Everything you need to know about approaches to strategy formulation. Strategy formulation is often referred to as strategic planning or long-range planning. This process is primarily analytical, not action- oriented.

The strategy formulation process is concerned with developing a corporation’s mission, objectives and policy.

This process involves scanning external and internal environmental factors, analysis of the strategic factors and generation, evaluation and selection of the best alternative strategy appropriate to the analysis.

The approaches used for generating the strategic alternatives and their analysis and evaluation range from simple common sense approaches to highly sophisticated model building. That is, they are both qualitative and quantitative.

In this article we will discuss about the approaches to strategy formulation that are proven, tested and trusted by the strategists.

The approaches are:- 1. Intuitive Approach 2. Muddling through or Disjointed Incrementalism 3. Gap Analysis Approach 4. Capital Investment Appraisal 5. Portfolio Approach 6. Entrepreneurial Approach 7. Key-Factors Approach 8. ‘Inside Out’ Planning 9. Integrated Approach.

Approaches to Strategy Formulation: Intuition Approach, Gap Analysis, Portfolio Approach, Key-Factors Approach and a Few Others

Approaches to Strategy Formulation – Approaches that are Proven, Tested and Trusted by the Strategist for Formulating Strategies

Strategy formulation is often referred to as strategic planning or long- range planning. This process is primarily analytical, not action- oriented. The strategy formulation process is concerned with developing a corporation’s mission, objectives and policy. This process involves scanning external and internal environmental factors, analysis of the strategic factors and generation, evaluation and selection of the best alternative strategy appropriate to the analysis.

The approaches used for generating the strategic alternatives and their analysis and evaluation range from simple common sense approaches to highly sophisticated model building. That is, they are both qualitative and quantitative. These approaches are proven, tested and trusted by the strategists.

Approach # 1. Intuition:

Strategic decisions based on intuition are marked by the extensive use of strong common sense, hunches, inner feeling or popularly known as ‘gut-feelings’ of the person making any decision. This intuitive approach does not rest on the formal corporate planning structure and system but chooses to base the strategies on instinctive know ledge of the management.

Intuition is the residuary base for covering up deficiencies in other bases of decision making. In using intuition, a person’s personal suggestions, influences, preferences and mental frame of the individual deciding play major role. Decisions based on intuition are more subjective than objective.

Though subjective in nature, the advocates of ‘hunch’ believe strongly that he has a very strong ‘precognitive’ ability as is better suited to anticipate the future, particularly in such cases where reliable data are lacking or inadequate. It is quite possible that such a decision maker might have been consciously influenced by the past knowledge, training and the background.

His feelings are quite ‘natural’ in his way and not deliberate that is, no set pattern of decisions is usually made by a person using his base. He handles the problem apparently and gives his decision. Normally, such decision-maker is, by nature, an activist, fast- mover, inside as to questions of situation and finds a unique solution to even the most complex problem.

He banks heavily on instincts, a personal feel for a given situation but blends all towards realistic solution. He enjoys a great quality of sensing the opportunities by sheer conviction of belief and pushing forward like a dare-devil. Intuitive minds are more imaginative and visionary than analytical brains.

Like other nations of the west and east, India does not lag behind in such visionaries. The best examples can be J.R.D. Tata, S.L.Kirlosker, B.V. Roa, G.D.Birla, Keshub Mahindra, Dhirubhai Ambani, G.M. Modi, R.P. Goenka, Mafatlal and so on. These great-sons of India founded their companies on intuitive mind than scientific analysis.

The decisions based on intuition are good because- i. They take lesser period of time ii. Problems with limited influential factors have ready solutions and iii. They provide an opportunity to make the decision-making ability a habit.

However, the demerits are- i. There is a danger that decisions may go wrong if hunch goes wrong, ii. The means for substantiating the decision to peers of the decider are not available, iii. They minimise the importance of other bases of decision-making unduly.

In case this intuitive and creative approach is combined with intellectual or scientific and analytical reasoning. This is what Mr. Henry Mintzberg emphasized. He says “There are good people with both analytical and creative abilities. Just one by itself is dangerous- one leads to paralysis by analysis, and other causes extinction by instinct. You have to test creative ideas analytically, but you also have to eyeball analysis creatively or intuitively. A healthy organisation combines them.”

Approach # 2. Muddling through or Disjointed Incrementalism:

Muddling through or disjointed incrementalism is an adhoc approach. The meaning of the term ‘ad-hoc’ is—”for a particular occasion only”, or ‘improvised’. Under adhocism the management arrives at strategic cut off point when the opportunities force them to do so. That is, the adhoc approach avoids intellectual exercise of prediction.

It stresses the present than future. There is no deliberate effort to predict the future. This is quite reverse to the very concept of modern management. According to the present day management, a true manager is one who makes event to happen, he does not wait for the happening of an event. However, adhoc approach allows the things to happen on their own. That is, adhoc approach is ‘proactive’ and not reactive.

The merits of the adhoc approach are- i. The decisions are made quickly, ii. It is not costly in terms of time, talent and treasure iii. It is good and the only way to arrive at decision where future cannot be anticipated with greatest degree of accuracy.

The demerits of this approach are- i. No attempt to probe the future and no intellectual attempt, ii. Personal bias may turn the choice more subjective iii. It is against the theory of management.

Approach # 3. Gap Analysis:

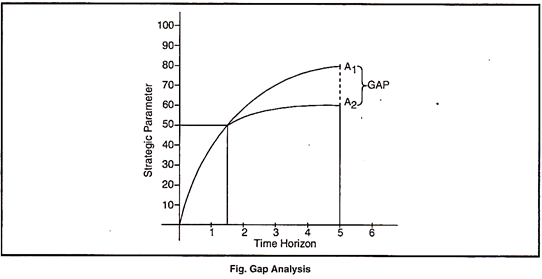

It is quite obvious that there is slip between cup and the lips. That is, there is gap between a promise and performance. Different parameters of performance-sales, profit cost and so on can be compared at definite time interval and with a lapse time one finds a gap between actual sales, profits and costs with the projected sales, profits and costs. There may be different reasons that can be attributed for this gap.

Gap analysis examines the current position of a firm in terms of operational performance, resources, and activities of the competitors, its current and planned research and development program, price elasticity of demand for its products, constraints imposed by the corporate objectives on its actions external economic conditions, and the present stage the firm has reached in product life cycle.

In simple terms, gap analysis is to do with the gap between the target and actual performance by following a particular strategy and, if gap exists what alternative strategy helps to wipe of the gap.

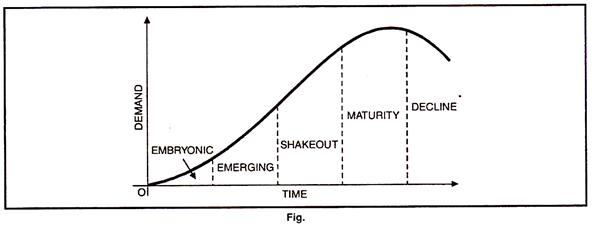

The following diagram makes it amply clear:

The above diagram clearly demonstrates that for the first one and half years, there is no gap in the targeted and actual performance and after that the gap goes on widening and it is exactly A1 A2 in fifth year and this gap goes on widening after five years unless a new strategy is replacing the existing one.

Thus, gap analysis points out the implications and consequences of alternative courses of action that are designed to realise the target in terms of profit, sales, costs and so on. It is equally true that alternative courses carry differing levels of risks.

For instance, if the company wants to wage a war-price-war-against the competitors the level of risk will differ from say introduction of new product line than spending more on advertising campaign side by side improving the existing product.

The factors that are accountable for widening the gap are corporate planning, managerial policy, and corporate policy and so on, on one side and the external forces on the other.

Approach # 4. Capital Investment Appraisal:

Capital investment or capital expenditure is that portion of total capital outlay which is sink or blocked for the longest period. That is, this expenditure or investment is dead in the sense that it cannot be liquidated unless there replacement or the closure of the firm. Capital expenditure or investment appraisal is a must to avoid unwanted and wrong investment.

This capital investment appraisal is to do with three things namely- 1. Arriving at the cash inflows in case of different strategic decisions by evaluating the marketing, production, financial and other dimensions. 2. Arriving at different cash outflows that consist of expenditure on plant and machinery, land and building the associated expenses and fees (legal) and the working capital. 3. Evaluation of cash inflows and outflows in terms their respective time values.

In fact, arriving at cash outflows does not pose any problem. The real problem is that estimating or projecting the cash inflows over the estimated life-span of these assets. The experts have come out with a number of evaluation methods which are broadly classed into two categories as traditional and modern.

The traditional methods do not take into account the time value of money and the modern they do care for time value. The traditional methods are- pay back and accounting rate of return. The modern methods are net present value, profitability index and internal rate of return. It pays to note each of the methods.

Pay back or pay out method calculates the number of years the investment proposal takes to recover original cost of investment plus installation charges. It is a rough and ready method which tells that lesser the period the lesser the risk associated with the investment proposal. Indirectly it evaluates the profitability of the project.

ii. Accounting Rate of Return Method:

Accounting rate of return measures the return on investment. This rate x>f return may on original investment or average investment. The decision criterion is higher the accounting rate of return better the proposal.

iii. Net Present Value Method:

This method takes into account the time value of money. That is, the yearly cash inflows are discounted at given rate of cost of capital over the life and compared to the total cash outflows.

The decision criterion is, if the cash inflows-discounted-are more than the cash outflows, better accept otherwise reject. That is, any proposal showing positive balance is an indication that the investment proposal is contributing to the wealth maximisation.

This is a variation of the net present value. Under this method, the discounted cash inflows are compared with the original investment. In case the cash inflows-discounted-are more than investment or more than one, it is a promising investment failing which it is not worthwhile to entertain.

IRR or trial and error method is an attempt to find the rate at which the discounted cash inflows are equal to the original investment. The decision criterion is a proposal with higher rate of discount is acceptable. Sometimes cut off rate can be used.

Suppose, it is company’s policy to accept IRR above 15 percent, it means that up to 15 percent-the projects are not acceptable. Anything more than 15 percent is acceptable. The higher the rate of IRR, better the investment proposal as it is put to acid test of cold facts.

These above methods are applied in conditions of certainty. In case of uncertain conditions, there are two ways to evaluate. One is assign the probabilities of cash-inflows and get the discounted value. Another way is to determine the net present value under dynamic variables of marketing, financial, technological and political situations. This is possible by simulation technique using computers.

Approach # 5. Portfolio:

Portfolio analysis is an attempt to determine the long term growth and, therefore, profitability prospects in the light of changing strengths and weaknesses of a firm. The specialty of this port-folio analysis is that it divides the whole organisation into distinct businesses and investigates at length each business as an entity and assesses the extent to which each entity contributes to the entire business spread.

The fundamental objective is to design a strategy which helps the organisation to have the most appropriate allocation of resources so as to gain most. The port-folio techniques available are basically three but certain variations are also developed.

These are:

i. Boston Consultancy Group model

ii. GE Nine-Cell Planning Grid

iii. Industry Evolution Matrix

iv. Directional Policy Matrix Model

v. Profit Impact Market Strategy Model

vi. Arthus D. Little Company matrix

vii. Space Matrix

viii. QSP Matrix

i. Boston Consulting Group Business Matrix:

Boston Consulting Group Model or Port-folio Planning Model is the model which aims at clearly identifying the underlying tenets of specific business segments. It is a careful analysis of each product and market segment as a separate business so that each business may be assigned to a specific strategy or sub- strategy.

It involves the allocation of according to corporate perspective of each of the business segments within the total port-folio. This model uses the growth-market share matrix concept to evaluate firm’s products, business or profit centres as distinct entities and helps the strategic managers to identify the cash-flow requirements of the different businesses which are part of their port-folio.

ii. GE Nine-Cell Planning Grid:

General Electrical Company (GEC) of U.S.A. has developed a nine- cell grid with the help of Mc Kinsey & Company of U.S.A.

GE grid is different from BCG matrix on two counts:

(a) GE grid has considered a number of factors in assessing the industry attractiveness and business strength instead of a single measure to one of two dimensions—market share and market growth.

(b) GE grid considers three degrees of a dimension-high, medium and low as compared to BCG matrix where two degrees-high and low considered.

In order to measure business strength a number of factors such as market share, profit margin, ability to compete, market knowledge, technology, competitive position and management caliber. These factors may be quantified on the basis of assessing the strength and importance of different factors for being successful in an industry.

The degree of strength and importance may be assigned rating and weight subjectively based on personal experience. Industry attractiveness factors include industry profit margin, competition, market size and growth rate, economies of scale technology, social, environmental, legal and human factors. Those factors can also be quantified in the same way as has been said in the case of business strength factors.

Nine Cells of GE grid are divided into three zones and depicted by different colours- green, yellow and red. This is analogous to traffic signal-green for go, yellow for wait, and red for stop.

iii. The Industry Evolution Matrix:

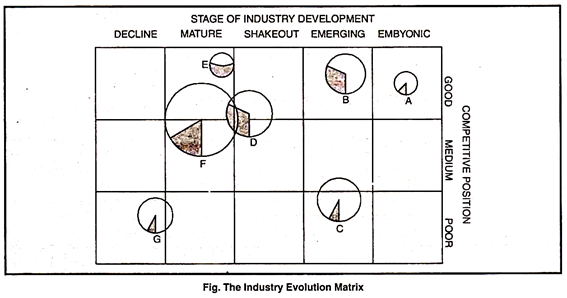

This industry evolution matrix is also called as product/market Evolution Matrix. This analytical model is designed by Charles Hofer who proposed three by five matrix or 15 cell matrix based on industry evolution as an improvement over Mckinsey Matrix. Accordingly, the business units are classified according to two parameters namely, the product/market evolution of the units and their competitive positions.

Like, business planning grid of the ‘stop light’ strategy model, the relative size of the respective industries is represented by circles and relative market share of the concerned business is shown by the shaded parts of the circles.

The product/market evolution or stages of industry development are plotted on vertical axis of the matrix and divided into five segments marking each stage namely, embryonic, emerging, shake out, maturity and decline, which configure as under-

The competitive position is plotted on the horizontal axis is three segments namely, good, medium and poor. The following diagram gives a vivid picture of Charles Hofer’s Matrix.

The matrix projects the position of different SBUs which are in different stages of life cycle. Business A enjoying a very strong competitive position in embryonic stage indicating its high potential question mark which should be matured.

Business B with good competitive position on the marging stage is a developing winner which should be cared for. Business C has a poor competitive position in emerging stage needs very extra care if it is to further progress positively. Business D has strong competitive position in shake out stage can be turning winner and advancing maturity stage that guarantees profit earning.

Business units E and F are profit producers which are to be managed to encourage them to consolidate and maintain their competitive strength. Business unit G is having poor competitive position and is in decline stage and is a loser which is to be divested or liquidated.

Improvement Over McKinsey Matrix – The Industrial Evolution Matrix is an improvement over the McKinsey Matrix as it tries to assess the competitive position of SBU with regard to industry life cycle.

Ignores Industry Attractiveness – Though it gives weightage to industry life cycle concept, it safely ignores the significant factors of industry attractiveness.

iv. Directional Policy Matrix Model:

This is better known by its abbreviation as DPM model which was developed by Royal Dutch Shell Chemicals of England. It uses two dimensions or parameters namely, business sector prospects and the company’s competitive strengths to choose the strategies.

Each parameter is further sub-divided. The competitive capabilities parameter is divided into strong, average and weak degrees. The business sector prospects into three degrees as attractive, average and unattractive.

Thus, it has three by three or nine sectors for analysis. Each sector or quadrant is given the type of strategy to be followed based on the position it occupies in the matrix.

v. Profit Impact of Market Strategy Model:

After having mastered the GE’s screening grid analysis, now the time has come to know about an alternative to this process of business unit analysis. The alternative available is profit impact of marketing strategy (PIMS).

The Strategic Planning Institute (SPI) in Cambridge, Massachusetts, developed an alternative tool based on extensive data bank that contains information about business performance and various factors found related to business performance.

Strategic Planning Institutes research program better known as PIMS, involves use of data collected and analysed over a period of twenty years by Professor Sindney Schoerffler and his close associates. The PIMS data bank currently contains detailed information for more than 2200 companies or the SBUs within the companies.

The data got from each participating company consists of nearly one hundred items including descriptive features of the market environment, the state of competition, the strategy followed by the business and the operating results obtained.

Each company is expected to supply its assumptions Or the postulates about the “most likely” future rates of changes in sales, prices, material costs, wage rates and equipment costs as a part of its profile. Normally, such information is collected in two time ranges namely, one to four years and five to ten years.

It is very important to note here that a business area services as the unit of analysis in the PIMS Studies.

Here, each business is a division product-line or other profit centre within its parent company, selling a distinct set of products and services or only products or services to an identifiable group of customers, is comparison with a well-defined set of competition and for which purposeful separation can be made of revenues, operating costs, investments and strategic plans.

Depending on the individual case and situation, a company might choose to give data on any product category or an entire division with several products. The requirement of purposeful or meaningful segregation of revenues, operating costs, investments and strategic plans is likely to result in reporting by division or business unit than by specific product market categories. Following is the chart showing business information in the PIMS data-base.

vi. Arthur D. Little Company Matrix:

This is the matrix suggested by Arthur D. Little Company for portfolio analysis which is twenty sector or four by five matrix which aims at linking stages of the product life cycle with the competitive strength of the businesses. It is like industry evolution or market evolution which has been designed by Charles Hofer. The change is that of measuring the business strength in five point range instead of three point range.

The SBUs are classified according to their business strength. The SBUs are plotted on the vertical axis which is divided into five segments namely, weak, tenable, favourable, strong and dominant. The stages of life cycle of the products are plotted on the horizontal axis in four segments namely, embryonic, growth, maturity and decline.

The strategic approach differs according to the position of the business in terms of the business strength and the stage of the product life cycle. That is, ‘build up’ strategy in case of SBU of which products are in embryonic or growth stage subject to the condition that the SBUs enjoy favourable and strong business position.

The ‘hold’ strategy is for the SBUs having a favourable to dominant business strength whose product is in maturity stage. For SBUs with the product in the decline stage and having a strong or dominant business strength, the ‘harvest’ strategy fits.

However, for any such SBU having weak business strength, with unacceptable return on investment, the ‘divestment’ strategy is the only alternative. The same strategy is also applicable to that SBU which has weak business strength and product in the maturity stage.

Since, it is like the industry evolution matrix, it enjoys same set of merits and suffers from same set of demerits as in case of industry evolution matrix.

Arthur D. Little Company Matrix—that is just prior to “choice of a strategy”

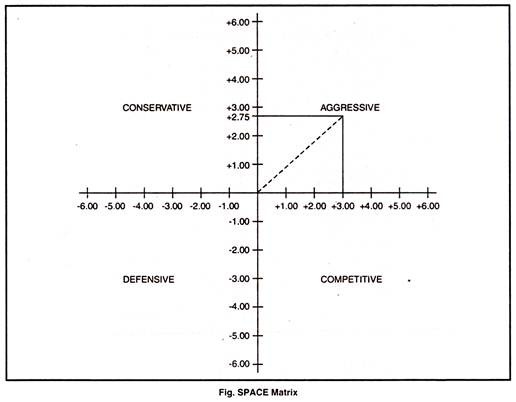

Space matrix is a managerial tool used to analyse a company as to what type of a strategy a company should employ. The strategic position and action evolution matrix or short a SPACE matrix is the strategic management tool that focuses on strategy formulation particularly as related to the competitive position of an organisation.

How space matrix method works?

The best thing to understand as to how it works, it pays to reverse engineer it. To start with take a look at what is the outcome of a SPACE matrix analysis.

The space matrix is broken down into four quadrants where each quadrant suggests a different type or a nature of a strategy namely, aggressive, conservative, defensive and competitive.

The space matrix look as configured below:

This specific SPACE matrix clearly states that a company should follow an aggressive strategy. Here, the company has strong competitive position in the market with rapid growth. It requires to use its internal strengths to develop a market penetration and market development strategy. This comprises of product development, integration with other companies, and acquisition of competitors and so on.

The question arises at the level that how one gets the possible outcomes projected in the space matrix? The space matrix analyses the functions upon the two internal and two external strategic dimensions in order to determine the company’s strategic posture in the industry. This space matrix is founded on four areas of analysis.

The internal strategic dimensions are- (i) Financial Strength (FS) and (ii) Competitive advantage (CA). The external strategic dimensions are- (i) Environmental Stability (ES) and (ii) Industry Strength (IS).

There are many SPACE matrix factors under the internal strategic dimensions. These factors analyse a business internal strategic position. The financial strength factors mostly come from company accounting.

These SPACE matrix factors may include say, return on investment, leverage, turnover, liquidity, working capital, cash-flow and others. Competitive advantage factors cover say, the speed of innovation by the company, market niche position, customer loyalty, product quality, market share, product life cycle and the like.

Each and every business is affected deeply by the environment in which it operates. SPACE matrix-factors related to business external strategic dimensions are say, overall economic condition, GDP growth, inflation rate, price elasticity, technology, barriers to entry, competitive pressures, industry growth potential, and so on. These factors can be very well analysed by using the Michael E Porter’s Five Forces Model.

The SPACE matrix calculates the importance of each of these dimensions and places then on a Cartesian graph with X and Y coordinates.

viii. Quantitative Strategic Planning Matrix (QSPM):

Strategic management process is in objective, logical, systematic approach for making major decisions in an organisation. It tries to organise qualitative and quantitative information in a way that allows effective decisions to be made under conditions of uncertainty.

Though strategic managements is not a pure science, it lends itself to a nice, neat, one-two three approach, the process is viewed as consisting three distinct stages namely, strategy formulation, strategy implementation and strategy evaluation. It is the Quantitative Strategic Planning Matrix (QSPM) that rightly fits in the first stage of strategy formulation, and is an excellent tool for deciding among the feasible alternative strategies.

Though it is not used widely by strategists, QSPM is an excellent tool for assimilating and prioritizing the key internal, external and competitive information needed for devising an effective strategic plan.

The relative importance of various facts, figures, trends and data in deciding among feasible alternative strategies to pursue is critically important in formulating strategies that can provide major competitive advantages to the firm. It is the QSPM provides. a clear cut frame work for this prioritization process.

The basic tenet of QSPM is that firms need to systematically assess their external and internal environments, conduct research, carefully evaluate the pros and cons of various alternatives, perform analyses and then decide up a particular course of action.

In contrast, professor Mintzberg’s notion of “crafting” strategies embodies, the artistic model, which suggests that strategic decision making be based basically on holistic thinking, intuition creativity and imagination. Professor Mintzberg and his followers reject strategies that stem from objective analysis such as QSPM analysis, preferring instead subjective imagination.

In contrast, many managers and academicians reject strategies that are the outcome of emotion, lunch, creativity and politics. The proponents of the artistic view generally consider strategic planning exercises and development matrices such as the QSPM to be time poorly spent.

The Mintzberg Philosophy insists more on informality as opposed to formality. It is worthwhile to note that the two approaches are not certainly mutually exclusive, but Professor Mintzberg refers to strategic planning as an “emergent” process whereas more objective proponents use the term “deliberate” process.

The deliberate process of which the QSPM is a part contends that it is unwise for the strategists to rely too much on gut feeling and opinion in the absence of research data, competitive intelligence and analysis in formulating strategies.

There is a widespread agreement that formulating strategies begins with the development of a clear vision and mission, followed by an internal and external assessment that leads to establish long term objectives, and finally generate and decide among specific strategies to pursue, whether one is more supportive of the emergent or deliberate approach to strategic planning.

Merits and Limitations of QSPM:

QSPM analysis has its own merits and demerits or limitations.

1. QSPM sets strengths considering simultaneously or sequentially.

2. Integration of pertinent external and internal factors in the decision making process.

1. QSPM requires intuitive judgements and educated assumptions.

2. QSPM is only as goods as the prerequisite inputs.

3. In QSPM, only strategies within a given set are evaluated relative to each other.

Approaches to Strategy Formulation – 6 Main Approaches: Intuition, Disjointed Incrementalism, Entrepreneurial Approach, Key-Factors Approach and a Few Others

Possible approaches to strategy formulation are many. Gilmore has distinguished between the traditional approaches which developed during the period between World Wars I and II and the modern approach which has evolved since the mid-1950s.

The traditional approach comprised:

(a) A size-up of the situation of the company as a whole generally on the basis of size-ups of the functional departments;

(b) Determination of objectives; and

(c) Development of programme of action covering the various activities of the company in the light of direction and unity of purpose provided by the objectives.

It was an open-ended process. As Gilmore put it, there was a definite tendency for top management to size up the situation, starting at the very base; formulate objectives and programmes of action; organise to carry out the plans; and exercise executive control; but then drift along until serious problems made it necessary to size up the situation again. In short, the traditional approach was characterised by a concern for short-term problems, sporadic diagnosis and sizing up the situations as a basis for new course of action, and adaptability to meet changes in current conditions.

The new, modern approach has evolved with emphasis on reappraisal of the existing strategy in the light of changing external conditions, constant surveillance of the environment to identify and capitalise on long-term opportunities, formulation of alternative strategies, if necessary, and choosing an appropriate strategy, all within a formalised system.

In a model set-up, the process of strategy making should work as follows – Current strategy is reappraised from time to time in the light of internal operating results, economic trends, competitors’ action, and technological developments. When opportunities and threats have been disclosed, management proceeds to ask questions designed to indicate when and in what respect strategy should be changed. If a new economic mission is called for, the planners proceed to formulate a revised approach. This, in turn, calls for the revision of the competitive approach and of the programme of action.

If the economic mission is considered sound, the competitive approach is questioned. If the competitive approach seems appropriate, the process continues until the appropriate area for revision is identified and a new strategy is formulated.

The method of strategy formation delineated above is a rational, normative proposition. One may also distinguish between different approaches to strategy-making on the basis of the thrusts which generate strategic alternatives and determine the effectiveness of strategic decisions.

Let us examine these approaches briefly:

Approach # 1. Intuition:

The basic premise of this approach is that the strategy evolves in the mind of the chief executive without ever being explicitly stated and without the aid of formal procedures. “Intuition.” Sterner has observed, “is an excellent approach if it is brilliant.” Along with intuition, personal judgment is also a necessary element in this approach.

In the United States, Alfred Sloan of General Motors Corporation, Henry Ford of Ford Motor Car Company, and in India, Lala Sri Ram, Walchand Hirachand, J.R.D. Tata, G.M. Modi, Shri Anantharamakrishnan. G.D. Birla, to name a new among the pioneer industrialists, are often remembered for their imagination, drive and expansive vision, which led to corporate growth and prosperity in different fields.

The strategies developed by each of them over the years may be attributed to their intuition and judgment. The very nature of strategy formation is said to provide the raison d’ etre of this approach. As Anthony has put it, Strategic planning is essentially irregular. Problems, opportunities, and ‘bright ideas’ do not arise according to some set time table; they have to be dealt with whenever they happen to be perceived.

The appropriate analytical techniques depend on the nature of the problem being analysed and currently there is no general approach (such as a mathematical model) that is of much help in the analysis of the types of strategic problems. Indeed, any attempt to introduce a systematic approach is quite likely to dampen the essential element of creativity.

Approach # 2. Disjointed Incrementalism:

Sometimes referred to as ‘muddling through’, this approach to strategy-making reflects an attitude of management having strong preference for acting only when forced to, and then considering a few convenient alternatives involving only small, non-disruptive changes in the organisation.

The decisions made are of remedial nature. Only those alternatives are considered which are important, interesting and easily understandable. The strategist, instead of comprehending strictly and literally present states of affairs or the consequences of present policies, attempt only to understand the respects in which various possible states differ from each other and from the status quo.

Lindblom stressed the rationale of this approach on the ground that the comprehensive analytical approach to strategy-making – careful analysis of many alternatives of expected goals – is not helpful because of man’s inability to cope with complex problems, the lack of information, the cost analysis, the problem of timing, and the difficulty of stating realistic goals.

Approach # 3. Entrepreneurial Approach:

The thrust underlying this approach is related with the role of the manager as an entrepreneur. Drucker has depicted the role of an entrepreneurial manager as that of a systematic risk-maker and risk-taker, looking for and finding opportunity. “Entrepreneurship is essentially the acceptance of change as an opportunity and the acceptance of ‘the leadership in change’ as the unique task of the entrepreneur.”

The role of an entrepreneur is opportunity-focused and not problem- focused. Briefly speaking this general description of the entrepreneurial manager indicates what is expected of him, but it does not enlighten us on how he should go about performing his role.

Approach # 4. Key-Factors Approach:

This approach consists of determining the really significant factors that are important in the success of a particular business and concentrating major decisions on it. For instance, a new imaginative toy may be a critically strategic factor in the success of a toy company. Or, finding a propitious niche in the market where a company can give the customers an irresistible value that is not being satisfied at a relatively low cost, may again be the cornerstone of strategy formation.

Approach # 5. ‘Inside Out’ Planning:

According to Ewing, a basic approach to developing strategies could be ‘inside out’ planning. Strategies, he suggests, ought to be first conceived in a thought process arising out of the unique talents and resources possessed by a company. Market forecasts should be considered later as a kind of check or constraint on strategies so conceived.

Approach # 6. Integrated Approach:

An integrative approach to the strategy-making process provides a framework which consists of the following parts:

(a) Analysing the present internal and external conditions;

(b) Identifying and evaluating the present strategy—the major objectives, policies and plans currently guiding the firm;

(c) Search for strengths and weaknesses viewed within the present strategy and environment;

(d) Considering changes in the present strategy;

(e) Generating alternatives to resolve the problems and exploit the opportunities;

(f) Developing alternative unified strategies by combining the various alternatives in each of the problem and opportunity area;

(g) Evaluation of each unified strategy in terms of the enterprise objectives and choosing the strategy that best satisfies the objectives.

For an on-going organisation, re-appraisal of the present strategy actually becomes the first phase in the total process. This requires identification of the existing strategy. It is often difficult to identify the present strategy. The strategy being followed may not be articulated.

Or, there may be an articulated strategy that is not adhered to in practice. Or, again, the enterprise may not have developed any real strategy, it may be muddling through and being tossed about by the force of events. If no strategy is clearly indicated, it must be constructed from actual events and statements.

Identification of the present strategy is invariably accompanied by an analysis of the enterprise objective, policies, and plans in the context of the functional areas and managerial configuration of the organisation, and the external conditions. Thus, by implication, in the process of identification and description of the strategy, the evaluation of strategy, is also under way.

More specifically, the effectiveness of the present strategy may be assessed on the basis of the following criteria:

(a) Past results;

(b) Its appropriateness for the future; and

(c) Its rationale, i.e., by asking why the present strategy has been pursued.

Review of performance in terms of results achieved is an important basis of appraising the present strategy. But the relevant questions to be raised in this connection are: How do the results compare with the objectives of the enterprise? Have the achievements been realised within the bounds of policies established by management?

Have the results been achieved with an acceptable degree of risk? Were the achievements really the outcome of strategy, or fortuitously derived in spite of the strategy? Or, if the results have not been up to expectations, was it due to a faulty strategy or due to unforeseen changes in the environment?

Rather than the past results, what is perhaps more essential to consider is whether the present strategy would be appropriate for the future; in other words; ‘consistency with the environment’ should be the major criterion to assess the present strategy. In a dynamic sense, it implies judging the effectiveness of strategy with respect to the environment as it is changing, rather than with respect to the environment as it is now. If the present strategy was effective in the past, it is history. The more important question is “whether it will be a useful compass in the uncharted waters of the future.”

An insight into the appropriateness of the present strategy for the future can be had also by reference to its rationale, i.e., the fundamental reasons underlying the present strategy. Often the raison d’ etre of a strategy lies in the personal background, needs, aspirations, and values of the owners, managers, or the strategy- makers.

The appropriateness or otherwise of these factors, among other things, should be taken into account in determining the appropriateness of the strategy. Again, the genesis of the present strategy might have been the identification and exploitation of one or more opportunities perceived by management in the past.

Changes in the environment may have thrown up other opportunities since then. Obviously, the present strategy needs to be judged in terms of the newly emerging environment for the future. A third possible basis of the present strategy may be the distinctive internal capacity of the firm in particular respects. To judge the appropriateness of the present strategy which stemmed from a competence or capability, one should naturally ascertain whether and to what extent the strategy is consistent with the internal resources position, the potential advantages.

While it may be possible to identify the most dominant reasons underlying a strategy, it is also possible that a combination of several reasons formed the basis of the present strategy. Assessment of the strategy should, therefore, the governed by the appropriateness of the blend of factors leading to the strategy.

Whether a change in strategy is called for should not be difficult to decide in the light of the appraisal of present strategy. The change called for may be in the strategy itself, or in the implementation of the strategy. Change in strategy may be necessitated by one or more of the following reasons – changes in the environment; changes in the internal resource position and capabilities; results not measuring up to expectation in sales and profits or market shares; increased intensity of competition in the product market; changes in consumer preferences; a change in the size of the organisation; and to correct problems which are apparent.