Working capital in a business is needed because of the operating cycle. But the need for working capital does not come to an end after the cycle is completed.

Since the operating cycle is a continuous process, there remains a need for continuous supply of working capital. However, the amount of working capital required is not constant throughout the year, but keeps fluctuating.

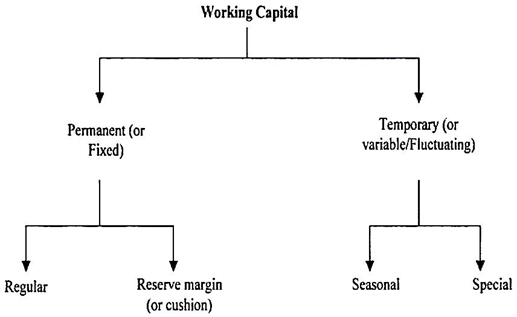

Working Capital represents the excess of Current Assets of a firm over and above its Current Liabilities. Working Capital can be classified into various types based on two broad categories.

Working capital can be classified on the basis of its composition. Thus, we can have gross working capital comprising current assets and net working capital representing current assets minus current liabilities.

ADVERTISEMENTS:

Learn about the types of working capital:

On the Basis of Concept are – 1. Gross Working Capital 2. Net Working Capital

On the Basis of Need are – 1. Permanent Working Capital 2. Temporary Working Capital

Also learn about some more types of working capital:

ADVERTISEMENTS:

1. Fluctuating Working Capital 2. Balance Sheet Working Capital 3. Cash Working Capital 4. Negative Working Capital

Types of Working Capital: Gross, Net, Permanent, Temporary, Balance Sheet, Cash and Negative Working Capital and More…

Types of Working Capital – On the Basis of Time Period: Permanent and Variable Working Capital

Types of Working Capital:

On the basis of time period, working capital can be divided into two categories:

Type # 1. Permanent Working Capital:

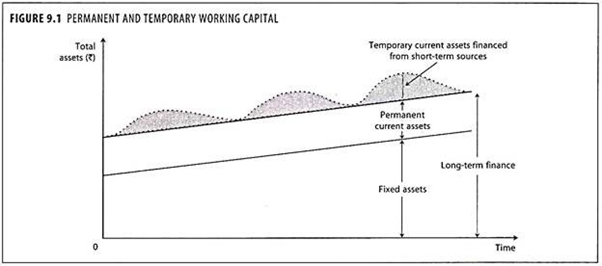

It means that minimum amount of investment in all current assets which is required at all times in an enterprise. Such investment is the irreducible minimum and remains permanently sunk in business. It is also called fixed working capital or regular working capital. It increases with growth in the size of an enterprise. It should be financed out of long term funds.

Type # 2. Variable Working Capital:

ADVERTISEMENTS:

It implies additional current assets required at different time periods during the operating cycle. The amount of such working capital keeps on fluctuating from time to time depending on the volume of business activities.

For example, extra inventory has to be maintained to support sales during peak sales period. On the other hand, less inventory is needed during the slack season.

Similarly, extra working capital may be necessary to face trade cycles and natural calamities. Variable working capital is also known as temporary or irregular working capital. Such working capital should be financed out of short term funds.

Types of Working Capital – On the Basis of Necessity: Permanent and Fluctuating Working Capital

The operating cycle in a firm causes the need for working capital. Production of goods is a continuous process in the firm. Thus, current assets are required continuously in a firm. But, the amount of current assets needed may vary on certain occasions.

ADVERTISEMENTS:

On the basis of necessity, the working capital can be of two types:

Type # (i) Permanent Working Capital:

Permanent working capital is the minimum level of working capital continuously required in a firm in order to maintain its operational activities. Each firm has to maintain this minimum level of working capital irrespective of its operation level.

The permanent working capital required in a firm will increase with the expansion of its business. Permanent working capital is generally financed through long-term sources of finance.

Type # (ii) Fluctuating Working Capital:

The additional working capital required above the minimum level of working capital in order to meet the requirement arising out of fluctuations in sales.

ADVERTISEMENTS:

The demand for temporary or variable working capital may arise due to change in seasonal demand of products of the firm. Temporary working capital is generally financed by short-term funds.

Different Types of Working Capital – Gross, Net, Permanent, Temporary, Balance Sheet and Cash Working Capital

The working capital may be classified as under:

Type # 1. Gross Working Capital:

According to this concept, whatever funds are invested are only in the current assets. This concept expresses that working capital is an aggregate of current assets. The amount of current liabilities is not deducted from the total current assets. This concept is also referred to as “Current Capital” or “Circulating Capital”.

Type # 2. Net Working Capital:

The term net working capital can be defined in two ways:

ADVERTISEMENTS:

(1) The most common definition of net working capital is the capital required for running day-to-day operations of a business. It may be expressed as excess of current assets over current liabilities.

(2) Net working capital can alternatively be defined as a part of the current assets, which are financed with long-term funds. For example, if the current asset is Rs. 100 and current liabilities is Rs. 75, then it implies Rs. 25 worth of current assets is financed by long-term funds such as capital, reserves and surplus, term loans, debentures, etc.

It is called positive net working capital. On the other hand, if the current liability is Rs. 100 and current assets is Rs. 75, then it implies Rs. 25 worth of short-terms funds is used for investing in the fixed assets.

This is known as a negative working capital situation. This is not a favourable financial position. When the current assets are equal to current liabilities, it implies that there is no net working capital. This means no current asset is being financed by long-term funds.

ADVERTISEMENTS:

Net Working Capital = Current assets – Current liabilities.

Type # 3. Permanent Working Capital:

This refers to the minimum amount of investment required in all current assets at all times to carry out a minimum level of activity. In other words, it represents the current assets required over the entire life of the business.

Tandon committee has referred to this type of working capital as ‘Core current assets’ or ‘Hard-core working capital’. The need for investment in current assets may increase or decrease over a period of time according to the level of production. Some amount of permanent working capital remains in the business in one form or another.

This is particularly important from the point of view of financing. Tandon Committee has pointed out that this type of core current assets should be financed through long-term sources like capital, reserves and surplus, preference share capital, term loans, debentures, etc.

Leaders in two-wheelers Hero Honda Ltd. and in four-wheelers Maruti Udyog Ltd. keeping their model in each type in their showrooms are typical examples of permanent working capital.

Type # 4. Temporary Working Capital:

Depending upon the production and sales, the need for working capital over and above permanent working capital will change. The changing working capital may also vary on account of seasonal changes or price level changes or unanticipated conditions.

ADVERTISEMENTS:

For example, raising the prices of materials, labour rate and other expenses may lead to an increase in the amount of funds invested in the stock of raw materials, work-in-progress as well as in finished goods.

Sometimes additional working capital may be required to face the cut-throat competition in the market. Sometimes when the company is planning for special advertisement campaigns organised for promotional activities or increasing the sales, additional working capital may have to be financed.

All these extra capital needed to support the changing business activities are called temporary, fluctuating or variable working capital.

Type # 5. Balance Sheet Working Capital:

It is calculated from the items appearing in the balance sheet. Gross working capital and Net working capital are examples of balance sheet working capital.

Type # 6. Cash Working Capital:

A firm’ s cash working capital is required to make payments to its suppliers, to incur day-to-day expenses and to pay salaries, wages, interest etc. The items of cash working capital appear in the profit & loss account.

How many Types of Working Capital are there?

Types of Working Capital are as follows:

ADVERTISEMENTS:

Working Capital can be classified in two ways, firstly, on the basis of concept, and secondly, on the basis of its need.

(1) On the Basis of Concept:

On this basis working capital may be of two types:

(i) Gross Working Capital

(ii) Net Working Capital

(2) On the Basis of Need:

ADVERTISEMENTS:

On this basis also working capital may be of two types:

(i) Permanent Working Capital

(ii) Temporary Working Capital

4 Main Types of Working Capital – Gross, Net, Permanent and Temporary Working Capital

The working capitals are of different types, they are:

1. Gross Working Capital

2. Net Working Capital

ADVERTISEMENTS:

3. Permanent Working Capital

4. Temporary Working Capital

Type # 1. Gross Working Capital:

The term gross working capital refers to the total of all current assets. Current assets are the assets which can be converted into cash within the financial year. It includes sundry debtors, short term securities, bills receivables and inventories.

Type # 2. Net Working Capital:

The term net working capital refers to the difference between current assets and current liabilities. It is the firm’s ability to meet its operating expenses and current liabilities.

Type # 3. Permanent Working Capital:

The minimum amount of current assets which are kept by a firm for the entire year to ensure smooth running of business operations. The minimum level of current assets maintained by the firm is called permanent working capital. This is also called Regular Working Capital or Fixed Working Capital.

Type # 4. Temporary Working Capital:

Any amount over and above the permanent working capital is called temporary or variable working capital. In other words, it is additional current assets maintained to meet fluctuations or changes in the business during the operating year. Temporary working capital is required to meet short term obligations.

Types of Working Capital – Based on Measurement and Based on Time Period

Primarily, different types of working capital are given below:

1. Based on Measurement:

ADVERTISEMENTS:

i. Gross Working Capital – Gross working capital refers to the amount of funds invested in various components of current assets. It consists of raw materials, work in progress, finished goods, debtors, short-term investments, etc. It is calculated with the help of the following formula –

Gross working capital = Book value of current assets

Or

Gross working capital = Net Working Capital + Current Liabilities

ii. Net Working capital – It represents excess of current assets over current liabilities. It indicates the soundness of current financial position. It can be calculated with the help of the following formula –

Net working capital = Current Assets – Current Liabilities.

Basis of difference between net working capital and gross working capital:

Net Working Capital:

i. Meaning – It represents excess of current assets over current liabilities.

ii. Calculation – Net working capital = Current Assets – Current Liabilities

iii. Nature – It indicates the ability of the business enterprise to meet its operating expenses and current liabilities.

iv. Importance – It is very important to understand the financial position of the business enterprise.

v. Example – Current liabilities include accounts payable, short-term loans, employee salaries, etc. Current Assets include stock, debtors, cash, etc. Excess of Current Assets over Current Liabilities is Net Working Capital.

Gross Working Capital:

i. Meaning – It refers to the amount of funds invested in various components of current assets.

ii. Calculation – Gross working capital = Book value of current assets

iii. Nature – It indicates the sum of current assets of a business enterprise.

iv. Importance – Real financial position is not depicted.

v. Example – Cash, short-term investments, accounts receivable, inventory. Liabilities are not taken into account.

2. Based on Time Period:

i. Permanent Working Capital:

Permanent working capital refers to the minimum amount of current assets that is required at all times to ensure a minimum level of uninterrupted business operations.

It is of two types:

a. Initial working capital – It is that part of permanent working capital which is required at the time of commencement of business. The capital required at the time of commencement of business is usually contributed by the owners.

b. Regular working capital – It is that part of permanent capital which is required for the day-to-day operations of the business. It ensures sufficient amounts of cash to maintain reasonable quantities of raw materials for processing into finished goods at all times.

ii. Variable Working Capital:

The temporary or variable working capital varies with the volume of operations. This is the additional working capital required from time to time over and above the permanent working capital.

It is of two types:

a. Seasonal working capital

It refers to liquid capital needed during a particular season. During the peak season, business enterprises have to increase the purchase of raw materials (e.g., wool by woolen mills, etc.,) and employ more people to convert them into finished goods. This requires a large amount of working capital during the peak season.

b. Special working capital

It is that part of the variable capital which is needed for financing special operations. It is the extra capital required to meet specific business expenses or unforeseen contingencies such as – advertisement campaigns for increasing sales or coping up with increased prices, strikes, natural calamities, etc.

Types of Working Capital – Permanent Working Capital and Temporary or Variable Working Capital

Types of Working Capital:

Type # 1. Permanent Working Capital:

It refers to the minimum level of current assets which is continuously required by the enterprise to carry on its regular business operations. For instance, every organization has to maintain a minimum stock of raw material, finished goods cash balance etc. for smooth functioning of their production.

Since working capital invested in these current assets is permanently blocked, hence it is also known as fixed working capital. The need for permanent working capital will fluctuate depending upon the growth of the business.

The permanent working capital can be further classified into regular working capital and reserve working capital.

(i) Regular Working Capital:

Regular working capital assists in circulation of current assets from cash to inventories, from inventories to receivables and from receivables to cash and so on.

(ii) Reserve Working Capital:

Reserve working capital is the excess amount over the requirement for regular working capital which may be provided for contingencies that may arise at unstated periods such as strikes, rise in prices, depression etc.

Type # 2. Temporary or Variable Working Capital:

It is the additional working capital needed to support the changing production and sales in the business. In other words, it represents additional current assets required at different times during the operating year. For example, extra inventory has to be maintained to support sales during peak periods.

Investment in inventories, receivables, etc., will decrease in periods of depression. As the amount of working capital keeps on fluctuating from time to time on the basis of business activities, it is termed as temporary working capital. Variable working capital can be further classified as seasonal working capital and special working capital.

(i) Seasonal Working Capital:

The capital required to meet the seasonal needs of the enterprise is called seasonal working capital. During the season time, firms are required to source its needs to meet the seasonal demand. The working capital which required meeting the seasonal needs of the enterprise is called seasonal working capital.

(ii) Special Working Capital:

The capital which is required to meet the special exigencies such as launching extensive marketing campaigns for conducting research, extra production, extra purchase etc is referred as special working capital.

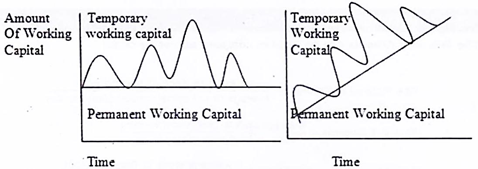

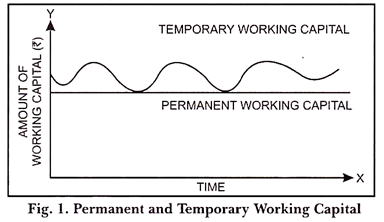

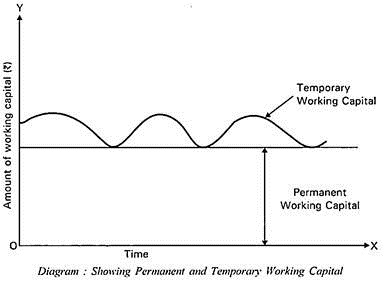

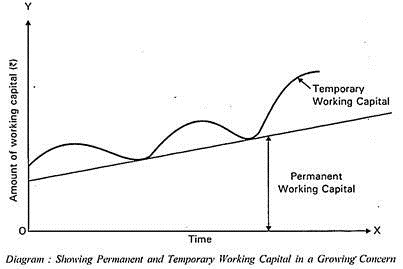

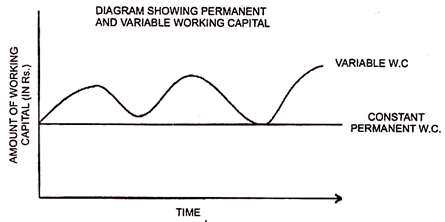

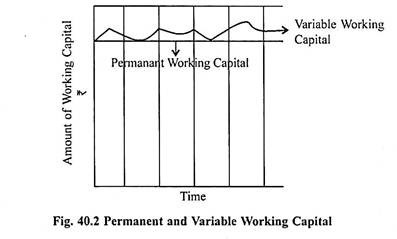

The above figure depicts that the permanent working capital is stable. But over the period it may increase or decrease, depending upon the firm’s requirement of working capital. But the temporary working capital is always fluctuating, sometimes increases and sometimes decreases.

Types of Working Capital – Permanent and Variable Working Capital (With Figures)

Types of Working Capital are as follows:

Permanent and Variable Working Capital:

In business, current assets are required because of the operating cycle. But the need for working, Marginal capital does not end with the completion of the operating cycle.

Operating cycle goes on continuously and therefore, in order to understand the need for working capital, it becomes essential to distinguish between permanent or regular and variable or seasonal or temporary working capital.

(1) Permanent Working Capital:

The requirements for current assets do not remain stable throughout the year and fluctuate from time to time. A certain minimum amount of raw material, work- in-progress and finished goods and cash must be maintained regularly in the business so that day to day operations of the business could continue without any obstacles.

This minimum requirement of current assets is called permanent or regular working capital. The arrangement of permanent working capital should be made from long-term sources only, for example share capital, debentures, long-term loans, etc.

(2) Variable Working Capital:

In certain months of the year, the level of business activities is higher than normal and, therefore, additional working capital may be required along with the permanent working capital. It is known as variable or temporary working capital. This part of the working capital is required due to changes in demand and supply of goods on account of change in seasons, etc.

For example- in a boom period, stock is to be kept to fulfil the demand and the amount of debts increases due to more sales. Similarly, in depression, the amount of stock and debts declines. Thus, extra working capital required due to changes in demand and production is called variable working capital.

In order to run the business smoothly, working capital of both types is required. Variable working capital is required for a short time. Therefore, it should be financed from the short-term sources only so that later it can be refunded when it is not required.

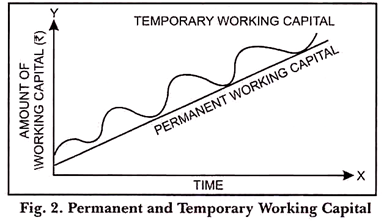

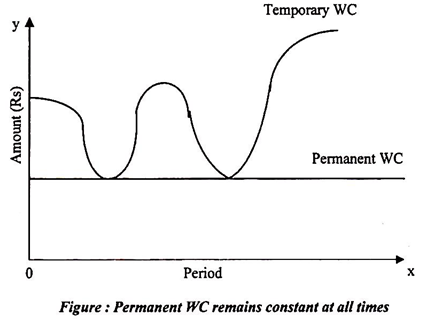

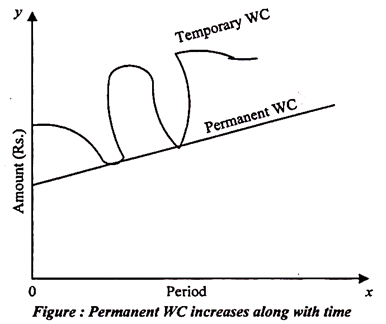

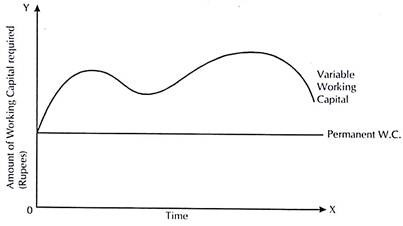

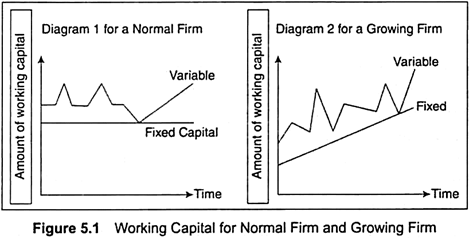

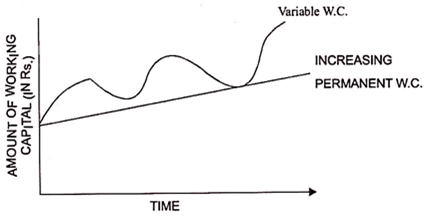

From Fig. 1 it is clear that the need for regular working capital remains the same for the whole year, whereas variable working capital needs are sometimes high and sometimes low. In a growing concern, the need for working capital goes on rising because of an increase in the level of business activities. It is presented in Fig. 2.

Types of Working Capital – Permanent Working Capital and Temporary or Fluctuating Working Capital

There are two types of working capital:

Type # 1. Permanent Working Capital:

This refers to that minimum amount of investment in all current assets which is required at all times to carry out the normal activities of business. It represents the current assets required on a continuous basis over the entire year.

This type of working capital is permanently needed for the business and therefore termed as ‘Permanent working Capital’. In a normal firm permanent working capital remains constant but in a growing firm, permanent working capital also increases overtime.

Type # 2. Temporary or Fluctuating Working Capital:

It refers to that part of total working capital which is required by a business over and above the permanent working capital. It is also called variable working capital, since the volume of temporary working capital keeps on fluctuating from time to time.

In other words, it represents additional current assets required at different times during the operating year.

For example- inventory and receivables has to be increased to support sales during peak sales period. On the other hand, investment in inventories, receivables, etc. will decrease in periods of depression.

Top 5 Types of Working Capital – Gross, Net, Negative, Permanent and Variable Working Capital

Types of working capital are as follows:

1. Gross working capital.

2. Net working capital.

3. Negative working capital.

4. Permanent working capital.

5. Variable working capital.

Type # 1. Gross Working Capital:

It is a financial concept.

So it refers to the total investments in current assets such as:

i. Cash in hand Cash at Bank

ii. Accounts receivable (i.e., Bills receivable & debtors)

iii. Stock of finished goods

iv. Work-in-progress

v. Stock of materials

vi. Prepaid expenses

Type # 2. Net Working Capital:

It is an accounting concept. It means net current assets, i.e., the excess of current assets over current liabilities.

i.e., Working capital = Current assets – Current liabilities.

Type # 3. Negative Working Capital (Working Capital Defect):

When the current liabilities are more than the current assets, it is called negative working capital.

Type # 4. Permanent Working Capital (Fixed or Regular or Hard Core Capital):

It is the amount of working capital which remains in the business permanently, in one form or another. For example cash or bank balance, stock in trade to be maintained as minimum to carry on business operations at any time.

Type # 5. Variable Working Capital (Temporary, Fluctuating Capital / Additional Current Assets):

It refers to the amount of working capital which goes on changing from time to time with the change in the volume of business activities.

Types of Working Capital – Permanent and Temporary or Variable Working Capital (With Diagrams)

Working capital in a business is needed because of the operating cycle. But the need for working capital does not come to an end after the cycle is completed.

Since the operating cycle is a continuous process, there remains a need for continuous supply of working capital. However, the amount of working capital required is not constant throughout the year, but keeps fluctuating.

On the basis of this concept, working capital is classified into two types:

(1) Permanent Working Capital:

The need for working capital or current assets fluctuates from time to time. However, to carry on day-to-day operations of the business without any obstacles, a certain minimum level of raw-materials, work-in-progress, finished goods and cash must be maintained on a continuous basis. The amount needed to maintain current assets on this minimum level is called permanent or regular working capital. The amount involved as permanent working capital has to be met from long-term sources of finance, e.g., capital, debentures, long-term loans etc.

(2) Temporary or Variable Working Capital:

Any amount over and above the permanent level of working capital is called temporary, fluctuating or variable working capital. Due to seasonal changes, the level of business activities is higher than normal during some months of the year and therefore, additional working capital will be required along with the permanent working capital.

It is so because during peak season, demand rises and more stock is to be maintained to meet the demand. Similarly, the amount of debtors increases due to excessive sales.

Additional working capital thus needed is known as temporary working capital because once the season is over; the additional demand will be no more. Need for temporary working capital should be met from short term sources of finance, e.g., short-term loans etc. so that it can be refunded when it is not required.

Both types of working capital are necessary to run the business smoothly.

The distinction between permanent and temporary working capital is illustrated in the following diagram:

Above diagram shows that permanent working capital remains the same throughout the year, while temporary working capital is fluctuating in accordance with seasonal demand.

However, in case of an expanding concern, the need for permanent working capital may not be constant and it would be increasing.

Therefore, the permanent working capital line also may not be horizontal and it will go on rising as illustrated in the following diagram:

Types of Working Capital – On the Basis of Concept and On the Basis of Time

Types of Working Capital are:

1. On the Basis of Concept:

On the basis of its concept, it may be either gross working capital or net working capital. Gross working capital is represented by the total current assets. On the other hand net working capital is the excess of current assets over current liabilities.

i) Gross Working Capital = Total Current Assets

ii) Net Working Capital = Current Assets – Current Liabilities

As per general practice working capital means net working capital.Net working capital may be positive or negative. If the current assets are more than current liability then it will be positive and if the current assets are less than current liability then net working capital will be negative.

Gross working capital is a quantitative aspect of working capital. It is also known as revolving or circulating capital or short term capital, because the investments in current assets keep revolving and are being constantly converted into cash and this cash flows out again in exchange for other current assets. While net working capital is a qualitative aspect of working capital.

Net working capital can alternatively be defined as that part of the current assets which are financed with long-term funds. Since current liabilities represent sources of short-term funds, as long as current assets exceed the current liabilities, the excess must be financed with long term funds. This alternate definition is more useful.

The net working capital concept is preferred for the following reasons:

(i) It enables and shows the firm’s ability to meet the operating expenses and short-term liabilities.

(ii) It is an indicator of the firm’s short-term solvency.

(iii) It indicates the margin of protection available to the short-t term creditors.

(iv) It suggests the need for financing part of working capital out of permanent funds of the enterprise.

2. On the Basis of Time:

According to GeneStenberg, the working capital can be classified into two categories on the basis of time and requirement:

i) Permanent Working Capital:

This type of working capital is referred as “hard core working capital” by Tendon Committee. It refers to the minimum amount of investment which should always be there in current assets like inventory, accounts receivable, or cash balance etc., in order to carry out business smoothly.

This investment is of a regular or permanent type and this is directly associated with the size of the firm as the size of firm expands, the requirement of permanent working capital also increases and vice-versa.

ii) Variable Working Capital:

The excess of the amount of working capital over permanent working capital is known as variable working capital. The amount of such working capital keeps on fluctuating from time to time on variations in business activities. It may again be subdivided into seasonal and special working capital.

Seasonal working capital is required to meet the seasonal demands of busy periods occurring at stated intervals. In a cold drink factory, the demand will be high during the summer season and therefore, more working capital is required to maintain higher production.

On the other hand, special working capital is required to meet extraordinary needs for contingencies. Events like strike, fire, unexpected competition, rising price tendencies or initiating a big advertisement campaign require such capital.

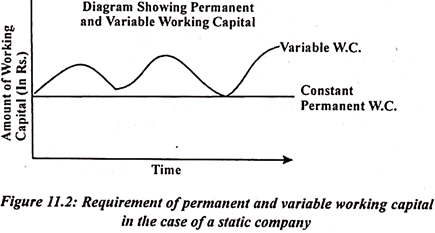

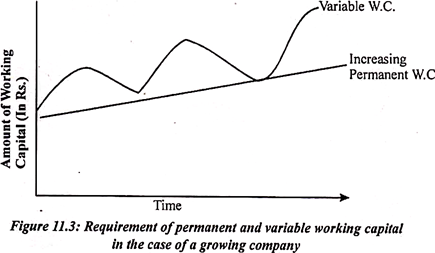

Following is the diagrammatic representation of permanent working capital and variable working capital:

The above diagram is showing the requirement of permanent and variable working capital in the case of a static company. In a static company the permanent working capital remains constant as shown in the diagram above.

The above diagram is showing the requirement of permanent and variable working capital in case of a growing company. In growing company the permanent working capital also increase with the growth of the firm as shown in the diagram above.

Types of Working Capital (With Diagrams and Difference Between Permanent and Temporary Working Capital)

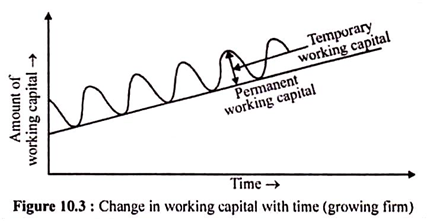

A business activity does not come to an end on realisation of cash from the debtors. Rather, it is a continuous process. Thus, the need for working capital continues to exist. But, the amount of working capital required keeps on changing with time. There is a certain minimum level of working capital which shall be continuously maintained by a firm.

This requirement is referred to as permanent or fixed working capital. Any amount over and above the permanent requirement of working capital is called a temporary or variable working capital.

The need for temporary requirements may arise due to seasonal demands. The difference between permanent and temporary working capital is shown below in Figure 10.2 & 10.3.

As can be observed from the figure given above, the permanent requirement is shown by a horizontal line along the X-axis which reflects that it is constant over time.

However, sometimes this requirement may gradually increase with time particularly in case of expanding firms. In such case, the temporary and permanent working capital would be as shown below in Figure 10.3.

Figure 10.3 : Change in working capital with time (growing firm)

The difference between Permanent and Temporary Working capital can be summarized as under:

(a) Permanent working capital is the minimum amount of investment to be made in business to continue its operation whereas temporary working capital is an additional investment in working capital to meet the fluctuations in demands.

(b) Permanent working capital requirement grows with the expansion of business whereas temporary working capital grows with magnitude of fluctuations in demand.

(c) Permanent working capital is generally financed through long term sources of funds whereas temporary working capital is generally financed through short term sources of funds.

(d) Permanent working capital is fixed over a period of time whereas temporary working capital is fluctuating.

Types of Working Capital – Permanent working capital and Temporary Working Capital (With Figures and Features)

Generally speaking, the amount of funds required for operating needs varies from time to time in every business. A certain amount of assets in the form of working capital is always required, if a business has to carry out its functions efficiently and without a break.

But a certain amount is needed for meeting day- to-day expenditures of business which varies from time to time. These two types of requirements – permanent and variable are the basis for a convenient classification of working capital.

Type # (i) Permanent working capital:

It is the amount of funds which is required to produce goods and services necessary to satisfy demand at its lowest point. Such capital is constantly changing from one asset to another without leaving the business process until the business ceases to exist.

The Tandon committee has named it as “Core Current Assets”. This capital can again be subdivided into (i) Regular working capital and (ii) Reserve margin or cushion working capital.

Regular working capital is the minimum amount of liquid capital needed to keep up the circulation of the capital from cash to inventories to receivables and back again to cash.

This would include a sufficient cash balance in the bank to pay all bills, maintain an adequate supply of raw materials for processing, carry a sufficient stock of finished goods to give prompt delivery and affect the lowest manufacturing costs and enough cash to carry the necessary accounts receivables for the type of business engaged in.

Reserve margin or cushion working capital is the excess over the need for regular working capital that should be provided for contingencies that arise at an unstated period. The contingencies include

(a) rising prices, which may make it necessary to have more money to carry inventories and receivables or may make it advisable to increase inventories;

(b) business depressions, which may raise the amount of cash required to ride out usually stagnant periods;

(c) strikes, fires and unexpectedly severe competition, which use up extra supplies of cash, and

(d) Special operations such as experiments with new products or with new method of distribution, war contracts, contracts to supply new businesses and the like, which can be undertaken only if sufficient funds are available and which in many cases mean the survival of a business.

Features:

The permanent working capital has the following characteristics:

(a) It is classified on the basis of time factor;

(b) It constantly changes from one asset to another and continues to remain in the business process;

(c) Its size increases with the growth of business operations;

(d) It should be financed out of long term funds

Type # (ii) Temporary working capital:

It represents working capital requirements over and above permanent working capital and is dependent on factors like peak season, trade cycle, boom etc. It is also called fluctuating or variable working capital. It can further be classified as seasonal working capital and special working capital.

Seasonal working capital is the additional amount of current assets – particularly cash, receivables and inventory which is required during the more active business seasons of the year.

Special working capital is the part of temporary working capital which is required for financing special operations such as extensive marketing campaigns, experiments with product or methods of production, carrying of special jobs etc.

Features:

The temporary working capital possesses the following characteristics:

(a) It is not always gainfully employed, though it may change from one asset to another, as permanent working capital does.

(b) It is particularly suited to businesses of a seasonal or cyclical nature.

The distinction between permanent and temporary working capital is of great significance particularly in arranging the finance for a firm. The permanent working capital should be raised in the same way as fixed capital is procured, through a permanent investment of the owner or through long term borrowing.

As business expands, this regular capital will necessarily expand. If the cash realised from sales includes a large enough profit to take care of expanding operations and growing inventories, the necessary additional working capital may be provided by the earned surplus of the business.

Temporary working capital needs can, however, be financed out of short term borrowings from the bank or from the public in the form of deposits.

The position with regard to the “permanent working capital” and “Temporary working capital” can be shown with the help of following figure:

From the above figure, it is crystal clear that the amount of permanent working capital remains the same over all periods of time, e.g., Rs. 5 lakh at all times, irrespective of the amount of sales, activity etc.

But it cannot be presumed that the permanent working capital will always remain fixed throughout the life of the firm. As the size of the business grows, permanent working capital too is bound to grow.

This position can be depicted with the help of the following figure:

The above figure made it clear that the permanent working capital increases in amount (rupee value) based on the activity level of the firm, for example, working capital of Rs. 5 lakh may be sufficient for a turnover level of 25 lakh.

When the turnover increased to Rs. 50 crore, after a certain time period, the amount of working capital should rise and hence, should be an amount higher than Rs. 5 lakh.

Types of Working Capital (With Diagram)

Permanent and Variable Working Capital:

The need for current assets arises due to the operating cycle, which is a continuous process and thereby there is a continuous need for current assets. But the value of current assets is not always the same, that is, it increases and decreases over time.

In other words, there is always a minimum level of current assets which is continuously required by the firm to carry on its business operations i.e., certain investments in stock, debtors, bills receivable, cash, marketable securities, etc.

This minimum level of current assets to run the business operations is known as permanent or fixed working capital. The minimum investment is the same as the firm’s investment is fixed assets.

At the same time, the firm may have to invest more for working capital due to changes in production, sales, increased demand, etc. Similarly the need for working capital will decrease due to less demand for the product, changes in the market conditions, competitive products, etc.

So, the extra working capital required to run the business operations is called fluctuating, or variable or temporary working capital.

The permanent and variable working capital requirements of the firm can be explained with the help of the following diagram:

It is clear from the diagram that the permanent working capital level is fairly constant, while the temporary working capital is fluctuating, that is, sometimes increasing and sometimes decreasing, in accordance with the changes.

Types of Working Capital – Permanent and Temporary Working Capital (With Figure)

Types of Working Capital are as follows:

Permanent and Temporary Working Capital:

Considering time as the basis of classification, there are two types of working capital viz- ‘permanent’ and ‘temporary’:

a. Permanent Working Capital:

The magnitude of investment in working capital may increase or decrease over a period of time according to the level of production. But, there is a need for a minimum level of working capital to carry its business irrespective of change in level of sales or production. Such a minimum level of working capital is called ‘permanent working capital’ or ‘fixed working capital’.

It is the irreducible minimum amount necessary for maintaining the circulation of current assets. The minimum level of investment in current assets is permanently locked-up in business and it is also referred to as ‘regular working capital’. It represents the assets required on a continuing basis over the entire year.

The permanent component current assets which are required throughout the year will generally be financed from long-term debt and equity. Tandon committee has referred to this type of working capital as ‘core current assets’.

Core current assets are those required by the firm to ensure the continuity of operations which represents the minimum levels of various items of current assets viz., stock of raw materials, stock of work-in-process, stock of finished goods, debtors balances, cash and bank etc.

This minimum level of current assets will be financed by the long-term sources and any fluctuations over the minimum level of current assets will be financed by the short- term financing.

b. Temporary Working Capital:

It is also called ‘fluctuating working capital’. It depends upon the changes in production and sales, over and above the permanent working capital. It is the extra working capital needed to support the changing business activities. It represents additional assets required at different items during the operation of the year.

A firm will finance its seasonal and current fluctuations in business operations through short-term debt financing. For example, in peak seasons, more raw materials to be purchased, more manufacturing expenses to be incurred, more funds will be locked in debtors balances etc. In such times excess requirement of working capital would be financed from short- term financing sources.

The management of working capital is concerned with maximizing the return to shareholders within the accepted risk constraints carried by the participants in the company. Just as excessive long-term debt puts a company at risk, so an inordinate quantity of short-term debt also increases the risk to a company by straining its solvency.

The suppliers of permanent working capital look for long-term return on funds invested whereas the suppliers of temporary working capital will look for immediate return and the cost of such financing will also be costlier than the cost of permanent funds used for working capital.

Types of Working Capital Based on Two Broad Categories – Based on Time and Based on Concept (With Figure)

Working Capital represents the excess of Current Assets of a firm over and above its Current Liabilities. Working Capital can be classified into various types based on two broad categories.

These are explained as follows:

1. Based on Time:

Based on time, Working Capital can be categorised into two broad categories.

These are:

(i) Permanent or Fixed Working Capital, and

(ii) Temporary or Variable Working Capital.

(i) Permanent Working Capital:

Permanent Working Capital is that level of Working Capital which is required all the time or rather which should be maintained all the time in a firm to ensure smooth functioning of a firm without any fund crisis.

Permanent Working Capital is also defined as the minimum amount of investment in Current Assets which is essential for effective functioning of a business. As Permanent Working Capital is fixed, it is financed by long-term funds such as the issue of shares, debentures, loans, etc.

According to the Tandon Committee, Permanent Working Capital is also known as – ‘hard core Current Assets’ of a business. Since every business has to purchase a minimum amount of raw materials, some machinery, hire labour, bear some expenses and so on, it needs to maintain a fixed amount of Working Capital always.

Permanent or Fixed Working Capital can be further classified into ‘Regular Working Capital’ and ‘Reserve Working Capital’. Regular Working Capital refers to the minimum amount of liquid capital that must be maintained throughout to ensure smooth circulation of capital from cash to inventories, receivables and realisation of cash from receivables.

Sufficient bank balance is a source of regular Working Capital. Reserve Working Capital is the Working Capital required over and above the Regular Working Capital. This type of Working Capital is required to ensure an uninterrupted flow of capital to meet the contingencies arising from natural disasters, strike, war, recession, etc.

(ii) Temporary or Variable Working Capital:

Temporary or Variable Working Capital is that Working Capital which is required over and above the Permanent Working Capital, i.e., in excess of Permanent Working Capital. It is variable in nature. It is not essential throughout the year all time. However, it is required in some seasons or for some special reasons.

Temporary Working Capital can be further classified into ‘Seasonal Working Capital’ and ‘Special Working Capital’. Seasonal Working Capital refers to the Working Capital required to meet the seasonal demand. Seasonal Working Capital demand arises owing to increase in demand during peak seasons.

To meet the increase in demand, increase in production is essential. Hence more raw materials are required, more expenses are to be incurred and debtors increase. Seasonal Working Capital demand is a short-term requirement which is usually financed by short-term funds.

Special Working Capital is required for some special purposes such as – extensive marketing campaigns, new experiments with process or products, etc. This type of Working Capital is required for emergency situations and is not required in the ordinary course of business. Special Working Capital is also usually financed by short-term funds.

Figure 5.1 shows Working Capital for normal and growing firm –

2. Based on Concept:

Based on the concept, there are two types of Working Capital.

They are

(i) Gross Working Capital and

(ii) Net Working Capital. Net Working Capital can be further subdivided into two types.

These are

(i) Positive Working Capital and

(ii) Negative Working Capital.

(i) Gross Working Capital:

Gross Working Capital is the sum total of Current Assets. Experts have defined gross Working Capital as the capital invested in Current Assets of a firm. The Balance Sheet approach to Gross Working Capital is defined as –

Gross Working Capital = Total Current Assets

Gross Working Capital is very important for a firm, it indicates the total amount of funds invested in Current Assets. Gross Working Capital is vital for any business since it is an indicator of the funds available for paying off Current Liabilities.

Gross Working Capital is the quantitative concept of Working Capital. An optimum amount of gross Working Capital should be maintained to avoid fund crunches.

Gross working capital offers the following advantages:

a. It indicates the amount of funds required for Current Assets.

b. It also indicates the funds available for meeting up the obligations.

c. It takes into account the net figure of different items such as – stock net of obsolete stock, debtors less provisions if any, etc.

d. It is important for measuring the return on Working Capital.

e. It implies an increase in Current Assets that would lead to an increase in Net Working Capital.

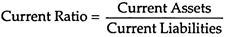

(ii) Net Working Capital:

Net Working Capital is the difference between Current Assets and Current Liabilities. It is the excess of Current Assets over Current Liabilities. It is a narrow concept. The Balance Sheet Approach to Net Working Capital states Net Working Capital as –

Net Working Capital = Total Current Assets – Total Current Liabilities

Net Working Capital is the qualitative concept of Working Capital. Net Working Capital indicates the liquidity position of a firm, i.e., its ability to repay short-term debt obligations or Current Liabilities.

Current ratio to measure the liquidity position of a firm is determined by the following formula:

The current ratio is usually taken as 2:1 (It may be noted in this context that this figure varies from industry to industry). Current ratio indicates the current asset backing for every rupee of Current Liabilities.

Net Working Capital can be positive or negative. Net Working Capital is the excess of Current Assets over Current Liabilities. If we deduct the amount of total Current Liabilities from the total Current Assets we get the figure for Net Working Capital.

Symbolically, it is represented as follows –

Net Working Capital = ΣCurrent Assets – ΣCurrent Liabilities

If total Current Assets are more than total Current Liabilities, then it is the positive Working Capital. It can be expressed as follows –

Positive Working Capital – ΣCurrent Assets > ΣCurrent Liabilities

When total Current Assets are less than total Current Liabilities or Current Liabilities are greater than Current Assets then it is known as negative Working Capital. It can be expressed as –

Negative Working Capital – ΣCurrent Assets < ΣCurrent Liabilities

Net working capital measure offers the following advantages:

1. It indicates the liquidity position of the firm.

2. It indicates the ability of a firm to meet its short-term debt obligations.

3. It is the assurance for the creditors regarding their dues.

4. It indicates the viability of a business financially.

Apart from these, there is another concept of ‘Zero Working Capital’. Zero Working Capital arises in situations where –

ΣCurrent Assets = ΣCurrent Liabilities.

Types of Working Capital – Permanent Working Capital and Temporary Working Capital

Categorisation of working capital can be made either based on its concept or the need to maintain current assets either permanently and/or temporarily. As per conceptual view, it may be classified into gross working capital or net working capital.

Gerstenberg has conveniently classified the working capital into

(a) regular or permanent working capital and

(b) temporary or variable working capital.

The variable working capital is again bifurcated into seasonal and special working capital.

1. Permanent Working Capital:

Permanent working capital is the minimum investment kept in the form of inventory of raw materials, work-in-process, finished goods, stores & spares, and book debts to facilitate uninterrupted operation of a firm. Though this investment is stable in the short-run, it certainly varies in the long-run depending upon the expansion programmes undertaken by a firm.

It may increase or decrease over a period of time. The minimum level of current assets maintained in a firm is usually known as permanent or regular working capital.

2. Temporary Working Capital:

A firm is required to maintain an additional current asset temporarily over and above the permanent working capital to satisfy cyclical demands. Any additional working capital apart from permanent working capital required to support the changing production and sales activities is referred to as temporary or variable working capital.

In other words, an amount over and above the permanent level of working capital is temporary, fluctuating or variable working capital. At times, additional working capital is required to meet the unforeseen events like floods, strikes, seasonal production and price hike tendencies and contingencies.

Types of Working Capital – On the Basis of Balance Sheet Concept and On the Basis of Periodicity (Time)

Working capital can be classified either on the basis of Balance Sheet concept or on the basis of periodicity (Time) of its requirements.

(1) On the Basis of Balance Sheet Concept:

On the basis of the B/S concept, it may be either gross working capital or net working capital. Gross working capital is represented by the total current assets. The net working capital is the excess of current assets over current liabilities.

(a) Gross Working Capital = Total Currents Assets (CA)

(b) Net Working Capital = Current Assets – Current Liabilities

(2) On the Basis of Requirement:

According to Gerstenbergh, the working capital can be classified into two categories on the basis of time and requirement:

(a) Permanent Working Capital:

It refers to the minimum amount of investment which should always be there in fixed or minimum current assets like inventory, accounts receivable, or cash balance etc., in order to carry out business smoothly.

This investment is of a regular or permanent type and as the size of the Firm expands, the requirement of permanent working capital also increases. Tandon Committee has referred to this type of working capital as “hard core working capital”.

(b) Variable Working Capital:

The excess of the amount of working capital over permanent working capital is known as variable working capital. The amount of such working capital keeps on fluctuating from time to time on variations in business activities. It may again be subdivided into seasonal and special working capital.

Seasonal working capital is required to meet the seasonal demands of busy periods occurring at stated intervals. On the other hand, special working capital is required to meet extraordinary needs for contingencies. Events like strike, fire, unexpected competition, rising price tendencies or initiating a big advertisement campaign require such capital.

The following diagram illustrates the difference between permanent and variable working capital:

The above is the case of a static company and in case of growing company permanent working capital requirement will be increasing as is shown in the diagram given below:

Types of Working Capital – The Gross Working Capital and The Net Working Capital

The working capital is broadly divided into two types, namely, Concept-based or Balance Sheet View and Time-based or Operating Cycle View.

This divides the working capital into:

(1) Gross working capital, and

(2) Net working capital.

Type # 1. The Gross Working Capital:

The Gross Working Capital will be the total capital invested in the current assets of the company, which means, the assets which could be converted into liquid cash within an accounting period, or one year. It represents the liquidity position of the organisation.

Gross Working Capital = Book value of Current Assets

Type # 2. The Net Working Capital:

The Net Working Capital is the difference between the current assets and the current liabilities. It is used to evaluate the short-term financial position of the organisation. Net working capital means excess of current assets over current liabilities.

Net Working Capital = Current Assets – Current Liabilities

Types of Working Capital

Working capital can be classified on the basis of its composition. Thus, we can have gross working capital comprising current assets and net working capital representing current assets minus current liabilities.

From the view of a finance manager this basis of classification is helpful since it categorises the various areas of financial responsibility. For instance, funds invested in cash, inventories and receivables require careful planning and control if the firm is to maximise its return on investment.

This is an important variable influencing pattern of financing capital requirements. Using time as a basis, working capital may be categorised as permanent and variable working capital.

Permanent working capital represents current assets required on a continuous basis over the entire year. A manufacturing enterprise has to carry an irreducible minimum amount of inventories necessary to ensure uninterrupted production and sales.

Likewise, some amount of funds remain tied in receivables when the firm sells goods on credit terms. Some amount of cash has also to be held by the firm so as to exploit business opportunities, meet operational requirements and to provide insurance against business fluctuations.

Thus, the minimum amount of current assets which a firm has to hold for all the time to come to carry on operation at any time is termed as permanent or regular working capital. It represents the ‘hard core’ of the working capital.

Financing of this portion of working capital should be made along the line of fixed assets. However, permanent working capital changes its form constantly from one asset to another whereas fixed assets retain their form over a long period of time.

Further, fund of value representing permanent working capital never leaves the business process and therefore, the suppliers should expect its return until the business ceases to exist. Finally, permanent working capital will tend to expand so long as the firm experiences growth in its operations.

Over and above the permanent working capital, the firm may need additional current assets temporarily to satisfy seasonal/cyclical demands. Thus, for example, added inventory must be held to support the peak selling periods. Receivables increase following periods of high sales. Extra cash may be needed to pay for additional suppliers following expansion in business activity.

Similarly, in periods of dull business conditions when most of the produce remains held in stock due to precipitate fall in demand, the company would require additional cash to tide over the crisis. Excess amount of working capital may be carried to face cutthroat competition or any other contingencies like strikes and lockouts.

This additional amount of working capital represents variable or temporary working capital, size of which depends upon changes in levels of production and sales resulting from changes in market conditions. Funds requirements for this purpose are of short duration.

Permanent working capital will remain stable over a period of time while variable working capital fluctuates — sometimes rising and sometimes declining. In contrast, a firm experiencing a growth situation will require permanent working capital on an increasing scale and therefore, a permanent working capital line will no longer remain stable.

Types Of Working Capital – On the Basis of its Composition (With Figure)

Working capital can be classified on the basis of its composition. Thus, we can have gross working capital comprising current assets and net working capital representing current assets minus current liabilities.

From the viewpoint of a finance manager, this basis of classification is helpful since it categories the various areas of financial responsibility. For instance, funds invested in cash, inventories and receivables require careful planning and control if the firm is to maximize its return on investment.

While the above classification is very significant to financial management, it is not completely adequate as it does not mention time which is an important variable that influences the pattern of financing working capital requirements. Using time as a basis, working capital may be categorized as permanent and variable capital.

Permanent working capital represents assets required on a continuous basis over the entire years. A manufacturing enterprise has to carry an irreducible minimum amount of inventories necessary to ensure uninterrupted production and sales. Likewise, some amount of funds remains in receivables when the firm sells goods on credit terms.

Some amount of funds has to be held in cash so as to exploit business opportunities, meet operational requirements and to provide insurance against business fluctuations. Thus, the minimum amount of current assets which the firm has to hold for all the time to come to carry on operations at any time is termed as permanent or-regular Working Capital.

It represents the ‘hard core’ of the working capital. Financing of this portion of working capital should be made on the line of fixed assets. However, permanent working capital differs from fixed assets. Permanent working capital will tend to expand so long as the firm experiences growth in its operations.

Over and above the permanent working capital, a firm may need additional current assets temporarily to satisfy seasonal/cynical demands. Thus, for example, added inventory must be held to support the peak selling periods. Receivables increase following periods of high sales.

Extra cash may be needed to pay for additional supplies following expansion in business activity. Similarly, in periods of dull business conditions when most of the produce remains unsold additional cash will be required to tide over the crisis. Excess amount of working capital may be carried to face-cut-throat competition or any other contingencies like strikes and lockouts.

This additional amount of working capital represents variable or temporary working capital, size of which depends upon changes in levels of production and sales resulting from changes in market conditions. Funds requirements for this purpose are of short duration.

Figures 40.2 depict graphically permanent and temporary working capital needs in a state and growing firm, respectively. It may be noted from Figure 40.2 that permanent working capital will remain stable over a period, while temporary working capital fluctuates — sometimes rising and sometimes declining.