Here is a term paper on the ‘Receivables Management in a Firm’ for class 11 and 12. Find paragraphs, long and short term papers on the ‘Receivables Management in a Firm’ especially written for school and management students.

Term Paper on Receivables Management

Term Paper Contents:

- Term Paper on the Meaning of Receivables Management

- Term Paper on the Objectives of Receivables Management

- Term Paper on Credit Policies

- Term Paper on Credit Terms

- Term Paper on Collection Policies

Term Paper # 1. Meaning of Receivables Management:

In depth examination of one of the most important components of current assets that is cash, it is observed that a basic strategy to reduce the operating cash requirement of a firm is to accelerate the collection of receivables so as to reduce the average collection period. The receivables represent an important component of the current assets of a firm.

The term receivables are defined as “debt owed to the firm by customer arising from sale of goods or services in the ordinary course of business.”

When a firm makes an ordinary sale of goods or services and does not receive payment, the firm grants trade credit and creates accounts receivable which could be collected in the future. Receivables management is also called trade credit management. Thus, accounts receivable represent an extension of credit to customers, allowing them a reasonable period of time in which to pay for the goods received.

The sale of goods on credit is an essential part of the modern competitive economic system. In fact, credit-sales and therefore receivables are treated as a marketing tool to aid the sale of goods. The credit sales are generally made on open account in the sense that there is no formal acknowledgement of debt obligations through a financial instrument.

As a marketing tool, they are intended to promote sales and thereby profits. However, extension credit involves risk and cost. Management should weigh the benefits as well as cost to determine the goal of receivables management.

Term Paper # 2. Objectives of Receivables Management:

The objective of receivables management is “to promote sales and profits until that point is reached where the return on investment in further funding receivables is less than the cost of funds raised to finance that additional credit i.e., cost of capital.”

The specific cost and benefit which are relevant to the determination of the objectives of receivables management are as below:

1. Costs.

2. Benefits.

1. Costs:

The major categories of costs associated with the extension of credit and accounts receivable are:

(a) Collection Cost.

(b) Capital Cost.

(c) Delinquency Cost.

(d) Default cost.

a. Collection Cost:

These are the administrative costs incurred in collecting the receivables from the customers to whom credit sales have been made.

Included in this category of cost are:

(i) Additional expenses on the creation and maintenance of a credit department with staff, accounting records, stationary, postage and other related items,

(ii) Expenses involved in acquiring credit information either through outside specialist agencies or by the staff of the firm itself.

Note:

These expenses would not be incurred if the firm does not sell on credit.

b. Capital Cost:

The increased level of accounts receivable is an investment in assets. These have to be financed thereby involving a cost.

There is a time-lag between the sale of goods to and payment by the customers. Meanwhile, the firms have to pay employees and suppliers of raw materials, thereby implying that the firm should arrange for additional funds to meet its own obligations while waiting for payment from its customers. The cost on the use of additional capital to support credit sales, which alternatively could be profitably employed elsewhere, is, therefore, a part of the cost of extending credit or receivables.

c. Delinquency Cost:

This cost arises out of the failure of the customers to meet their obligation when payment on credit sales becomes due after the expiry of the credit period. Such costs are called delinquency costs.

The important components of this cost are:

(i) Blocking-up of funds for an extended period.

(ii) Cost associated with steps that have to be initiated to collect the over-dues such as reminders and other collection efforts, legal charges where necessary and so on.

d. Default Cost:

The firm may not be able to recover the over-dues because of the inability of the customer. Such debts are treated as bad debts and have to be written off as these cannot be realized. Such costs are known as default costs associated with the credit sales and accounts receivables.

2. Benefits:

Beside costs, another factor that has a bearing on accounts receivables management is the benefit emanating from credit sales. Benefits are the increased sales and anticipated profits because of a more liberal policy. When firms extend trade credit, that is invest in receivables, they intend to increase the sales.

The impact of a liberal trade policy is likely to take following two forms:

i. It is oriented to sales expansion, i.e., growth oriented.

ii. The firm may extend credit to protect its current sales against emerging competition. i.e., sales retention.

Investment in receivables involves costs as well as benefits. The extension of trade credit has a major impact on sales, costs and profitability.

Other things being equal, a relatively liberal policy and therefore, higher investment in receivables will produce larger sales. However costs will be higher with liberal policies than with more stringent measures. Therefore, accounts receivable management should aim at a tradeoff between profit (benefit) and risk (cost).

The decision to commit funds to receivables or the decision to grant credit will be based on a comparison of the benefits and costs involved, while determining the optimum level of receivables.

Note:

a. Costs and benefits to be compared are marginal costs and benefits means firms should only consider the increment i.e., additional benefits and costs that result from a change in the receivables or trade credit policy.

b. Though it is true that general economic condition and industry practices have a strong impact on the level of receivables, a firm’s investment in this type of current assets is also greatly affected by its internal policy.

c. A firm has little or no control over environmental factors, such as economic conditions and industry practices but it can improve its profitability through a properly conceived trade credit policy or receivables management.

Term Paper # 3. Credit Policies:

The firm’s objective with respect to receivables management is not merely to collect receivables quickly but attention should also be given to the benefit cost trade off involved in the various areas of accounts receivable management. The first decision area is credit policies.

The credit policy of a firm provides the framework to determine:

(a) Whether or not to extend credit to a customer.

(b) How much credit to extend the credit policy decision of firm has two broad dimensions:

(i) Credit standards.

(ii) Credit analysis.

A firm has to establish and use standards in making credit decisions, develop appropriate sense of credit information and methods of credit analysis.

A. Credit Standards:

The term credit standards represent the basic criteria for the extension of credit to customers.

The quantitative basis of establishing credit standards are factors such as:

i. Credit rating.

ii. Credit references.

iii. Average payments periods.

iv. Certain financial ratios.

The above factors are not given due weightages while finding out the tradeoff between benefits and costs to the firm as a whole.

Following are the two major divisions of overall standards:

(i) Light or restrictive.

(ii) Liberal or non-restrictive.

The trade-off with reference to credit standards cover:

1. The collection cost.

2. The average collection period/investment in accounts receivable.

3. Level of bad debts losses.

4. Level of sales.

The above factors should be considered while deciding whether to relax credit standards or not of standards are relaxed, it means more credit will be extended while if standards are tightened less credit will be extended.

The implications of the four factors are as below:

1. Collection Costs:

The implications of relaxed credit standards are:

i. More credit.

ii. A bigger credit department to service accounts receivable and related matters.

iii. Increased in collection cost.

The effect of tightening of credit standards will be exactly the opposite.

Note:

a. These cost are likely to be semi variable, because upto a certain point the existing staff will be able to carry on the increased workload, but beyond that, additional staff would be required.

b. These are assumed to be included in the variable cost per unit and need not be separately identified.

2. Investments in Receivables or the Average Collection Period:

The investment in accounts receivable involves a capital cost as funds have to be arranged by the firm to finance them till customers make payments.

Higher the average accounts receivable, the higher is the capital or carrying cost. A change in the credit standards-relaxation or tightening leads to a change in the level of accounts receivable either.

(a) Through a change in sales.

(b) Through a change in collection.

A relaxation in credit standards implies an increase in sales which in turn, would lead to higher average accounts receivable. Further, relaxed standards would mean that credit is extended liberally so that it is available to even less credit-worthy customers who will take a longer period to pay over-dues. The extension of trade credit to slow-paying customers would result in higher level of accounts receivables.

A tightening of credit standards would signify:

(i) A decrease in sales and lower average accounts receivable.

(ii) An extension of credit limited to more creditworthy customers who can promptly pay their bills and thus a lower average level of accounts receivable.

Thus, a change in sales and change in collection period together with a relaxation in standards would produce a higher carrying costs while change in sales and collection period result in lower costs when credit standards are tightened. These basic reactions also occur when change in credit terms or collection procedures are made.

3. Bad Debt Expenses:

Another factor which is expected to be affected by changes in the credit standards is bad debt default expenses. They can be expected to increase with relaxation in credit standards and decrease if credit standard become more restrictive.

4. Sales Volume:

Changing credit standards can also be expected to change the volume of sales. As the standards are relaxed, sales are expected to increase; conversely, a tightening is expected to cause a decline in sales.

Note:

a. Sales volume increase with relax standards hence more is profit and vice versa.

b. Average collection period increases with relax standards hence less is profit as cost of collection and cost of capital goes up and vice versa.

c. Bad debts increases with relax standard leads to profit goes down and vice versa.

B. Credit Analysis:

Besides establishing credit standards, a firm should develop procedures for evaluating credit applicants. The second aspect of credit policies of a firm is credit analysis and investigation.

Two basic steps are involved in credit investigation process:

(a) Obtaining credit information.

(b) Analysis of credit information.

On the basis of credit analysis that the decisions to grant credit to a customer as well as the quantum of credit would be taken.

Obtaining Credit Information:

The first step in credit analysis is obtaining credit information on which to base the evaluation of a customer.

The sources of information are:

1.External.

2. Internal.

1. External:

The availability of information from external sources to assess the credit worthiness of customers depends upon the development of institutional facilities and industry practices.

In India, the external sources of credit information are not as developed as in the industrially advanced countries of the world.

Depending upon the availability the following external sources may be employed to collect information:

(i) Financial statements.

(ii) Bank references.

(iii) Trade references.

(iv) Credit Bureau Reports.

i. Financial Statements:

One external source of credit information is the published financial statements that are the balance sheet, profit and loss a/c etc. The financial statements contain very useful information. They throw light or an applicant’s financial viability, liquidity, profitability and debt capacity.

Although the financial statements do not directly reveal the past payment records of the applicant, they are very helpful in assessing the overall financial position of a firm, which significantly determines its credit standing.

ii. Bank References:

Another useful source of credit information is the bank of the firm which is contemplating the extension of credit. The modus operandi here is that the firm’s banker collects the necessary information from the applicant’s banks.

Alternatively, the applicant may be required to ask his banker to provide the necessary information either directly to the firm or to its bank.

iii. Trade References:

These refer to the collection of information from firms with whom the applicant has dealing and on the basis of their experience would work for the applicant.

iv. Credit-Bureau Reports:

Finally, specialist credit bureau reports from organisations specialising in supplying credit information can also be utilised.

2. Internal:

Usually firms require their customers to fill various forms and documents giving details about financial operations. They are also required to furnish trade reference with whom the firms can have contacts to judge the suitability of the customers for credit.

This type of information is obtained from internal sources of credit information. Another internal source of credit information is derived from the records of firm contemplating an extension of credit. It is likely that a particular customer/applicant may have enjoyed credit facility in the past.

In that case the firm would have information on the behaviour of the applicants in terms of the historical payment pattern. This type of information may not be adequate and may, therefore have to be supplemented by information from other sources.

Analysis of Credit Information:

Once the credit information has been collected from different sources, it should be analysed to determine the credit worthiness of the applicant.

Although there are no established procedures to analyse the information, the firm should devise one to suit its needs.

The analysis should cover following two aspects:

(a) Quantitative.

(b) Qualitative.

(a) Quantitative:

The assessment of the quantitative aspects is based on the factual information available from the financial statements, the past records of the firm, and so on.

The 1st step involved in this type of assessment is to prepare an Aging schedule of the accounts payable of the applicant as well as calculate the average age of the accounts payable. This exercise will give an insight into the past payment pattern of the customer.

The next step in analysing the credit information is through a ratio analysis of the liquidity, profitability and debt capacity of the applicant. These ratio should be compared with the industry average.

Note:

Trend analysis over a period of time would reveal the financial strength of the customer.

(b) Qualitative:

The quantitative assessment should be supplemented by a qualitative/ subjective interpretation of the applicant’s credit worthiness. The subjective judgement would cover aspects relating to the quality of management.

The references from other suppliers, bank references and specialist bureau reports would form the basis for the conclusions to be drawn. In the ultimate analysis, therefore, the decision whether to extend credit to the applicant and what amount to extend will depend upon the subjective interpretation of his credit standing.

Term Paper # 4. Credit Terms:

The second decision-area in accounts receivable management is the credit terms. After the credit standards have been established and the credit worthiness of the customers has been assessed, the management of a firm must determine the terms and conditions on which trade credit will be made available.

The stipulations under which goods are sold on credit are referred as credit terms. These relate to the repayment of the amount under the credit sale. Thus, credit terms specify the repayment terms of receivables.

Credit-terms have the following three components:

(1) Credit period.

(2) Cash discount.

(3) Cash discount period.

1. Credit Period:

The duration of time for which trade credit is extended, during this period the overdue amount must be paid by the customer.

2. Cash Discount:

The overdue amount will be reduced by this and customer can take advantage of it by paying the overdue within the stipulated time.

3. Cash Discount Period:

This refers to the duration during which the discount can be availed of. These terms are usually written in abbreviations.

Example 1:

“3/7 net 30” stands for.

3 signify the rate of cash discount i.e., 3% which will be available to the customer if they pay the overdue with in stipulated time.

7 represents the time duration i.e., 07 days with in which a customer must pay to be entitled to the discount.

30 means the maximum period for which credit is available and the amount must be paid is any case before the expiry of 30 days.

In other words, the abbreviation ‘3/7 net 30’ means that the customer is entitled to 3% cash discount if he pays within 07 days after the beginning of the credit period 30 days. If however he does not want to take advantage of the discount and credit period, affect the tradeoff.

Note:

Here focus in analysing the credit terms is from the view point of supplier of trade credit and not the recipients from whom it is a source of financing.

Cash Discount:

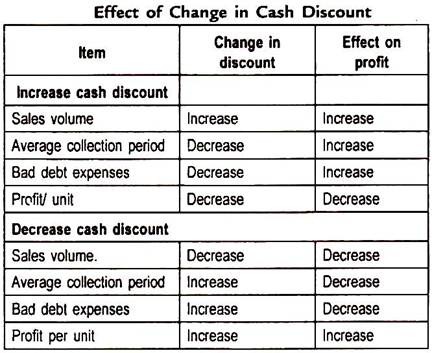

The cash discount has implications for the sales volume, average collection period/average investment in receivables, bad debt expenses and profit per unit. In taking a decision regarding the grant of cash discount, the management has to see what happens to these factors if it initiates increase or decrease in the discount rate. The changes in the discount rate would have both +ve (positive) and -ve. (negative) effects.

The implications of increasing or initiating cash discounts are as below:

(i) The sales volume will increase. The grant of discount implies reduced prices. If the demand for the product is elastic, reduction in prices will result in higher sales volume.

(ii) The customer would like to pay within the discount period to take the advantage of discount, the average collection period will be reduced. The reduction in the collection period will lead to a reduction in the investment in receivable i.e., to the cost. As a result profit will increase.

(iii) The discount will have a (-ve) negative effect on the profits. This is because the decrease in price would affect the profit margin/ unit of sale.

Example 2:

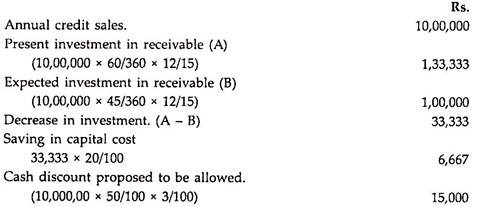

XYZ Ltd., has annual credit sales amounting to Rs.10,00,000 for which it grants a credit of 60 days. However, at present no discount policy is offered by the firm to its customers. The company is considering a plan to offer a discount “3/15 net 60”. The offer of discount is expected to bring the total credit period from 60 days to 45 days and 50% of the customers (involve) are likely to avail the discount facility. The selling price of the product is Rs15 while the average cost per unit comes to Rs12.

Please advise the company to resort to discount facility if the rate of return is 20% and a month is equal to 30 days.

Solution:

Since saving of Rs.6,667 on the capital cost is less than the cash discount of Rs.15,000 proposed to be allowed, the firm should not offer the cash discount facility on the above terms.

It may however, consider the modification till the time capital cost saving exceed the cash discount allowed.

Credit Period:

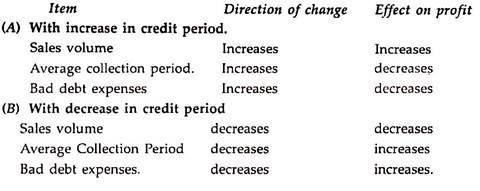

The second component of credit terms is the credit period.

The expected effects of a change in the credit period are as below:

Notes:

a. In practice, it may not be possible to discriminate among various customers while granting credit if their credit worthiness has been established.

b. Discrimination may be possible in respect to products. Credit may not be granted in the case of products which sell fast and the margins are rather low. On the contrary, credit would be necessary in the case of those products which have yet to capture the market.

Term Paper # 5. Collection Policies:

The third area involved in the accounts receivables management is collection policies. These refer to the procedures followed to collect accounts receivable when, after the expiry of credit period, they become due.

These policies cover two aspects which are as below:

1. Degree of efforts to collect the over-dues.

2. Type of collection efforts.

1. Degree of Collection Effort:

To understand the effect of collection effort, the credit polices of a firm may be categorised into:

(a) Strict/tight.

(b) Lenient.

The collection policy would be tight if very vigorous procedures are followed. A tight collection policy has implications which involve benefits as well as costs. The management has to consider a tradeoff between these. Likewise, a lenient collection effort also affects the cost- benefit trade-off.

The effect of tighten the collection are as below:

i. The bad debt expenses i.e., default cost would decline.

ii. Average collection period will be reduced.

iii. Firm will benefit and its profit will increase.

iv. A very rigorous collection strategy would involve increased collection costs.

v. May lead to decline in sales volume.

2. Types of Collection Efforts:

The second aspect of collection policies relates to the steps that should be taken to collect over-dues from the customers. A well-developed/established collection policy should have clear-cut guidelines as to the sequence of collection efforts.

After the credit period is over and payments remain due the firm should initiate measures to collect them. The efforts should in the beginning be polite, but, with the passage of time, it should gradually become strict.

The steps usually taken are:

i. Letters, including reminders to expedite payment.

ii. Telephone calls for personal contact.

iii. Personal visits.

iv. Help of collection agencies

v. Legal action.

Note:

The firm should take recourse to very stringent measures like legal action, only after all other avenues have been fully exhausted. These not only involve a cost but also affect the relationship with the customers. The aim should be to collect as early as possible, genuine difficulties of the customers should be given due consideration.