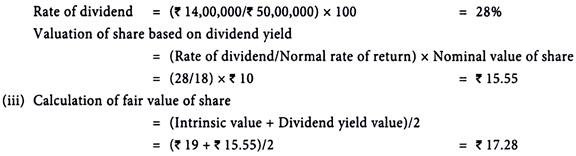

Here is a term paper on the ‘Methods of Valuation of Shares and Business’. Find paragraphs, long and short term papers on the ‘Methods of Valuation of Shares and Business’ especially written for school and college students.

Term Paper # 1. Net Assets Method or Intrinsic Value Method:

The valuation of shares is based on the net assets of the company as given below:

This method is also known as ‘Intrinsic value method’.

The intrinsic value of an equity share is calculated basing on the proportion of net assets available to each individual equity share.

While calculation of net assets the following points should be considered:

(i) All tangible and intangible assets to be taken at net realisable value.

(ii) All fictitious assets are to be ignored.

(iii) Present worth of goodwill should be included in net assets. The carrying amount of goodwill shown in the Balance sheet is not relevant.

(iv) All outside liabilities to be taken at the values payable on the date of valuation of shares.

(v) Any arrears of dividends, provision for tax, provision for doubtful debts etc. should be considered.

(vi) From the amount of net assets, the claim of preference shareholders is to be deducted to get the amount of net assets available to equity shareholders.

Illustration 1:

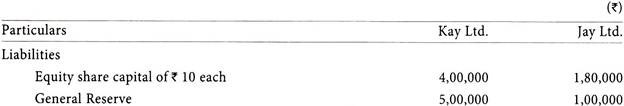

The following are the balance sheets of Kay Ltd. and Jay Ltd. as on 31st March, 2013:

The Board of directors of Kay Ltd. approved to takeover Jay Ltd. as on 30th September, 2013. Find out the ratio of exchange of shares on the basis of the book values.

Solution:

Calculation of Intrinsic value of shares:

Calculation of Ratio of Exchange:

L.C.M. of intrinsic value of shares of two companies = 60

Value of 2 shares of Kay Ltd. = Rs.60

Value of 3 shares of Jay Ltd. = Rs.60

Therefore, the ratio of exchange of shares on the basis of book value shall be two shares of Kay Ltd. for every three shares of Jay Ltd.

Number of shares of Kay Ltd. to be issued

= Net Assets value of Jay Ltd./Intrinsic value of Shares of Kay Ltd.

= Rs.3,60,000/Rs.30 = 12,000 shares

Thus, the ratio of exchange is 12,000 shares of Kay Ltd. for 18,000 shares of Jay Ltd., i.e., two shares of Kay Ltd. for every three shares of Jay Ltd.

Term Paper # 2. Dividend Yield Method:

Ownership of shares in a company entails the holders of shares to receive dividends as and when declared.

Since investors in a company get their return in the form of a dividend, the amount of dividend paid gives some indication of how valuable the shares will be to the potential buyer.

When valuing a small shareholding (which cannot influence the proportion of earnings to be distributed), the calculation should be based on the dividends, rather than earnings per share.

If dividend is seen as one of the key factors determining how valuable shares are, it is possible to look at the relationship between level of dividend and price in other companies and base a price on what dividend is normally paid.

This concept can be presented as a formula for any individual company to an accepted average for similar business.

Dividend per share = Total dividend declared/No. of shares

Value of business = Value per share × Total number of shares

The same result can be obtained using figures for the business as a whole rather than per share, if the information is available in that form.

Total value of business = Total dividend/Average dividend per share

The disparity between the dividend policies of unlisted and listed companies is caused by a number of factors.

The listed company tries to prevent fall in its share price which leave it vulnerably to a takeover bid and unable to attract additional investment; a generous dividend policy helps to maintain a high share price.

Unlisted companies, and especially private companies, find it more difficult to attract external funds.

The need to plough back into the business a large proportion of earnings leaves limited amounts available for distribution.

Disadvantages:

This method is subject to the following disadvantages:

1. This method ignore the element of capital gain which is the important financial justification for investing in shares.

2. The growth of a company could be seen as being a mean to securing the flow of dividends to shareholders in future, rather than a goal in itself.

3. This method is based on the assumption that dividend policy will remain constant. In practice, companies can and do change their dividend policies.

4. In case of unquoted companies, they are not concerned to keep shareholders happy, so levels of dividend may well be lower than for quoted companies. This valuation might, therefore, under value unquoted companies.

5. One drawback of the dividend yield valuation of an unlisted share is that it is usually based on past dividends, and these may not be representative of future expectations which should help, determine the current price.

Illustration 2:

Ashoka Builders Ltd. has an issued and paid up capital of 5,00,000 shares of Rs.10 each. The company declared a dividend of Rs.12.50 lakhs during the last five years and expects to maintain the same level of dividends in future. The control and ownership of the company is lying in the few hands of Directors and their family members. The average dividend yield for listed companies in the same line of business is 18%. Calculate the value 3000 shares in the company.

Solution:

Dividend per share = Rs.12,50,000/5,00,000 shares = Rs.2.5

Dividend yield = 18%

Value per share = Rs.2.5/0.18 = Rs.13.89

Value of 3000 shares = 3000 shares × Rs.13.89 = Rs.41,670

Illustration 3:

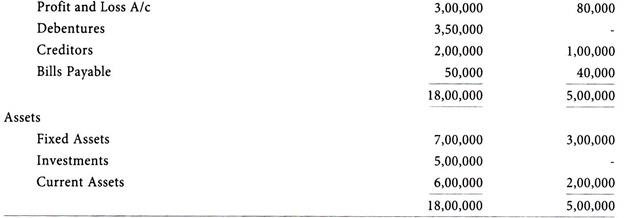

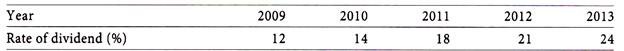

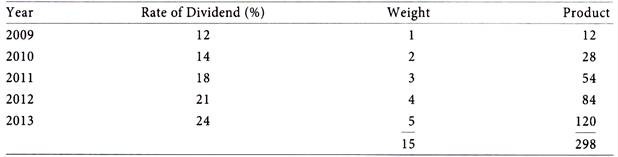

ABC Ltd. has declared dividend during the past five years as follows:

The average rate of return prevailing in the same industry is 15%.

Calculate the value per share of Rs.10 of ABC Ltd. based on the dividend yield method.

Solution:

Weighted average rate of dividend = 298/15 = 19.87%

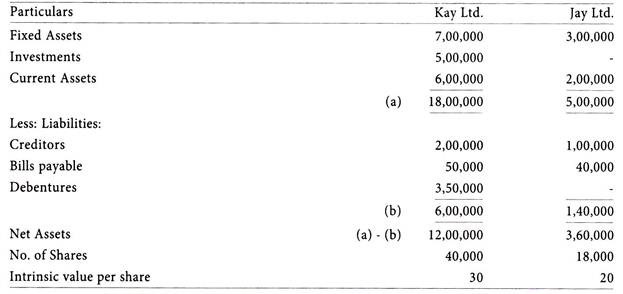

Illustration 4:

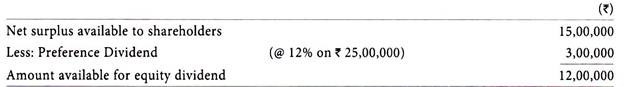

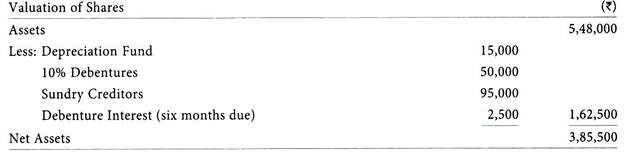

The profit of a company, limited by shares, for the year ended 31st March, 2013 were Rs.60,00,000. After setting apart amounts for interest on borrowings, taxation and other provisions, the net surplus available to shareholders is estimated at Rs.15,00,000.

The company’s capital base consisted of:

(i) 1,00,000 Equity shares of Rs.100 each, Rs.50 per share paid up; and

(ii) 25,000 12% Cumulative redeemable preference shares of Rs.100 each, fully paid up.

Enquiries in the stock market reveal that shares of companies engaged in similar business and declaring a dividend of 15% on equity shares are quoted at a premium of 10%.

What do you expect the market value of the company’s shares to be, basing your working on the yield method?

Solution:

Rate of Equity Dividend = (12,00,000/50,00,000) × 100 = 24%

Expected market value at 15% dividend = Rs.50 + Rs.5 = Rs.55

Market value of share = Rs.55 × 24/15 = Rs.88

Illustration 5:

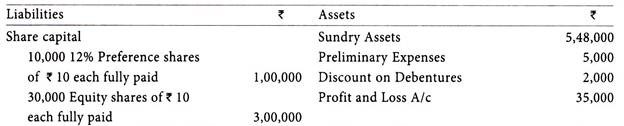

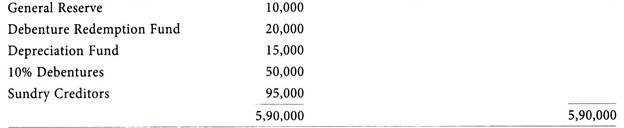

The following is the Balance sheet of P Ltd. as at 31st March, 2013:

The debenture interest is owing for six months and dividends on preference shares are in arrears for one year.

Assuming the assets are worth their book values, show the approximate valuation of shares if:

(i) Preference shares are preferential as to capital and arrears are payable in a winding up; and

(ii) Preference shares are preferential as to capital but arrears of preference dividends are not payable.

Solution:

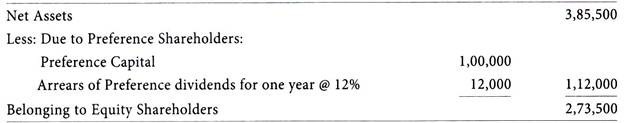

(i) If the preference shares are preferential as to capital and arrears are payable in a winding up, then the share valuation will be as under:

Value of Preference Share = Rs.1,12,000/10,000 shares = Rs.11.20

Value of Equity Share = Rs.2,73,500/30,000 shares = Rs.9.12

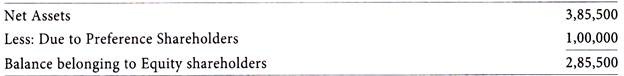

(ii) If preferential shares are preferential as to capital but arrears are not payable, then the valuation will be as below:

Value of Preference Share = Rs.1,00,000/10,000 shares = Rs.10

Value of Equity Share = Rs.2,85,500/30,000 shares = Rs.9.52

Term Paper # 3. Earnings Yield Method:

To overcome the problems associated with dividends, the yield based upon earnings can be used.

The total amount of profit belongs to the shareholders, whether distributed as dividend or not.

The undistributed profit used to finance the growth of the business helps to increase the value of the shares, and is just as much a part of the shareholders return on the investment as the dividend.

The value of a company on the earnings yield basis is the value of the stream of profit or earnings which the company is expected to generate.

Calculation of an earnings yield value involves three steps:

(i) Predict the future maintainable profits (annual earnings) of the company being valued.

(ii) Identify the required earnings yield by reference to the results of similar companies.

(iii) Apply the earnings yield to future profits using the following formula-

Annual earnings (Step 1)/Required earnings yield (Step 2)

The profit figure is available from the Profit and Loss Account of the company.

But when estimating the future earnings, factors which cause distortions and changes anticipated in the future should be taken care of.

The ability of the valuer to prepare an accurate forecast will depend on access to relevant information.

Illustration 6:

Kavery Industries Ltd. is expected to generate future profits of Rs.54,00,000.

What is its value of business if investments of this type are expected to give an annual return of 18%.

Solution:

Annual earnings = Rs.54,00,000

Required earnings yield 18% = 18/100 = 0.18

Value of Business = Rs.54,00,000/0.18 = Rs.3,00,00,000

Illustration 7:

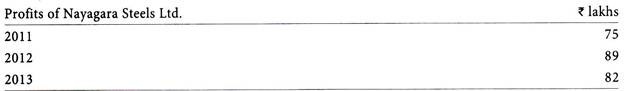

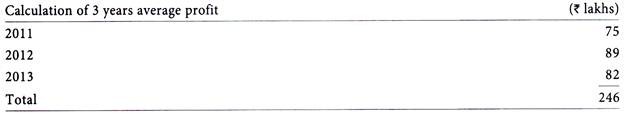

Jain Castings Ltd. agrees to acquire Nayagara Steels Ltd. based on the capitalisation of last three years profits of Nayagara Steels Ltd. at an earnings yield of 21%.

Calculate the value of business on earnings yield basis.

Solution:

Average profit = Rs.2,46,00,000/3 = Rs.82,00,000

Earnings yield = 21% = 21/100 = 0.21

Business valuation = Earnings/Yield = Rs.82,00,000/0.21 = Rs.3,90,47,620 say Rs.390 lakhs

Illustration 8:

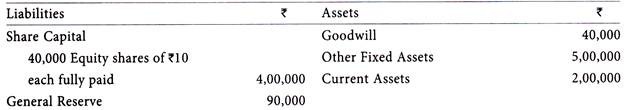

On 31st March, 2013 the Balance sheet of a joint stock company disclosed the following position:

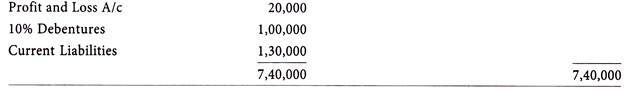

On 31st March, 2013 the goodwill of the company was valued at Rs.50,000 while other fixed assets were valued at Rs.3,50,000. The net profit earned by the company amounted to Rs.51,600 for 2010-11; Rs.52,000 for 2011-12; and Rs.51,650 for 2012-13. Every year an amount equal to 20% of the profit earned was transferred to general reserve – this being considered reasonable in the industry in which the company is engaged. A return of 10% on the investment is considered fair in the industry.

Compute the value of the company’s share by the yield method.

Solution:

(ii) Calculation of Expected Return:

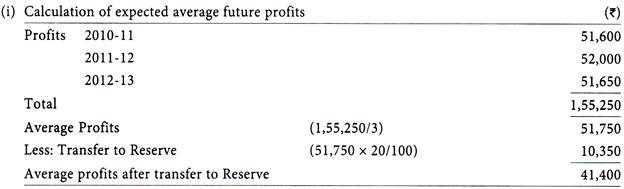

Illustration 9:

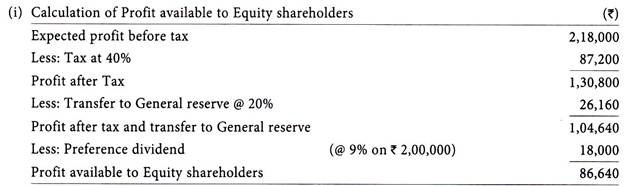

From the following particulars, calculate the value of an equity share:

Solution:

(ii) Calculation of Expected rate of earnings:

(iii) Calculation of value of an Equity share:

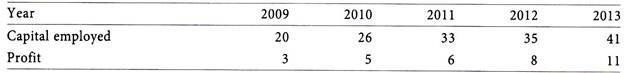

Term Paper # 4. Return on Capital Employed Method:

It is a simple method which considers the rate of return on capital employed which will be required from the company whose shares are to be valued.

This is based on the predetermined notion of the rate of return investor would expect on this particular type of investment, and then having decided on the earnings of the company, to calculate the capital sum that would result in such a rate of return.

The steps used in this method are as follows:

(i) Select the past period of investigation.

(ii) Estimate maintainable profits, after making any necessary adjustments.

(iii) Establish the acceptable normal rate of return on capital invested in a similar type of company, allowing for the industry effect, the size of the company, and the level of capital gearing.

(iv) Capitalise maintainable profits at a rate established as the acceptable rate of return.

The problem with this type of approach is that the estimate of earnings is usually based on historical earnings.

Whether this is a straight average of the past five years’ earnings, or some weighted average attaching greater importance to the more recent year’s earnings, it is still based on past performance.

Illustration 10:

Sarojini Steels Ltd.’s after tax profit for the year 2013 is Rs.24 lakhs. The company is expecting to earn an after tax profit of Rs.30 lakhs in the next five years. All the companies in the similar business is yielding a post-tax accounting rate of return of 24%. Calculate the valuation of the company based on accounting rate of return.

Solution:

Illustration 11:

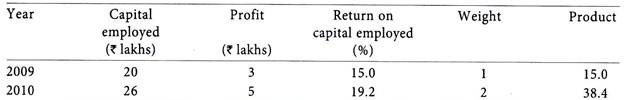

From the following data available from the books of Timken Bearings Ltd., calculate the value of equity shares based on return on capital employed:  The market expectation being 16%.

The market expectation being 16%.

Solution:

The rate of return on capital employed is calculated by adopting weighted average method is as follows:

Weighted average rate of return on capital employed = 333.6/15 = 22.24%

Term Paper # 5. Price/Earning Ratio Method:

Quoted companies are regularly described in terms of their Price/Earning (P/E) ratio.

Like the earnings yield this links price and earnings, but P/E is the inverse of earnings yield, dividing price by earnings rather than earnings by price.

As with the earnings yield, the figures can be calculated per share or for the company as a whole using simple formula:

Total Business valuation = Total Earnings × P/E ratio

Valuation per share = Earnings per share × P/E ratio

The P/E ratio can be used as a valuation tool of shares and business.

This ratio sets earnings net of tax per share (EPS) against the current market price of the share, and is expressed as a number.

It can be seen as the number of years which the investor must wait to recoup the invested sum out of earnings, whether they are distributed as a dividend or not.

The P/E ratio is normally thought of as the number of times earnings an investor would pay for a small number of shares of a company.

If the total shares of company are being purchased, the market P/E ratio may have to be adjusted.

For valuation under this method, there must be an industry P/E ratio that is appropriate for the investment.

The P/E ratio method would be used when it is not realistic to estimate the yearly cash flows into the future or indeed the rate at which they will grow.

Financial analysts often use P/E ratios as a guide to the market value.

Listed companies offer significant advantages to their members as their shares are marketable and their large size gives them an element of stability: these advantages make their shares more desirable, and therefore more highly priced, than those of an unlisted company.

The P/E ratio of an unlisted company is expected to be less than that for a corresponding listed company, and so the use of unadjusted quoted ratios can result in over-valuation.

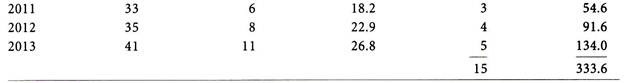

Illustration 12:

Permanent Magnets Ltd. is having an issued and subscribed capital of 5,00,000 equity shares of Rs.10 each fully paid up. The company’s after tax profits for the year 2013 amounting to Rs.28 lakhs. The average present stock exchange price of the company’s share is Rs.19.

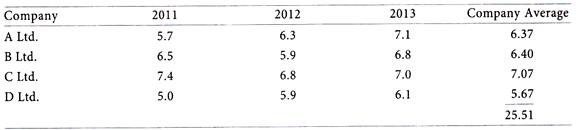

The Price/Earnings Ratio of the four listed companies to be used for calculation, their type of business seems to be similar to Permanent Magnets Ltd. are:

Calculate the valuation of business and per share based on average P/E ratio of the industry.

Solution:

Calculation of P/E Ratio of four listed companies:

Average P/E ratio = 25.51/4= 6.38

Earnings per share = Profit after tax/No. of Equity shares = Rs.28,00,000/5,00,000 shares = Rs.5.60

P/E Ratio of Permanent Magnets Ltd.

= Market price per share/Earnings per share = Rs.19/Rs.5.60 = 3.39

Value per share = Earnings per share × Average P/E ratio = Rs.5.60 × 6.38 = Rs.35.73

Value of business = Total earnings × Average P/E ratio = Rs.28,00,000 × 6.38 = Rs.178.64 lakhs

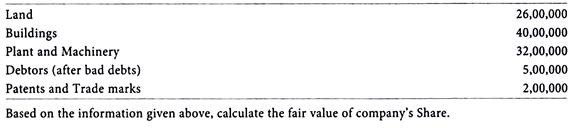

Term Paper # 6. Fair Value Method:

The fair value of shares is the average of the value of share determined under Net assets method and Dividend yield method calculated by using the following formula:

Fair value of share = (Share value under Net Assets method + Share value under Dividend yield method)/2

The combination of both the above methods will bring together the advantages accompanied to it.

This method try to minimize the demerits of both the methods.

This method is used in valuing shares of investment companies for computation of wealth tax.

Illustration 13:

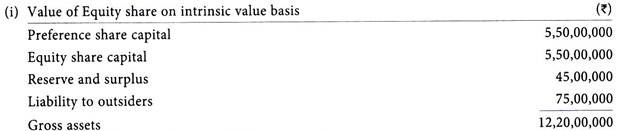

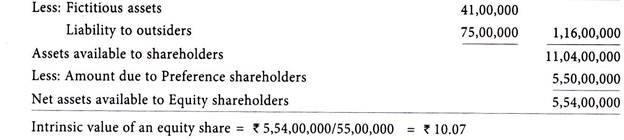

From the following particulars, calculate the fair value of an equity share assuming that out of the total assets, those amounting to Rs.41,00,000 are fictitious:

(i) Share capital 5,50,000 10% Preference shares of Rs.100 each, fully paid up

55,00,000 Equity shares of Rs.10 each, fully paid up

(ii) Liability to outsiders Rs.75,00,000

(iii) Reserves and surplus Rs.45,00,000

(iv) The average normal profit after taxation earned every year by the company during the last five years Rs.85,05,000

(v) The normal profit earned on the market value of fully paid equity shares of similar companies is 12%.

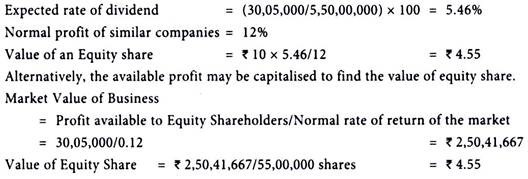

Solution:

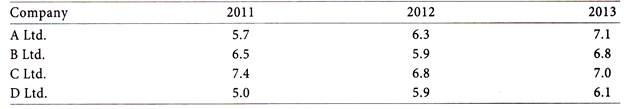

Illustration 14:

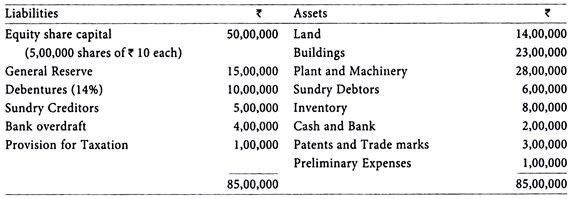

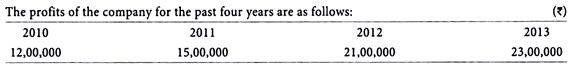

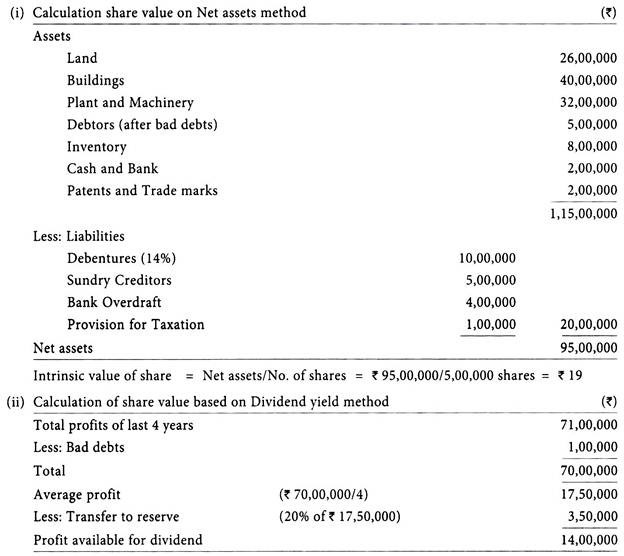

The Balance Sheet of Jamuna Synthetics Ltd. as at 31st March, 2013 is given below:

Every year, the company transfers 20% of its profits to the general reserve.

The industry average rate of return is 18% of the share value. On 31st March, 2013, Independent expert valuer has assessed the following assets:

Solution: