Here is a term paper on ‘Stock Index Futures’ especially written for school and college students.

Term Paper # 1. Meaning of Stock Index Futures:

Stock index futures is one of the varieties of futures contracts.

The first stock index futures contract based on value line index was introduced by Kansas City Board of Trade (KCBT) on 24th February, 1982.

It was followed two months later by the S&P 500 Index Futures contract introduced by the Chicago Mercantile Exchange (CME).

At present, S&P 500 Index Futures is the most actively traded futures contract.

A stock index is a composition of select securities traded on an exchange, e.g. Sensex is a composition of 30 blue-chip securities being traded on BSE.

Therefore, a stock index futures contract is simply a futures contract where the underlying variable is a stock index such as BSE Sensex, S&P CNX, and NIFTY etc.

The value of stock index futures derives its value from a stock index value.

Theoretically, an investor who buys a stock index futures contract agrees to buy the entire stock index and the seller agrees to sell the entire stock index.

Term Paper # 2. Features of Stock Index Futures:

Distinguishing features of Stock Index Futures contract are as follows:

1. Multiple or Market Lot Size:

The Stock Index Futures can be bought or sold only in a specified lot size. The market lot size for Nifty futures is 200. It means that if on a day Nifty futures is quoting at a price of Rs.1,400 then the value of one Nifty futures contract shall be Rs.2,80,000 i.e. (200 × Rs.1,400).

2. Margin Requirement and Mark to the Market:

Like any other futures contract a Stock Index Futures contract is also characterized by margin requirement. The traders in a Stock Index Futures market are required to keep good faith deposits which are adjusted on a daily basis to account for the gains or losses.

There are three types of margins in a futures market:

i. Initial Margin:

It is the margin amount initially required to open a margin account for trading.

ii. Maintenance Margin:

It is the minimum amount of margin money that must be maintained in a margin account. If balance in margin account falls below this level, a margin call is made and the trader is required to deposit additional amount so as to restore the balance in margin account back to the level of initial margin.

iii. Variation Margin:

Variation margin is the amount of ‘margin call’ required to be deposited by the trader in case balance in margin account falls below maintenance margin level.

3. Cash Settlement:

A Stock Index Futures contract does not entitle physical delivery of stocks and the contract is settled in cash on the settlement date. This is because it is virtually impossible to deliver all the stocks comprising the Stock Index and that too in the same proportion in which they appear in the index at the time of settlement.

4. Specifications:

On a Stock Index Futures contract indicate the underlying index, contract size, price steps or tick size, price bands or price range, trading cycle, expiry day, settlement basis and settlement price. These specifications make a Stock Index as a tradable security that can be bought or sold.

5. Contract Lifetime:

The lifetime of each series is generally three months worldwide. At any point of time there are three series open for trading.

Term Paper # 3. Over-The Counter Market for Derivatives:

The OTC derivatives have witnessed rather sharp growth over the last few years, which is owing to the modernization of commercial and investment banking and globalization of financial activities.

While both exchange-traded and OTC derivative contracts offer many benefits, the former have rigid structures compared to the latter.

The OTC derivatives markets have other following features compared to exchange-traded derivatives:

(i) The management of counterparty (credit) risk is decentralized and located within individual institutions.

(ii) There are no formal centralized limits on individual positions, leverage, or margining.

(iii) There are no formal rules for risk and burden-sharing.

(iv) There are no formal rules or mechanisms for ensuring market stability and integrity, and for safeguarding the collective interest of market participants.

(v) The OTC contracts are generally not regulated by a regulatory authority. Although they are affected indirectly by national legal system, banking supervision and market surveillance.

Term Paper # 4. Pricing of Stock Index Futures Contract:

Theoretical or fair price of a Stock Index Futures contract is derived from the well celebrated cost of carry model.

Stock Index Futures price depends upon:

1. Spot index value,

2. Cost of carry or interest rate, and

3. Carry return i.e., dividends expected on securities comprising the index.

Mathematically,

F = Se (r – y)t

Where, F = Future Price

S = Spot value of index

e = Exponential constant with value 2.718

r = Cost of carry or interest cost

y = Carry return e.g. dividend income

t = Time to maturity in years

Illustration 1:

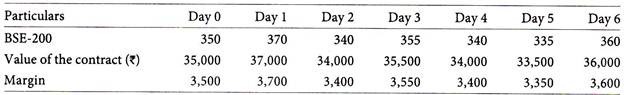

Stock index futures are the most popular equity derivatives where the contract value is based on the stock index value. For instance if BSE-200 is currently trading at 350 points then the contract value will be Rs.35,000 which is derived by multiplying index value of 350 by 100 which is fixed.

The investor has to deposit a margin of say 10% of the contract value which is Rs.3,500. As the margin is mark to market, the margin requirements shall be calculated daily linked to the value of the stock index. Thus, if the BSE- 200 moves in the following manner over the next 6 days the margin requirement will be calculated accordingly.

In the above case the profit to the investor over a period of 6 days shall be Rs 1,000 (i.e. 36,000 – 35,000).

(i) As the settlement is done on cash basis the risk of fake certificates, forgery and bad deliveries can be avoided.

(ii) Secondly, the investment to be made is low which is restricted to the margin amount.

(iii) Thirdly, the stock index is difficult to be manipulated and the possibility of cornering is reduced.

(iv) Fourthly, as the Stock index is an average, it is much less volatile than individual stock prices.

(v) Lastly, as the stock index futures enjoy great popularity they are likely to be more liquid than all other types of equity derivatives.

Term Paper # 5. Reasons for Popularity of Stock Index Futures:

The Stock Index Futures is the most preferred derivatives in India owing to the undernoted reasons:

1. The portfolio hedging is given priority by the institutional and other enormous equity-holders.

2. The most cost-efficient hedging is the Stock Index Futures.

3. Stock index is almost beyond the scope of manipulation whereas it is very easy to manipulate the individual stock price.

4. The most liquidity featured Stock Index Futures are the most popular in India and abroad.

5. The remote possibility of bankruptcy in Stock Index Futures has been guaranteed by the clearing house effects.

6. The volatility of Stock Index Futures is much lower than the individual stock price.

7. The Stock Index Futures are cash settled all over the world and its value is derived independently from the cash market and safely accepted as the settlement price.

8. The Individual Stock Futures are always used for manipulating their prices in cash market.

9. The less volatility featured Stock Index Futures has lowered the requirement of capital adequacy and margin in comparison to Individual Stock Futures.

10. The well regulatory framework for Stock Index Futures ensures less complexity and thereby growing popularity for equity derivatives.