In this article we will discuss about the public sector enterprises in India. Learn about:- 1. Introduction to Public Sector Enterprises in India 2. Nature of Public Enterprises 3. Characteristics 4. Rationale 5. Types 6. Role in Economic Development 7. Importance 8. Performance 9. Organizational Structure 10. Managerial Problems 11. Delegation of Enhanced Financial Powers 12. MoU System 13. Criticisms.

Public Sector Enterprises in India: A Complete Guide

Public Sector Enterprises in India – An Introduction:

Historically, Public Enterprises (PEs) played an important part in the development of Indian industry and economy. At the time of independence, it was considered that political independence without self-reliance could be detrimental to the country sovereignty and autonomy in policy making.

The massive investments which were made in the early decades after independence to build public sector was more out of historical necessity than from adhere-rice of any political ideology. The basic objectives of setting up of the PEs were to build infrastructure for economic development, create employment opportunities, and promote balanced regional development and to generate investable resources for development.

At that time, Hanson rightly stated that, “Whatever the ultimate perspective may be, the country anxious to develop economically has no alternative but to use public enterprise on a considerable scale, at the very least in order to get things going.” He has also gone to the extent of saying that “Public enterprise without a plan can achieve something: a plan without public enterprise is likely to remain on paper.”

ADVERTISEMENTS:

Keeping these facts in mind, in India Public Enterprises (PEs) were structured as an instrument of government policy and not designed for purely commercial gains or profit making. They were also required to fulfill several other objectives such as provision for basic infrastructure, basic goods and services, development of backward areas, providing employment and promoting welfare of people, specially the weaker section of the society.

Also as required by Article 39 of the Constitution, the public sector was mean to help develop an economic system which did not result in the concentration of wealth and means of production to the detriment of the common man – and to ensure that the ownership and control of material resources of the community were so distributed as to subserve the common good.

The massive investments required for developing the infrastructure and basic goods and services, at that time could only be provided by the government. To undertake these massive developments, PEs was created as separate corporations or companies so that these organisations could be kept away from government procedures and run on commercial lines.

Public Enterprises (PEs) represents one of the most solid and enduring creations of independent India, The strong industrial base that our country enjoys today which has enabled India. India time and again to withstand both domestic and global shocks is largely a contribution of vibrant public enterprises.

ADVERTISEMENTS:

However, today, in the competitive environment there is urgent need to redefine the public sector philosophy so that the achievements attained painstakingly over decades are not squandered away simply because the response of PEs to changing scenario was delayed. Now, there is growing need to review the government priorities in the light of current demands of Indian economy and to initiate steps to move away from the “governing of business to the business of governing.”

Public Sector Enterprises in India – Nature:

The major definitions given by the authorities on public enterprises are as follows:

A.H. Hanson states that- “Public enterprises mean state ownership and active operations of industrial, agricultural, financial and commercial undertakings.” The term has been used here in a more familiar sense and the coverage of enterprises is very specific.

ADVERTISEMENTS:

Encyclopedia Britannica:

“The term usually refers to government ownership and active operation of agencies engaged in supplying the public the goods and services which alternatively might be supplied by privately owned profit motivated firms (private enterprise).” The definitional has laid emphasis on government ownership and absence of profit motive.

N.N. Mallya has laid more emphasis on the autonomous character and stated as follows: “Public enterprises are autonomous or semi-autonomous corporations and companies established, owned and controlled by the state and engaged in industrial and commercial activities.”

S.S. Khera contends that “By public enterprise is meant the industrial, commercial and economic activities carried on by the Central Government or by a State Government or jointly by the Central Government and a State Government and in each case either solely or in association with private enterprise, so long as it is managed by a self-contained management.”

ADVERTISEMENTS:

The definition has stressed the following points:

(i) It covers the industrial, commercial and economic activities.

(ii) State ownership whether by the Centre or by the state is essential.

(iii) It is managed by a self-contained managerial cadre.

ADVERTISEMENTS:

Friedman defines public enterprise as “an institution operating a service of an economic or social character, on behalf of the government, but as an independent legal entity, largely autonomous in its management, through responsible to the public, government and Parliament and subject to some direction, by the government, equipped on the other hand with independent and separate funds of its own and the legal and commercial attributes of a commercial enterprise.” The definition is comprehensive and has covered almost all the important features of PE, i.e., government ownership, autonomous functioning, accountability to public through government and Parliament, separate financial system, etc.

Public Sector Enterprises in India – Characteristics:

Main characteristics of public enterprises:

Characteristic # 1. Public Ownership:

The public enterprises should either be wholly owned by the Central Government or State Government(s) or local authority or jointly owned by two more of them, Government ownership means that more than 50% of the equity is being held by a public authority. If the enterprise is owned by the government and private persons, the state must have the predominant share (at least 51%) in the ownership of such enterprises.

ADVERTISEMENTS:

Section 617 of the Indian Companies Act clearly specifies that ‘Government company means any company in which not less than fifty one per cent of the paid up share capital is held by the Central Government or by any State Government or Central Government partly and partly by one or more State Governments.’

Further, the public corporations and the department undertakings are fully owned by the government. It has to be kept in mind that the public enterprises do not include the enterprises functioning under co-operative sector. Recently, the State Government of Uttar Pradesh, however, has included the co-operative enterprises under public sector fold.

Characteristic # 2. Government Control and Management:

Public enterprises are managed by the government or the public authority. If a public enterprise is operating under the management of private institutions, it does not mean that it has become a private enterprise. The essential condition for a PE is that the government has got a right to manage and control the affairs of the enterprise. In the USA, the Atomic Energy Commission is managed by private institutions and even then it is called a PE.

Characteristic # 3. Public Accountability:

The enterprises are provided funds from the public exchequer. It becomes imperative that they should be accountable to the public through Parliament, whose funds are invested to carry on the activities of the enterprises. This goal is achieved through ministers, government, Parliament, audit bodies, etc.

Characteristic # 4. Public Purpose:

ADVERTISEMENTS:

The private enterprise is essentially a business proposition in which public purpose finds a subsidiary or peripheral position and in no case supersedes business considerations. In PE, social aspects can well precede, supersede and even completely engulf business considerations. The public interest in various forms and shape provides an under-current for all its strategic decisions.

Characteristic # 5. Wide Coverage of Activities:

The public enterprises are not established for a specific line of activity or manufacture. They cover varied range of activities. “If we exclude agriculture, home trade, and a few other areas, mostly in the unorganized sectors like lorry transportation, it pervades the economy world today.” In India, specially after independence, the PEs are operating in almost every area, viz., construction, marketing, agriculture, finance, development, mining etc.

Characteristic # 6. Economic Enterprise:

In a public enterprise, the price charged for its goods and services is expected to cover the cost. In some cases, the price charged may not cover the cost, but the aim is that in the long run the enterprise as a whole would at least break even. Hospitals, universities and a few public utilities like railways, posts and telegraphs charge a fee for their service, but as it does not cover, and it is also not intended to cover, the cost, such activities are not PE, though owned and managed by the state.

Characteristic # 7. Autonomous Functioning:

In spite of the initial huge investment made by the government, the PEs are provided sufficient autonomy to manage their affairs in their own fashion. The self- contained management has the right to manage the affairs on the basis of sound business considerations and prudent commercial practices. The government does not interfere in their day-to-day activities. The finances of these enterprises are kept separate from the public exchequer. Departmental undertakings are exception to this financial autonomy.

Thus, public enterprise can be defined- “as an activity of the government, whether central, state or local, involving manufacturing or production of goods including agriculture, or making available the services, it has a sound blending of public purpose, public accountability, autonomous functioning and inherent right to manage and control the enterprise by the government.”

Public Sector Enterprises in India – Rationale:

Rationales of public enterprises are as follows:

Rationale # 1. Instrument for Success of Planning:

ADVERTISEMENTS:

It is usually said that the success of a planned economy is based on the growth of public enterprises. Modern economy has inevitably to be a planned economy and the responsibility of planning is to be discharged by the government which necessarily leads to the participation of the state in the actual management of the enterprises in addition to the regulation of commerce and industry managed by private entrepreneurs.

Rationale # 2. Provision of Infrastructure:

To transform the ‘colonial’ economy into a ‘national’ economy and form a background to developed one, the basic requisite is to provide infrastructural facilities. Railways, road, telecommunications, power, shipping, airlines, postal, banking and insurance facilities have to be developed for the rapid advancement of the country.

Rationale # 3. Development of Key and Basic Industries:

It has been the experience of various developing economies, including India, that private entrepreneurs have mainly engaged themselves in commercial and less risky ventures. They do not take sufficient- interest in the development of key and basic industries, mainly because they do not have sufficient capital and other resources for it and also that they do not want to take risks involved in it. With the result, Governments of these economies have been forced to come forward to develop such key and basic industries to achieve self-reliance and faster development of the economy.

Rationale # 4. Balanced Regional Growth:

Private entrepreneurs are guided mainly by profit motive. They establish industries in those areas where they expect a high rate of profit and security of their investment. They are also not in position to exploit the natural resources effectively. These things have forced the Government to intervene in the economic activities through a planned dispersal of industries, which will ensure balanced regional growth of the country. It is only through the state the development of relatively backward areas can be affected.

Rationale # 5. Establishment of a Socialist and Welfare Oriented Society:

The functions of the Government which were originally limited to the maintenance of law and order, defence of the country, etc., have considerably been expanded in recent years. A Government, which is wedded to the establishment of a socialist and welfare-oriented society, is increasingly compelled to enter directly into industrial and commercial activities to achieve this objective. It is the duty of the state to protect the society from the exploitation of industrialists of private capitalists by establishing PEs and thereby providing sufficient opportunities to all concerned to develop themselves.

Rationale # 6. Preventing Concentration of Economic Power:

ADVERTISEMENTS:

It has become the major duty of the state to remove the inequalities of income and wealth prevailing in the society as much as possible. It was felt that the economic systems should be so changed which may not be conducive to the accumulation of wealth and economic power in a fewer hands. By establishment PEs, this objective can also be achieved satisfactorily.

It has been pointed out that- “Private enterprise leads to vast inequalities in the distribution of wealth which are not desirable on social grounds and also on economic grounds to the extent they are the result of unearned income.” It artificially creates the paradox of ‘poverty in the midst of plenty.’ Producers, on the one hand, complain of gluts and surpluses while consumers, on the other hand, are under-fed, under- clothed and under-sheltered.

Rationale # 7. Meeting Defence Requirements:

Industries connected with the production of arms and ammunition or supplies of services essential to the defence of the country have always been considered fit to be set up in the public sector. Obviously, private production cannot possibly be depended upon from the point of view of the national security and safety. Besides, there is a need for utmost secrecy which could be secured only when the industry is under state ownership and control.

Rationale # 8. Effective Implementation of Government Policies:

The Government policy has an important bearing on the nature of the product to be manufactured, the management of the undertaking, pricing of products, scale of operations and personnel, etc. The private enterprises are mainly concerned with their own self-interest and may not pay due attention on the Government policies effectively. On the other hand, the PEs is to be run in the larger interest of the national. Therefore, they are careful in proper interpretation and effective implementation of Government policies.

Rationale # 9. Model Employer:

State participation in commerce and industry is an important instrument of attaining the objective of serving as model employer. By establishing PEs, the state is in a position to set up ideals in the areas of non-retrenchment of surplus staff, housing provisions, management and technical training, fixation of reasonable level of wages for workmen and introduction of workers’ participation in management. There is ample scope for leadership on the part of the state to act as a model employer.

Rationale # 10. Contribution to National Exchequer:

The surpluses generated by the PEs could be profitably utilized for social benefits. They may also contribute towards further investment and growth of the economy. If these enterprises are left in the hands of private entrepreneurs, the profits would be pocketed by them and the surpluses could not be utilized in the larger interests of the economy. In India, the state has had laid upon it, by Directive Principles of State Policy, the responsibility for the total socio-economic welfare of the people.

Rationale # 11. Stimulation of Research and Development Activities:

ADVERTISEMENTS:

It is the primed duty of the state to stimulate Research and Development activities and to build up indigenous technologies leading to optimum self-reliance. Private entrepreneurs consider the expenditure on R&D as wasteful expenditure. It is through PEs that the Government can discharge its responsibility of stimulating research and development efforts more effectively.

Public Sector Enterprises in India – Types:

PEs are engaged in the manufacture of goods and provision of services in almost all the important spheres of economic activity.

A categorization on the above basis will give the following types of PEs:

Type # 1. Commercial Public Enterprises:

They are not engaged in the manufacture of any product or service. They actively participate in trading and marketing activities. The State Trading Corporation of India Ltd., the Minerals and Metals Trading Corporation Ltd., the Food Corporation of India, the Indian Oil Corporation and the Cotton Corporation of India are the examples of such enterprises.

Type # 2. Manufacturing Public Enterprises:

Majority of the PEs can be put in this category. They produce capital as well as consumer goods. They provide infrastructural facilities to provide an investment base to private entrepreneurs. Enterprises engaged in the manufacture of steel, oil, machinery, chemicals, fertilizers, engineering equipments, transportation equipments, minerals, etc., may be kept in this category.

Type # 3. Financial Public Enterprises:

ADVERTISEMENTS:

These government-owned enterprises are engaged in the provision of finance for industries. Industrial Development Bank of India, Industrial Finance Corporation of India, Unit Trust of India, State Finance Corporations, State Bank of India, Nationalized Commercial Banks, etc., are providing funds to commercial and industrial enterprises in public and private sector.

Type # 4. Promotional Public Enterprises:

A few PEs are engaged in the promotion of industries specially in SSI sector. The activities of National Small Industries Corporations are related to promotion of SSI units. Further, the activities of National Industrial Corporations are related to promotion of SSI units. Further, the activities of National Industrial Development Corporation Ltd. and Indian Mines Bureau are promotional by nature. At present, financial PEs are also engaged in promotional activities.

Type # 5. Public Utilities:

A few public utilities like Doordarshan, Akashavani, Road Transport Corporations, State Electricity Boards, Railways, Post and Telegraphs etc. are providing services to general public. Their services are essential by nature. They are operating under monopolistic conditions but they have to keep the ‘public interest’ uppermost.

Role of the Public Sector in Economic Development:

It is experience of all developing nations that the public sector plays a very important role in economic development. Indeed its role has to be a dominant one if economic development is to be accelerated. The public sector in India is also intended to fulfill some of the specific objectives of planning.

These includes as follows:

Role # 1. Achieving Socialistic Pattern:

ADVERTISEMENTS:

The achievement of the object of a socialistic pattern of society in India has made it necessary for the government to assume direct responsibility for developing certain industries. “In an underdeveloped country, a high rate of economic progress and the development of a large public sector and a co-operative sector are among the principal means for effecting transition towards socialism.” Expansion of the public sector is expected to counter the tendency towards monopolies and concentration of economic power which is socially undesirable.

Role # 2. Building Industrial Base:

The Planning Commission observes: “The public sector is expected to provide specially for the further development of industries of basic and strategic importance or in the nature of public utility services, other industries being also taken up by the Government to the extent necessary.”

The public sector has to pioneer some of the key but difficult projects where gestation periods are very long and full output can be reached only after several years of operation. Thus the role of the public sector has been confined to industries of growth- generating and infrastructure type. In fact, the public sector has assisted their expansion from Plan to Plan.

Role # 3. Capital Formation:

It is now realised that capital formation is the key to economic growth. By creating opportunities for investment, the government encourages the people to save and invest. The government can also increase collective savings through taxation and borrowing. The government can also resort to deficit financing. In these ways it can mobilise resources required for speedy economic development.

Role # 4. Social Overheads:

It is for the public sector to create social overheads like institutions for general and technical education, hospitals, etc. The private investor cannot be expected to put his capital in such projects where no money return can be expected. The returns in the form of better health and higher education and technical skills accrue to the whole society rather than to the individual investors.

Role # 5. Economic Overheads:

The investment in economic overheads too is too large to be within the reach of any individual investor. Moreover, the return from such investment is not only low but it is realised only after a long time. Only the public sector can, therefore, make investment ill economic overheads like roads, railways and ports. Economic overheads create external economies for other industries and accelerate economic growth.

Role # 6. Optimum Allocation of Resources:

The public sector plays an important role in bringing about optimum allocation of resources in the community so that economic development is promoted. The resources are likely to be misallocated by private enterprise guided by profit motive. For instance, private investment may be directed to the production of non-essential goods for the rich, whereas the production of essential goods for the masses may be neglected.

It is only the public sector which can be guided by considerations of social welfare.

Role # 7. Balanced and Unbalanced Growth:

The Nurkesian doctrine of balanced growth requires investment simultaneously in capacity of private entrepreneurs.

Similarly, planned unbalanced development as propounded by Prof. Hirschman will be out of the question in a purely private sector, because investment has to be made in some specific fields to generate maximum external economies. Public sector has, therefore, necessarily to step in to accelerate economic development.

Role # 8. Balanced Regional Development:

The private sector will not hazard investment in backward and comparatively underdeveloped regions. But the development of such regions is considered socially desirable. Only the public sector can be relied upon to do this. The government can create infrastructure in these regions and quicken their growth.

Role # 9. Social Objectives:

There are several desirable social objectives for which governments in the underdeveloped countries can only rely on the public sector will prevent the concentration of income and wealth in a few hands. Profits of public enterprises can be utilised for promoting general social welfare. Then there is the removal of disguised unemployment by diverting surplus labour from agriculture to productive spheres.

Role # 10. Creation of Investible Surpluses:

The profits in the private sector are squandered away in conspicuous consumption, but the profits of public enterprises can be ploughed back in business.

Thus the role of public sector in promoting economic development cannot be over-emphasised. In the words of the then Prime Minister, Mrs. Indira Gandhi, “We advocate public sector for three reasons- to gain control of the commanding height of the economy; to promote critical development in terms of social gains or strategic value rather than primarily on consideration of profit; and to provide commercial surpluses with which to finance further economic growth.

Public Sector Enterprises in India – Importance:

The public sector has been playing a significant part in the economic development of the country. Indeed, the public sector has attained such an influential position in the Indian economy that the achievement of the country’s economic and social goals depends primarily on its effective performance.

Public sector is considered a powerful engine of economic development and an important instrument of self-reliance.

The main contributions of public enterprises to the country’s economy may be described as follows:

Importance # 1. Filling of Gaps:

When India gained independence, it was facing the serious gaps in the industrial structure of the country, specifically in the area of heavy industries. Basic and key industries required large capital investment, involved extensive risks and suffered from long gestation periods. Private sector could not come forward to establish such industries.

Thus, Public sector was succeeded in filling up these gaps through rapid industrialisation leading to production of strategic capital goods such as machinery, tools and equipments. The public sector has noticeably broadened the industrial base of the country and speeded up the pace of industrialisation.

Importance # 2. Employment:

Public sector has provided employment to many people and resolved the unemployment problem in the country. Public sector accounts for about two-third of the total employment in the organised industrial sector in India. By taking over many sick units, the public sector has protected the employment of millions. Public sector has also contributed a lot towards the improvement of working and living conditions of workers by playing a model employer.

Importance # 3. Balanced Regional Development:

Private industries often focus towards certain areas, while neglecting other backward areas. However, public sector organisations have set-up their plants in backward and untouched parts of the country. These areas were deficient of basic industrial and civic facilities like electricity, water supply, township and manpower.

Public enterprises have nurtured these facilities, hence, introducing complete transformation in the socio-economic life of the people in these regions. Steel plants of Bhilai, Rourkela and Durgapur; fertilizer factory at Sindri, machine tool plants in Rajasthan, precision instruments plants in Kerala and Rajasthan, etc., are a few examples of the development of backward regions by the public sector.

Importance # 4. Optimum Utilisation of Resources:

Public enterprises use scarce resources of the nation in a wise manner. Owing to their big size, they are able to reap the benefits of large-scale operations. They help cutting down wasteful completion and ensure full use of installed capacity. Finally, optimum utilisation of resources results in better and cheaper production.

Importance # 5. Mobilisation of Surplus:

Public sector enterprises reinvest the profits earned for expansion and diversification. Furthermore, public sector organisations like banks and financial institutions assemble scattered public savings, thus, contributing in the process of capital formation in the country. Public enterprises also fetch considerable foreign exchange through exports.

Importance # 6. Self-Reliance:

Public enterprises have minimised to a large extent the need for imports by producing better substitutes of products within the country. These enterprises also earn significant amount of foreign exchange through exports.

Importance # 7. Socialistic Pattern of Society:

Public sector is a medium for accomplishing social objectives. Public enterprises check concentration of wealth and private monopolies. Therefore, these enterprises can be used as potent means of economic and social change.

Importance # 8. Public Welfare:

Public enterprises work towards improving the state of welfare in the country. They supply essential commodities at affordable prices. An appropriate balance between demand and supply is maintained to protect consumers against exploitation by money-minded businessmen. Public enterprises also protect and promote the interests of workers.

Public Sector Enterprises in India – Performance:

Performance of PEs has been evaluated in terms of investment, sales, profit and employment.

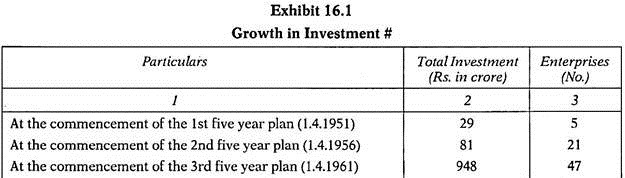

Performance # 1. Investment:

The aggregate investment in PEs grew from Rs. 29 crore in 5 enterprises in 1951-52 to Rs. 5,28,951 crore in 246 enterprises in 2008-09. The financial investment in PEs during 2008- 09 over 2007-08, moreover, increased by Rs. 73,584. Overall growth in investment in PEs is given in Exhibit 16.1.

While the Central Government has the majority equity holding in PEs (84.49%) investment in terms of both equity and long term loans has been forthcoming from other parties as well, such as, the financial institutions, banks, private parties (both India and foreign), State Governments and holding companies.

However, there is drastic change in ‘sources of investment’ that is a significant change in 2004-05 to 2008-09. Whereas the share of Central Government in total investment stood at 37.78 per cent in 2004-05, it declined to 29.83 per cent in 2008-09.

The share of financial institutions/banks (and ‘others’), on the other hand, that was 39.89 per cent in 2004- 05 has gone up to 54.09 per cent in 2008-09. In a way this shows the greater confidence of FIs and banks in the PEs. The share of ‘foreign parties’ in total financial investment has also shown increase from 8.37 per cent in 2004-05 to 8.52 per cent in 2008-09.

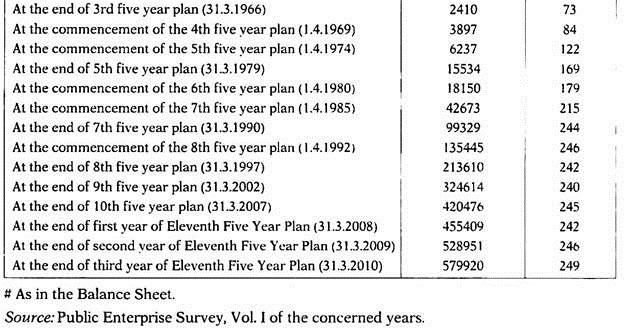

Performance # 2. Sales Performance of PEs:

The volume of the sales of public enterprises has been growing over the period. The sales of Rs. 1,33,906 crores during 1991-92 have increased to Rs. 3,89,199 crores during 1999-2000 and Rs. 5,86,140 crores during 2003-04. The figures showing the absolute and relative position of turnover for the year 1991-92 and onwards have been shown in Exhibit 16.2.

It may be seen from the above exhibit that the public sector enterprises have shown consistent growth in the turnover/operating income. It has increased from Rs. 1,33,906 crores in 1991 -92 to Rs.3,89,199 crores during 1999-2000. The increase in turnover during this period works out to 191% and 25.5%.

It is to be noted that turnover was Rs. 28,635 crores during 1981-82 which has crossed 1,00,000 crores mark during 1989-90. During 2005-06, the turnover is increased to Rs. 8,32,584 crores. As a percentage of capital employed, it is highest at 140%. The turnover increased to Rs. 9,64,419 crores.

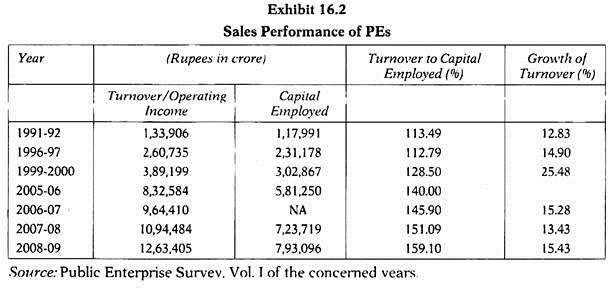

Performance # 3. Profitability of Public Enterprises:

Pre-tax profits assume greater importance as a yardstick for judging the operational efficiency of management since the level of tax rate at any given point of time is determined by the government and, therefore, constitute an extraneous factor beyond the control of the management. The investors, however, are more concerned with the post-tax profits that are available to compensate against the capital provided by them. The related figures have been shown in Exhibit 16.3.

The pre-tax profits have recorded substantial improvement during 1975-2000. From a figure of Rs. 306 crores in 1975-76 it has been risen to Rs. 22,262 crore in 1999-2000 more than 72 times during last 24 years. The post-tax profits have also increased substantially from Rs. 19 crore in 1975-76 to Rs. 14,555 crores in 1999-2000.

In terms of percentage, the returns are insignificant during 1975-76 to 1990-91. But thereafter it increased to about 9% on investment in 1999-2000 Similarly, post-tax profit on equity comes to 17.65 per cent in 1999-2000 in comparison to 13.70 per cent in 1995-96. During 2005-06, post-tax profit increased to Rs. 70,288 crores.

Performance # 4. Human Resource Management in PEs:

Large scale employment by public enterprises has over the years, led to a situation where some of the enterprises are saddled with over employment or excess manpower resulting in low level of per capita productivity. Government has initiated a voluntary retirement scheme in public enterprises to help them shed excess manpower and to improve the age mix and the skill mix. Emphasis is also being given to training and re-training programmes to bring about overall improvement in per capita productivity.

As on 31.3.2009, the 246 PEs employed over 15.35 lakh people (excluding casual workers). One-fourth of the manpower was in managerial and supervisory cadres. The PEs has thus a highly skilled workforce, which is one of their basic strengths. The PEs, in turn, provides lifetime employment to their employees.

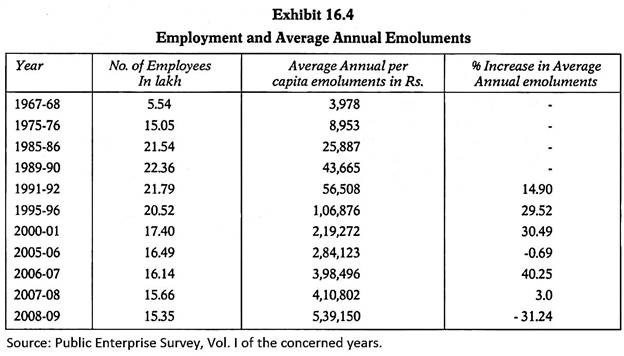

As the PEs operate under dynamic market conditions, while, some of them may face shortage of people, others may have excess manpower The Government, therefore, initiated a Voluntary Retirement Scheme (VRS) to help these enterprises to shed excess manpower. The continuous increase in the total number of employees, their salaries and wages and their wage level of PEs in India may be seen from Exhibit 16.4.

The basic parameters of the model Voluntary Retirement Scheme which were notified by the Government vide DPE’s OM dated 5-10-1988 and 6-1 -1989 was in force since 1988 till April, 2000. Government has improved upon the existing scheme and introduced a new scheme of VRS on 5-5-2000 and again on 6-11-2001.

As per the available information, about 3.03 lakh employees opted for Voluntary Retirement Scheme (VRS), till 31 -3-2009. A good many PEs, are faced with a high rate of ‘attrition’, as employees are leaving to join other organizations on account of higher salaries being offered elsewhere. The total number of employees in PEs that was 15.65 lakhs in 2007-08 came down further to 15.35 lakhs in 2008-09.

Organizational Structure of Public Enterprises:

The Public Enterprises (PEs) belong to either of the two broad classifications of ‘statutory corporations’ or ‘Government companies’. While the Corporation form of PEs have their objectives and scope defined in the legislation/Act of Parliament, the Company form of PEs have their functions articulated based on the Articles of Association.

These Government companies are, moreover, registered with the Registrar of Companies under the Companies Act, 1956. The PEs are mostly commercial enterprises. Some PEs, such as, National Film Development Corporation, National Research Development Corporation, National Small Industries Corporation Ltd., Jute Corporation of India Ltd. and Handicrafts & Handloom Export Corporation India Ltd. etc., are, however, ‘promotional’ in nature.

In general, these are large scale enterprises requiring appropriate organizational structure, with particularization of functions and delegation of authority (from top to bottom). With a view to bring about unity of purpose, moreover, there is always the need for co-ordination.

Necessary planning is called vis-a-vis order booking/demand forecasting, sales network, man-and- machine utilization, design and research, welfare measures and job satisfaction of employees. Different PEs have been taking various HR initiatives for employee involvement, knowledge acquisition, career and succession planning etc. for improving the performance in their respective organizations.

Essentially, these initiatives revolve around building competency levels followed by commitment to the organization and systems improvement, and finally evolving a vibrant corporate culture. The Department of Public Enterprises (DPEs), Government of India has been, furthermore, formulating guidelines in respect of organizational structure, corporate governance, wage and salary policy, executive development programme etc., which are applicable to all the PEs.

Public Sector Enterprises in India – Managerial Problems:

Major Managerial Problems of Indian Public Enterprises are as follows:

Managerial Problem # (i) Lack of Clarity in Objectives:

The objectives of private enterprises are quite clear but this is not true for public enterprises. Even after so many years, we are still grappling with this issue and the policy statement has not yet come forward with-clear out objectives for these enterprises. In the absence of clearly defined objectives of the enterprises, it is indeed a great problem to judge their efficiency properly and correctly.

Managerial Problem # (ii) Under-Utilisation of Capacity:

It was suggested by CPU that “Government should immediately analyse the reason for this persistent underutilization of capacities in various undertakings and take remedial measures in respect of each of them.” The main factors affecting capacity utilization are power shortages, inadequacy of demand, equipment breakdowns, lack of balancing equipment, inadequacy of raw materials and managerial inefficiencies.

Managerial Problem # (iii) Low Profile of Research and Development Activities:

In the Industrial Policy Statement of 1980, it was stressed that the Indian industry must earmark substantial resources for research and development for constantly update technologies with a view to optimal utilization if scare resources, better service to consumer and achieving greater exports.

Recurring expenditure on R&D was incurred only by the giant concerns. The nature of activities of PE units also limits the scope of R&D efforts. Many of the PEs are engaged in the provision of services, manufacture of critical and scare items and production of those items whose imports were heavy. In all these cases, incentive research and development efforts are not at all required.

Managerial Problem # (iv) Over Capitalization:

The study team found several undertaking over capitalized. In this connection, the study team mentioned the causes lending to overcapitalization can be traced to inadequate planning, delays and avoidable expenditure during construction, surplus machine capacity, tied aid resulting in the compulsion to purchase to imported equipment on a non-competitive basis, expensive turn-key contracts, bad location of projects and the provision of housing and other amenities on liberal scale.

Managerial Problem # (v) Faulty Pricing Policy:

The pricing policy of PEs are not guided solely by the profit maximization principle, but are under the regulation and control of the government. Most of the PEs produce products which serve as inputs for other sectors of the economy. It would be suicidal from the point of view of the overall growth of the economy if prices of steel, fertilizers or coal are fixed very high. The PEs have to keep in mind the social implications of its price policy. In this connection, it is important to remember that the prices are kept low even when costs have been rising.

Managerial Problem # (vi) Poor Profitability and Lower Returns:

A review of the working of PEs reveals that either the profits in them or have been deplorably low or that they have been making losses. Consequently, the losses are mounting the year after year.

Managerial Problem # (vii) Problem of Low Labour Productivity:

Labour welfare increases the productive efficiency of the workers and infuses in them a new spirit of self-realisation and consciousness. In the initial years of operations, public sector units are not in a position to provide all fringe benefits and welfare amenities which are provided by the enterprise of decades or so.

Managerial Problem # (viii) Problem of Training and Management Development:

Trained manpower is a critical factor in economic development. With the fast expansion of the existing PEs and additions through nationalization, the training and development of personnel has acquired a great deal of significance. Many of the PEs do not have their own training institutes.

Regarding the development programmes abroad, the selection of participants is done entirely in a mechanical way. Contents of the many of the programmes are based on the traditional theories of management organisation and western Philosophy. As the training for employees is not directly related with consideration, the PEs employees do not take any interest in acquisition of training facilities.

Managerial Problem # (ix) Lack of Professionalism in Management:

The ARC Study team on public undertakings reported that personnel managers in PEs were often not professionally qualified and professional departments more or less resembled the establishment sections of the government departments with their activity often decaying into a lifeless routine.

Managerial Problem # (x) Vacant Position for Top Management:

Till recently, appointments to top posts of Managing Director, General Managers, Financial Advisers, etc., were to be made by the government. In respect of the other important posts also many enterprises had to obtain prior approval of the government for creation of posts and making appointments. This leads to unnecessary delays in filling up the posts and the top positions remain vacant for the long duration.

Managerial Problem # (xi) Competition with Private Sector Enterprises:

Stiff and cut-throat competition in case of elastic increases the advertising expenditure. The units, if it is monopolistic position for an inelastic product, can enjoy a good market for its sale operations.

Managerial Problem # (xii) Poor System of Quality Control:

PEs generally have “state to stage” inspection starting from incoming material to the finished product. Some enterprises also hold quarterly review meetings to discuss unfavourable trends in quality and also to fix targets for reduction of off- grade reduction. A large number of PEs follow the statistical quality control techniques for regulating the quality of products.

Managerial Problem # (xiii) Problem of Parliamentary Control:

The real problem of parliamentary control is how to strike a balance between the autonomy necessary for commercial operations and the right of Parliament to discuss the working and performance of PEs. PEs is more likely seek advice from the Ministry even on minor matters so that the responsibility to explain them automatically shifts to Ministry.

Public Sector Enterprises in India – Delegation of Enhanced Financial Powers:

1. Maha Navratna Scheme:

Maha Navratna PSUs are the biggest public sector undertaking (PSU’s) of India. Presently, only Indian Oil, ONGC, SAIL and NTPC have been declared as Maha Navratna. But only NTPC will be able to exercise the authority since the other companies are not having the requisite number of independent directors in their boards. These companies shall be allowed to take decisions on projects independently of Government values up to Rs. 5,000 crores.

2. Navratna Scheme:

Under this scheme, the Government has delegated enhanced powers to PEs having comparative advantage and the potential to become global players.

Navratna PEs are as under:

(i) Bharat Electronics Limited

(ii) Bharat Heavy Electricals Limited

(iii) Bharat Petroleum Corporation Limited

(iv) Coal India Limited

(v) GAIL (India) Limited

(vi) Hindustan Aeronautics Limited

(vii) Hindustan Petroleum Corporation Limited

(viii) Mahanagar Telephone Nigam Limited

(ix) National Aluminium Company Limited

(x) NMDC Limited

(xi) Power Finance Corporation Limited

(xii) Power Grid Corporation of India Limited

(xiii) Rural Electrification Corporation Limited

(xiv) Shipping Corporation of India Limited

The powers presently delegated to the Boards of Navratna PEs are as under:

(i) Capital Expenditure:

The Navratna PEs have the powers to incur capital expenditure on purchase of new items or for replacement, without any monetary ceiling.

(ii) Technology Joint Ventures and Strategic Alliances:

The Navratna PEs have the powers to enter into technology joint ventures or strategic alliances and obtain by purchase or other arrangements, technology and know-how.

(iii) Organizational Restructuring:

The Navratna PEs have the powers to effect organizational restructuring including establishment of profit centres, opening of offices in India and abroad, creating new activity centres, etc.

(iv) Human Resources Management:

The Navratna PEs have been empowered to create and wind up all posts up to E-6 level and make all appointments up to this level. The Boards of these PEs have further been empowered to effect internal transfers and re-designation of posts. The Board of Directors of Navratna PEs have the power to further delegate the powers relating to Human Resource Management (appointments, transfer, posting, etc.) of below Board level executives to sub-committees of the Board or to executives of the PE, as may be decided by the Board of the PE.

(v) Resource Mobilization:

These PEs have been empowered to raise debt from the domestic capital markets and for borrowings from international market, subject to condition that approval of RBI/Department of Economic Affairs, as may be required, should be obtained through the administrative Ministry.

(vi) Joint Ventures and Subsidiaries:

The Navratna PEs have been delegated powers to establish financial joint ventures and wholly owned subsidiaries in India or abroad with the stipulation that the equity investment of the PE should be limited to the following amounts-

(a) Rs. 1000 crore in any one project,

(b) 15% of the net worth of the PE in one project,

(c) 30% of the net worth of the PE in all joint ventures/subsidiaries put together,

(d) Mergers & Acquisitions (M&A).

The Navratna PEs have been delegated powers for mergers and acquisitions subject to the conditions that:

(i) It should be as per the growth plan and in the core area of functioning of the PE,

(ii) Conditions/limits would be as in the case of establishing joint ventures/subsidiaries, and

(iii) The Cabinet Committee on Economic Affairs would be kept informed in case of investments abroad. Further, the powers relating to Mergers and Acquisitions (M&A) are to be exercised in such a manner that it should not lead to any change in the public sector character of the concerned PE.

(vii) Creation/Disinvestment in subsidiaries:

The Navratna PEs have powers to transfer assets, float fresh equity and divest shareholding in subsidiaries subject to the condition that the delegation will be in respect of subsidiaries set up by the holding company under the powers delegated to the Navratna PEs and further to the proviso that the public sector character of the concerned PE (including subsidiary) would not be changed without prior approval of the Government and such Navratna PEs will be required to seek Government approval before existing from their subsidiaries.

3. Miniratna Scheme:

In October 1997, the Government had also decided to grant enhanced autonomy and delegation of financial powers to some other profit making companies subject to certain eligibility conditions and guidelines to make them efficient and competitive. These companies, called Miniratnas, belong to two categories, namely, Category-I and Category-II.

The eligibility conditions and criteria are:

(i) Category-I PEs should have made profit in the last three years continuously, the pre-tax profit should have been Rs. 30 crores or more in at least one of the three years and should have a positive net worth.

(ii) Category-II PEs should have made profit for the last three years continuously and should have a positive net worth.

(iii) These PEs shall be eligible for the enhanced delegated powers provided they have not defaulted in the repayment of loans/interest payment on any loans due to the Government.

(iv) These public sector enterprises shall not depend upon budgetary support or Government guarantees.

(v) The Boards of these PEs should be restructured by inducting at least three non-official Directors as the first step before the exercise of enhanced delegation of authority.

(vi) The administrative Ministry concerned shall decide whether a Public Sector Enterprise fulfilled the requirements of a Category-I/Category-II company before the exercise of enhanced powers.

The delegation of decision-making authority available at present to the Boards of these Miniratna PEs is as follows:

a. For PEs in Category I:

The power to incur capital expenditure on new projects, modernization, purchase of equipment, etc., without Government approval upto Rs. 500 crore or equal to net worth, whichever is less.

b. For PEs in Category II:

The power to incur capital expenditure on new projects, modernization, purchase of equipment, etc., without Government approval upto Rs. 250 crore or equal to 50% of the net worth, whichever is less.

(ii) Joint Ventures (JVs) and Subsidiaries:

a. Category I PEs:

The power to establish joint ventures and subsidiaries in India with the stipulation that the equity investment of the PE in any one project should be limited to 15% of the net worth of the PE or Rs. 500 crore, whichever is less. The overall ceiling on such investment in all projects put together is 30% of the net worth of the PE.

b. Category II PEs:

The power to establish joint ventures and subsidiaries in India with the stipulation that the equity investment of the PE in any one project should be 15% of the net worth of the PE or Rs. 250 crore, whichever is less. The overall ceiling on such investment in all projects put together is 30% of the net worth of the PE.

(iii) Mergers and Acquisitions (M&A):

The Board of Directors of these PEs have the powers for Mergers and Acquisitions (M&A), subject to the conditions that- (a) it should be as per the growth plan and in the core area of functioning of the PE, (b) conditions/limits would be as in the case of establishing joint ventures/subsidiaries, and (c) the Cabinet Committee on Economic Affairs would be kept informed in case of investments abroad. Further, the powers relating to Mergers and Acquisitions (M&A) are to be exercised in such a manner that it should not lead to any change in the public sector character of the concerned PEs.

(iv) Scheme for HRD:

To structure and implement schemes relating to personnel and human resource management, training, voluntary or compulsory retirement schemes, etc. The Board of Directors of these PEs have the power to further delegate the powers relating to Human Resource Management (viz., appointments, transfer, posting, etc.) of below Board level executives to sub-committees of the Board or to executives of the PE, as may be decided by the Board of the PE.

Public Sector Enterprises in India – MoU System:

The Memorandum of Understanding (MoU) as applicable to public sector enterprises is a negotiated document between the government and the management of the enterprise specifying clearly the objectives of the agreement and the obligations of both the parties. It was first introduced in France in two phases, that is, as ‘contracts de programme’ in 1970 and as ‘contracts of ‘Enterprise’ in 1979 consequent to the Simon Nora Committee Report (1967). The main purpose of the MoU system is to ensure a level playing field to the public sector enterprises vis-a-vis the private corporate sector.

MoU system in India was first introduced in 1986 as a result of the recommendations of the Arjun Sengupta Committee Report (1984). The Committee laid emphasis on medium term contract between the Government and the Public Enterprises (PEs) and recommended a five- year agreement that may be reviewed annually. Moreover, since the PEs have been set up as part of the national/central plan, the Committee favoured MoUs especially in respect of PEs in the core sectors of steel, coal, power, petroleum, fertilizer and petro-chemicals.

MoU System ‘Process and Principles’:

The process of finalizing the MoUs starts with the issue of detailed Guidelines by the Department of Public Enterprises (DPE) on the basis of which the PEs submit their draft MoU after getting them approved by the respective Boards and the Administrative Ministries. The draft MoUs indicate the (five) performance targets on a five point scale for the ensuing financial year.

These draft MoUs are then discussed, improved and finalized during the MoU negotiation meetings. The MoU negotiations are attended by the Chief Executives of the PEs, Senior Officers from the administrative Ministries and the representatives of the nodal Government agencies such as Planning Commission and Ministry of Finance. The Task Force on MoU set up by DPE, moreover, provides the oversight during the MoU negotiations.

AIMS and Objectives of MoU System in PEs:

The aims and objectives of the MoU system are broadly the following:

a. To improve the performance of public sector enterprises by increasing autonomy of Management of the Company.

b. To remove the fuzziness in goals and objectives of public sector enterprises.

c. To evaluate the performance of management through objective criteria.

d. To provide incentive for better performance in future.

The incentives under the present system take two forms, namely ‘monetary’ and ‘nonmonetary’ incentives. As per the Second Pay Revision Committee recommendations (for the executives of PEs) vide DPE OM No. 2(70)/08-DPE (WC)-GL-XV/08 dated 26-11-2008, the variable Performance Related Pay (PRP) would be payable in the case of profit making PEs at 100% eligibility levels if the PE achieves the MoU rating as “Excellent”.

If the PE’s MoU is rated as “Very Good”, the eligibility of PRP would be 80% of the basic pay. In respect of “Good” and “Fair” ratings, the eligibility levels would be 60% and 40% respectively. However, there will be no PRP irrespective of the profitability of PE, in case it is rated as “Poor”. [Moreover, 60% of the PRP will be given with the ceiling of 3% of Profit Before Tax (PBT) and 40% of the PRP will come from 10% of incremental profit. Further, the PRP has been linked to the performance of the individual executives, which will be based on a robust and transparent Performance Management System].

The non-monetary incentives comprise the MoU Awards. These awards are also an expression of commitment of the policy makers to the MoU system. While excellent performing PEs are awarded with the MoU (Excellent) Awards with Trophies and Excellence Merit Certificates, the remaining excellent performing PEs are recognized with Excellence Merit Certificates.

Public Sector Enterprises in India – Criticisms:

There are arguments against public enterprises on the grounds of a few considerable weaknesses in their organisation and working.

Generally, these undertakings face the following problems:

Criticism # 1. Delay in Completion:

Usually, the establishment and completion of public enterprises takes a lot of time. Delay in completion leads to increase in the cost of establishment, and benefits that are supposed to derive from them are postponed.

Criticism # 2. Faulty Evaluation:

In some cases, public enterprises are planned on political grounds. Due to such shallow objectives, there is no proper assessment of demand and supply and expected costs and benefits. There are no defined objectives and guidelines to pursue its goals. In the absence of proper project planning, there is under-utilisation of capacity and wastage of national resources.

Criticism # 3. Heavy Overhead Costs:

It has been noted that public enterprises spend a lot of money on rendering housing and providing other services to their employees. Although, such services help the employees considerably, yet it eats-up a large portion of the capital and the project runs out of sufficient finance for proper completion.

Criticism # 4. Poor Returns:

Maximum numbers of public enterprises in India are facing losses. In some cases, the profits earned do not earn a reasonable return on huge investment. Factors such as lack of effective financial controls, wasteful expenditure and arbitrary pricing policy result in losses.

Criticism # 5. Inefficient Management:

Due to excessive centralisation of authority and lack of motivation public enterprises are managed inefficiently. High level posts are often occupied by persons lacking necessary expertise but enjoying political support.

Criticism # 6. Political Interference:

There is frequent interference from politicians and civil servants in the working of public enterprises. Such interference leaves little scope for initiative and freedom of action. Public enterprises enjoy little autonomy and flexibility of operations.

Criticism # 7. Labour Problems:

In the absence of proper manpower public enterprises suffer from over-staffing. Jobs are created to fulfill employment goals of the Government. Guarantee of job in these enterprises encourages trade unions to be militant in pursuing their aims.