Here is a term paper on the ‘Technique of Leasing’. Find paragraphs, long and short term papers on the ‘Technique of Leasing’ especially written for school and college students.

Term Paper Contents:

- Term Paper on the Definition and Meaning of Lease Financing

- Term Paper on the Features of Lease Contract

- Term Paper on the Types of Lease

- Term Paper on the Structure of Lease Rentals

- Term Paper on the Effects of Leasing on Financial Statements

- Term Paper on the Tax Effects of Leasing

- Term Paper on the Methods for Evaluation of Lease or Buy Decision

- Term Paper on the Advantages of Leasing

- Term Paper on the Disadvantages of Leasing

Term Paper # 1. Definition and Meaning of Lease Financing:

The technique of leasing gives the facility to possess and operate the asset without owning the asset.

ADVERTISEMENTS:

It is a method of financing where huge capital outlays are substituted by periodical rental payments.

Under a typical leasing transaction, a lessor acquires the title to the equipment to be leased by paying 100 per cent value for the asset identified by the lessee and then leases it out to the lessee under a lease agreement for a period normally less than the depreciable life of the asset.

Under the lease financing, an asset can be acquired without incurring the initial purchase cost by just making payment of lease rentals over a specified period of the lease contract.

It is more or less an off-balance sheet financing, where neither the acquisition of asset nor the loan is to be shown in the financial position statement.

ADVERTISEMENTS:

The periodical lease rentals paid will be shown in the financial position statement as business expenditure.

Term Paper # 2. Features of Lease Contract:

The important features of lease contract are as follows:

1. The lease finance is a contract.

ADVERTISEMENTS:

2. The parties to contract are lessor and lessee.

3. Equipment are bought by lessor at the request of lessee.

4. The lease contract specifies the period of contract.

5. The lessee uses these equipment’s.

ADVERTISEMENTS:

6. The lessee, in consideration, pays the lease rentals to the lessor.

7. The lessor is the owner of the assets and is entitled to the benefit of depreciation and other allied benefits e.g., under sections 32A and 32B of the Income-tax Act.

8. The lessee claims the rentals as expenses chargeable to his income.

Term Paper # 3. Types of Lease:

ADVERTISEMENTS:

i. Financial Lease:

A lease is considered as a financial lease if the lessor intends to recover his capital outlay plus the required rate of return on funds during the period of lease.

It is a form of financing the assets under the cover of lease transaction.

ADVERTISEMENTS:

In this type of leases, lessee will use and have control over the asset without holding the title to it.

The lessee acquires most of the economic values associated with the outright ownership of the asset.

The lessee is expected to pay for upkeep and maintenance of the asset.

This is also known by the name ‘capital lease.

ADVERTISEMENTS:

The essential point of this type of lease agreement is that it contains a condition whereby the lessor agrees to transfer the title for the asset at the end of the lease period at a nominal cost.

At the end of lease it must give an option to the lessee to purchase the asset he has used at the expiry of the lease.

Under this lease usually 90% of the fair value of the asset is recovered by the lessor as lease rentals and the lease period is 75% of the economic life of the asset.

The lease agreement is irrevocable.

Practically all the risks incidental to the asset ownership and all the benefits arising therefrom is transferred to the lessee who bears the cost of maintenance, insurance and repairs.

Only the title deeds remain with the lessor.

ADVERTISEMENTS:

This lease is preferred in the following situations:

(i) When the lessee wants to own the asset but does not have enough funds to invest.

(ii) The time period to use the asset is substantially long at lower lease rentals.

ii. Operating Lease:

An operating lease is similar to the financial lease in almost all aspects.

This lease agreement gives to the lessee only a limited right to use the asset.

ADVERTISEMENTS:

The operating lease is generally for a short-term, where the lessor is usually the manufacturer of the asset, who want to increase his sales by allowing the customers to pay in installments for a short-term and ultimately the title to the asset will be transferred to the lessee on making full payment.

In some cases the lessor keeps the title to the goods and he continues to lease the asset to other party until the life of the asset is completed.

In the operating lease, it is the responsibility of the lessee to maintain and upkeep the asset properly when the asset is under his control.

The lessor will enjoy the depreciation claim and the lessee will show his lease rentals and asset maintenance expenses as business expenditure.

At the end of the life of the asset, it will be sold off by the lessor to get the salvage value.

This lease is preferred in the following situations:

ADVERTISEMENTS:

(i) When the long-term suitability of asset is uncertain.

(ii) When the asset is subject to rapid obsolescence.

(iii) When the asset is required for immediate use to tie over a temporary problem.

iii. Sale and Lease Back:

Under this the lessee first purchases the equipment of his choice and then sells it to the lessor firm.

The lessor in turn leases out the asset to the same lessee.

ADVERTISEMENTS:

The advantage of this method is that the lessee can satisfy himself completely regarding the quality of the asset and after possession of the asset convert the sale into a lease arrangement.

This option he can exercise even in the case of an old asset used by him for some time to get the release of a lump-sum cash which he can put into alternative use.

The lessor gets the tax credit for depreciation.

This method of financing an asset is also popular when the lessee is in liquidity problems, he can sell the asset to a leasing company and takes it back on lease.

This will improve the liquidity position of the lessee and will continue to use the asset without parting with it.

iv. Leveraged Lease:

ADVERTISEMENTS:

In this form of lease agreement, the lessor undertakes to finance only a part of the money required to purchase the asset.

The major part of the finance is arranged with a financier to whom the title deeds for the asset as well as the lease retails are assigned.

There are usually three parties involved, the lessor, the lessee and the financier.

The lease agreement is between the lessee and lessor as in any other case. But it is supplemented by another separate agreement between the lessor and the financier who agrees to provide a major part (say 75%) of the money required.

This is a type of lease agreement which will enable the lessor to undertake an expand volume of lease business with a limited amount of capital and hence it is named leverage leasing.

v. Sales Aid Leasing:

A leasing company will enter into an agreement with the seller, usually manufacturer of the equipment, to market the latter’s product through its leasing operations.

The leasing company will also get commission for such sales, which add up to its profits.

Term Paper # 4. Structure of Lease Rentals:

The lease rentals are payable on periodical basis over the specified lease period.

The lease rentals should be structured in such a way that it will be convenient for both lessor and lessee.

In a competitive situation, the lessee will tend to obtain lease finance where the lease rentals are lowest.

The lessor has to recover his principal amount invested as well as the desired return on investment.

Lease rent structure may be in the following ways:

i. Equal Annual Plan:

In this plan, the annual lease rent payable is divided into equal amounts by applying the annuity factor for the specified period of lease at a predetermined interest rate taken as discount rate.

ii. Stepped-Up Plan:

Under this plan, the annual lease rent will go on increasing every year with a specified rate of increase.

iii. Balloon Payment Plan:

In this plan, the annual lease rent payable in the initial year would be less, fixed up in such a way to meet the nominal amount comparative to the cost of investment, but the ending years of lease periods, the rest of the amount is payable in lump sum.

iv. Deferred Payment Plan:

Under this plan, the lease rent need not be paid for the initial specified period. But lease rent payable in the subsequent period, in equal annual amounts will recover the cost of financing for the deferred payment period also.

Term Paper # 5. Effects of Leasing on Financial Statements:

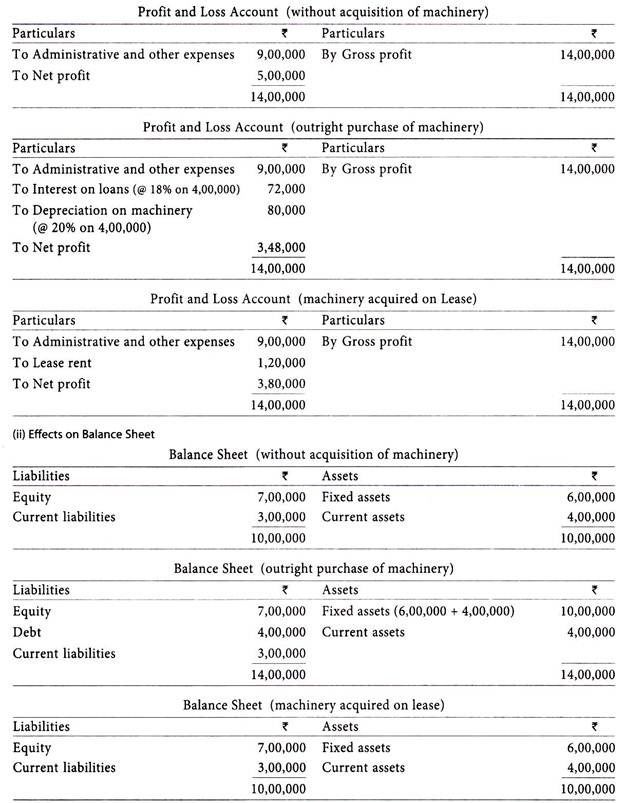

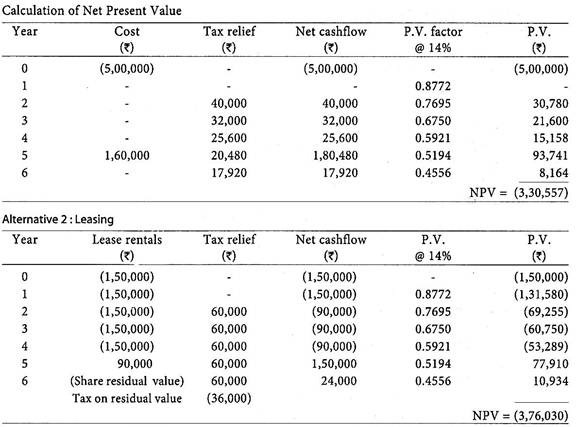

1. Effects on Profit and Loss Account:

Accounting profit has tended to be higher under lease financing rather loan financing, only the lease payments were charged in the profit and loss account, whereas when a company borrows and buys both the interest payments and depreciation charges on the asset acquired are charged as an expense. Particularly in the early years of loan, accounting profit tended to be higher under the lease agreement.

2. Effects on Balance Sheet:

The level of total assets appearing in the balance sheet has generally been lower under a lease arrangement than a loan arrangement. All loans appear in the balance sheet as sources of finance and all purchased assets appear as part of the total assets employed. However, with leased assets no lease obligation usually appears in the Balance sheet.

Illustration 1:

Gupta Leasing Ltd. is proposing to acquire special purpose machinery. The initial cost of machine is Rs. 4,00,000. Depreciation allowance is given @ 20% p.a. on reducing balance method. To finance the entire cost, the company intend to get a loan of Rs. 4,00,000 on interest @ 18% p.a. Another proposal has come for review to take the same machinery on lease basis on annual lease rentals of Rs. 1,20,000 for a period of 5 years. How would the acquisition of assets under the above two alternatives effect the Profit and Loss account and Balance sheet?

Solution:

(i) Effects on Profit and Loss Account.

Term Paper # 6. Tax Effects of Leasing:

The tax effects that arise from the lease transactions is given below:

(i) From the view point of lessee:

The full amount of the annual lease payment is a deductible expense for computing taxable income.

(ii) From the view point of Lessor:

The Lessor is entitled to claim the depreciation allowance and the lease rentals will be taken into consideration in computation of taxable income.

In the leasing situation, the lessor claims whatever capital allowances are available and may pass on some of the benefits via lower leasing charges to the lessee.

The amount, if any, which is passed on will depend upon competition within the market and also on how close the lease is to the lessor’s year end.

A potential lessee should ideally seek a lessor just before the lessor’s year-end.

If the lessor buys an asset just before a year-end, then the benefit of the tax allowance is received at the earliest possible opportunity, which is an inducement to the lessor to arrange the deal.

Term Paper # 7. Methods for Evaluation of Lease or Buy Decision:

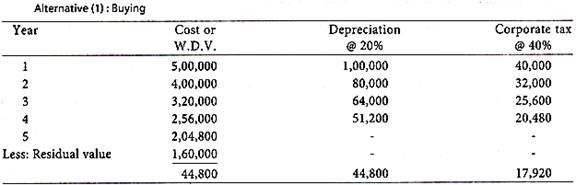

I. Present Value Method:

Under this method the present value of lease rentals are compared with the present value of the cost of an asset acquired on outright purchase by availing a loan.

In leasing, the tax advantage in payment of lease rentals will reduce the cash outflow.

In case an asset is purchased by borrowing a loan, repayment of principal and interest on loan is considered as cash outflow and it is reduced by tax advantage of depreciation claim and interest charge.

The present values of the net cash outflows over the period of lease is considered to ascertain the present value over the lease/loan period.

The alternative with low total present value of cash outflow will be selected.

II. Cost of Capital Method:

Under this method, the rate of cost of capital is calculated for the payment of installments and then it is compared with the cost of capital of the other available sources of finance such as fresh issue of equity capital, retained earnings, debentures, term loans etc.

The lease option is chosen if the rate is lower than the cost of equity capital etc.

This method does not require the prior selection of any discounting rate.

III. Bower-Herringer-Williamson Method:

Under this method, the financial and tax aspects of lease financing are considered separately.

The following steps are involved in evaluation of lease decision:

Step 1:

Make a comparison of the present value of cost of debt with the discounted value of gross amount of lease rentals. The rate of discount applicable is being the gross cost of debt capital. Then, obtain the total present value of a financial advantage/disadvantage of leasing.

Step 2:

Compute the comparative tax benefit during the lease period and discount it at an appropriate cost of capital. The total present value is the operating advantage/disadvantage of leasing.

Step 3:

When the present value of operating advantage of lease is more than its financial disadvantage, then select the leasing. When the present value of financial advantage is more than operating disadvantages, then select the leasing.

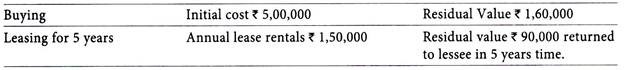

Illustration 2:

Vindhya Papers Ltd. planning to install a captive generator set at its plant. Its Finance Manager is asked to evaluate the alternatives either to purchase or acquire generator on lease basis.

Depreciation @ 20% p.a. on written down value. Corporate tax rate 40%. After tax cost of debt is 14%.

The time gap between the claiming of the tax allowance and receiving the benefit is one year. Evaluate the lease or buy decision based on the above information.

Analysis – From the above analysis, by applying the discounted cash flow technique, we can observe that the net present value of cash outflow is higher in case of leasing decision i.e., Rs.3,76,030 as compared to buying decision it is only Rs.3,30,557. The company may go for purchase of the generator instead of acquiring on lease basis.

Term Paper # 8. Advantages of Leasing:

From the View Point of Lessee:

1. It is an easy method of financing capital asset having a heavy cost involved.

2. It permits the lessee for alternative use of funds without incurring huge capital investment on an asset.

3. There is margin money or down payment required for acquiring the asset on lease.

4. It spreads the capital cost over a period of the lease, so that sufficient flexibility is available by just making payment of periodical lease rentals.

5. The lease rentals can be structured according to the needs of the lessee.

6. It is comparatively a cheaper source of finance with less hassles particularly due to tax effect.

7. It helps to conserve the funds which can be used to improve the liquidity and can be used for some other urgent purposes.

8. The lessee can avoid the risk of obsolescence by taking the asset on lease basis.

9. Leasing is free from restrictive covenants such as debt-equity ratio, dividend declaration etc.

10. The lessee can get lease finance upto 100% of the cost of asset.

11. Small entrepreneurs and technocrats who have got uncertain income can be able to get the necessary equipment on lease basis.

12. The procedure is simple and documentation is minimum.

13. Lease rentals are deductible expense for gaining tax shield.

14. It is an ‘off-balance sheet’ financing and help to keep the debt-equity ratio will not get effected.

15. More beneficial to manufacturers to get plant and equipment on lease rather than purchasing it due to withdrawal of investment allowance.

From the View Point of Lessor:

1. It is an asset based financing for a productive purpose and it is safer than normal course of financing business.

2. The lessor can claim depreciation and will also enjoy the tax benefit.

3. Lease rentals provide regular income and maintaining liquidity of the concern.

Term Paper # 9. Disadvantages of Leasing:

The leasing suffers from the following disadvantages:

1. The main criticism of lease method of financing is that the accounting procedure adopted for recording lease method of financing is highly unsatisfactory.

2. Lease financing, compared to other methods, is costly for the lessee.

3. The financial lease has all the rigidities of other methods of financing.

4. As the lessee is not the owner of the asset, technically he cannot enforce the warranties or guarantees enforceable against the vendor.