Here is a term paper on the ‘International Monetary Fund’. Find paragraphs, long and short term papers on the ‘International Monetary Fund’ especially written for school and college students.

Term Paper on the IMF

Term Paper Contents:

- Term Paper on the Introduction to International Monetary Fund (IMF)

- Term Paper on the Objectives of the IMF

- Term Paper on IMF Quotas

- Term Paper on the Types of IMF Loans

- Term Paper on the Covenants to IMF Loans

- Term Paper on the Performance of IMF

- Term Paper on the Joint Initiatives of IMF and World Bank

Term Paper # 1. Introduction to International Monetary Fund (IMF):

ADVERTISEMENTS:

The IMF is a specialized institution of the United Nations Organization. It was set up as a non-profit organization at the United Nations Monetary and Financial Conference held at Bretton Woods, New Hampshire (USA) in 1944. The IMF was the brainchild of Britain and the United States. Both countries wanted the IMF to be a central institution in a new economic system that they believed would come to exist after World War II.

The Unites States itself was divided on the principal role that the IMF was expected to play. The intention of the chief US negotiator was to make the IMF provide funds to a member-country experiencing temporary Balance of Payment (BOP) deficits, so that the recipient government could follow Keynesian policies and effect social reforms.

But the US State Department wanted the IMF to be set up so that the recipient of an IMF loan would open up its borders to international trade (multilateralism), and adopt conservative macroeconomic policies. This would force the borrower-country to undertake policies that reduced (or eliminated) any BOP deficit, and give maximum importance to quick loan repayment rather than addressing unemployment and accelerating economic development.

In the British delegation’s proposal, a new currency called Bancor was the reserve currency and the settlement currency. Member-countries would create an international reserve asset called ‘Bancor’, and pay each other in Bancor to settle international transactions. The American delegation prevailed and the IMF’s Articles of Agreement largely incorporated the delegation’s and the US State Department’s views. The IMF was set up to ensure that international monetary policies were in accordance with its rules, and enforce an international monetary system on member-countries.

ADVERTISEMENTS:

The IMF has three main sources of funding—contributions from its members (who are called shareholders), gold reserves (it is the world’s largest holder of gold), interest charges and loan repayments from borrower countries. USA is the IMF’s largest shareholder, and member contributors are primarily developed countries.

There are three types of contributions:

i. Quotas:

They are dues paid by member-countries. They are the largest source of IMF funds, and are the basis for extending loans to member-countries. Quotas create a pool of funds called currency pool.

ADVERTISEMENTS:

ii. Borrowings:

They are borrowings by the IMF either from member-countries, the G10 (under the General Agreement to Borrow), from oil exporting countries, or commercial borrowing from private institutions.

iii. Trusts:

These contain extra contributions by member-countries for specific purposes.

ADVERTISEMENTS:

The IMF’s main revenue is interest income on its loans to member-nations. The revenue meets the IMF’s operating costs, and interest payments on member contributions used for making the loan. By 2007, the number of countries seeking an IMF loan dropped sharply, as did the volume of IMF loans. This adversely affected the size of total interest income earned, and the IMF posted a loss. To augment its revenues, it began selling parts of its gold reserves. India purchased 200 tons of gold in 2009.

Term Paper # 2. Objectives of the IMF:

The IMF’s Articles of Agreement specify its objectives as:

i. Promoting international monetary cooperation

ADVERTISEMENTS:

ii. Providing scope for consultation and collaboration on international monetary problems

iii. Facilitating balanced growth of international trade

iv. Promoting exchange stability

v. Maintaining orderly exchange arrangements among members

ADVERTISEMENTS:

vi. Avoiding competitive depreciation of exchange rates

vii. To help set up a multilateral system of payments for member-countries to settle their current account transactions

viii. To help member-countries overcome bop deficits, by providing assistance through loans

ix. To ensure that bop ‘disequilibria’ of member-countries are of short duration.

ADVERTISEMENTS:

The IMF promotes international currency stability by providing loans out of a currency pool. It encourages the elimination of exchange restrictions by member-countries. It reviews exchange rates followed by countries on an annual basis, and compares the official exchange rate system of each country, with its actual (de facto) exchange rate system. Objectives relating to exchange rate systems and correction of BOP difficulties are of special relevance to students of International Finance.

Par Value:

The Bretton Woods Agreement (BWA) was an exchange rate system in force between 1944 and 1971. It followed the gold standard (and its variants, the gold bullion standard and the gold exchange standard). Countries that adopted the gold standard fixed the value of their paper currencies in terms of a quantity of gold of a specified purity. As the sum of existing gold reserves and newly minted gold fell short of the demand for gold, the BWA sought to overcome this by expressing the US dollar in terms of gold, and the currencies of the other 43 signatories to BWA, were fixed in terms of the US dollar.

During this period, the IMF was given sweeping powers to monitor compliance of the exchange rate system. Member-countries had to establish and announce a value for their currency in terms of the US dollar. This value was called the par value. Exchange rate stability was based on exchange rate parities. Each member-country had to maintain orderly exchange arrangements and was expected to maintain the par value of its currency.

After the demise of the BWA, the IMF concentrated on alleviating Balance of Payments (BOP) related issues of member-countries. It identified the ‘correct’ macroeconomic policies that a distressed member- country ought to follow, and prescribed policy reforms to solve the country’s BOP problems.

The reforms vary depending upon the nature and size of the BOP deficit, as well as the country’s economic and social priorities. They reflect the assumption that a country’s economic imbalances lead to lower rate of economic growth and higher unemployment, which get reflected through a BOP deficit and inflation.

ADVERTISEMENTS:

SDRs:

The US dollar was the reserve currency under the Bretton Woods system. The IMF created an artificial currency in 1969 called the Special Drawing Right, to take pressure off the US dollar. Even after the Bretton Woods system was abandoned, the SDRs continued. They are the IMF’s unit of account. They represent a potential claim on the freely usable currencies of IMF members.

SDR holders can obtain these currencies in exchange for their SDRs either:

i. Through the arrangement of voluntary exchanges between member-countries

ii. Through the sale of SDRs to member-countries

The SDR is a weighted average of specific currencies selected by the IMF. The weights are reviewed periodically. The value of the SDR was initially defined as equivalent to 0.888671 g of fine gold, and the SDR was the weighted average of 16 currencies. The number of currencies and their weights changed over time. In 1981, the SDR was redefined as the weighted average of a basket of five currencies—the US dollar, the German mark, the Japanese yen, the pound sterling, and the French franc.

ADVERTISEMENTS:

In 1996, the US dollar had a weight of 39%, the German mark 21%, the Japanese yen 18%, the pound sterling and the French franc, 11% each. After the introduction of the euro in 2001, the number of currencies dropped to four. The SDR was calculated as the sum of specific amounts of the four currencies valued in US dollars, on the basis of exchange rates quoted at noon each day in the London market. The IMF reviews the valuation of the SDR every five years, and calculates the SDR value on a daily basis. On November 5, 2010, the SDR was valued as 1 USD = SDR 0.63094, or conversely, 1 SDR – USD1.58494.

Term Paper # 3.

IMF Quotas:

Each of the 184 member-countries of the IMF has a quota that is broadly determined by its economic position relative to other members, with respect to variables such as its national income, exports, imports, gold holdings and US dollar balances. The quotas are changed considering economic factors such as GDP, current account transactions and official reserves. In January 1999, quotas were increased by 45% in order to reflect the expansion of the world economy, increased risk of financial crisis and rapid liberalization of trade and capital flows.

Quotas are denominated in SDRs. As the largest member of the IMF, USA has a quota of SDR 37.1 billion. India’s quota is SDR 4,158.20 million (1.95% of the total quotas). A member’s quota subscription has to be paid in full upon joining the IMF. Up to 25% must be paid in SDRs or widely accepted currencies (such as the US dollar, the euro, the Japanese yen, or the pound sterling), while the rest can be paid in the member’s own currency.

Quotas determine voting power in the IMF. Each IMF member has 250 basic votes plus one additional vote for each SDR 100,000 of quota. Accordingly, USA has 371,743 votes (17.10% of the total). In September 2010, developed countries held 60% of the voting rights in the IMF. In the October 2010 G20 meeting held in South Korea, central bank governors and ministers decided to double the quotas of member-countries. This seemingly innocuous decision resulted in a shift of voting power to rapidly growing countries. Brazil, Russia, India, and China became members of the top 10 shareholders of the IMF. This reduced the voting power of advanced countries to 54%.

India and the IMF:

ADVERTISEMENTS:

India joined the IMF on December 27, 1945. It has an SDR quota of SDR 4,158.20 million. India took three IMF loans—an extended fund facility loan of SDR 5,000 million in 1981, a standby facility of SDR 551.93 million on January 18, 1991, and another standby facility of SDR 1,656 million on October 31, 1991. The standby loans triggered the reforms of 1992, because the loans came with conditions to implement a radical and free market-oriented overhaul of policies. India’s repayments to the IMF were SDR 0.56 million in 2010.

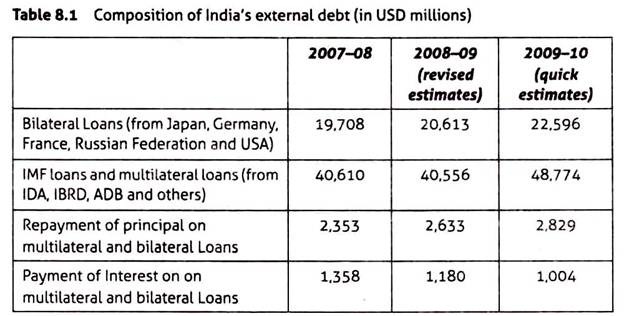

Thereafter, it has to repay SDR 2.76 million each year from 2011 to 2014. In a sign of the country’s reversal of fortunes, India purchased 200 metric tons of gold from the IMF in November 2009. Table 8.1 presents trends in the size of India’s external debt from multilateral institutions. An interesting aspect of its external debt is the currency composition—53% was denominated in US dollars, 9% in SDRs, 11% in yen, and 18.7% in rupees.

Term Paper # 4. Types of IMF Loans:

The IMF gives loans to each member-country based on its quota. This is called the access limit. In 2009, the access limit was raised from 100% of each country’s quota to 200%. The type of loan given depends upon the country’s BOP problems—whether they are temporary or permanent. According to the Ministry of Finance’s Status Report on India’s external debt (2009-10), IMF loans taken by 128 developing countries declined each year during 2004-2008, and dropped from $ 96 billion in 2004 to $ 25.7 billion in 2008.

Since the IMF wants quick and timely loan repayment so that it can re-lend to other countries in need, all member-countries seeking a loan have to follow a set of IMF specified guidelines and policies. Loan sanction is based on a letter of intent given by the country, in which it lists the promises it intends to keep on sanction of the loan. The sanctioned loan is released in installments, each of which is called a ‘tranche’.

ADVERTISEMENTS:

1. Temporary Oil Facility:

It was in force between 1974 and 1976. The rising price of oil and oil-related products was an external shock that caused a sharp rise in the current account deficit of less developed countries. The loan was intended to finance a member-country’s BOP deficits caused by the jump in oil prices and its impact on the member-country’s import bill.

2. Buffer Stock Facility:

This was set up in 1969, because the IMF accepted the need for an international buffer stock.

3. Trust Fund:

It was set up in 1976, to give concessional loans to low- income countries.

ADVERTISEMENTS:

4. Standby Facility:

It was set up in 1952, and is the most commonly used facility by member-countries. This assistance is given for a period of one year. It is meant for economic stabilization, so that the borrowing country’s BOP position improves, and it attains a reasonable level of price stability and economic growth. In return, the country has to adopt fiscal austerity, and ensure competitive exchange rates, sound financial markets, and implement deregulation. The standby facility was simplified in 2009—the frequency of IMF reviews of the recipient country was reduced, and countries were permitted to draw most of the loan right at the beginning.

5. Compensatory Financing Facility:

It was available between 1973 and 2009. It was set up to provide assistance to countries that exported primary products. A member-country experiencing a temporary export shortfall due to a decrease in primary commodity prices in world markets, could apply for to tide over this problem.

6. Supplementary Financing Facility:

It was set up in 1979 to give additional assistance to a member-country whose BOP problem is large in relation to its quota with the IMF, and not reversible in a short period. A member-country can borrow up to 300 % of its quota. The loan has stringent conditions attached to it.

7. Extended Fund Facility (EFF):

It was created in 1974. A member-country could borrow up to 140% of its quota, for a period of two to three years. This loan carries tough conditions. India took an EFF loan of US $5 billion in 1991, which at that time was the largest loan ever given by the IMF to a member-country. By availing this loan, India was bound by its covenants.

8. Short-Term Liquidity Facility:

It was a loan extended for a period up to nine months, only to countries with very strong economic fundamentals. The maximum loan amount was 500% of the country’s quota. This facility was discontinued in 2009.

9. Enhanced Structural Adjustment Facility (ESAF):

It was available between 1987 and 1999. Under the scheme, concessional loans on a temporary basis were granted to low-income countries. In 1996, the ESAF was converted into a permanent facility. A country could borrow up to 140% of its IMF quota, for a three-year period, at an interest rate of 0.50% p.a. The ESAF was replaced by the Poverty Reduction and Growth Facility in 1999.

10. Poverty Reduction and Growth Facility (PRGF):

Under this program, concessional loans are given to low-income countries. The program is structured to suit each country’s characteristics and circumstances. Its aim is to ensure that the aid reaches the poor; hence it focuses on the processes by which the funds are distributed within the country.

11. Flexible Credit Line:

It was introduced in 2009. A loan was given to countries which, according to the IMF, had ‘very strong fundamentals, policies, and track record of policy implementation’. The loan was to be disbursed in a lump sum, rather than in installments. The repayment period ranged between three-and-a-half years and five years.

Some of the key criteria that a country applying for the flexible credit line, has to satisfy are:

(i) A strong financial sector and effective regulation thereof

(ii) Low, stable inflation, and strong economic fundamentals (low and sustainable sovereign debt, and BOP)

(iii) Consistently provide access to international capital markets

Term Paper # 5.

Covenants to the IMF Loans:

When the IMF was set up, there was an understanding that a loan would be given to a member-country without any covenants attached. Later on, conditions relating to the use of the loan and the policy actions that the borrowing country must take began to be imposed. The USA was instrumental in the IMF imposing the conditions, because it believed that such a stand would ensure loan repayment, and also that member-countries would apply only if they were confident of complying with the conditions. These covenants have come to be known as conditionalities.

Loans given for permanent BOP problems carry the maximum number of conditionalities. The IMF monitors compliance, and if the member- country is unwilling or incapable (or both) of taking the imposed policy actions, further installments of the loan are withheld. On sanction of a loan, the IMF gives its seal of approval that the member-country will follow the prescribed macroeconomic policies. The seal of approval causes the creditworthiness of the country to improve. The policies can be sweeping in their breadth and scope. Any deviation by the borrowing member-country from the conditionalities gives the IMF the right to either waive, modify or replace conditionalities.

The prescribed macroeconomic policies (consisting of demand management and supply management policies that are anti-inflationary in nature) may require the member-country to:

i. Control bank credit

ii. Raise interest rates

iii. Control budget deficits

iv. Dismantle price controls (remove the administered pricing regime)

v. Liberalize foreign exchange controls

vi. Devalue the exchange rate

vii. Remove import controls

viii. Change the policies on subsidies

ix. Institute reforms in the public sector

x. Increase efficiency of investment and ease entry for FDI

Conditionalities may be qualitative (non-measurable) such as one that the member- country should not increase exchange restrictions as a method of coping with BOP problems; or quantitative (measurable) conditions for which performance targets can be set. Examples include expansion of domestic credit, reduced reliance by the member-country’s government on domestic credit, and BOP targets. There are also cross- conditionalities imposed by multilateral agencies. If a member-country has simultaneously applied for loans to the IMF and the World Bank, then the latter loan will be sanctioned only if the conditionalities under the IMF loan are accepted.

Conditionalities may also be classified as low or high. The former are imposed in the case of compensatory finance facility and buffer stock facility and apply to the reserve tranche and first tranche. The borrowing country has to consult the IMF on its BOP policies, and avoid imposing restrictions on international transactions. When the latter type are imposed, the borrowing country has to give a quantitative description of its policies, performance targets, the type of measures it is going to take, and undertake to continue the measures on a sustained basis. Every 12 months, the borrowing country must submit a detailed quantitative report of the steps undertaken, their impact, and the performance targets achieved.

Evolution of the Conditionalities:

The first conditionality, imposed in 1948, stated that an East European country could get an IMF loan only if it was not getting aid under the Marshal Plan. From 1952, member-countries had to agree to follow policies prescribed by the IMF by signing a letter of intent. The IMF would monitor the end use of credit to determine whether the member-country was using it in accordance with the agreed principles. Conditionalities were modified by the IMF from time to time, with the last modification and ‘modernization’ undertaken in 2009.

In 1958, conditionalities relating to performance criteria were formally introduced.

The performance criteria included ceiling on government expenditure, ceiling on public sector credit, withdrawal of subsidies, overall credit ceilings, and liberalization of imports. In 1968, conditionalities for standby agreements were specified. For all borrowing above the gold tranche, the member-country was required to be in regular consultation with the IMF. The borrowing country could draw above the gold tranche only if it met the performance criteria.

Conditionalities were modified twice in the 1970s as a response to the OPEC oil crisis and huge increase in oil prices from $1.80 per barrel in 1971 to $35 per barrel in 1981. As many countries had to import oil to meet their domestic needs, their import bills shot up and caused BOP deficits. The modifications were intended to make a member-country apply for an IMF loan when early symptoms of BOP problems arose and not when the situation became difficult to address.

In the 1980s there was another oil shock and the conditionalities were modified once again. The IMF felt that a more holistic treatment of BOP problems was needed. It began advocating policies on taxes, prices, subsidies, interest rates, exchange rate, devaluation, privatization, as well as changes in fiscal and monetary policies. So, the IMF includes any economic variable it considers as being relevant, and imposes conditionality. Such variables could be the member-country’s external debt, export-import policy, strategy for agricultural development, and pricing in the public sector.

Term Paper # 6. Performance of the IMF:

The success or otherwise of the IMF must be assessed with reference to its objectives. It successfully reinvented itself after the demise of the Bretton Woods Agreement as a multilateral lending agency that oversaw BOP difficulties and came to the aid of distressed countries. Beginning in the 1960s, several developing countries in South America and Asia took IMF loans. But their post-loan experience has not always been encouraging. In the 1980s, many countries that sought IMF assistance were struggling due to oil price shocks and a decline in international prices of commodities.

This caused external borrowing of countries such as Argentina, Brazil, Chile, Columbia, and Peru to rise, while their private borrowing from international banks also rose. The rise in the flow of international credit led to an increase in money supply and inflation. Interest payments increased and Argentina and Mexico fell into a debt trap, causing an international debt crisis.

In 1982, for the first time, the IMF gave a loan of USD 5 billion to Mexico, on condition that private commercial banks also gave loans. As the debt crisis deepened, some borrowing countries (Brazil, Bolivia, Costa Rica and Ecuador) suspended their debt payments by 1987 while some others (Brazil and Mexico) entered into an agreement with the IMF to reschedule debt repayment.

Some countries successfully implemented structural adjustment programs (South Korea and Turkey), but others could not (Chile, Mexico, Uruguay). Since the 1980s, almost all IMF loans given to less developed member-countries have had uniformly tough conditionalities even though they are supposed to be tailored to each country’s unique situation. The economic and social consequences of policy changes implemented by member-countries are significant. The austerity programs include a reduction in government spending, raising tax rates, reducing subsidies and controlling inflation. In spite of this, when BOP problems are caused by external factors, the issues may reappear.

In spite of following IMF prescriptions for liberalization of capital markets, countries in Asia, Europe and Latin America suffered ‘extreme macroeconomic crises’. But the IMF continued to advocate accelerated capital market liberalization and countries experienced extreme volatility in exchange rates. The IMF was criticized for not enforcing its prescriptions, and for failing to predict the onset of a financial crisis.

The IMF believed that devaluation of a member-country’s domestic currency could reduce the distortion in the structure of relative prices and alleviate BOP problems. When Mexico devalued its currency by 15% on December 20, 1994, the IMF approved saying that this ‘would help reinforce economic recovery and secure the viability of Mexico’s external position’. But the devaluation led to a speculative attack on the Mexican peso, the financial crisis deepened, the Mexican government had to let the peso float, and the country slid into a severe recession.

Devaluation and BOP Deficits:

When a country on a fixed exchange rate has BOP deficits, and devalues its currency, its exports become cheaper and more attractive, but imports become costlier. After the devaluation, there is expenditure switching and expenditure reduction. As a result, exports rise, imports fall, and the BOP deficit declines. So, devaluation can reduce the distortion in the structure of relative prices and alleviate BOP problems.

Though the IMF has been criticized for prescribing the same tough macroeconomic policies to all countries, irrespective of each country’s unique problems, stage of development, composition of the export-import basket, paradoxically, it has also been accused of non- uniformity in its responses to financial crises. It prescribed tough macroeconomic policies and currency devaluation to restore investor confidence in East Asia; in Russia it tried to maintain exchange rates, and in Brazil a large financing package was sanctioned.

The IMF was accused of being more or less a mute spectator during the US subprime crisis in 2007 and the subsequent global recession. The fact remains however, that the IMF is the principal international agency to which countries turn to when in need. The frequency of financial crises and the huge size of bailout packages mean that the IMF is likely to continue to be a part of the solution even in the future.

Term Paper # 7. Joint Initiatives of the IMF and the World Bank:

Both institutions jointly participate in two schemes of assistance.

Heavily Indebted Poor Countries (HPIC) Program:

Launched in 1996, this program gives aid to poor countries that have a heavy burden of external debt. By 2010, 36 countries received aid of $72 billion; they used the amount to repay their external debt (with a consequent reduction of external debt as a percentage of GDP).

Conditions for eligibility for the HPIC program are:

i. The applicant country must be eligible to borrow from the International Development Agency (IDA).

ii. It must be eligible to avail the IMF’s extended credit facility.

iii. It should have earlier taken loans from the IMF and/or World Bank and implemented the prescribed policies.

iv. It should show commitment to poverty reduction.

Multilateral Debt Relief Initiative (MDRI):

It was launched in 2005. Under this scheme, the IMF, the IDA, and the African Development Fund give complete loan waiver on loans extended to low income HIPC countries. An eligible HPIC is one with a per capita income of less than USD380 and had outstanding loans from one or all of the above three institutions as of 2004.