After reading this article you will learn about:- 1. Meaning and Concept of Working Capital 2. Classification of Working Capital 3. Factors 4. Sources 5. Uses.

Meaning and Concept of Working Capital:

Working Capital refers to a firm’s investment in short term assets-cash, short term securities, accounts receivable and inventories. Net Working Capital is defined as current assets minus current liabilities. Working Capital management refers to all aspects of the administration of both current assets and current liabilities.

Working capital is needed in any business because of the time lag between paying for materials and operating costs, and getting the money back again (together with added profit) from the customer.

Working capital means current assets. Current assets means assets which can be converted into cash within an accounting year and includes cash, short term securities, bills receivable, stock etc. Gross working capital refers to the firm’s total investment in current assets.

ADVERTISEMENTS:

Net working capital = current assets – current liabilities. The term working capital is commonly used for the capital which is required for day-to-day working in a business concern, such as for purchasing raw material, for meeting day-to-day expenditure on employee salaries, wages, rents, advertising etc.

Classification of Working Capital:

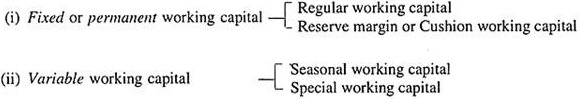

Working capital may be classified as follows:

(1) On the basis of concept Working capital may be classified as:

(i) Gross working capital.

ADVERTISEMENTS:

(ii) Net working capital.

These terms have been discussed above.

(2) On the basis of periodicity of requirement:

(i) Permanent (or Fixed) Working Capital:

ADVERTISEMENTS:

This capital is permanently locked up in the current assets to carry out the business smoothly. This investment in current assets is of the permanent nature and will increase as the size of business expands.

Permanent working capital is that minimum amount of investment in raw materials, work-in-process inventory, finished goods, stores and spares, accounts receivable and cash balance which a firm is required to have in order to carry on a desirable level of business activity.

Such an amount cannot be reduced if the firm wants to carry on the business operations without interruption. It is that minimum amount which is absolutely essential throughout the year on a continuous basis for maintaining the circulation of current assets.

ADVERTISEMENTS:

Minimum cash is required for making payment of wages, salaries, and other expenses; minimum stock is required to maintain regular supplies and minimum investment in debtors is essential on account of credit sales according to the period of credit allowed to the customers. Since the requirement of permanent or hard core working capital is on a permanent basis, such working capital should be financed out of long-term funds.

Characteristics of permanent working capital:

(1) The size of permanent working capital grows with the growth of business.

(2) It keeps on changing its form from one current asset to another.

ADVERTISEMENTS:

(3) As long as the firm is a going concern, working capital cannot be substantially reduced.

(a) Regular Working Capital:

It is the minimum amount of liquid capital needed to keep up the circulation of the capital from cash to inventories, to receivable and again to cash. This would include sufficient minimum bank balance to discount all bills, maintain adequate supply of raw materials etc.

(b) Reserve Margin or Cushion Working Capital:

ADVERTISEMENTS:

It is the excess over the needs or regular working capital that should be kept in reserve for contingencies that may arise at any time. These contingencies include rising prices, strikes, special operations such as experiments with new products etc.

(ii) Variable Working Capital:

Variable working capital requires changes with the increase or decrease in the volume of production or business.

Variable working capital can be classified as:

ADVERTISEMENTS:

(a) Seasonal Working Capital:

The working capital required to meet the seasonal needs of the industry or business is known as seasonal working capital. For example, if an enterprise is marketing woolen garments, it needs more money for that purpose during winter months than in summer season. Similar is the case with a factory/business engaged in the production or marketing or coolers, refrigerators or air-conditioners. They are all Seasonal products.

(b) Special Working Capital:

Special working capital is that part of the variable working capital which is meant for meeting the special business operations such as extensive marketing campaigns, experiments with products or methods of production, etc.

The distinction between fixed and variable working capital is of great significance particularly in raising the funds for an enterprise. Fixed working capital should be raised in the same way as fixed capital is procured. Variable working capital is procured out of short-term borrowings from the bank or from the public.

Factors Affecting Requirements for Working Capital:

ADVERTISEMENTS:

In addition to the investment in a fixed asset, it is sometimes necessary to carry additional cash, receivables or inventories. This investment in working capital is treated as a cash outflow at the time it occurs.

The working capital needs of a firm are influenced by the following factors:

(1) Nature of Business:

A machine tool manufacturing concern which has a long operating cycle and sells largely on credit has a very substantial working capital requirement.

On the other hand a service firm, such as an electricity undertaking or a transport corporation with a short operating cycle and sales predominantly on cash basis, has a modest working capital requirement.

(2) Seasonality of Operations:

ADVERTISEMENTS:

A firm manufacturing seasonal products such as fans, coolers, woolen clothes etc., has a highly fluctuating working capital requirement.

On the other hand, a firm manufacturing electric bulbs or tube-lights or televisions has fairly even sales round the year and hence a stable working capital need.

(3) Conditions of Supply:

If the raw inventory required for production is easily available throughout the year, the firm can manage with a small capital being involved in inventory. However, if the raw material supply is scant and unpredictable, then, to ensure continuity of production, the firm has to keep a good stock of inventory which will involve large working capital.

(4) Marketing Conditions:

If the market is strong and competition is weak, the firm can manage with smaller inventory of finished goods as customers can be served after a delay. In this situation, the firm can insist on cash selling or even can ask for advance payment. This will avoid lock up of funds in accounts receivable.

ADVERTISEMENTS:

On the other hand, if many firms are making the same product (like T.V., Refrigerators, etc.) and the competition is high, the firm has to keep a larger inventory of finished goods so that its product is not out of stock at any time. In this situation, the working capital needs tend to be high.

Sources of Working Capital:

(1) Funds from business operations.

(2) Other incomes such as from dividends, transfer fees, donations, interest from investments made in other companies, etc.

(3) Sale of non-current assets such as useless and obsolete plant and machinery.

(4) Long-term borrowings.

(5) Issue of additional equity capital or preference share capital.

Uses of Working Capital:

ADVERTISEMENTS:

1. Loss from business operations would decrease the working capital.

2. The purchase of non-current assets generally causes a decrease in current assets or increase in current liabilities. Therefore, it should appear as the use of funds.

3. The retirement of long-term liabilities such as payment to preference shareholders and debenture holders involves the use of cash.

4. Dividend to shareholders.

5. Interest to lenders.