Internal Analysis in Strategic Management! Learn about:- 1. Introduction to Internal Analysis 2. Functional Analysis 3. SWOT Analysis 4. Gap Analysis 5. Porter’s Value Chain Analysis 6. Product Life Cycle Analysis 7. Environmental Analysis 8. Competitive Position Analysis 9. Competitor Analysis 10. Strategic Group Analysis 11. Fundamental Analysis.

Further this article will help you to learn about:

- Internal Analysis Tools

- Importance of Internal Analysis

- Internal Analysis Example

- Internal Analysis in Strategic Management

- Internal and External Analysis in Strategic Management

- SWOT Analysis Internal and External Factors

- Internal and External Analysis of a Company

Internal Analysis in Strategic Management: SWOT Analysis, Importance and Internal Analysis Tools

Internal Analysis # 1. Introduction to Internal Organizational Analysis:

The internal operations of a firm determine the strengths and weaknesses of a firm. Strengths allow the firm to take advantage of opportunities available in the environment, while weaknesses represent potential threats to the organization and limit the strategies available to the firm. The internal factors are generally regarded as controllable factors, because the company generally has control over these factors; it can alter or modify such factors as its personnel, physical facilities.

Internal environment basically consists of firm’s own resources and capabilities. It means the nature of technology possessed, patents and designs, financial and managerial resources etc. It also means company’s capability to produce superior quality, manage supply chains and access to input. It also consists of other intangible assets like company’s name/image, foreign tie-ups etc.

Commonly evaluated characteristics of a firm include the functional areas of marketing, finance, production, human resources, research and development and general management. The internal aspects of the firm determine the competencies of the firm that can be used effectively exploiting opportunities and responding to threats represented by the environment. A firm must determine what its competencies are so that it can consider alternative strategies for the present and the future.

In other words, the internal strengths and weaknesses of an organization must be assessed before realistic strategic alternatives can be determined. A thorough internal analysis helps managers to better understand factors contributing to sales, costs, profits, market share and relationships between these and other salient organization characteristics. Firms competing in the same industry may develop and maintain different internal strengths and weaknesses and be quite effective.

Internal Analysis # 2. Functional Analysis:

The important element in internal analysis of a firm is evaluating its financial health. A thorough analysis of financial statements can provide much information about an organization and will identify symptoms of basic problems occurring within an organization. The trends in sales, profits, capital employed etc. show whether the firm is improving or worsening in its performance.

Allocation of key resources and comparison with their real profit contribution will be analyzed. This will involve a study of the company’s liquid resources and probable future cash flow position will be analyzed. Like financial policies, financial position and capital structure are important internal factors affecting business performance, strategies and decisions.

Financial strategies reflect the priorities and expectations of the organization in capital acquisition and allocation of capital to various projects. Financial strategies also reflect capital structure, cash flow requirements, and credit and payment policies of the organization.

The financial analysis typically evaluates:

(a) Profitability – ability to utilize assets to produce profit.

(b) Liquidity – ability to convert assets into cash to meet current financial needs.

(c) Leverage – balance between debt and equity.

(d) Operating efficiency – performance of various operating subunits relative to inputs utilized.

Financial ratios are commonly used to assess a firm’s financial standing and to identify signs of existing or potential problems.

The typical list of strengths in financial efficiency includes:

(a) Favourable attitude of shareholders, debenture-holders and potential investors

(b) Easy access to low cost funds

(c) Cooperation from financial institutions and banks

(d) Efficient management information system, as well as, budgetary control system

(e) Tax benefits from central and state governments

(f) High level of creditworthiness

(g) Most favourable debt-equity ratio and liquidity ratio etc.

Marketing has been defined as human activity directed at satisfying needs and wants through exchange processes, satisfying the customers’ needs and wants; involves an examination of product mix, price, promotion and channels of distribution. Product demand and market segments serves as important sources of profit. The marketing capability depends on industry attractiveness, product competitive position, and product market profitability to keep it on the growth path.

The marketing capability depends on emergence of new customer segments, changes in customer habits, preference and buying behaviour, product differentiation, product positioning, product pricing, packing and distribution, sales promotion and advertising, marketing mix, marketing channels, branding etc. The changes in the technological, regulatory, social or economic environment of the industry that either have an impact on the product, market scope of the firm or help it to cut costs and improve productivity and enhance profitability.

Distribution is another important element of marketing strategies. Distribution begins with the producer and ends with the ultimate consumer. The channels of distribution are the set of institutions that perform the activities needed to move the product and its title from production to consumption. A thorough analysis of distribution system will reveal the weaknesses existing in it. The marketing and distribution strategies needed to be modified depending on the findings in internal analysis.

A typical list of strengths in the marketing and distribution capability include:

(a) Established brand image

(b) Most feasible marketing channel partners

(c) Favourable attitude of consumers towards product quality

(d) Most efficient distribution logistic system

(e) Wide range of products

(f) Market oriented product pricing

(g) Effective sales promotion and advertising

(h) Effective feed-back of market information

(i) Effective marketing management information systems

The operation function is performed by that group of persons in a business who are responsible for producing the goods or providing the services that the business offers to the public. Operations management has been defined as managing the resources required to produce the products or services provided by an organization.

The operations management consists of decisions in five areas viz., process, capacity, inventory, human resource and quality. Production strategies relating to decisions on quality, product design, production cost, production efficiency, capacity management, productivity of labour and machines, operating personnel, maintenance etc.

The manufacturing process may be intermittent or continuous; and customized or mass production. The adoption of CAD/CAM, Just-In-Time, Flexible manufacturing, Standardization, Small batches of production, Supply chain management, Tight inventory control etc. are the features of current production systems.

The economies of scale can be achieved through mass production and it will reduce the overall unit cost of production. The operations management enables the company to focus on low cost as well as product differentiation.

The strategic management of operations concentrates on the following issues:

(a) The selecting and designing of products or services to meet customer needs;

(b) Designing and updating production facilities so that products or services are produced efficiently; and

(c) Controlling of the scheduling of machines and labour so that products or services are available on schedule and in the quantities and quality required to meet customer needs.

The operations strategies should align with the overall corporate strategies in pursuit of organizational goals and objectives.

The human resources management functions relates to the centralized management of personnel, their activities, development and control for the whole organization. In modern business environment, personnel are considered as resources through which strategies are developed and implemented.

Quality of human resource management can contribute much to organizational performance. Human resource management consists of five important strategic decision areas viz., employment, human resource development, compensation, human relations and industrial relations.

J.M. Ivancevich and W.F. Glueck identified the following strategies in human resource are:

(a) Employ the skills and abilities of the work force efficiently.

(b) Provide the organization with well-trained and well-motivated employees.

(c) Increase employees’ job satisfaction and self-actualization.

(d) Develop and maintain a quality of work life that makes employment in the organization a desirable personal and social situation.

(e) Communicate HRM policies to all employees.

(f) Manage change to the mutual advantage of individuals, groups, the enterprise and the public.

Human resources activities basically consist of the following three areas:

(a) Job Analysis:

i. Job description

ii. Job specs

iii. Forecasting labour needs

iv. Predicting labour market conditions

(b) Procurement of Human Resources:

i. Recruitment planning

ii. Employee selection and training

iii. Affirmative action

(c) Maintenance of Human Resources:

i. Performance appraisal

ii. Compensation and benefits

iii. Career planning and development

iv. Employee relations

v. Communications and grievances

The human resource management will influence the direct and indirect labour cost of the organization, which shows impact on overall profitability of the organization. The strategic issues like engagement of part-time employees, contract workers, job workers, outsourcing, autonomous work teams, cross functional work teams etc. are also resolved. The skill, interests and aptitudes of employees influence the strategies selected. The labour turnover and attrition rates need to be constantly monitored.

The research activities relates to searching for new products, new manufacturing process, improvement of existing products, processes or equipment. The development activities involve putting research on commercial basis. The research and development strategies covers the areas like searching new product, improve the existing product, finding new production methods, improving existing technologies etc.

The research costs are incurred for carrying basic research or applied research. But the development costs start with decision taken to produce new product or improved product and when decision is taken to adopt new technologies and new production methods. The objective in carrying basic research is to improve the existing scientific and/or technical knowledge. But the applied research is carried for the purpose directed towards a specific practical aim or objective.

The R&D strategies should address:

(a) The focus of R&D activities (pure and applied research)

(b) The relationship of R&D activities to other functional areas (e.g. operations and marketing)

(c) The aggressiveness of the firm’s R&D posture

(d) The time horizon for results expected from R&D department.

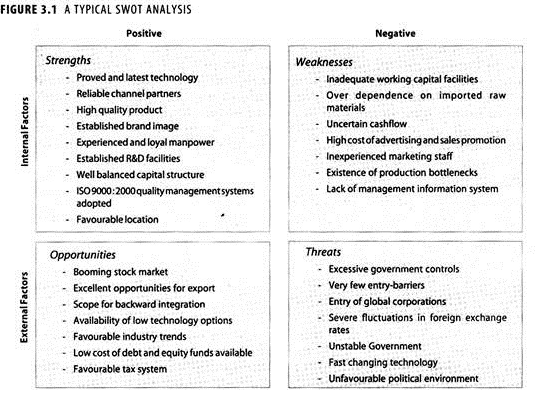

Internal Analysis # 3. SWOT Analysis

:

It is a critical analysis and assessment of strengths and weaknesses, opportunities and threats in relation to the internal and external environmental factors affecting an entity. It is simply referred to as ‘SWOT analysis’. It involves a systematic analysis of the internal strengths and weaknesses of a business firm (financial, technological, and managerial) and of the external opportunities and threats in the firm’s environment like changes in the markets, laws, technology and the actions of the competitors.

Strengths and weaknesses analysis focus on particular strengths and weaknesses of the firm itself. It is an internal appraisal and intended to shape its approach to the external world. Opportunities and threats analysis is done particularly with regard to profit making opportunities in the business environment and identifiable threats e.g. falling demand, new competition, technology advancements, government regulation, changing tastes and habits of consumers etc. It is more concerned with the appraisal of external environment of business.

The meaning of strength, weakness, opportunity and threat can be summarized as follows:

Strength:

It is an inherent capacity which an organization can use to gain strategic advantage. It may be the availability of a particular resource with the firm or the ability of the firm to leverage it to performing certain activities better than its competitors.

Weakness:

It is an inherent limitation or constraint which creates strategic disadvantages. It is the non-availability of particular resource with the firm or the inability of the firm to leverage that resource in performing certain activities better than its competitors.

Opportunity:

It is a favourable condition in the firm’s environment which enables it to consolidate and strengthen its position.

Threat:

It is an unfavourable condition in the organization’s environment which creates a risk or causes damage to the firm, which the firm is not equipped to handle.

SWOT analysis will provide basis for evaluating the extent to which the firm is likely to achieve its various objectives and for identifying new products and market opportunity. It is an internal as well as external appraisal of a firm which will enable in identifying the strategic approach to be formulated that will fit into its business environment.

SWOT analysis will provide basis for evaluating the extent to which the firm is likely to achieve its various objectives and for identifying new products and market opportunity. It is an internal as well as external appraisal of a firm which will enable in identifying the strategic approach to be formulated that will fit into its business environment.

The basic objectives of conducting SWOT analysis are:

(a) To identify the shortcomings in the company’s present skills and resources.

(b) To exploit the strengths of the company to achieve its objectives.

(c) To focus on profit-making opportunities in the business environment and for identifying threats.

(d) To highlight areas within the company, which are strong and which might be exploited more fully and weaknesses, where some defensive planning might be required to prevent the company from downfall.

SWOT analysis is useful at corporate, functional and competitive strategy levels as it addresses the current fit between the organization and its environment, and considers the potential impact of strategy changes. A decision taken in the light of a sound and thorough SWOT analysis can be informative to the extent that the organization becomes proactive, the basic aim of any strategic planning, and seeks to manage environment rather being reactive i.e. responding to changes that managers have failed to foresee.

The organizational analysis, being part of SWOT analysis should cover each major element like leadership, organizational structure, production, marketing, finance, personnel, company image and standing etc. SWOT analysis should include economic factors, political factors, social factors, state of competition, state of technology, emerging trend of consumer needs, import, export, foreign exchange position etc.

SWOT analysis may be undertaken effectively through a ‘brain storming session, which should be attended by all key executives and functional heads. SWOT analysis enables a manager to present a picture of the company before it chooses any strategy. Such assessment clarifies the perspective of the company at a given point of time. SWOT analysis offers a static picture of the company in relation to some specific environmental condition.

SWOT analysis will enable the company in the following ways:

(a) Eliminating the weaknesses that expose a company to external threats.

(b) Highlights the strengths, which the firm should seek to exploit.

(c) Converts the threat or weakness into an advantage.

(d) Expose the shortcomings in the company’s present skills and resources.

(e) Match the company’s strengths to take advantage of the opportunities in the market place.

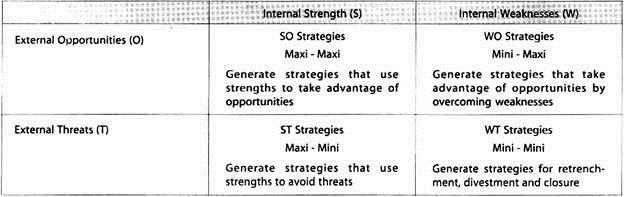

The relationships in a SWOT analysis are generally represented by a 2 x 2 matrix. The ‘strengths’ and ‘opportunities’ are both positive considerations. The ‘weaknesses’ and ‘threats’ at, both negative considerations. The SWOT matrix is an important matching tool that helps managers in generating four types of strategies i.e. SO, WO, ST and WT.

SWOT matrix is a conceptual framework for a systematic analysis for matching opportunities and threats that are external with strengths and weaknesses which are internal for the organization. When these four attributes combine, they result in four sets of different strategic alternatives.

The SWOT matrix is shown as follows:

The SO strategies try to improve the company’s strengths relative to its environmental opportunities. These strategies use firm’s internal strengths to take advantage of external opportunities. It is the aim of enterprises to move from other positions of the matrix to this one. When the firm faces a weakness, it strive to overcome it, making such weaknesses into strengths. When a major threat is faced by the firm, it will try to avoid such threat by focusing on opportunities.

The WO strategies will enable the firm to overcome weaknesses and focus to tap its opportunities. WO strategies are evolved to improve internal weaknesses by taking advantage of external opportunities. The firm with internal weaknesses in certain areas may overcome them by developing such competencies internally or acquire from outside to take advantage of opportunities available in the external environment.

The ST strategies try to gear up the internal strengths to reduce the vulnerability of external environmental threats. The basic objective of these strategies is to maximize the advantage of internal strengths while minimizing the external environmental threats.

The WT strategies are the defensive strategies used to counter the internal weaknesses as well as external threats. In this situation retrenchment, joint ventures and liquidation strategies need to be evolved to up or out.

SWOT matrix is widely used as a strategic planning tool and used to generate several strategic alternatives. The aim of a business organization is to move from one position to another desirable position in the SWOT matrix. SWOT matrix can be prepared for the whole organization or for particular strategic business unit.

The SWOT matrix is criticized for the following reasons:

(a) It does not show how to achieve a competitive position.

(b) It is a static assessment of the organization on a particular time.

(c) It lead the firm to overemphasize a single internal or external factor in formulating strategies.

To analyze the business situation, a strategist need to prepare several SWOT matrix for different points of time.

Internal Analysis # 4.

Gap Analysis:

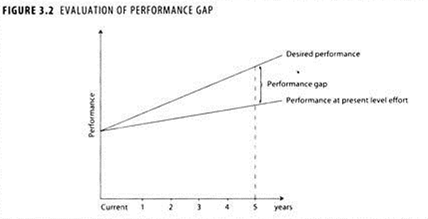

Gap analysis is the process of identifying the gap between the optimized allocation and integration of inputs and the current level of allocation. Gap analysis done by comparing current level of performance of the organization or SBU with the set goals. The gap analysis process involves determining, documenting and approving the variance between business requirements and current capabilities. When the current performance does not meet the predetermined objectives, a firm must select a strategy to reduce gap.

This analysis provide insight into areas that have opportunities for improvement. While performing gap analysis, the attention is focused on the gap between actual or anticipated values and the most desirable values expected to attain. This will help in formulation of suitable strategies to close the gap. Performance gap means the inability of the strategy adopted to give the desired results. To bridge this gap the management must strive hard for new strategies.

The companies sets objectives for a future period of time, say five years, and then works backward to find out where it can reach through present level of efforts. By analyzing the difference between the projected and desired performance, a gap could be found. While conducting gap analysis, a comparison of forecasted profit of the whole organization with the desired level of profit as expected by the shareholders is made.

The identified gap in between them is called ‘planning gap’ which is divided into the following four elements:

(a) Product-line Gap – this portion of gap is due to each product in the full product line.

(b) Distribution Gap – this portion of gap is caused due inadequate distribution system.

(c) Usage Gap – this portion of gap is mainly caused due to less usage of the products/services than expected.

(d) Competitive Gap – this portion of gap is caused by sales lost to competitors due to inefficient marketing management.

For each of the above gaps, a distinct set of strategies to be evolved to reduce the overall gap.

The gap analysis requires the review of the following:

(a) Environmental position

(b) Functional level strategies

(c) Business level strategies

(d) Corporate level strategies

Before managers make decision to change strategies the following conditions must exist:

(a) A gap must exist between the existing and desired state of affairs.

(b) The gap must be large enough to be noticed, and must be seen as worthy of attention.

(c) The organization must be motivated to reduce the gap.

(d) The management of the firm must believe that there is something that can be done to reduce the gap.

In situations where the causes of performance are spread throughout the organization, gap analysis may be most appropriate technique for evaluating alternative strategies. However, portfolio analysis may be useful in tracing the overall poor performance to a particular portion of the business.

The business firms may take the following strategic actions to reduce or close performance gaps:

(a) Changing strategic plans for current business units.

(b) Adding units to the business portfolio.

(c) Deleting business units that are performing poorly.

(d) Improve business climate and alter conditions for the poor performance.

(e) Reducing corporate performance objectives if they are unrealistic.

The stages in the diagnosis of gap analysis are:

(a) Identify the current strategy. What are the assumptions or predictions about the environment on which current strategy is based?

(b) Predict the future environment. Are the assumptions or predictions the same? Is there a gap?

(c) Assess the significance of the gap between the current and future environments for the firm. Are changes in objective needed? Do changes in strategy appear useful to consider? Will they reduce the gap?

Internal Analysis # 5. Porter’s Value Chain Analysis:

With highly competitive environment, the organizations are aiming to be ‘customer driven’ i.e. customer satisfaction is priority one. One of the key tools in the hands of the management to achieve above aim is ‘value chain analysis’. The term ‘value’ refers to the usefulness of the product or service and as a result its value to the customer. Value engineering aims to reduce non-value added costs by reducing the quantity of cost drivers of non-value added activities.

The value of an organization depends upon the activities of the organization. Value is the amount buyers are willing to pay for what a firm provides them. The total revenue reflects the value. Creating value for buyers exceed the cost of doing so is the goal of any generic strategy.

Value chain is defined as “the linked set of value-creating activities all the way from basic raw material sources for component suppliers to the ultimate end-use product or service delivered to the customer.”

Value chain analysis is defined as “a means of segregating various activities of a business and identify them with respect to their contribution towards value generation by identifying the cost i. e. inputs consumed by that activity and output generated by that activity.”

The value chain approach was developed by Michael Porter in the 1980s in his book “Competitive Advantage- Creating and Sustaining Superior Performance.”

‘Value chain analysis’ is a strategic managerial tool to assess and review the various business functions in which utility is added to the products or services. The various business functions include research and development, design of products, services or process, production, marketing, distribution, customer service and strategy and administration.

Value chain analysis not only describes these as an essential and valued contributor but also integrates and coordinate the efforts of all these business functions in addition to developing the capabilities of each individual business function. By this way value chain analysis helps the management towards proper planning, operation, performance evaluation and decision making.

Porter depicts the value chain, comprising the above interrelated primary and secondary activities. Porter classified the full value chain into nine interrelated primary and support activities. Primary activities can be related to actions which the organization performs to satisfy external demands while secondary activities are performed to serve the needs of internal ‘customers’.

(i) Primary activities are the fundamental activities performed by an organization in order to be operative. They are- (a) Inbound logistics, (b) Operations, (c) Outbound logistics, (d) Marketing and sales and (e) Service.

(ii) Secondary activities are support activities, i.e. those activities required to ensure the efficient performance of the primary activities. Support activities are- (1) Infrastructure, (2) Human resources management, (3) Technology development, and (4) Procurement.

In contrast, the customary functional divisions within businesses are principally- warehousing, production, marketing, distribution, and administration.

This view is normally reflected in the hierarchical structures along which organizations are organized. It fails, however, to reflect the processes which the organization executes to service its customers and represents a more vertical perspective of an organization.

The different value chain activities can be briefly described as follows:

Value Chain Activity # i. Primary Activities:

a. Inbound Logistics:

Inbound logistics cover all the activities performed to have goods and services available for the operational processes as and when they will be required. This may include buying, transport, receiving, inspection, storage, etc.

b. Operations:

These are the operations the organization performs to convert its raw materials or products into a state for resale. In the case of a manufacturing concern these may be various production-related activities such as production control, machining, finishing, etc. For a retail business these may be the merchandising and display activities used to offer goods to customers for sale.

c. Outbound Logistics:

These are the activities performed to move merchandise between the seller and the purchaser. They may include selection, scheduling, transport, etc. of deliveries. Some businesses such as cash-and-carry wholesalers may not have such activities as these tasks are performed by the customer.

d. Marketing:

This includes all the activities performed to create demand for the organization’s products and services and includes advertising, sales, market research, etc.

e. Service:

It pertains to the services rendered to the customer. These include financing services such as financing the outstanding balance, or after-sales service to products, or services to handle customer queries and complaints, etc.

Value Chain Activity # ii. Support Activities:

a. Infrastructure:

This consists of the management structure which services the whole organization as well as structures such as reception, general postal services, messengers, financial accounting and other general activities. An attempt to trace these costs to any specific cost object will result in an inordinate amount of work.

The total amount of such cost should be relatively small in comparison with total cost and this cost is usually considered to be untraceable. The cost of the physical infrastructure (plant, equipment, etc.) is considered part of the cost of activities where the infrastructure is used.

b. Human Resources Management:

This is the basic activity of overseeing the acquisition, maintenance and severance of staff and principally services the primary activities. Personnel departments, in-house medical services and even sports clubs may be part of this major activity.

c. Technology Development:

The development of technology today may require large sums of money take place over a lengthy period of time and ultimately benefit a multitude of users in the organization. This cost must thus be seen as any capital project which cannot be charged to users before the project is operative.

Technology development cost could thus be capitalised and expensed to users over the useful life of the project. Cost of operating technology must, however, be traced to users on a usage basis. An example may be a large computer project which may take several years to complete. Users will only benefit from the project once it is operative and there is no point in charging this cost before such time.

d. Procurement:

The procurement activity services the organization as a whole by acquiring all necessary goods and services which the organization may require. If the activity is specifically related to the acquisition of, say, raw materials it could be seen as part of the inbound logistics process, i.e. a primary activity. If, however, the procurement activity cannot be linked to purchases for primary activities, it will be considered a secondary (support) activity.

The above value chain activities can, to a greater or lesser extent, be found in most businesses. The value chain serves as a useful mechanism to analyze an organization in order to determine what activities it performs to convert inputs to outputs. It also helps to develop a good understanding of the primary and support activities.

Value chain analysis is a powerful tool for managers to identify the key activities within the firm which form the value chain for that organization, and have the potential of a sustainable competitive advantage for a company. There in, competitive advantage of an organization lies in its ability to perform crucial activities along the value chain better than its competitors.

The value chain framework of Porter is an interdependent system or network of activities, connected by linkages. The linkages and relationships between various activities are often the basis on which competitive advantage is achieved. This also applies to linkages of the value chain of an organization with those of its suppliers, channels and customers. Resource analysis is an important means of assessing an organization’s strategic capacity.

Traditionally, much of the discussion on resource analysis has centered on the idea of strengths and weaknesses. The concept of ‘value chain’ is particularly useful in understanding an organization’s capability. Since it concentrates on value activities and the linkage between activities, rather than simply resources per se. An organization can be viewed as a flow of activities performed to provide products or services to the customers.

The concept of value chain concentrates on value activities and the linkage between activities for understanding an organization’s strategic capability, rather than simple resource analysis. Firms competing into the same industry sector are likely to have similarly configured value chains. Linkages between activities would be vital in creating competitive advantage.

Linkages exists within the firm, both horizontally and vertically and outside the firm with suppliers and customers. Identification of core or key competencies should help an organization to decide about which products and services, it should produce or perform in-house and which it should source from outside. Analysis of costs through the value chain is an important aspect of value chain analysis and design to provide essential data to search the competitive advantage and strategic capability.

Firms create value for their customers through performing activities mentioned in the value chain. To gain Competitive advantage over its rivals, a firm must either provide comparable buyer value by performing the activities more efficiently than its competitors (cost leadership) or perform activities in a unique way that creates greater buyer value and command a premium price (differentiation).

A firm’s value chain is an interdependent system of network of activities, connected by linkages. Gaining competitive advantage requires that a firm’s value chain is managed as system rather than a collection of separate parts. A firm should strive to understand not only its own value chain activities but also of the competitors, distributors and suppliers.

The value chain concept highlights four profit improvement areas:

(a) Linkages with suppliers

(b) Linkages with customers

(c) Process linkages within the value chain of a business unit

(d) Linkages across business unit value chain within the firm.

The concept has been extended beyond individual organizations and can also apply to whole supply chains and distribution networks. The industry wide synchronized interactions of those local value chains create an extended value chain, sometimes global in extent.

An enterprise’s activities convert inputs into outputs; value is added to inputs in order to convert them into outputs (products and/or services) which are purchased and used or consumed by customers.

The chain of activities that is performed to add value to inputs in order to arrive at the final outputs is referred to as the ‘value chain’. This concept was originally identified and defined by Porter. If an enterprise wishes to enjoy a competitive advantage it must carry out its activities in a more cost-effective way than its competitors do.

It is therefore clear that such an enterprise needs to have a value chain in which:

(i) There are a minimum number of activities,

(ii) All activities are effective, and

(iii) All activities are performed at a relatively low cost.

Internal Analysis # 6. Product Life Cycle Analysis:

Many products generally have characteristic of perishable distinctiveness. The distinctiveness of a product degenerates over a period into a common commodity. This process by which the distinctiveness gradually disappears as the product merges with other competitive products has been rightly termed by Joel Dean as ‘the cycle of competitive degeneration’.

The cycle begins with the identification of new consumer need and the invention of a new product and is often followed by patent protection and further development to make it saleable. This is usually followed by a rapid expansion in its sales as the product gains market acceptance.

Then competitors enter the field with imitation and rival products and the distinctiveness of the new product starts diminishing. The speed of degeneration differs from product to product. The innovation of a new product and its degeneration into a common product is termed as the ‘life cycle of a product’.

Activities in Product Life Cycle:

Typically the life cycle of a manufactured product will consist of the following:

Activity # a. Market Research:

Before any investment is made, the investor must believe that what the company proposes to make can be sold at a price which will permit a profit to be made. This usually means that market research will establish what product the customer wants, how much he is prepared to pay for it and how many he will buy.

Activity # b. Specification:

When market research has established what is to be made, it will be necessary to turn the general statement of requirements into a detailed specification which will tell the designer and manufacturing engineer precisely what is required. The design specification will give such details as required life, maximum permissible maintenance costs, maximum permissible manufacturing cost, the delivery date, the required performance of the product.

Activity # c. Design:

With a precise specification, the designers can produce the drawings and process schedules which define the geometry of the product and some of the manufacturing processes.

Activity # d. Prototype Manufacture:

From the drawings it will be possible to manufacture a smaller number of the product. These prototypes will be used to develop the product and eventually to demonstrate that it meets the requirements of the specification.

Activity # e. Development:

When a product has been made for the first time, it is necessary to prove that it meets the requirements of the specifications. In fact, when a product is first made it rarely meets the requirements of the specification and changes have to be made until it does. This period of testing and changing is ‘development’. Development can be very expensive and often generates a large negative cash flow before any products have been sold and hence, before any positive cash flows have been generated.

Activity # f. Tooling:

When a product is shown to meet the requirements of the specification and if calculations suggest that it will be profitable, the decision will be made to make to sell. This is not a decision that will be taken lightly because, in many cases, the decision to make a product for sale is a commitment to tool up for production. Tooling up for production can mean building a production line costing several lakhs of rupees, building expensive jigs, bujing special purpose machine tools or, in some other way, making a very large initial investment.

Activity # g. Manufacture:

The manufacture of a product involves the purchase of the raw materials, the purchase of bought-out components, the use of labour to make and assemble the product, and the use of supervisory labour.

Activity # h. Selling:

When the product is fit to sell and available, it may be necessary to spend money on a campaign to sell the product.

Activity # i. Distribution:

In the process of selling the product, it must be distributed to the sales outlets and to the customers.

Activity # j. Product Support:

When the product has been bought, the customer will expect it to be supported. The manufacturer or supplier will have to make sure that spares and expert servicing are available for the life of the product. The manufacturer or the supplier may even have to offer free servicing and parts replacement during the early life of the product.

Activity # k. Decommissioning or Replacement:

When a manufacturing product comes to an end, the plant used to build the product must be reused, sold, scrapped or decommissioned in a way that is acceptable to society.

Cost Control and Product Life Cycle:

Products and services typically pass through a series of distinct phases is termed the PLC. PLC is the pattern of expenditure, sales level, revenue, and profit over the period from new idea generation to the deletion of a product from the product range. PLC costing is a way to enhance the control of manufacturing costs. The thrust of PLC costing is the distribution of costs among categories changes over the life of the product, as does the potential profitability of a product.

Hence, it is important to track and measure costs during each stage of a PLC; research and development, design of a product, production, marketing, distribution and after sales service. It is known that the majority of products are determined at an early stage of the PLC. It is critical to control costs in the development stage of a product even though much of the product costs are not actually incurred until later.

In the traditional cost accounting system, however, cost analysis is usually conducted at the end of the life cycle (i.e., production stage) when not much can be done to change the cost structure. PLC costing approach is used to provide a long-term picture of product line profitability, feedback on the effectiveness of life cycle planning and cost data to clarify the economic impact of alternatives chosen in the design engineering phase etc.

Depending upon scientific management needs varying levels of detailed information may be captured by strategists for selected phases of life cycle. The major benefit of adopting PLC costing is that it provides an overall framework for considering total incremental costs over the entire life span of a product, which in turn facilitates the analysis of parts of the whole where cost effectiveness might be improved.

Internal Analysis # 7.

Environmental Analysis:

ETOP:

‘ETOP’ stands for ‘Environmental Threat and Opportunity Profile’. ETOP is tool used for environmental analysis. Assessment of the environmental information and determining the relative significance of threats and opportunities require a systematic evaluation of the information developed in the course of environmental analysis.

The environmental sectors in the analysis are listed in summary fashion. In a more extensive diagnosis, the sub-factors would be examined first and summary ETOP would be prepared. Preparation of ETOP is a convenient means by which attention of top management may be drawn to the most critical factors and their potential impact on the strategy of the firm as a whole and key aspect of its operation.

SAP:

The strategic advantage profile (SAP) is a tool for making a systematic evaluation of the enterprise’s strategic advantage factors which are significant for the company and its environment. The managers develop a SAP and match it with the ETOP to create conditions for adjusting or changing strategies or policies.

Internal Analysis # 8.

Competitive Position Analysis:

Competitive position has been highlighted by Simmonds as the basic determinant of future profits and of the business’s value. Since competitive position can change over time, so can profits and value, but it should not be assumed that an improvement in competitive position will be associated with an improvement in short-run profits. In fact, the opposite is likely to be the case due to the cost of building up a competitive position, which depresses current profits in favour of future profits.

This raises the question as to whether competitive position can be measured in accounting terms – not just for a given business but also for its main competitors, and not just at a point in time but also over time. Simmonds has attempted to do this by applying Strategic management accounting.

He makes it clear, however, that it is not possible to express competitive position as a single figure. But it is possible to offer an array of indicators relating to the competitive situation which will give managers insights into a business’s competitive position. Simmonds recommends that competitive data is built up for the market leader, close competitors and laggards rather than for all competitors.

Sales and Market Share:

Sales revenue of each firm relative to the total market is a cornerstone. Changes in market share should be closely monitored for they indicate changes in competitive position, with implications for future profits. Adding market share details to Management accounting reports enables managers to make more sense of what is happening.

Volume and Demand:

The incorporation of market share assessment into management accounting seems one of the most obvious steps in moving towards Strategic management accounting. A great deal of effort has also been expanded in trying to identify a standard product life cycle and relate strategy.

Price Experience:

Variations in costs from those of competitors are not the only indicators of strategic advantage or vulnerability. A competitor may use price policy to gain market share or to gain higher profits. Under inflation, most real price reduction takes place through firms holding prices while costs escalate or raising prices less than the cost inflation. Moreover the timing of price setting and hence strategy review is forced upon management by the rate of inflation rather than chosen as part of the strategy.

External reconstruction of competitor costs requires skill and imagination, collection of competitor prices is much more straight forward. Of course, few competitors sell just one product at one price, but it should not be difficult for strategists to build a weighted price index for a competitor. Where competitor revenues are also available, these may be used as to check the accuracy of such an index or as an alternative in the calculation.

Return on Competitive Position:

The capital expenditure decisions of a firm are, perhaps, its most important decisions. The scarce resources of capital are allocated to investments from which benefits or returns are expected over a period of time. Return from investment in competitive position will differ according to the future demand pattern.

In a high growth market, for example, the doubling of accumulated experience is rapid and the opportunity for correspondingly high cost reduction is equally great. A firm that can increase its market share in high growth market stands to gain considerably it is also possible that the cost of doing so will be low because the gain is achieved from the market growth without taking business away from competitors. In many situations, competitors are only aware of competitive attack when their sales fall.

Resources, Cash Flow and Portfolios:

Any decision should reflect on assessment of the effect on competitors’ profits and market share extended to forecast the pattern of conflict over the longer term. This pattern of conflict will, in turn, depend on competitors’ resources and liquidity as well as their profits.

Sometimes, competitors will lack of resources to retaliate; at other times some competitors will be protected with in a profitable market segment and will remain unaffected by competitive attack. More than any other business function, Strategic management has the skill for such competitor assessments. The skill needed amounts to accounting for competitors, from outside, and projected a head to suitable horizon.

Internal Analysis # 9. Competitor Analysis

:

A thorough analysis of the competitive environment can provide a strategist with many insights into current and future characteristics of the competitors and their strategic moves. The competitor analysis deals with the actions and reactions of individual firms within an industry or strategic group.

According to Porter, the purpose of conducting a competitor analysis is to:

(a) Determine each competitor’s probable reaction to the industry and environmental changes;

(b) Anticipate the response of each competitor to the likely strategic moves by the other firms; and

(c) Develop a profile of the nature and success of the possible strategic changes each competitor might undertake.

The competitor analysis is carried by firms competing in an industry with just a few firms possessing relatively equal capabilities. Competitor analysis is conducted by the firms operating in oligopolistic industries, to closely monitor and analyze the strategies, actions and moves of each competitor in the industry, to withstand to competition by making counter strategies and plans.

The competitor analysis tries to gather information on the following aspects:

(a) List of competitors to the firm.

(b) Competitors’ current strategies and moves.

(c) Competitors’ future goals and likely strategies.

(d) Objectives and intentions of the competitor.

(e) Strengths and weaknesses of the competitors.

(f) Likely response or retaliation of the competitors for firm’s actions and strategies.

Knowledge of competitors’ goals and objectives may help to predict its reactions to strategic moves and enable the firm to deal with environmental or industry events that occur.

Internal Analysis # 10.

Strategic Group Analysis:

According to Porter, a strategic group is the group of firms in an industry following the same or similar strategy along the strategic dimensions. A strategic group is a set of business units or firms that pursue similar strategies with similar resources. The classification of firms in the industry into a set of strategic groups in highly useful in better understanding of the competitive environment and enable to form a level playing field for competitive strategies.

Strategic groups are conceptually defined clusters of competitors that share similar strategies and therefore, compete more directly with one another than with other firms in the same industry. The theory of strategy groups emphasizes that within an industry, firms with similar asset configurations will pursue similar competitive strategies with similar performance results.

The firms in strategic groups with high mobility barriers will have greater profit potential than those in groups with lower mobility barriers. These barriers also provide a rationale for why firms continue to compete with different strategies despite the fact that all strategies are not quickly successful.

The companies belong to the same strategic group in the industry might have one or more of the following common features:

(a) Marketing and distribution channels

(b) Product features, attributes and quality

(c) Pricing of product and discounts

(d) Technological processes

(e) Product lines and product range

(f) After sales service and customer support facilities

(g) Degree of vertical and horizontal integration

(h) Geographical coverage and logistic services

(i) Marker share and cost structure

(j) Industry experience curve in which firm is lying etc.

Strategic group in an industry can be mapped by plotting the market positions of competitors in a two dimensional graph by selecting any two variables. By comparing the market positions of each firm separately or grouping them into like positions.

Step 1 – Identify the competitive characteristics that differentiate firms in the industry like price, market share, quality, brand image etc.

Step 2 – Plot the firms on a two-variable map, using pairs of differentiating characteristics.

Step 3 – Classify firms that fall into same category into one strategic group.

Step 4 – Determine the position of each strategic group, by making proportional to the size of the group’s respective share of total industry sales revenues.

The firms within a strategic group are in direct competition with each other than those in other strategic groups within the industry. Firms in each of the strategic groups might have different effects of the Porter’s five forces. The kind of opportunities and threats might vary across different strategic groups. Many empirical studies observes that very weak evidence of a link between strategic group membership and company profit rates inspite of the fact that strategic group model predicts otherwise.

Internal Analysis # 11. Fundamental Analysis:

The fundamental analysis suggests that every stock has an intrinsic value, which should be equal to the present value of the future stream of income from the stock discounted at an appropriate risk related rate of interest. Fundamental analysis tries to value the underlying factors in a business and estimate the intrinsic value of a security. Fundamental analysis is all about doing qualitative and quantitative analysis about basic details of the business such as the revenue, expenses, assets, liabilities and all other fundamental aspects of the company.

Fundamental analysis suggests that every stock has an intrinsic value, which should be equal to the present value of the future stream of income the stock discounted at an appropriate risk related rate of interest. Estimate of real worth of a stock is made by considering the earning potential of a company.

Estimate of real worth of a stock is made by considering the earning potential of a company, which depends on investment environment and factors relating to specific industry, competitiveness, quality of management, operational efficiency, profitability, capital structure and dividend policy. Fundamental analysts assume for the purpose of valuation that a share’s current intrinsic value must be calculated not on its potential capital gain, but on the total future return for which an investor holds the share for good.

Thus, a share’s true value ‘discounts’ its future earnings, that is, it takes into account the present worth of all those anticipated earnings. As the approach is based on relevant factors like economic climate and trends in financial markets, it generally gives more realistic estimate of the value of a stock.

The fundamental analysis is helpful in establishing basic standards, but cannot be totally relied because of the uncertainties associated with the economic and market factors. The analysis of the following will reveal the intrinsic value of stocks and therefore the worth of the companies.

The fundamentals of a company can be grouped into two categories:

The quantitative analysis is based on numerical terms and factors like operational efficiency, profitability, capital structure and dividend policy. The quantitative factors are those which can be obtained from the financial statements. The factors like revenue, expenses, profit, deferred revenue, capital structure, working capital, deferred revenue etc. Let us consider some of the ratios which are used in qualitative analysis.

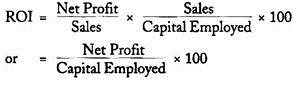

Return on Investment:

The prime motive of a business enterprise is to earn a return on capital employed or invested. The rate of return on investment (ROI) is determined by dividing net profit or income by the capital employed or investment made to achieve that profit. ROI consists of two components viz.- (1) Profit margin, and (2) Investment turnover as shown below-

For calculating the ROI, it is important that measures of profit and investment be clearly defined. Capital employed is taken to be the total share-holders funds, loans, minority interest and deferred taxation, reduced by capital work-in-progress, investment outside the business, preliminary expenses and debit balance of Profit and loss A/c.

Profit used as the numerator is the profit before taxation and before loan interest. Profit arising out of normal activities of the company should only be taken and abnormal and unusual items of receipts and expenses should be excluded. The analysis of firm’s ROI reveals the efficiency in utilization of assets in achieving the profits and its productivity.

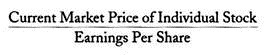

Price/Earning Ratio:

P/E ratio is the widely used index, which is calculated as follows:

Major economic dailies regularly publish this ratio for individual stocks. Other things remaining constant, a high P/E ratio is indicative of higher than warranted price. A P/E ratio below 15 is considered safe bait for prima facie consideration. This ratio measures the number of times the earnings of the latest year at which the share price of a company is quoted. It signifies the number of years in which the earnings can equal the current market price.

This ratio reflects the market’s assessment of the future earnings potential of the company. A high P/E ratio reflects earnings potential and a low P/E ratio low earnings potential. The P/E ratio reflects the market’s confidence in the company’s equity. P/E ratio is a barometer of the market sentiment.

Companies with excellent track record of profitability, professional management and liberal distribution policy have high P/E ratios, whereas companies with P/E ratios with moderate track record, conservative distribution policy and average prospects quote at low P/E ratio. The market price discounts the expected earnings of a company for the current year as opposed to the historical EPS.

Earnings per Share:

EPS provides a very strong basis for fundamental and bottom line analysis.

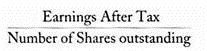

EPS is calculated as follows:

EPS denotes the post-tax profit per equity share. A slight variation in EPS is available in Cash Earnings per Share (CEPS) wherein non-cash expenditure like depreciation is added back to the earnings after tax for final computation. A change in EPS with corresponding change in sales volume provides a good measure about the responsiveness of the company’s profit position vis-a-vis market fluctuations.

This is one of the most important ratios which measures the net profit earned per share. EPS is one of the major factors effecting the dividend policy of the firm and the market prices of the company. Growth in EPS is more relevant for pricing of shares than absolute EPS. A steady growth in EPS year after year indicates a good track of profitability.

Book Value:

Book value indicates the net-worth per equity share calculated as follows:

The book value is a reflection of the past earnings and the distribution policy of the company. A high book value indicates that a company has huge reserves and is a potential bonus candidate. A low book value signifies a liberal distribution policy of bonus and dividends, or alternatively, a poor track record of profitability. Book value is considered less relevant for the market price as compared to EPS, as it reflects the past record whereas the market discounts the future prospects.

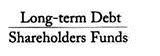

Debt Equity Ratio:

This ratio indicates the relationship between loan funds and net worth of the company, which is known as ‘gearing. If the proportion of debt to equity is low, a company is said to be low-geared, and vice versa.

A debt-equity ratio of 2:1 is the norm accepted by financial institutions for financing of projects. Higher debt-equity ratio may be permitted for highly capital intensive industries like petrochemicals, fertilizers, power etc. The higher the gearing, the more volatile the return to the shareholders.

Dividend Payout Ratio:

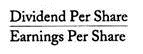

Dividend payout ratio is the dividend per share divided by the earnings per share. Dividend payout indicates the extent of the net profits distributed to the shareholders as dividend.

A high payout signifies a liberal distribution policy and a low payout reflects conservative distribution policy.

Dividend Yield:

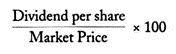

This ratio reflects the percentage yield that an investor receives on his investment at the current market price of the shares.

This measure is useful for investors who are interested in yield per share rather than capital appreciation.

Dividend Cover:

This ratio indicates the number of times; the dividends are covered by net profit. This highlights the amount retained by a company for financing of future operations.

Interest Cover:

The interest coverage ratio shows how many times interest charges are covered by funds that are available for payment of interest.

An interest cover of 2:1 is considered reasonable by financial institutions. A very high ratio indicates that the firms is conservative in using debt and a very low ratio indicates excessive use of debt.

The qualitative fundamentals involve the nature of industry, investment environment, factors relating to specific industry, competitiveness, quality management, corporate governance etc. The basic objective of making investment in stock is to obtain higher returns by selling the stocks at higher prices subsequently.

The positive change in price of stocks and income in the form of dividends and interest is expected by the investor to invest his funds in the stocks. The returns on the stock will be influenced by the external factors. The securities analyst must analyze the economic factors and the industry performance to forecast the earnings on investments.

The qualitative factors that affect the fundamentals and earning capacity value of the company are discussed briefly as follows:

a. Macro-Economic Analysis:

The analysis of the following factors indicates the trends in macro-economic changes that effect the risk and return on investments.

i. Money supply

ii. Industrial production

iii. Capacity utilization

iv. Unemployment

v. Inflation

vi. Growth in GDP

vii. Institutional lending

viii. Stock prices

ix. Monsoons

x. Productivity of factors of production

xi. Fiscal deficit

xii. Credit/Deposit ratio

xiii. Stock of food grains and essential commodities

xiv. Industrial wages

xv. Foreign trade and Balance of payments position

xvi. Status of Political and economic stability

xvii. Industrial wages

xviii. Technological Innovations

xix. Infrastructure facilities

xx. Economic and industrial policies of the government

xxi. Debt recovery and loans outstanding

xxii. Interest rates

xxiii. Cost of living index

xxiv. Foreign investments

xxv. Trends in capital market

xxvi. Stage of the business cycle

xxvii. Foreign exchange reserves

b. Industry Analysis:

The securities analyst will take into consideration the following factors into account in assessing the industry potential in making investments:

i. Post sales and earnings performance

ii. Governments attitude towards industry

iii. Labour conditions

iv. Competitive conditions

v. Performance of the industry

vi. Industry share prices relative to industry earnings

vii. Stage of the industry life cycle

viii. Industry trade cycle

ix. Inventories buildup in the industry

x. Investors preference over the industry

xi. Technological innovations

xii. Return on capital employed

xiii. Critical cost component

xiv. Availability of skilled manpower

xv. Constant innovation

xvi. Supply side constraints

xvii. Commoditized products

xviii. Regulatory constraints

xix. Growing domestic demand

xx. Expanding export market

xxi. Macro trends

c. Other Aspects of Fundamental Analysis:

i. Competitive Advantage:

The competitive advantage for an organization means discovering the needs of the customers and then satisfying them by having a technological development in competitive environment.

ii. Competitive Position:

The competitive position is the basic determinant of future profits and of the business value. Knowledge of relative costs and market share of important players in the industry is an important aspect of the company’s competitive position. The evaluation of firm’s comparative advantages or value added, relative to competitive firms is the major determinant of the company’s worth.

iii. Corporate Governance:

The policy of corporate governance adopted in an enterprise stipulates parameters of accountability, control and reporting functions of the Board of Directors. It is concerned with the establishment of a system whereby the directors are entrusted with responsibilities and duties in relation to the direction of corporate affairs.

iv. Company’s Intangibles:

The fundamental analysis takes into consideration the various intangibles of the company like brand image, cost advantage, technological development, investor friendly policies, human resource development and loyalty etc. which play a strong influence on the value of stock price of the company.

v. Efficiency of Management:

The capability and efficiency of the management who are in the control of affairs of the company will have a vital impact on the share price, since the management decision will make the company to get killed or win in the competitive business situations. The financial news dailies analysis will help in evaluation of management of a particular company.

vi. Timely Information and Transparency:

The timeliness and transparency in the information provided by the company help in deciding the security of the company in establishing a relation with its stakeholders.

vii. Structure of the Board of Directors:

The balanced structure of the board of directors which represents, finance, accounting, technical, human resources, marketing, production, special advisors will win the confidence of the investing public. Since the skills of different experts are balanced in the board room for development of the enterprise.

Fundamental analysis provides a more in-depth and fundamental measure of stocks from a long-term perspective by studying their fundamental parameters. Analysts perform fundamental analysis since it is largely believed that stock price does not reflect the value of the company. This true value or the intrinsic value can be estimated only through the fundamental analysis.