machinery and equipment up to Rs. 1 lakh and situated in towns with a population of less than 50,000 according to 1971 census figures.

(c) Small-scale industries comprising industrial units with an investment up to Rs 20 lakhs and in case of ancillaries with an investment in fixed capital up to Rs. 25 lakhs.

The Planning Commission has classified village and small-scale industries into two broad classes as given below:

1. Traditional industries; and

2. Modern small-scale industries including ‘tiny’ units and powerlooms

Traditional Industries, include handlooms, khadi and village industries, Semi-culture, handicrafts and coir. These industries are generally artisan-based, located mostly in rural and semi-urban areas, involve lower levels of investment in machinery and provide largely part-time employment.

Modern Small-Scale Industries and Powerlooms have certain degree of technological sophistication, use mostly power-oriented appliances, and are generally located close to or in the urban areas including the large industrial centres.

Project Report # 6. Basic Objectives of Small-Scale Enterprises:

Small enterprises in general aim at playing complementary role in the socio economic set up of a country. Its functional objectives are not only commercial but also social.

The basic objectives of small-scale business are:

(i) Providing increased employment opportunities on fair and reasonable terms.

(ii) Promoting production of a large variety of goods-specially consumer goods through labour-intensive methods.

(iii) Encouraging adoption of modern techniques in the unorganised traditional sector of the industry without causing any perceptible technological unemployment.

(iv) Facilitating an effective mobilisation of resources of capital and skill which would have otherwise remained unutilised.

(v) Integrating the viable small sector with the vital large scale-sector.

(vi) Encouraging and supporting the local talent and utilising local resources to achieve local self-sufficiency.

(vii) Avoiding the problems of unplanned urbanisation of industries,

(viii) Ensuring a more equitable distribution of the national income and a balanced industrial growth in different regions so as to lay down a basis for an essentially decentralised socio-economic set-up.

(ix) Creating a new cadre of small-entrepreneurs, professional and self employed experts.

(x) Correcting regional disparities in industrial growth through locational dispersal of small-enterprises.

Project Report # 7. Procedure for Registration of Small Scale Industries:

Registration of Small Scale Industrial undertakings would be done in two stages:

(a) Provisional registration.

(b) Permanent registration.

(a) Provisional Registration:

Provisional registration helps the party to take necessary steps to bring the unit into existence. It should be converted into a permanent registration once the unit comes into existence. The provisional/permanent registration are granted at the state/UT/district level by state D.I. or his designated authority.

A provisional registration is valid for one year in the first instance and thereafter may be renewed for a period of two more years in four six monthly extensions by the designated authority on submission of satisfactory proof that the party is taking concrete steps to establish the unit. The issue of provisional registration certificate normally should be automatic and should be given within a period of seven days after the receipt of the application.

The provisional registration may entitle the party to:

(1) Apply for a shed in an industrial area.

(2) Apply for power connection.

(3) Apply for financial assistance to State financial corporation/Nationalised Banks or other financial institutions on the basis of a project report as may be required by them.

(4) Apply to the NSIC/SSIC/other institutions for procuring machinery on hire purchase basis.

(5) Obtain sales tax, excise tax registration etc.

(6) Take other steps such as obtaining import license for capital goods/raw material etc.

(b) Permanent Registration:

When the party has taken all steps to establish the unit i.e.:

(1) Factory building is ready,

(2) All requisite machinery, testing equipment, etc., is installed,

(3) Power connection is obtained, application for permanent registration can be made.

On being satisfied after inspection that the unit is capable of production, a permanent registration certificate may be issued by the Directorate of Industries within one month of the receipt of application for permanent registration. All registered units should submit half yearly reports of the raw materials received/utilized, stocks on hand, production and sales to the Directorate of Industries in triplicate. The Director of Industries will maintain a list of all registered small scale units at his headquarters office.

Project Report # 8. De-Registration of Small Scale Industries:

A small scale unit already registered may be de-registered on any one or more of the following grounds:

(1) If the unit remained closed continuously for a period exceeding one year.

(2) If the unit failed/refused or avoided to give full and truthful information as called upon by the registering authority.

(3) If the unit has misutilised the raw materials allocated to it.

(4) If a unit is found to be a subsidiary of or owned or controlled by medium and large scale undertakings.

(5) If the fixed investment in plant, machinery etc., exceeds the ceiling prescribed for the unit.

Any unit aggrieved by the order of de-registration authority may appeal to the next higher prescribed authority as notified by the state Government within one month of the receipt of the order of de-registration.

Project Report # 9. List of Items Reserved for Exclusive Manufacture in Small Scale Sector:

A few of the many items reserved for exclusive manufacture in small scale sector are listed below. Detailed list can be had from Ministry of Industry, New Delhi.

1. Food and Allied Industries:

Ice-cream, pickles and chutneys, vinegar, bread, biscuits, poultry feed, synthetic syrups etc.

2. Textile Products Including Hosiery:

Cotton vests knitted, cotton socks knitted, cotton under garments knitted, woolen cloths, under garments etc.

3. Art Silk/Man-Made Fiber Hosiery:

Synthetic knitted socks and stockings, vests, briefs cardigans, pullovers etc.

4. Wood and Wood Products:

Sawn timber, wooden crates, sewing machine covers, tent poles, handles, furniture etc.

5. Paper Products:

Waxed paper, decorative papers, corrugated papers and boards, paper bags etc.

6. Leather and Leather Products Including Footwear:

Sole leather, hides, shoes, leather garments, purses, hand bags, watch straps etc.

7. Rubber Products:

Rubberized cloth, canvas hoses, cycle and rickshaw tyres and tubes etc.

8. Plastic Products:

Full PVC footwear chappals, sandals, shoes, acrylic sheets, spectacle frames etc.

9. Injection Moulding Thermo Plastic Products:

Handles, soap cases, cups, lunch boxes, water jugs, tumblers, hair brushes etc.

10. Chemicals:

Ammonium sulphate, cadmium acetate, cobalt nitrate, ferrous sulphate etc.

11. Dye Stuff:

Basic dyes-basic yellow, basic green, basic blue etc.

12. Organic Chemicals and Drugs:

Tartrates, sterate of zinc, paracetamol, resin etc.

13. Glass and Ceramics:

Fire clay, bricks and blocks containing less than 40% alumina.

14. Roofing and Flooring Tiles:

Wooden, clay and granite tiles.

15. Mechanical Engineering Excluding Transport Equipment:

C.I. manhole covers, weights, circlips, bright bars, etc.

16. Electrical Machines, Appliances and Apparatus Including Electronics:

Transformers, boosters, voltage stabilizers, PVC wires etc.

17. Bicycle parts, survey instruments, sports goods, stationery items, clocks and watches etc.

Project Report # 10. Assistance Provided to Small Scale Industries:

Financial Assistance:

A network of:

1. State financial corporations,

2. National Small Industries Corporation (NSIC) and State Small Industries Corporations (SSICs),

3. State Directorates of Industries,

4. Commercial Banks,

5. Industrial Development Bank of India, and

6. Regional Rural Banks, provide financial assistance to small scale units.

Industrial Development Bank of India provides re-finance to the industrial loans advanced by these institutions to small scale sector.

1. State Financial Corporations (SFCs):

State Financial Corporation grants term loans for the purchase of land, construction of factory premises and purchase of machinery and equipment for the setting up of new industries or for expansion or modernisation of the existing ones. SFCs generally prescribe a margin of 25% and allow an initial holiday of two years for the loan repayment (this period can be increased to five years in backward districts).

2. NSIC and SSICs:

NSIC and SSICs supply machinery on hire-purchase basis to small scale and ancillary industries, the value of which should not exceed Rs. 35 lakhs and Rs. 45 lakhs, respectively, inclusive of the value of machinery and equipment already installed. The payment for the machinery and equipment is made directly to the suppliers.

The hire-purchase value is generally recovered in 13 half-yearly installments and a rebate of 2 % allowed if the installments are paid before the due date. While NSIC supplies both imported and indigenous machinery, SSICs supply only indigenous machinery.

3. State Directorates of Industries:

State Directorates of Industries extend assistance ranging between Rs. 10,000/- and Rs. 50,000/- for the construction of a factory premises, purchase of machinery and equipment and working capital. These loans are repayable in five to seven years.

4. Commercial Banks:

Commercial banks provide short term and medium term financial assistance. The short term credit facilities are granted for working capital requirements of the units like those for raw materials, goods-in-process, finished products, bills receivables and book debts. The medium term loans are granted for the acquisition of land, construction of factory premises, purchase of machinery and equipment and operative expenses.

These loans are generally granted for periods ranging from five to seven years. They also establish letters of credit on behalf of their clients favouring suppliers of raw material/ machinery (both Indian and foreign) which extend the bankers’ assurance for payment and thus help their delivery.

Certain transactions, particularly those in contracts of sale to government departments, may require guarantees being issued in lieu of security/earnest money deposits for release of advance money, supply of raw materials for processing, full payment of bills on assurance of performance, etc. Commercial banks issue such guarantees also.

5. Industrial Development Bank of India (IDBI):

The IDBI, the apex development body for small, medium and large industries, extends assistance to SSI units through two major schemes:

(a) Bills Re-Discounting Scheme:

Under this scheme the manufacturers of indigenous machinery/capital equipment can offer deferred payment facilities to their buyers (the period of such payment being not less than six months and not more than five/seven years), the relative bills accepted/ guaranteed by the buyer and or his bankers, can be discounted by the manufacturer with his own bank to realize the cost of machinery immediately.

The latter, in turn, rediscounts the bills with the IDBI and obtains the amount paid. Subsequently he takes them back before their due dates and presents them for payment before the buyer/his guarantor.

(b) Refinance Scheme:

Under this scheme IDBI refinances eligible term loans granted by banks to the SSI borrowers.

6. National Bank for Agricultural and Rural Development (NABARD):

The National Bank for Agricultural and Rural Development was set up in July 1982 to provide re-finance assistance to State Co-operative Banks, Regional Rural Banks and other approved institutions for all kinds of production and investment credit to small scale industries, artisans, cottage and village industries, handicrafts and other allied activities.

Other Assistance Provided to Small Units:

(1) Supply of machine and equipment on hire-purchase.

(2) Supply of scarce raw materials and imported components.

(3) To demonstrate to them the use of modern technical processes and equipment.

(4) To train small industrialists.

(5) To render marketing (including export) assistance.

(6) Allotment of sheds.

(7) To provide power, water and transport facilities.

(8) To provide subsidy on fixed capital investment (i.e., land, building and machinery).

(9) To provide interest free loans.

(10) To provide loans at concessional rate of interest.

(11) Reservation of items for exclusive production in small scale sector.

(12) Reservation of items for exclusive purchase from small scale sector.

(13) Export promotion of specific commodities or groups of products such as chemicals, Gem and Jewellery, Handloom, Leather products etc.

Special Incentives:

(a) Special inducements are offered for development of entrepreneurship among the persons in hilly, rural and backward areas. For example, transport subsidy is given in remote and hilly backward areas in selected states/union territories. Capital subsidy up to 15% is also given to persons setting up their units in specified backward areas.

(b) New entrepreneurs are exempted for five years from income tax payment on their profits, up to 7.5% P.A. of the capital invested.

(c)Entrepreneurs are entitled to deduction of depreciation (on building, plant and equipment) out of the net profit.

(d) Entrepreneurs are completely or partially exempted from payment of central excise duty.

(e) Concessions are also given in stamp duty payable on the agreements and mortgage deeds executed to take loans from the government.

(f) Sales tax is not charged on machines purchased for setting up small scale industries in certain states.

(g) Import licences are given to those entrepreneurs who require raw material, machines and their spares to be purchased from other countries for running their units successfully.

(h) Training courses are organised exclusively for women entrepreneurs in technical and management subjects, in order to provide them opportunities for self-employment. They are also assisted in preparing projects on specific industries.

(i) Indians residing abroad and desirous of starting industries in India can bring machinery up to C.I.F. value of Rs. 25,00,000 and raw materials worth Rs. 5,00,000 or annual requirement of the unit, whichever is less. In addition to this, they are also given all the facilities normally available to all other prospective entrepreneurs in the country.

Assistance to Educated Unemployed:

With a view to help the educated unemployed to set up their own small industrial units, the state provides assistance in a package form so that they may take minimum possible time to set up their ventures.

The following types of assistance is made available, under this scheme:

1. Project Profiles:

In order to help the entrepreneurs to choose items of manufacture, the Directorate gets project profiles prepared from reputed consultants on items of manufacture having scope for sale. This enables the entrepreneurs to know the viability of manufacture of various items at the first instance.

2. Training:

The training enables the entrepreneurs to prepare the project report according to their requirement, government documentation and various other aspects of the manufacture/marketing of the items of manufacture.

The trainees are also given a stipend. In-plant training is also provided to the entrepreneurs through the State Government Quality Marking Centres and Industrial Development Centres. Besides Entrepreneurship Courses, Management (marketing, export, production, finance, personnel. etc.) and Technical Courses (tool maker, machinist, foundry-men, electroplating, foot wear manufacture, etc.) are also run by Small Industries Service Institutes (SISI).

3. Seed Money:

The educated unemployed after getting their major loan sanctioned from financial institutions are provided seed money to the extent of 10% of the cost of their project. This 10% is recoverable in 5 installments after their major liability of financial institution is over. This proportion of financial assistance is given at a nominal rate of 4% only and is counted as entrepreneurs own equity for the purpose of financial appraisal of their scheme.

4. Interest Subsidy:

Degree and Diploma holders is Engineering, who pass three month entrepreneurship course from the Institutions prescribed by the Government of India are eligible for the interest subsidy. The entrepreneurs have to pay only 7% rate of interest on loans sanctioned by financial institutions. The difference between 7% and the rate of interest to be charged by the financial institutions is reimbursed to the entrepreneurs by the state government. This facility is available only for a period of three years.

5. Educated Unemployed are Given Industrial Accommodation on Priority:

This scheme covers all educated unemployed youth who are matriculate and are within the age group of 18-35 years. Women and technically trained persons are given due consideration/weightage. From 1986-87, a minimum of 30% of the total sanctions has been reserved for Scheduled castes/Scheduled Tribes persons. ITI passed youth are also now eligible to set up industry/service ventures.

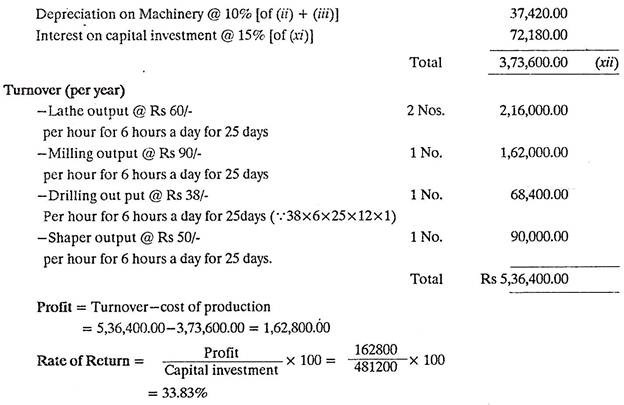

A Model Scheme to Start a Small Scale Industry for Example a Jobbing Workshop:

A jobbing workshop can undertake job order work which is available in plenty from large and medium scale industries, for example, a large or medium industry manufacturing Tractors can give job orders to make fuel tanks, silencers, etc.

Basis and Presumption:

a. The scheme has been made on the basis of 75% efficiency on single shift considering 25 working days in a month.

b. The rate of interest has been taken on 15% at an average.

c. The job work will be procured from outside industries along with raw material.

Process outline:

(a) Turning.

(b) Boring.

(c) Milling.

(d) Drilling.

(e) Heat-treatment if required from local units.

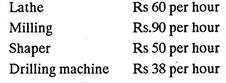

Rate of Machine:

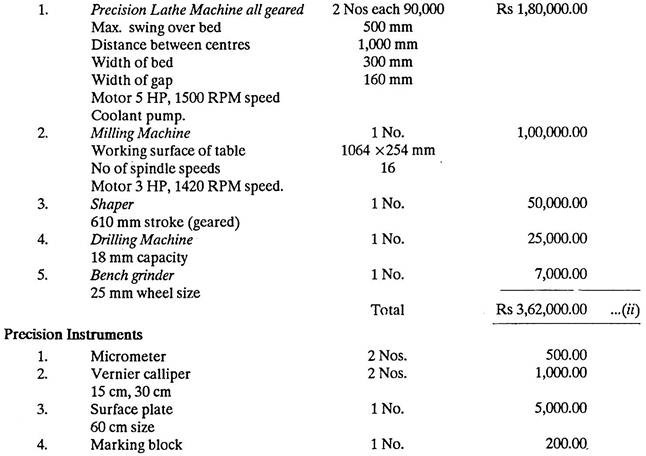

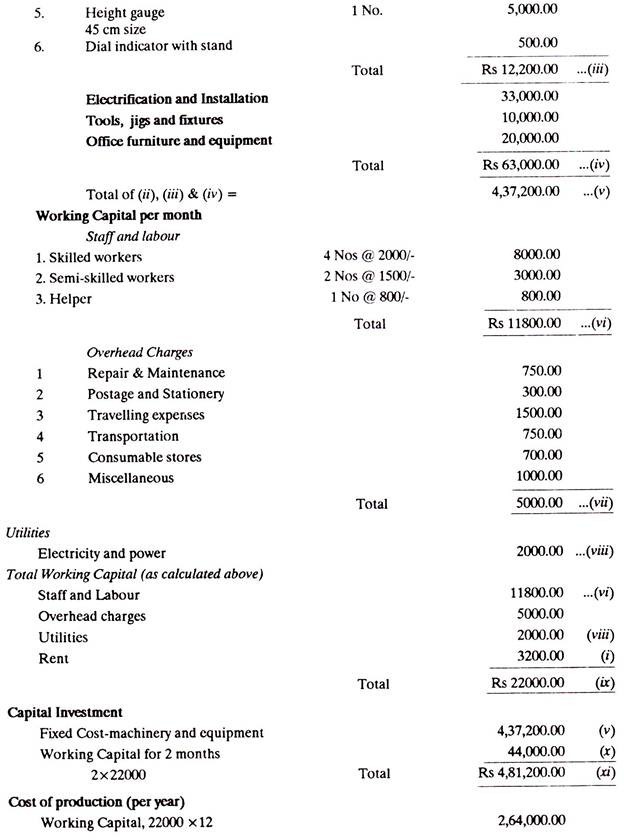

Land and Building:

Machinery and Equipment:

Project Report # 11. Advantages of Small Enterprises to Underdeveloped Countries:

It is stated that “small industries are more suited to an underdeveloped country and their progress will mean development of our economy”.

The advantages that accrue to the economy of a developing or underdeveloped country including our country by the development of small enterprises are summarised below:

(i) Small enterprises located in rural areas provide employment to rural artisans and landless labourers and thus check the incidence of migration to urban areas.

(ii) Small enterprises have larger employment potential compared to large scale units. “Problem of surplus man-power will be solved by the small industries.”

(iii) Development of small enterprises will to a large extent remove the drawbacks of capitalism, viz., monopoly, abnormal profiteering, concentration of wealth and economic power in few hands etc. They would pave way for equitable economic relations in industrial set-up of a country.

(iv) Small enterprises avoid concentration of industries in a particular area. There would be dispersal of industrial growth through a network of small enterprises all over the country. Regional imbalances, over-crowding of industries in a few metropolitan areas, and undesirable urbanisation will be curbed by small enterprises.

(v) New but simple techniques of production can be adopted more easily by small enterprises without much investment and without causing technological unemployment.

(vi) Small enterprises foster individual skill and initiative, promote self- employment particularly among the educated and professional class.

(vii) Small enterprises seek to reconcile productivity with the pattern of decentralised process of industrial growth.

(viii) Savings in social overheads like education, housing, medical facilities etc. can be made by “having industrial growth.”

(ix) Savings in social overheads like education, housing, medical facilities etc. can be made by “having industry nearer to people.”

(x) Small enterprises result in higher national income, higher purchasing power of people in rural and semi-urban areas and thus a higher standard of living of the masses.

Project Report # 12. Problems of Small Scale Industries:

The impressive growth and diversification of the small-scale sector notwithstanding a number of constraints continue to impede the development process in this sector.

Some of these are as follows:

(i) Management:

It is a patent fact that very few among our small entrepreneurs are equipped with the requisite managerial skills and have access to the services of technically qualified personnel, essential for the efficient operation of their enterprise. Management education being essentially oriented to the needs and requirements of large business complexes, there is a dearth of managerial talent which can be absorbed in small scale enterprises.

(ii) Technical Consultancy:

Another lacuna that has course to the fore relates to technical consultancy. Clearly, with several units in the small scale sector having ventured into sophisticated area of manufacture, requiring a high degree of technical skills and precision hitherto the sole domain of the large scale sector the demand for such services has stepped up to an extent that far outstrips the supply.

It needs to be emphasized here that the level of technical experience required for the small enterprise, today, would have be far move sophisticated than what would have sufficed with the traditional units based on simple technology.

(iii) Marketing:

The average small entrepreneur has often to contend with the limitations of a restricted market for his products. This gets magnified when small entrepreneurs are engaged. Independently in the production of consumer items the threat of competition from large units often forces the former to operate at very low profit margins resulting in retarded growth and at times closure of the units.

Given the demands and challenges of a competitive environment, the need for a strong and vibrant small scale sector assumes importance.

A few suggestions towards achieving this objective are as follows:

1. Availability of Management and Technical Expertise

2. Modernisation of Plant and Equipment

3. Satisfaction of Credit Procedures

4. Marketing

Project Report # 13. Development of Small-Scale Industries:

Due to the vigorous measures undertaken by the Government after independence, small-sector has registered an impressive growth. Small-scale industries, handicrafts, village industries etc. which had suffered drastic setback during British regime were given special attention by the Government after independence, so as to revive their vitality and strengthen their position in the integrated industrial set-up of the country.

Their chronic problems like lack of credit facilities, obsolete techniques, absence of marketing avenues, competition from large-sector were sought to be solved through direct and indirect assistance by the Government in the form of institutional arrangements for credit, tax-rebates, subsidies, reservation of certain items for small sector etc.

In order to provide specific support to the small-sector, the national agencies like ‘Small Industries Development Organisation’, ‘Small Industry Extension Training’, ‘National Small Industries Corporation’ was established.

Besides these Khadi and Village Industries Commission, All India Handicrafts Board, All India Handloom Board, Coir Board, Central Silk Board etc. have been set up to promote particular categories of small-scale crafts and industries. Industrial Estates, District Industries Centres are other institutional agencies designed to build up infrastructure for small-industries.

Small-Scale Sector in the Plans:

The allotment made in the First Plan for village and small scale industries amounted to Rs. 42 crores of which Rs. 5 crores were meant for small-scale industries. The Second Plan allotted Rs. 200 crores for small sector (village and small-scale industries) of which Rs. 61 crores were for mechanised small-scale industries.

During the Second Plan period about 60 industrial estates comprising 1000 small factories were set up. A number of items like bicycles, hand tools sewing machines, electric motors, fans, etc. recorded a rise in production up to 25 to 50 percent. Khadi handloom and power-loom production increased from 1,610 million metres to 2,148 million metres.

The Third Plan allocated Rs. 425 crores for small-sector development. It was proposed to set up 300 new industrial estates and increase handloom and power- loom cloth production to 3,200 million metres. But due to certain constraints, the targets remained unfulfilled and the actual expenditure amounted to only Rs. 241 crores.

It was however admitted that small-scale industries development programme was not able to prevent the menace of competition from large-scale sector and curb concentration of industries in large cities and towns.

The Fourth Plan provided for an outlay of Rs. 293 crores but actual expenditure worked out to be Rs. 251 crores only.

The Fifth Plan provided for an outlay of Rs 535 crores. It aimed at development of small industries by reserving 124 items exclusively for them and by initiating an intensive programme for development of ancillary industries as feeders to large-scale sector.

It also made a special reference to the appalling conditions under which persons engaged in small industries were living and postulated programes for removal of poverty and inequality in consumption standard of these persons by improving their skills and providing them more productive avenues of employment.

The actual expenditure in this Plan period was estimated at Rs. 388 crores. The production of small-scale industries increased from Rs. 538 crores in 1975 to Rs. 1000 crores in 1977-78.

The Village and Small-Scale Industries in the Sixth Plan (1980-85):

Promotion of village and small-scale industries continues to be an important element of the national development strategy.

The programmes for the village and small-scale industries during the Sixth Five-Year Plan are designed with the following objectives in view:

1. To improve the levels of production and earnings, particularly of the artisans by upgrading their skills and technologies and through better marketing.

2. To create additional employment opportunities through dispersal and decentralisation of these industries.

3. To utilise the existing installed capacities fully and thus make significant contribution to the growth of manufacturing sector.

4. To establish wider entrepreneurial base through the adequate training programme and provision of a number of incentives.

5. To create economically viable structure of village and small industries so as to reduce in stages the role of subsidies.

6. To increase the efforts to promote exports of the products of these industries.

The highlights of the policy to achieve these objectives are as summarised below:

(i) Integration of the programme for promotion of village and small-scale industries with other programmes of area development and adoption of an approach of a cluster of units, particularly in case of traditional industry.

(ii) Reorganisation of these units at the district level with a view to make them more effective and result-oriented.

(iii) Development, extension and transmission of appropriate technologies and skills.

(iv) Making availability of raw-materials sure and creating buffer-stock of raw materials in general and critical raw materials in particular.

(v) Rationalisation of the structure of interest rates and acceleration of flow of funds from financial institutions, particularly in favour of artisans, village industries and ‘tiny’ units.

(vi) Organisation of marketing, both for domestic and foreign markets on scientific basis keeping in mind the interests of the producers.

(vii) Reservation of selected items to be exclusively produced by and purchased from the village and small industries.

(viii) Effective promotion of ancillary industries.

(ix) Encourage, strengthen and extend the cooperative form of organisation, more particularly for the cottage and ‘tiny’ units.

(x) Building up of a more reliable, sound information system to ensure accurate data on which proper policy could be formulated and more exact evaluation is possible.