Here is a term paper on ‘Merger and Acquisition (M & A)’ for class 9, 10, 11 and 12. Find paragraphs, long and short term papers on ‘Merger and Acquisition (M & A)’ especially written for school and college students.

Term Paper on Merger and Acquisition (M & A)

Term Paper Contents:

- Term Paper on the Meaning of Merger and Acquisition

- Term Paper on the Kinds of Merger & Acquisition

- Term Paper on the Synergy in Merger & Acquisition

- Term Paper on the Strategic Motives of Merger & Acquisition

- Term Paper on the Financial Motives of Merger & Acquisition

- Term Paper on the Organizational Motives of Merger & Acquisition

- Term Paper on the Motives for Cross Border Merger & Acquisition

- Term Paper on the Tax Planning through Merger

- Term Paper on the Taxation Aspects of Takeover

- Term Paper on the Meaning of Takeover

- Term Paper on the Major Causes of Merger & Acquisition Failures

Term Paper # 1. Meaning of Merger and Acquisition:

Merger:

ADVERTISEMENTS:

Merger is said to occur when two or more companies combine into one company.

Merger is defined as ‘a transaction involving two or more companies in the exchange of securities and only one company survives.’

When the shareholders of more than one company, usually two, decides to pool the resources of the companies under a common entity it is called ‘merger’.

If as a result of a merger, a new company comes into existence it is called as ‘amalgamation’.

ADVERTISEMENTS:

As a result of a merger, one company survives and others lose their independent entity, it is called ‘absorption’.

Acquisition:

Acquisition is defined as “a purchase of a company or a part of it so that the acquired company is completely absorbed by the acquiring company and thereby no longer exists as a business entity”.

Takeover is considered as a form of acquisition.

Term Paper # 2. Kinds of Merger & Acquisition:

ADVERTISEMENTS:

1. Horizontal M&A:

When two or more corporate firms dealing in similar lines of activity combine together then horizontal M&A takes place.

The purpose of horizontal merger is elimination or reduction in competition, putting an end to price cutting, economies of scale in production, research and development, marketing and management etc.

A horizontal M&A is one that takes place between two companies which are essentially operating in the same market.

ADVERTISEMENTS:

Their products may or may not be identical.

The horizontal M&A takes place between business competitors who are manufacturing, selling, distributing the similar type of products or providing similar type of service for profit.

Horizontal M&A results in reduction of competitors in the same industry.

This type of M&A enables to derive the benefit of economies of scale and elimination of competition.

ADVERTISEMENTS:

2. Vertical M&A:

When a firm acquire its ‘upstream’ from it to or firm’s ‘downstream’, then vertical merger occurs.

In the case of ‘upstream’ type of merger, it extends to the suppliers of raw materials and in case of ‘downstream’ type of merger, it extends to those firms that sell eventually to the consumer.

The purpose of such merger is the lower buying cost of materials, lower distribution costs, assured supplies and market, increasing or creating barriers to entry for potential competitors.

ADVERTISEMENTS:

A vertical M&A is one in which the company expands backwards by M&A with a company supplying raw materials or expands forward in the direction of the ultimate consumer.

Thus, in a vertical M&A, there is a merging of companies engaged at different stages of the production cycle within the same industry.

3. Conglomerate M&A:

In marked contrast, conglomerate M&A is a type of combination which a firm established in one industry combines with another firm in another unrelated industry.

ADVERTISEMENTS:

Such M&A moves for diversification of risk constitutes the rationale.

In a conglomerate M&A, the concerned companies are in totally unrelated lines of business.

This type of M&A involves the integration of companies entirely involved in a different set of activities, products or services.

The merging companies are neither competitors nor complementary to each other.

Term Paper # 3. Synergy in Merger & Acquisition:

If the resources of one company is capable of merging with the resources of another company effortlessly, resulting in higher productivity in both the units, it is a case of synergy.

The combined effect of two or more courses of action is greater than the sum of individual companies.

ADVERTISEMENTS:

For example, if the technical manpower in one unit can exploit the modern machineries in another organization, it will be fruitful for both the organizations.

The concept of synergy can be explained symbolically as follows:

If ‘Company A’ merges with ‘Company B’, the value of merged entity called ‘Company AB’ is expected to be greater than sum of the independent values of Company A and Company B. i.e.

{V(A) + V(B)} < V(AB)

Where:

V(A) = Independent value of Company A

ADVERTISEMENTS:

V(B) = Independent value of Company B

V(AB) = Value of the merged entity

The greater value is ultimately expected to result into higher earnings per share for the merged entity.

The following are the synergy in the form of financial benefits available in the case of mergers:

1. Better Credit Worthiness:

This helps the company to purchase the goods on credit, obtain bank loan and raise capital in the market easily.

ADVERTISEMENTS:

2. Reduces the Cost of Capital:

The investors consider big firms as safe and hence they expect lower rate of return for the capital supplied by them. So the cost of capital reduces after the merger.

3. Increases the Debt Capacity:

After merger the earnings and cash flows become more stable than before. This increases the capacity of the company to borrow more funds.

4. Increases the P/E Ratio and Value Per Share:

The liquidity and marketability of the security increases after the merger. The growth rate, as well as, earnings of the firm will also increase due to various economies after the merged company. All these factors help the company to enjoy higher P/E in the market.

ADVERTISEMENTS:

5. Low Floatation Cost:

Small companies have to spend higher percentage of the issued capital as floatation cost when compared to a big firm.

6. Raising of Capital:

After the merger, due to increase in the size of the company and better credit worthiness and reputation, the company can easily raise the capital at any time.

Term Paper # 4. Strategic Motives of Merger & Acquisition:

The strategic motives behind M&A activities are as follows:

1. Expansion and Growth:

ADVERTISEMENTS:

If allowed by the government, expansion and growth through M&A is less time consuming and more cost effective.

2. Dealing with the Entry of MNCs:

Merger or joint venture is a possible strategy for survival with the arrival of MNCs. It may be difficult to beat the MNCs without strategically aligning with them.

3. Economies of Scale:

The combination of two or more companies will result in large volume of operations and it will result in economies of scale.

4. Market Penetration:

Traditionally a company might be catering to the middle-class and upper-middle class segment. Introducing a product for other market segment will be easier by acquiring a company which has a good market share in the specified segment.

5. Market Leadership:

It is not uncommon for the leading player in a market to acquire the second or third player in the market to retain the market position. With the combined additional market share, a company can afford to control the price in a better manner with a consequent increase in profitability.

6. Backward/Forward Integration:

Where supply of raw material is critical, acquiring a company producing the raw material will be an added advantage. This is a case of ‘backward integration’. Similarly, if the critical value additions are done in the subsequent stages, it may be profitable for an organization to engage in M&A activities resulting in ‘forward integration’.

7. New Product Entry:

Entering into a new product market is a time consuming effort. Companies with adequate resources will do well in new product market through M&A.

8. New Market Entry:

Advertisement and market promotion activities will be more cost effective if the organization has presence in many places. Taking away a new market from a competitor will be a costly affair. M&A may provide this advantage.

9. Surplus Resource:

To obtain additional mileage from an existing resource (be it funds, production capacity, marketing network, managerial talent) M&A might offer good potential.

10. Minimum Size:

Apart from the advantages brought about by the economies of scale, it may be required for a company to look forward to M&A just for survival. For example, investment in R&D might be crucial and the independent units may not be able to support it.

11. Risk Reduction:

In order to reduce the risk of the shareholders of the companies involved, M&A could be attempted. If the shareholder wants to reduce the risk of his portfolio, he can do so more efficiently as an individual.

12. Balancing Product Cycle:

Combining with a complementary industry to compensate for the fluctuations in a product cycle might be a good strategy. If the main product is seasonal – say ‘sugar’ – it will be beneficial to add another non-seasonal product, say ‘ceramics’, in the organization’s fold.

13. Arresting Downward Trend:

If the trend in the industry is pointing a downward trend when projected for the next five years, it is prudent to take-over the business belonging to a young and potential industry.

14. Growth and Diversification Strategy:

Many companies look for takeover or merger with a view to achieve growth, diversification and stability.

15. Refashioning:

Some companies resorted to M&T as a strategy by entering into high profile business through acquisition route, by diversifying from traditional business activity to latest technology related businesses like information technology, print media.

16. Diversification of Risk:

When a company produce single product then the company’s profits and cash flows fluctuate widely. This increase the risk of a firm. Diversification reduces the risk of the firm.

17. Reduction in Tax Liability:

The Income-tax Act provides for set off and carry forward of losses. The merger of a sick company with a profitable company will enable the profitable company to take advantage of tax benefits.

Term Paper # 5. Financial Motives of Merger & Acquisition:

1. Deployment of Surplus Funds:

The cash rich companies always look around to takeover cash strapped companies with a view to deploy surplus funds in investable projects.

2. Fund Raising Capacity:

The increase in fixed assets and current assets base will improve the fund raising capacity and more working capital finance can be sought from banks and financial institutions. The company can issue shares and other debt instruments to the public.

3. Market Capitalization:

The rise in income of target company increases the earnings per share as well as market value of the share. This will result in increase of market capitalization.

4. Tax Planning:

The provisions of the corporate Income-tax might subsidize the M&A activities and it may be possible to acquire a sick (with accumulated losses) but potential company economically.

5. Creation of Shareholder Value:

The M&A transactions are resorted to create shareholder value and wealth by optimum utilization of the resources of both companies.

6. Operating Economies:

The combinations will effect savings in overhead and other operating costs and will help in increasing the profitability of the organization.

7. Tax Benefits:

A company which has accumulated losses and unabsorbed depreciation can carry forward and offset against future taxable profits and reduce tax liabilities in amalgamating company.

8. Revival of Sick Unit:

If a viable unit becomes sick, a healthy company may like to merge with it so as to reap the benefit of the hidden potentials of the sick unit.

9. Asset Stripping:

If the market value of the shares is quoted below the true net worth of a company, it will be a target for acquisition.

10. Undervaluation of Target Company:

If the share price of target company is undervalued, the acquisition is justified. The efficiency of stock will bring in the equilibrium in share price over a period of time, after the acquisition. The acquirer will ultimately benefit from under-pricing of current share value.

11. Increasing EPS:

If the bidding company has a lower EPS as compared to its target company, the bidder can increase its overall EPS proportionally more than it has, if the share exchange ratio is 1:1. The process of increase in EPS through acquisition is called ‘boot-strapping’.

Term Paper # 6. Organizational Motives of Merger & Acquisition:

1. Superior Management:

By combining together the managerial skills are also pooled together. This will enhance the stability and increase the growth rate of both the companies.

2. Ego Satisfaction:

The money power available with the top management of big corporate houses do prompt the managers to explore the possibilities of M&A. The size of the combined enterprise satisfies the ego of the entrepreneurs and the senior managers.

3. Retention of Managerial Talent:

Human resources are considered essential and important. To assure growth to the senior management personnel in order to retain the management talent, it may be required to attempt M&A.

4. Removal of Inefficient Management:

M&A is a quick remedy to replace inefficient management from an organization which has, say, high product strength.

Term Paper # 7. Motives for Cross Border Merger & Acquisition:

There has been a substantial increase in the quantum of funds following across nations for M&A activities.

The companies go in for international acquisitions for a number of strategic or tactical reasons such as the following:

1. Growth Orientation:

To escape small home market, to extend markets served, to achieve economy of scale.

2. Access to Inputs:

To access raw materials, to ensure consistent supply of raw materials, to access technology, to access latest innovation, to access cheap and productive labour.

3. Unique Advantages:

To exploit the company’s brands, reputation, design, production and management capabilities.

4. Defensive Strategy:

To diversify across products and markets, to reduce earnings volatility, to reduce dependence on exports, to avoid home country political and economic instability, to compete with foreign competitors in their own territory, to circumvent protective trade barriers in the host country.

5. Client Needs:

To provide home country clients with service for their overseas subsidiaries e.g., banks and accountancy firms.

6. Opportunism:

To exploit temporary advantages e.g., a favourable exchange rate making cross boarder acquisition cheap.

Term Paper # 8. Tax Planning through Merger:

Under section 72A of the Income-tax Act, 1961, amalgamation results in the reduction of tax liability of amalgamated company.

The accumulated losses and unabsorbed depreciation of the amalgamating company shall be deemed to be loss (not being a loss sustained in speculation business) and depreciation of the amalgamated company for the previous year in which the amalgamation is effected.

The other tax benefits are as follows:

(i) Under section 47(vi) of the Income-tax Act, transfer of assets to the transferee company pursuant to a scheme of amalgamation is not a ‘transfer’ and does not attract capital gains tax.

(ii) Similarly, shares allotted to shareholders of the transferor company are not a transfer for attracting capital gains.

(iii) The provisions of the Income-tax Act says that acquisition of the property of the company in winding-up by another company does not amount to amalgamation.

(iv) Distribution of share of property by a company in winding-up to another company shall not be regarded as amalgamation.

(v) When the amalgamating company transfers depreciable assets to the amalgamated company, then the amalgamated company can claim depreciation on the written-down value of the transferred assets in the books of amalgamating company.

Term Paper # 9. Taxation Aspects of Takeover:

1. No special tax benefits are available in case of takeover deals.

2. By acquiring substantial voting power by the acquirer in the target company holding and subsidiary company relationship is established.

3. When the holding company sells such shares, would attract capital gains tax depending on the short- term or long-term holding period under the provisions of the Income-Tax Act, 1961.

Illustration 1:

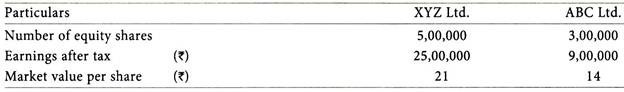

XYZ Ltd. is intending to acquire ABC Ltd. (by merger) and the following information is available in respect of the companies:

(a) What is the present EPS of both the companies?

(b) If the proposed merger takes place, what would be the new earning per share for XYZ Ltd. (assuming that the merger takes place by exchange of equity shares and the exchange ratio is based on the current market prices?)

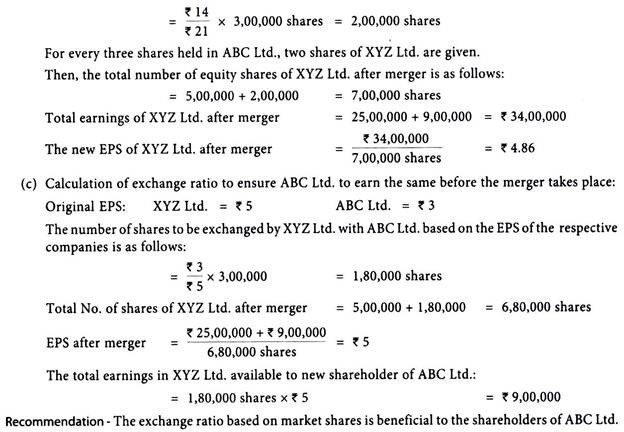

(c) What should be exchange ratio, if ABC Ltd. wants to ensure the same earnings to members as before the merger takes place?

Solution:

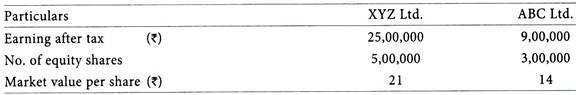

(b) Calculation New EPS of XYZ Ltd. After Merger (exchange ratio based on market prices)

Number of shares ABC Ltd. shareholders will get in XYZ Ltd. based on market price of shares is as follows:

Illustration 2:

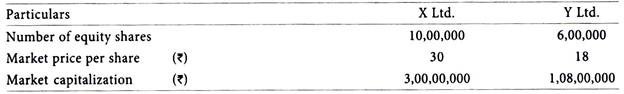

X Ltd. is considering the proposal to acquire Y Ltd. and their financial information is given below:

X Ltd. intend to pay Rs.1,40,00,000 in cash for Y Ltd., if Y Ltd.’s market price reflects only its value as a separate entity.

Calculate the cost of merger:

(i) When merger is financed by cash,

(ii) When merger is financed by stock.

Solution:

(i) Cost of Merger, when merger is financed by cash = (Cash – MVy) + (MVy – PVy)

Where,

MVy = Market value of Y Ltd.

PVY = True/intrinsic value of Y Ltd.

Then, = (1,40,00,000 – 1,08,00,000) + (1,08,00,000 – 1,08,00,000) = Rs.32,00,000

If cost of merger becomes negative then shareholders of X Ltd. will get benefited by acquiring Y Ltd. in terms of market value.

(ii) Cost of Merger when merger is financed by exchange of shares in X Ltd. to the shareholder of Y Ltd. Cost of merger = α PVxy – PVy

Where,

αPVXY = Value in X Ltd. that Y Ltd.’s shareholders get.

Suppose if X Ltd. agrees to exchange 5,00,000 shares in exchange of shares in Y Ltd., instead of payment in cash of Rs.1,40,00,000.

Then the cost of merger is calculated as below:

= (5,00,000 × Rs.30) – Rs.1,08,00,000 = Rs.42,00,000

PVXY = PVx + PVY = 3,00,00,000 + 1,08,00,000 = Rs.4,08,00,000

Proportion that Y Ltd.’s shareholder get in X Ltd.’s Capital structure will be:

= 5,00,000/10,00,000 + 5,00,000 = 0 333

True Cost of Merger = αPVxy – PVy = (0.333 × 4,08,00,000) – 1,08,00,000 = Rs.28,00,000

The cost of merger i.e., Rs.42,00,000 as calculated above is much higher than the true cost of merger Rs.28,00,000. With this proposal, the shareholders of Y Ltd. will get benefited.

Note:

(1) When the cost of merger is calculated on the cash consideration, when cost of merger is unaffected by the merger gains.

(2) But when merger is based on the exchange of shares, then the cost of merger depends on the gains, which has to be shared with the shareholder of Y Ltd.

Term Paper # 10. Meaning of Takeover:

Takeover is an acquisition of shares carrying voting rights in a company with a view to gaining control over the assets and management of the company.

In takeover, the seller management is an unwilling partner and the purchaser will generally resort to acquire controlling interest in shares with very little advance information to the company which is being bought.

Where the company is closely held by small group of shareholders, the controlling interest is obtained by purchasing the shares of other shareholders.

Where the company is widely held i.e. in case of listed company, the shares are generally traded in the stock market, the purchaser will acquire share in the open market.

Takeover is a business strategy of acquiring control over the management of target company – either directly or indirectly.

The motive of acquirer is to gain control over the board of directors of the target company for synergy in decision-making.

Kinds of Takeover:

1. Friendly Takeovers:

In a friendly takeover, the acquirer will purchase the controlling shares after thorough negotiations and agreement with the seller. The consideration is decided by having friendly negotiations. The takeover bid is finalized with the consent of majority shareholders of the target company. This form of purchase is also called as ‘consent takeover’.

2. Hostile Takeovers:

A person seeking control over a company, purchases the required number of shares from non-controlling shareholders in the open market. This method normally involves purchasing of small holdings of small shareholders over a period of time at various places. As a strategy the purchaser keeps his identity a secret. These takeovers are also referred to as ‘violent takeovers’.

3. Bailout Takeovers:

These forms of takeover are resorted to bailout the sick companies, to allow the company for rehabilitation as per the schemes approved by the financial institutions. The lead financial institution will evaluate the bids received for acquisition, the financial position and track record of the acquirer.

Defensive Measures in Hostile Takeover Bids:

A. Preventive Measures:

1. Shark Repellents:

The shark repellants are designed to make the target firm so unpleasant that it is attack-proof. They could include super majority provisions, i.e., 80% approval required for a merger, staggered board elections, fair price provisions to determine the price of minority shareholders’ stock, and dual capitalization, whereby the equity is restructured into two classes with different voting rights.

2. Poison Pills:

The poison pills are often securities issued by the target firm in the form of rights offerings. These allow the holders to buy stock in acquiring (hostile) firm at a low price. They would be distributed after a triggering event such as the acquisition of 20% of the stock of the target from by any individual partnership or corporation.

3. Golden Parachutes:

These are unacceptably high compensation packages that must be paid to managers if they are forced to leave the firm. Managers have five or ten-year contracts with provisions for full payments up-front if they are forced to leave.

4. Crown Jewels Lockup:

This is a contract to sell the firm’s valuable assets at below market price if the hostile bid succeeds.

B. Active Measures:

1. White Knight:

It is a company that comes to the rescue of a firm targeted for a takeover. The White Knight may make an offer to buy all or part of the target firm on more favourable terms than the original bidder and promise not to disassemble the firm or layoff the management or other employees.

2. White Squire Defence:

The target firm and White Squire, seek to implement a strategy to preserve the target firm’s independence. This is done by placing assets or shares in the hands of a friendly firm or investor who is not interested in acquiring control of the target firm and will not sellout to a hostile bidder.

3. Greenmail:

It refers to the payment of a substantial premium for a significant block of shares in return for an agreement not to initiate a bid for control of the firm. The takeover candidate can attempt to buy back its shares at a premium over the share’s market price, from the company or investor who initiated the hostile takeover attempt. The amount of the premium is referred to as ‘greenmail’.

4. Asset Restructuring:

The target company can sell assets that the bidder wants to another company. This action make the target company less desirable to the bidder.

5. Standstill Agreement:

It occurs when the target firm reaches a contractual agreement with the potential bidder that he will not increase his holding in the target firm for a particular period.

6. Capital Structure Changes:

The capital structure changes can be adopted by the target firm when a hostile bid has been initiated. The firm may issue new stock and place it in the hands of a friendly shareholder (white squire). It may buy back shares so as to ensure that they are not purchased by the hostile bidder or assume more debt in the form of bonds or bank loans.

7. Litigation:

It is one of the most common anti-takeover measures and is often used as a delaying tactic. The temporary halting of a takeover can give the target firm time to amount more effective defences or allow the bidding firm improve its offer. It may also allow other bidders to enter the process or a white knight to be courted.

8. Pac-Man Defence:

It is called after the ‘video game’ in which characters try to eat each other before they are eaten themselves, i.e., the firm under attack from a hostile bidder turns the table by bidding for the aggressor.

9. Overgearing:

By increasing the amount of debt makes the company less attractive to a predator. The increase in borrowings is a defensive policy that is sometimes adopted at the time of a takeover bid or in a situation where a company feels vulnerable to a takeover bid.

Term Paper # 11. Major Causes of Merger & Acquisition Failures:

1. Poor Strategic Fit:

The two companies having different strategies and objectives will not fit together. It may lead to conflict with one another.

2. Cultural and Social Differences:

The cultural and social differences among the human resources of the two entities may create serious complications while working together.

3. Insufficient Due Diligence:

Due diligence is to be observed by the officials in the top hierarchy. If such officials fails to do their duty, the merging process may give negative results and undue delays.

4. Failure to Integrate Properly:

The integration of the two companies requires a very high level of quality management. Integration is often poorly managed with little planning and design, leads to failure of merger process.

5. Payment of Excessive Consideration:

Sometimes excess premium is paid for the target company on expectation of synergies and if synergies are not realized then the premium paid to acquire the target is never recouped.

6. Limited Focus:

Purely financially motivated mergers, such as tax driven mergers on the advice of accountants, can be hit by adverse business consequences.

7. Unrelated Business Activities:

When the company has top class management with cash rich business and financial information system, it can go for a company with unrelated business activities, when the chances of successful takeover is bright. But in normal practice, the companies with unrelated business activities are not the potential target companies.

8. Financial Misinformation:

It would be a serious mistake if the takeovers were conducted without a proper audit of the financial affairs of the target company, and without evaluation of its costs, assets and liabilities and its financial and technical competencies.

9. Without Objective Evaluation:

The risk of failure will be higher if there is no detailed evaluation of target company’s business conditions is carried out by competent professionals.

10. Delays in Taking Management Control:

If the management of the target company is not possessed by the acquirer immediately, it would be difficult to achieve the goals set for acquisition.

11. Preparation for Unpleasant Surprises:

While merging the business of target company, the management of the acquirer company should keep in view that the activities of the target company may not appear exactly what they appear from outside.

12. Incompatibility of Partners:

An acquisition of a weak company by the strong company will always lead to positive results. But an alliance between two strong companies or two weak companies may lead to incompatibility and friction in merger process.

13. Ego Clash:

The differences of opinion among the directors who sit in a common board room after merger, may lead to ego clash.

14. Changing Business Models:

Forces fitting a low cost business into a high cost system gives negative results.

15. Quick Results:

The expectation of results too quickly may not be able to achieve to the expectation. This may cause to downgrade the confidence of the acquirer.

16. Diverging from Core Activity:

In some cases it reduces the buyer’s efficiency by deflecting it from its core activity and too much time is spent on new activity neglecting the old activity.

17. Loss of Identity:

Merger should not result in loss of identity which is a major strength for the acquiring company.